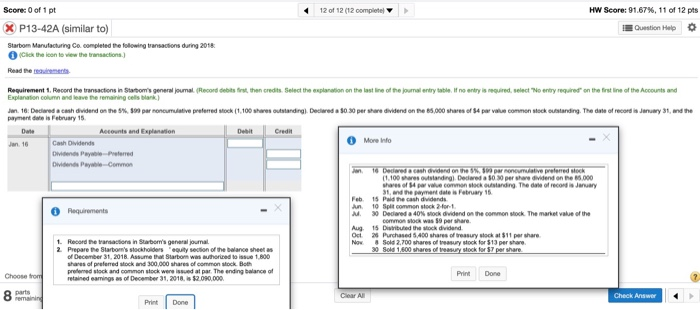

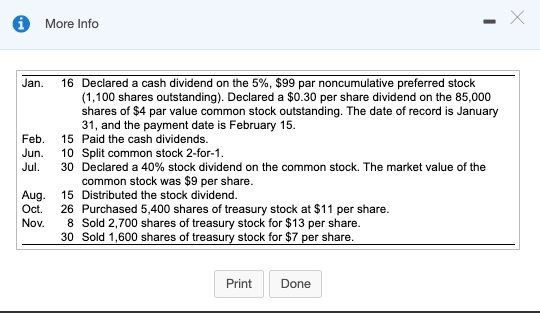

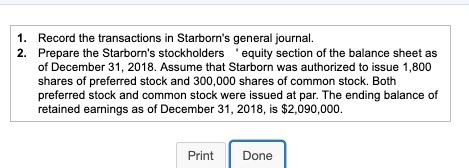

12 of 12 (12 completely HW Score: 91.67%, 11 of 12 pts Score: 0 of 1 pt X P13-42A (similar to) Starom Manufacturing Cocompleted the following transactions during 2018 Click the icon to wiew the transactions.) Question Help Read Requirement 1. Record the transactions in Starom's general Journal (Recorde r st, then credits. Select the explanation on the last line of the journal entry table if ne entry is uired, select "No entry required on the first line of the Accounts and Explanation Column and leave the remaining cells bank) Jan 16: Declared a cash dividend on the 5% 393 par noncumulative preferred stock (1.100 shares outstanding Declared a $0,30 per share dividend on the 85.000 shares of $4 par value common stock outstanding. The date of record is January 31, and the payment is February 15 Accounts and Explanation Debit Credit Jan 16 Cash Dividends 1 More info O d Pale-Preferred Dividends Common to bedred a cash dividend on the par t ive preferred stock shares of 4 por value common cousanding. The date of records January 31, and the payment date is February 15 e s Pebruary 15 1 Pald heath An Requirements Aug Oct Now 10 Sp o n stock for 30 Declared a 40stock dividend on the common stock. The market value of the common was 10 par share 15 Distributed the lock dividend. 25 Purchased 5.400 shares of treasury stock at $11 per share Sold 2,700 shares of stock for $13 per share 30 Sold 1,600 shares of treasury stock for 7 per share Record the a ctions in Subom's general journal Prepare the Startor's stockholders equity section of the balance sheet as of December 31, 2018 Assume that start was where to issue 1.800 shares of preferred stock and 300,000 shares of common stock. Both preferred stock and common stock were issued at par. The ending balance of retained earings as of December 31, 2018. $2.090.000 Choose from Print Done 8 remarind Check Answer Print Dono i More Info Jan. Feb. Jun. Jul 16 Declared a cash dividend on the 5%. $99 par noncumulative preferred stock (1.100 shares outstanding). Declared a $0.30 per share dividend on the 85,000 shares of $4 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. 15 Paid the cash dividends. 10 Split common stock 2-for-1. 30 Declared a 40% stock dividend on the common stock. The market value of the common stock was $9 per share. 15 Distributed the stock dividend. 26 Purchased 5,400 shares of treasury stock at $11 per share. 8 Sold 2,700 shares of treasury stock for $13 per share. 30 Sold 1,600 shares of treasury stock for $7 per share. Aug. Oct Nov. Print Done 1. Record the transactions in Starborn's general journal. 2. Prepare the Starborn's stockholders 'equity section of the balance sheet as of December 31, 2018. Assume that Starborn was authorized to issue 1.800 shares of preferred stock and 300,000 shares of common stock. Both preferred stock and common stock were issued at par. The ending balance of retained earnings as of December 31, 2018, is $2,090,000. Print Done