Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12 of the voting common stock of Moon Corp. on January 1, 2017, Sun solda aue of $is,000 to Moon for $20,000. The machine has

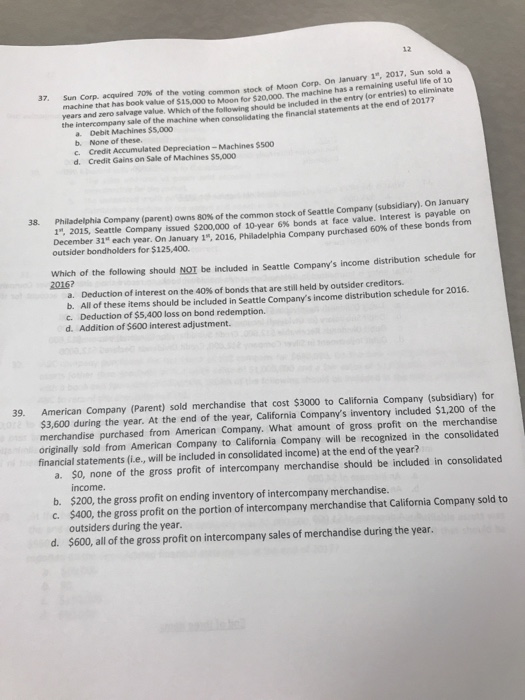

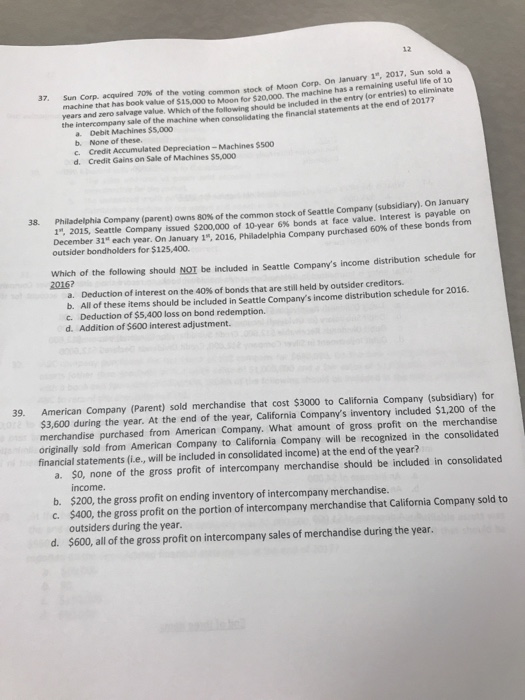

12 of the voting common stock of Moon Corp. on January 1", 2017, Sun solda aue of $is,000 to Moon for $20,000. The machine has a remaining useful life of 10 hch of the following should be included in the entry (or entries) to eliminate machine when consolidating the financial statements at the end of 20177 37. Sun Corp. acquired 70% the the intercompany sale of the a. Debit Machines $5,000 b. None of these. c. Credit Accumulated Depreciation- Machines $500 d. Credit Gains on Sale of Machines $5,000 38 subsidiary OnJanuary Philadelphia Company (parent) owns 80% of the com mon stock of Seattle Company 1". 2015, Seattle Company issued $200,000 of 10-year 6% bonds at face value. Interest is payable on December 31st each year. On January 1 outsider bondholders for $125,400. 2016, Philadelphia Company purchased 60% of these bonds from Which of the following should NOT be included in Seattle Company's income distribution schedule for 20162 a. Deduction of interest on the 40% of bonds that are still held by outsider creditors. b. All of these items should be included in Seattle Company's income distribution schedule for 2016. c. Deduction of $5,400 loss on bond redemption. d. Addition of $600 interest adjustment. American Company (Parent) sold merchandise that cost $3000 to California Company (subsidiary) for $3,600 during the year. At the end of the year, California Company's inventory included $1,200 of the merchandise purchased from American Company. What amount of gross profit on the merchandise originally sold from American Company to California Company will be recognized in the consolidated financial statements (i.e., will be included in consolidated income) at the end of the year? 39. a. $0, none of the gross profit of intercompany merchandise should be included in consolidated income $200, the gross profit on ending inventory of intercompany merchandise $400, the gross profit on the portion of intercompany merchandise that California Company sold to outsiders during the year. $600, all of the gross profit on intercompany sales of merchandise during the year. b. c. d

12 of the voting common stock of Moon Corp. on January 1", 2017, Sun solda aue of $is,000 to Moon for $20,000. The machine has a remaining useful life of 10 hch of the following should be included in the entry (or entries) to eliminate machine when consolidating the financial statements at the end of 20177 37. Sun Corp. acquired 70% the the intercompany sale of the a. Debit Machines $5,000 b. None of these. c. Credit Accumulated Depreciation- Machines $500 d. Credit Gains on Sale of Machines $5,000 38 subsidiary OnJanuary Philadelphia Company (parent) owns 80% of the com mon stock of Seattle Company 1". 2015, Seattle Company issued $200,000 of 10-year 6% bonds at face value. Interest is payable on December 31st each year. On January 1 outsider bondholders for $125,400. 2016, Philadelphia Company purchased 60% of these bonds from Which of the following should NOT be included in Seattle Company's income distribution schedule for 20162 a. Deduction of interest on the 40% of bonds that are still held by outsider creditors. b. All of these items should be included in Seattle Company's income distribution schedule for 2016. c. Deduction of $5,400 loss on bond redemption. d. Addition of $600 interest adjustment. American Company (Parent) sold merchandise that cost $3000 to California Company (subsidiary) for $3,600 during the year. At the end of the year, California Company's inventory included $1,200 of the merchandise purchased from American Company. What amount of gross profit on the merchandise originally sold from American Company to California Company will be recognized in the consolidated financial statements (i.e., will be included in consolidated income) at the end of the year? 39. a. $0, none of the gross profit of intercompany merchandise should be included in consolidated income $200, the gross profit on ending inventory of intercompany merchandise $400, the gross profit on the portion of intercompany merchandise that California Company sold to outsiders during the year. $600, all of the gross profit on intercompany sales of merchandise during the year. b. c. d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started