Answered step by step

Verified Expert Solution

Question

1 Approved Answer

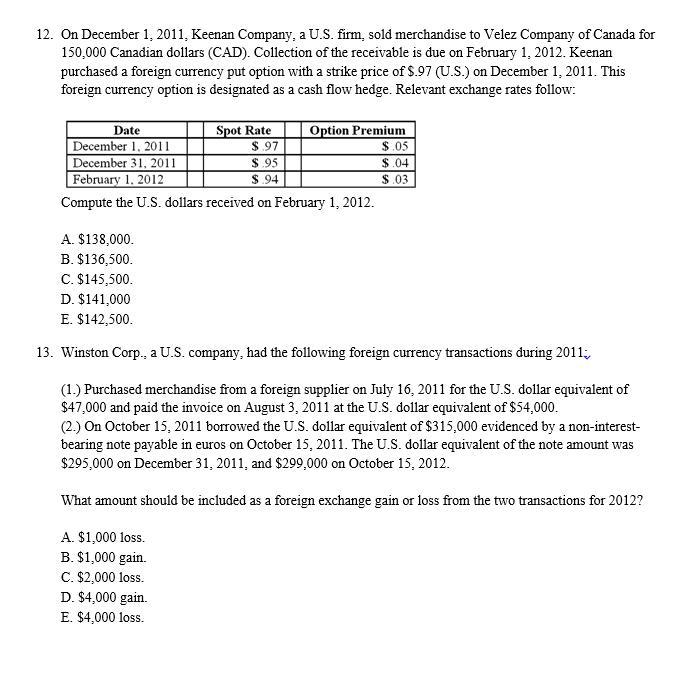

12. On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of

12. On December 1, 2011, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2012. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2011. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow: Date December 1, 2011 December 31, 2011 February 1, 2012 Compute the U.S. dollars received on February 1, 2012. A. $138,000. B. $136,500. C. $145,500. Spot Rate D. $141,000 E. $142,500. Option Premium $.05 $.04 $.03 $.97 $.95 $.94 13. Winston Corp., a U.S. company, had the following foreign currency transactions during 2011. (1.) Purchased merchandise from a foreign supplier on July 16, 2011 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2011 at the U.S. dollar equivalent of $54,000. (2.) On October 15, 2011 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest- bearing note payable in euros on October 15, 2011. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2011, and $299,000 on October 15, 2012. What amount should be included as a foreign exchange gain or loss from the two transactions for 2012? A. $1,000 loss. B. $1,000 gain. C. $2,000 loss. D. $4,000 gain. E. $4,000 loss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

12 To compute the US dollars received on February 1 2012 we need to calculate the effective exchange rate considering the spot rate and the option premium On December 1 2011 the spot rate was 97 and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started