Question

12. On March 28, 2020, a U.S. company issues a purchase order to buy merchandise for NZ$100,000. The company will pay the supplier on June

12.

On March 28, 2020, a U.S. company issues a purchase order to buy merchandise for NZ$100,000. The company will pay the supplier on June 28, 2020, so on March 28, the company enters a forward contract to purchase NZ$100,000 on June 28. The company takes delivery of the merchandise on May 2, 2020. On June 28, 2020, the company acquires NZ$100,000 using the forward contract and pays the supplier. The company sells the merchandise later in the year. The company's accounting year ends December 31. When the merchandise is sold by the U.S. company, cost of goods sold is:

Select one:

A. $73,000

B. $72,700

C. $73,200

D. $75,000

13. Please use the company information from above.

When the company takes delivery of the merchandise on May 2, 2020, accounts payable is credited in the amount of:

Select one:

A. $73,000

B. $73,200

C. $75,000

D. $72,500

14. Please use the company information from above.

What is the net effect on 2020 income of exchange rate changes due to the merchandise purchase and hedge?

Select one:

A. $300 loss

B. no effect

C. $2,500 loss

D. $500 loss

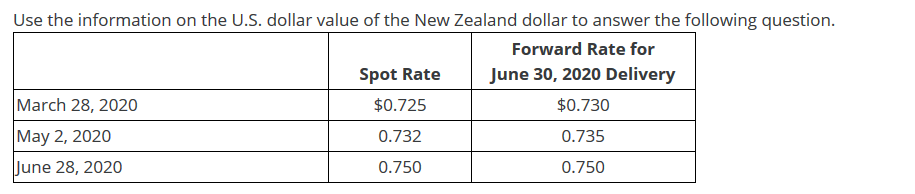

Use the information on the U.S. dollar value of the New Zealand dollar to answer the following question. Forward Rate for Spot Rate June 30, 2020 Delivery March 28, 2020 $0.725 $0.730 May 2, 2020 0.732 0.735 June 28, 2020 0.750 0.750Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started