Answered step by step

Verified Expert Solution

Question

1 Approved Answer

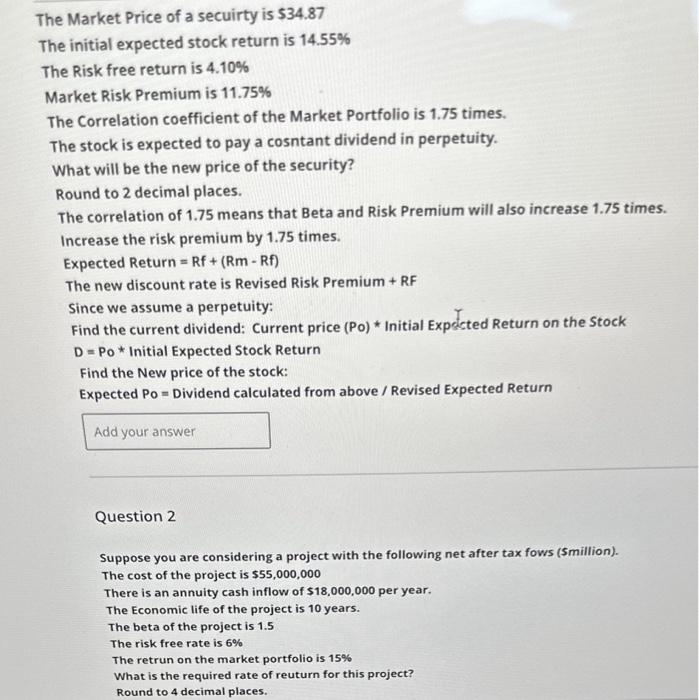

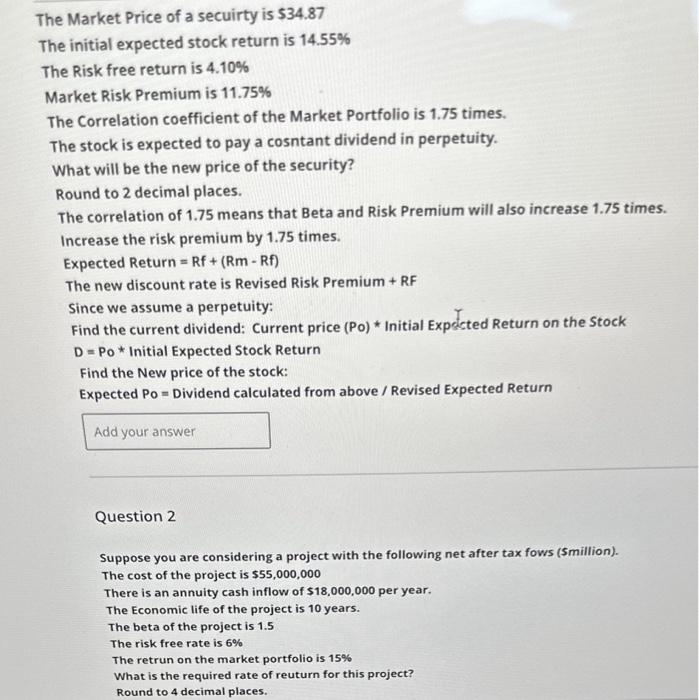

1&2 please The Market Price of a secuirty is $34.87 The initial expected stock return is 14.55% The Risk free return is 4.10% Market Risk

1&2 please

The Market Price of a secuirty is $34.87 The initial expected stock return is 14.55% The Risk free return is 4.10% Market Risk Premium is 11.75% The Correlation coefficient of the Market Portfolio is 1.75 times. The stock is expected to pay a cosntant dividend in perpetuity. What will be the new price of the security? Round to 2 decimal places. The correlation of 1.75 means that Beta and Risk Premium will also increase 1.75 times. Increase the risk premium by 1.75 times. Expected Return =Rf+(RmRf) The new discount rate is Revised Risk Premium + RF Since we assume a perpetuity: Find the current dividend: Current price (P0) * Initial Expsccted Return on the Stock D=Po Initial Expected Stock Return Find the New price of the stock: Expected Po= Dividend calculated from above / Revised Expected Return Question 2 Suppose you are considering a project with the following net after tax fows (smillion). The cost of the project is $55,000,000 There is an annuity cash inflow of $18,000,000 per year. The Economic life of the project is 10 years. The beta of the project is 1.5 The risk free rate is 6% The retrun on the market portfolio is 15% What is the required rate of reuturn for this project? Round to 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started