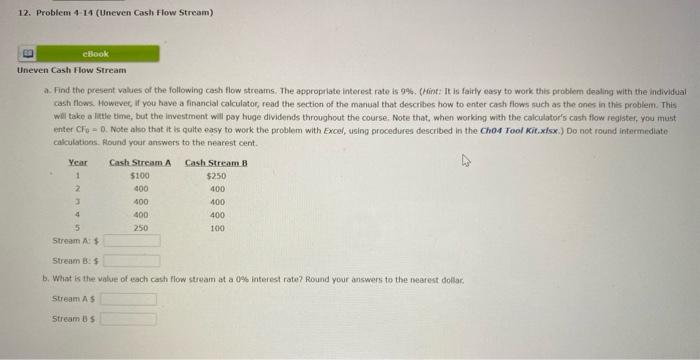

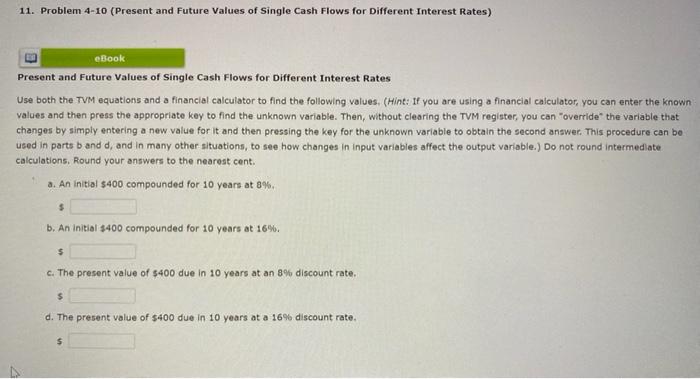

12. Problem 4-14 (Uneven Cash Flow Stream) cook Uneven Cash Flow Stream a Find the present values of the following cash flow streams. The appropriate interest rate is 9% (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that when working with the calculator's cash flow register, you must enter Cho - 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Chos Tool Kit.xlsx) Do not round intermediate calculations, Round your answers to the nearest cent Year 1 2 3 4 400 Cash Stream A Cash Stream B $100 $250 400 400 100 400 400 250 100 5 Stream AS Strum B:S b. What is the value of each cash flow stream at a 0% Interest rate? Round your answers to the nearest dollar Stream AS Stream Us 11. Problem 4-10 (Present and Future Values of Single Cash Flows for Different Interest Rates) eBook Present and future Values of Single Cash Flows for Different Interest Rates Use both the TV equations and a financial calculator to find the following values. (Hint: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown varlable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in Input variables affect the output variable.) Do not round intermediate calculations, Round your answers to the nearest cent. a. An initial $400 compounded for 10 years at 8% $ b. An initial $400 compounded for 10 years at 16%. $ c. The present value of $400 due in 10 years at an 8% discount rate, $ d. The present value of $400 due in 10 years at a 16% discount rate