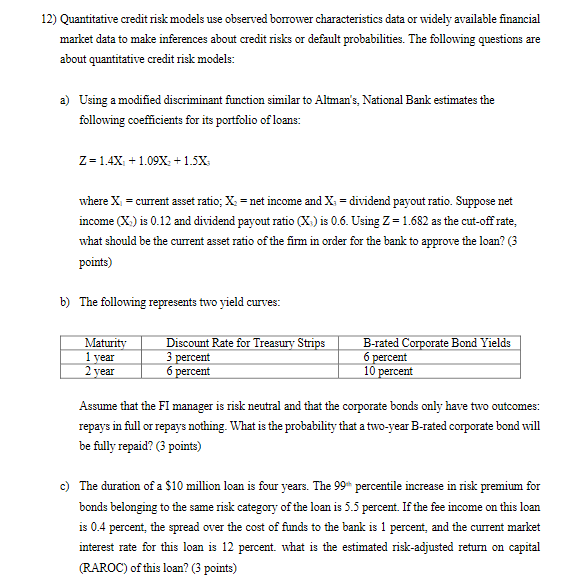

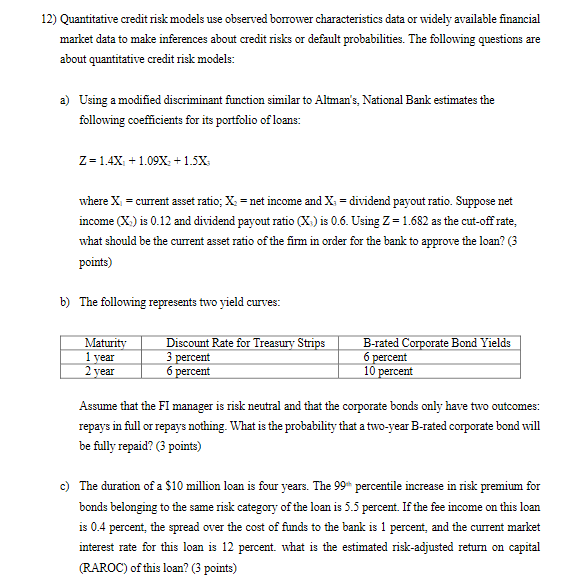

12) Quantitative credit risk models use observed borrower characteristics data or widely available financial market data to make inferences about credit risks or default probabilities. The following questions are about quantitative credit risk models: a) Using a modified discriminant function similar to Altman's, National Bank estimates the following coefficients for its portfolio of loans: Z=1.4X+1.09x +1.5X where X = current asset ratio; X = net income and X: = dividend payout ratio. Suppose net income (X) is 0.12 and dividend payout ratio (X) is 0.6. Using Z=1.682 as the cut-off rate, what should be the current asset ratio of the fim in order for the bank to approve the loan? (3 points) b) The following represents two yield curves: Maturity 1 year 2 year Discount Rate for Treasury Strips 3 percent 6 percent B-rated Corporate Bond Yields 6 percent 10 percent Assume that the FI manager is risk neutral and that the corporate bonds only have two outcomes: repays in full or repays nothing. What is the probability that a two-year B-rated corporate bond will be fully repaid? (3 points) c) The duration of a $10 million loan is four years. The 996 percentile increase in risk premium for bonds belonging to the same risk category of the loan is 5.5 percent. If the fee income on this loan is 0.4 percent, the spread over the cost of funds to the bank is 1 percent, and the current market interest rate for this loan is 12 percent. what is the estimated risk-adjusted retum on capital (RAROC) of this loan? (3 points) 12) Quantitative credit risk models use observed borrower characteristics data or widely available financial market data to make inferences about credit risks or default probabilities. The following questions are about quantitative credit risk models: a) Using a modified discriminant function similar to Altman's, National Bank estimates the following coefficients for its portfolio of loans: Z=1.4X+1.09x +1.5X where X = current asset ratio; X = net income and X: = dividend payout ratio. Suppose net income (X) is 0.12 and dividend payout ratio (X) is 0.6. Using Z=1.682 as the cut-off rate, what should be the current asset ratio of the fim in order for the bank to approve the loan? (3 points) b) The following represents two yield curves: Maturity 1 year 2 year Discount Rate for Treasury Strips 3 percent 6 percent B-rated Corporate Bond Yields 6 percent 10 percent Assume that the FI manager is risk neutral and that the corporate bonds only have two outcomes: repays in full or repays nothing. What is the probability that a two-year B-rated corporate bond will be fully repaid? (3 points) c) The duration of a $10 million loan is four years. The 996 percentile increase in risk premium for bonds belonging to the same risk category of the loan is 5.5 percent. If the fee income on this loan is 0.4 percent, the spread over the cost of funds to the bank is 1 percent, and the current market interest rate for this loan is 12 percent. what is the estimated risk-adjusted retum on capital (RAROC) of this loan? (3 points)