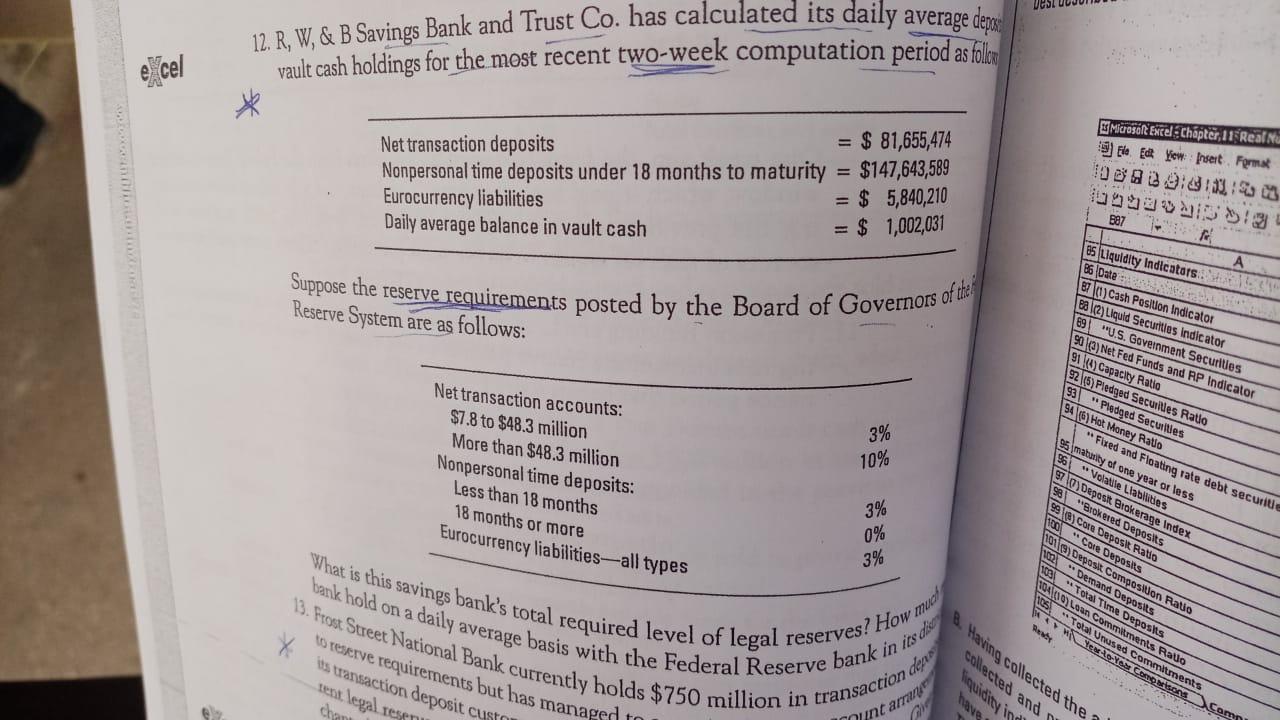

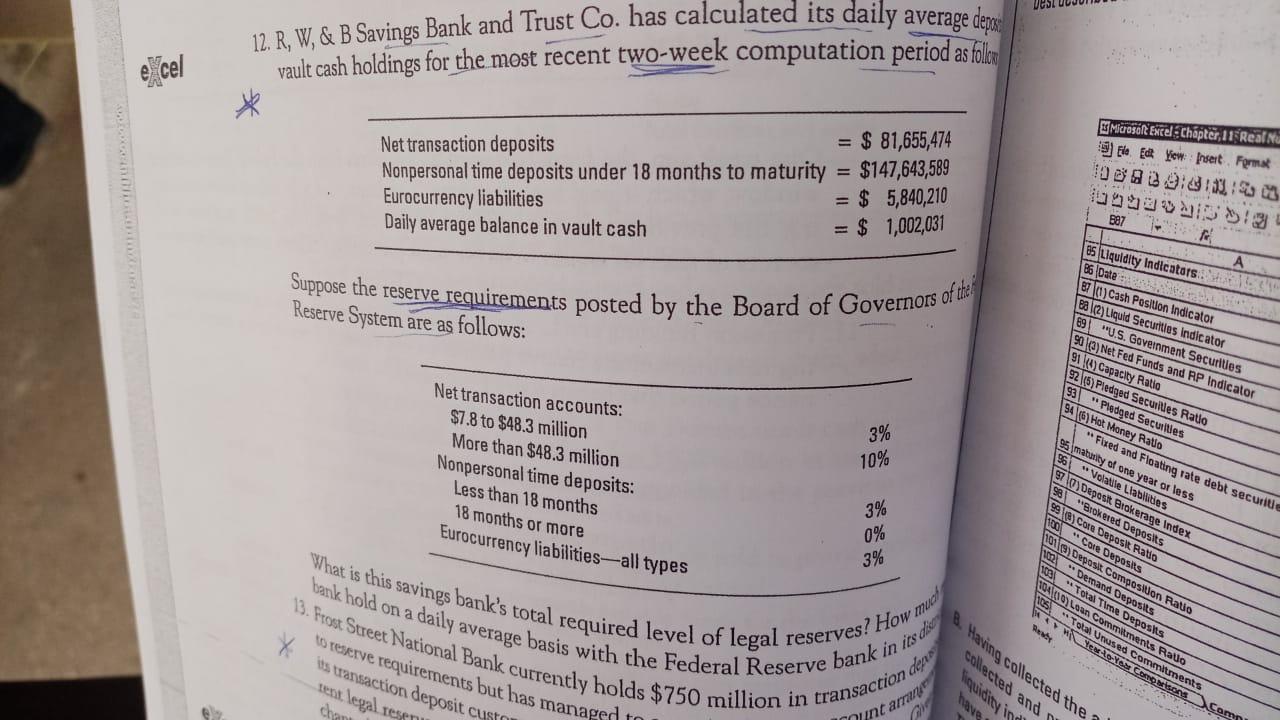

12. R, W, & B Savings Bank and Trust Co. has calculated its daily average dem vault cash holdings for the most recent two-week computation period as follo e cel Net transaction deposits $ 81,655,474 Nonpersonal time deposits under 18 months to maturity $147,643,589 Eurocurrency liabilities = $ 5,840,210 Daily average balance in vault cash = $ 1,002,031 3 Microsoft Excel Chapter 1 Real Nu 5)Ele Edt View: Insert Forms TOB 20:13 ; 3 B87 ! A Suppose the reserve requirements posted by the Board of Governors of the 65 Liquidity Indicators Oster 6701) Cash Position indicator BB (2) Liquid Securities Indicator 89 "U.S. Gaveinment Securities Reserve System are as follows: 90 ) Net Fed Funds and RP Indicator 91) Capacity Ratio 9255) Pledged Secuilles Rato 93 "Pledged Secuilles 94) Hot Money Rato Fued and Floating rate debt secure 95 maturity of one year or less Net transaction accounts: $7.8 to $48.3 million More than $48.3 million Nonpersonal time deposits: Less than 18 months months or more Eurocurrency liabilities--all types 3% 10% 3% 0% 3% 56 "Volatile Llabilities 970) Deposit Brokerage Index 98 "Brokered Deposits 99 ) Core Deposit Ratio * Core Deposits Vol) Depost. Composition Ratio w W** Demand Deposits 3. Frost Street National Bank currently holds $750 million in transaction des What is this savings bank's total required level of legal reserves? How much bank hold on a daily average basis with the Federal Reserve bank in its de LAV VesTotal Urased Rent 8. Having collected the Tume Deposits Comments Radio Se Yeniments lo rezerve requirements but has managed its transaction deposit custo tent legal resery chan collected and liquidity in Como meisons Camp mint am 12. R, W, & B Savings Bank and Trust Co. has calculated its daily average dem vault cash holdings for the most recent two-week computation period as follo e cel Net transaction deposits $ 81,655,474 Nonpersonal time deposits under 18 months to maturity $147,643,589 Eurocurrency liabilities = $ 5,840,210 Daily average balance in vault cash = $ 1,002,031 3 Microsoft Excel Chapter 1 Real Nu 5)Ele Edt View: Insert Forms TOB 20:13 ; 3 B87 ! A Suppose the reserve requirements posted by the Board of Governors of the 65 Liquidity Indicators Oster 6701) Cash Position indicator BB (2) Liquid Securities Indicator 89 "U.S. Gaveinment Securities Reserve System are as follows: 90 ) Net Fed Funds and RP Indicator 91) Capacity Ratio 9255) Pledged Secuilles Rato 93 "Pledged Secuilles 94) Hot Money Rato Fued and Floating rate debt secure 95 maturity of one year or less Net transaction accounts: $7.8 to $48.3 million More than $48.3 million Nonpersonal time deposits: Less than 18 months months or more Eurocurrency liabilities--all types 3% 10% 3% 0% 3% 56 "Volatile Llabilities 970) Deposit Brokerage Index 98 "Brokered Deposits 99 ) Core Deposit Ratio * Core Deposits Vol) Depost. Composition Ratio w W** Demand Deposits 3. Frost Street National Bank currently holds $750 million in transaction des What is this savings bank's total required level of legal reserves? How much bank hold on a daily average basis with the Federal Reserve bank in its de LAV VesTotal Urased Rent 8. Having collected the Tume Deposits Comments Radio Se Yeniments lo rezerve requirements but has managed its transaction deposit custo tent legal resery chan collected and liquidity in Como meisons Camp mint am