12

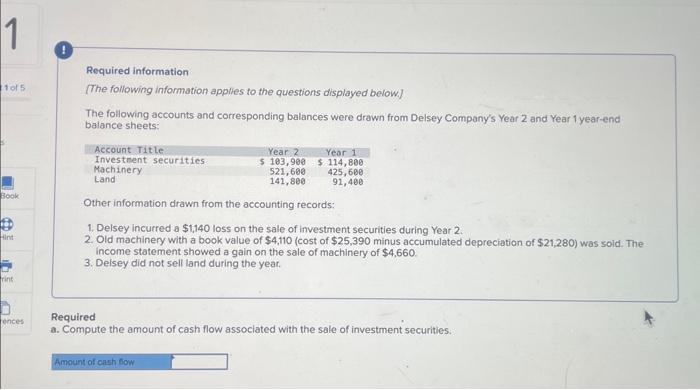

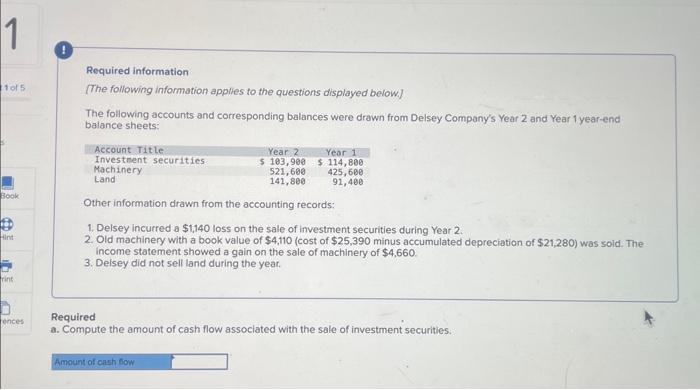

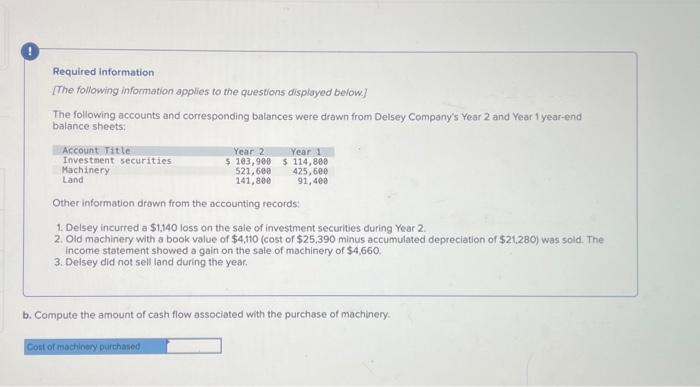

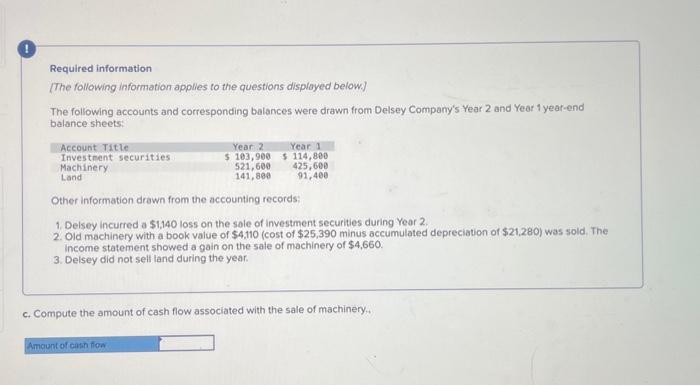

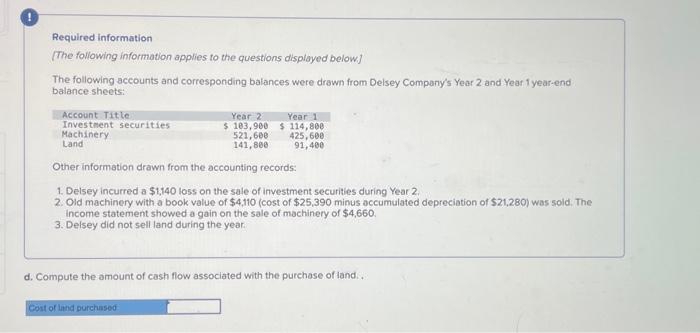

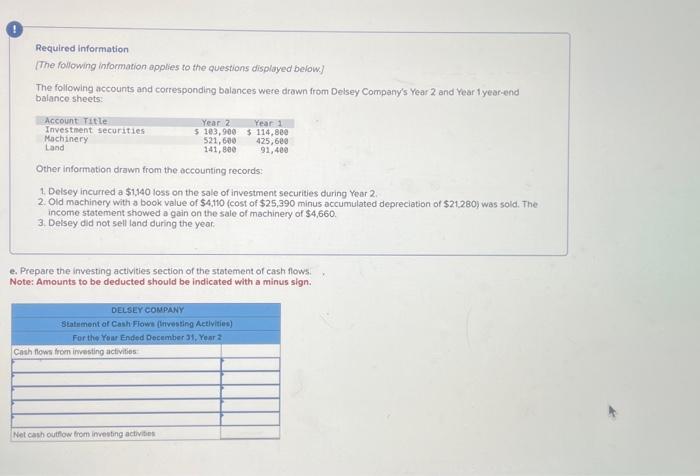

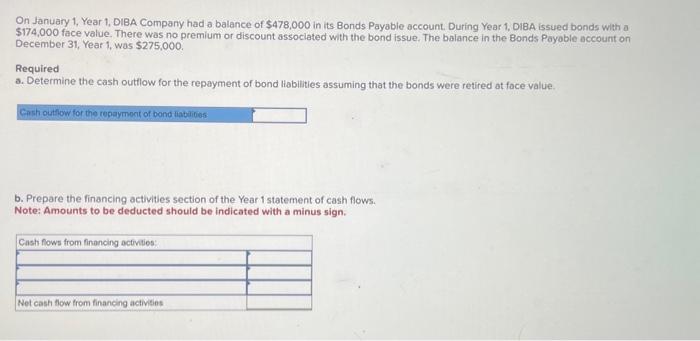

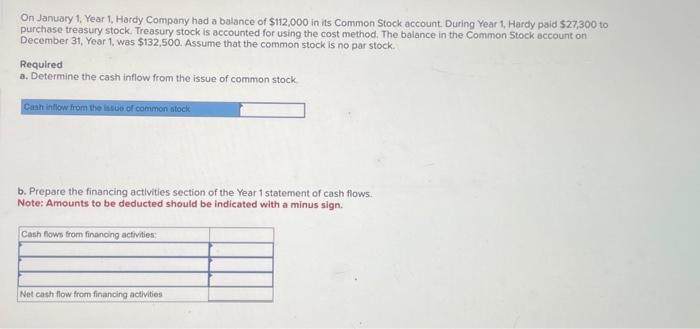

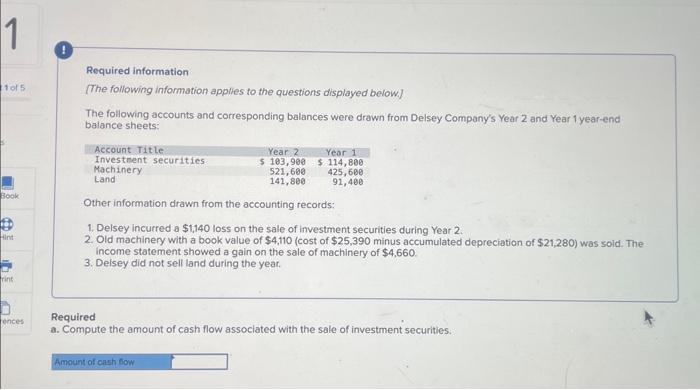

Required information The following information applies to the questions displayed below] The following accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Delsey incurred a $1,140 loss on the sale of investment securities during Year 2. 2. Old machinery with a book value of $4,110 (cost of $25,390 minus accumulated depreciation of $21,280 ) was sold. The income statement showed a gain on the sale of machinery of $4,660. 3. Delsey did not sell land during the year. Required a. Compute the amount of cash flow associated with the sale of investment securities. Required information The following information applies to the questions displayed below] The following accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Delsey incurred a $1,140 loss on the sale of imvestment securities during Year 2. 2. Old machinery with a book value of $4,110 (cost of $25,390 minus accumulated depreciation of $21,280 ) was sold. The income statement showed a gain on the sale of machinery of $4,660. 3. Delsey did not sell land during the year. b. Compute the amount of cash flow associated with the purchase of machinery. Required information The following information applies to the questions displayed below] The following accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Delsey incurred a $5,1,40 loss on the sele of investment securities during Year 2. 2. Old machinery with a book value of $4,110 (cost of $25,390 minus accumulated depreciation of $21,280 ) was sold, The income statement showed a gain on the sale of machinery of $4,660. 3. Delsey did not sell land during the year. c. Compute the amount of cash flow associated with the sale of machinery. Required information The following information applies to the questions displayed below] The following accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Other information drawn from the accounting records: 1. Delsey incurred a $1,440 toss on the sate of Investment securities during Year 2. 2. Old machinery with a book value of $4,110 (cost of $25,390 minus occumulated depreciation of $21,280 ) was sold. The income statement showed a gain on the sale of machinery of $4,660. 3. Delsey did not sell land during the year: d. Compute the amount of cash flow associated with the purchase of land. . Required information The folfowing information applies to the questions displayed below] The foliowing accounts and corresponding balances were drawn from Delsey Company's Year 2 and Year 1 year-end balance sheets: Other information drawn trom the occounting records: 1 Delsey incurred a $1,140 loss on the sale of investment securities during Year 2. 2. Old machinery with a book value of $4,110 (cost of $25,390 minus accumulated depreciation of $21,280 ) was sold. The income statement showed a gain on the sale of machinery of $4,660. 3. Delsey did not sell land during the year. e. Prepare the investing activities section of the statement of cash flows. . Note: Amounts to be deducted should be indicated with a minus sign. On January 1, Year 1, DIBA Company had a balance of $478,000 in its Bonds Payable account. During Year 1, DiBA issued bonds with a $174,000 face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payoble account on December 31, Year 1, was $275,000. Required a. Determine the cash outtlow for the repayment of bond liabilities assuming that the bonds were retired at face value. b. Prepare the financing activities section of the Year 1 statement of cash flows. Note: Amounts to be deducted should be indicated with a minus sign. On January 1, Year 1, Hardy Company had a balance of $112,000 in its Common Stock account. During Year 1, Hardy paid $27,300 to purchase treasury stock. Treasury stock is accounted for using the cost method. The balance in the Common Stock account on December 31 , Year 1 , was $132,500. Assume that the common stock is no par stock. Required a. Determine the cash inflow from the issue of common stock. b. Prepare the financing activities section of the Year 1 statement of cash flows. Note: Amounts to be deducted should be indicated with a minus sign