Question

12. SJ, Inc. covered the following employees under a qualified plan. Joan, a 9% owner and employee with compensation of $30,000. Lind, a commissioned salesperson

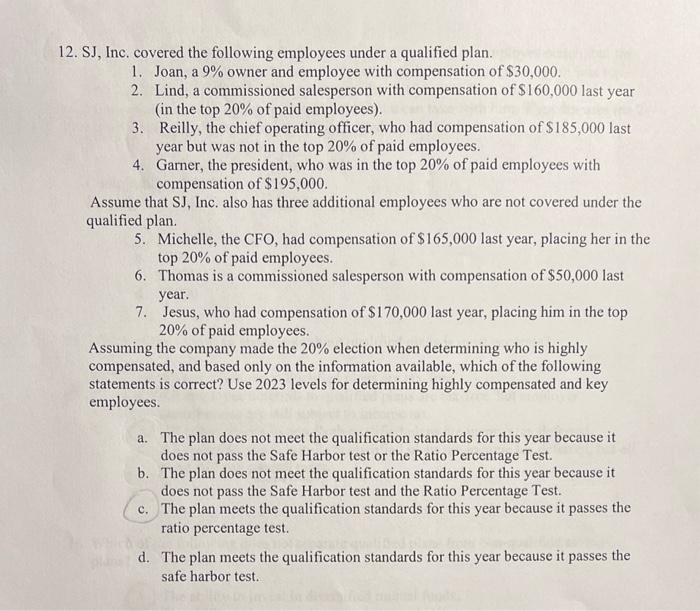

12. SJ, Inc. covered the following employees under a qualified plan.

- Joan, a 9% owner and employee with compensation of $30,000.

- Lind, a commissioned salesperson with compensation of $160,000 last year (in the top 20% of paid employees).

- Reilly, the chief operating officer, who had compensation of $185,000 last year but was not in the top 20% of paid employees.

- Garner, the president, who was in the top 20% of paid employees with compensation of $195,000.

Assume that SJ, Inc. also has three additional employees who are not covered under the qualified plan.

- Michelle, the CFO, had compensation of $165,000 last year, placing her in the top 20% of paid employees.

- Thomas is a commissioned salesperson with compensation of $50,000 last year.

- Jesus, who had compensation of $170,000 last year, placing him in the top 20% of paid employees.

Assuming the company made the 20% election when determining who is highly compensated, and based only on the information available, which of the following statements is correct? Use 2023 levels for determining highly compensated and key employees.

a. The plan does not meet the qualification standards for this year because it does not pass the Safe Harbor test or the Ratio Percentage Test.

b. The plan does not meet the qualification standards for this year because it does not pass the Safe Harbor test and the Ratio Percentage Test.

C. The plan meets the qualification standards for this year because it passes the ratio percentage test.

d. The plan meets the qualification standards for this year because it passes the safe harbor test.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started