12. Suppose you can invest in only the market index fund and 12-month treasury bill because of some regulation. E[r]=10%, SD[r]=20%, and rf=2%. You are a portfolio manager at Fidelity. Suppose, based on your price of risk and the portfolio theory, you invest $0.5m in the market index fund and $0.5m in the 12-month treasury bill today. One year later, the annual net return of the market index fund turns out 10%. If E[r], SD[r], rf, and your price of risk remain the same, how should you rebalance your portfolio? That is, do you have to sell or buy the market index fund after you observe its high return of 10%, based on the portfolio theory? Express your answer in a following manner. For example, if your answer is Sell $0.24m worth of the market portfolio, then enter -0.24. If your answer is Buy $0.92m worth of the market portfolio, then enter 0.92

18.

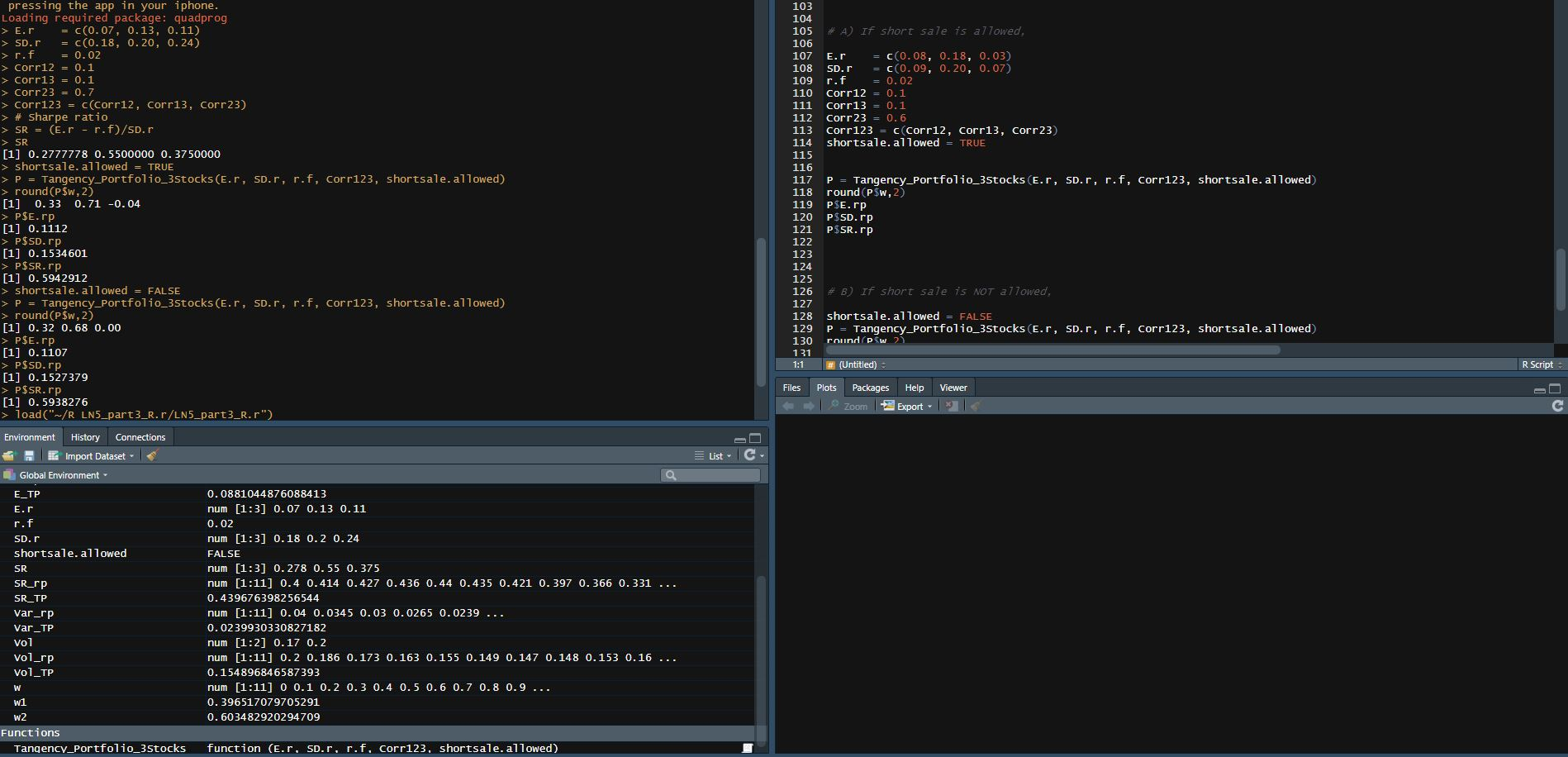

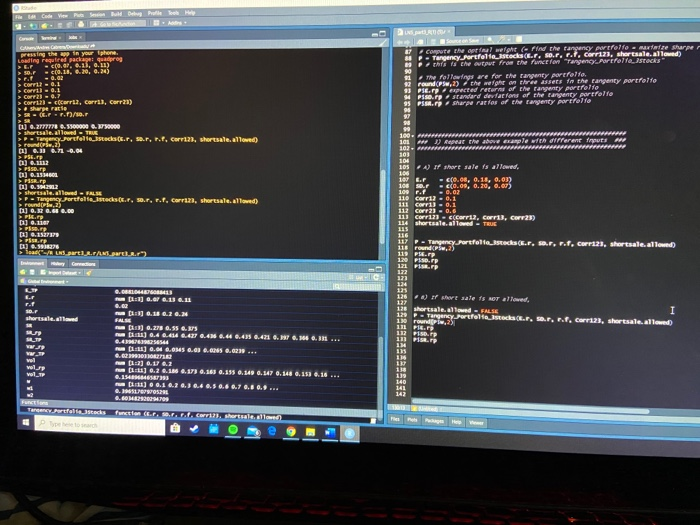

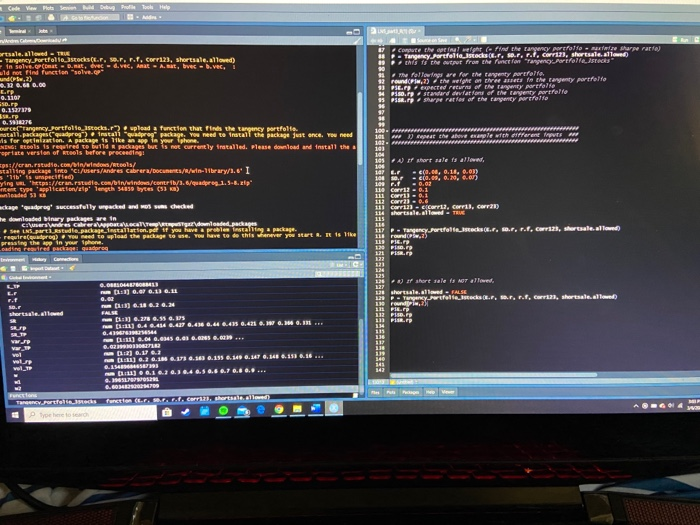

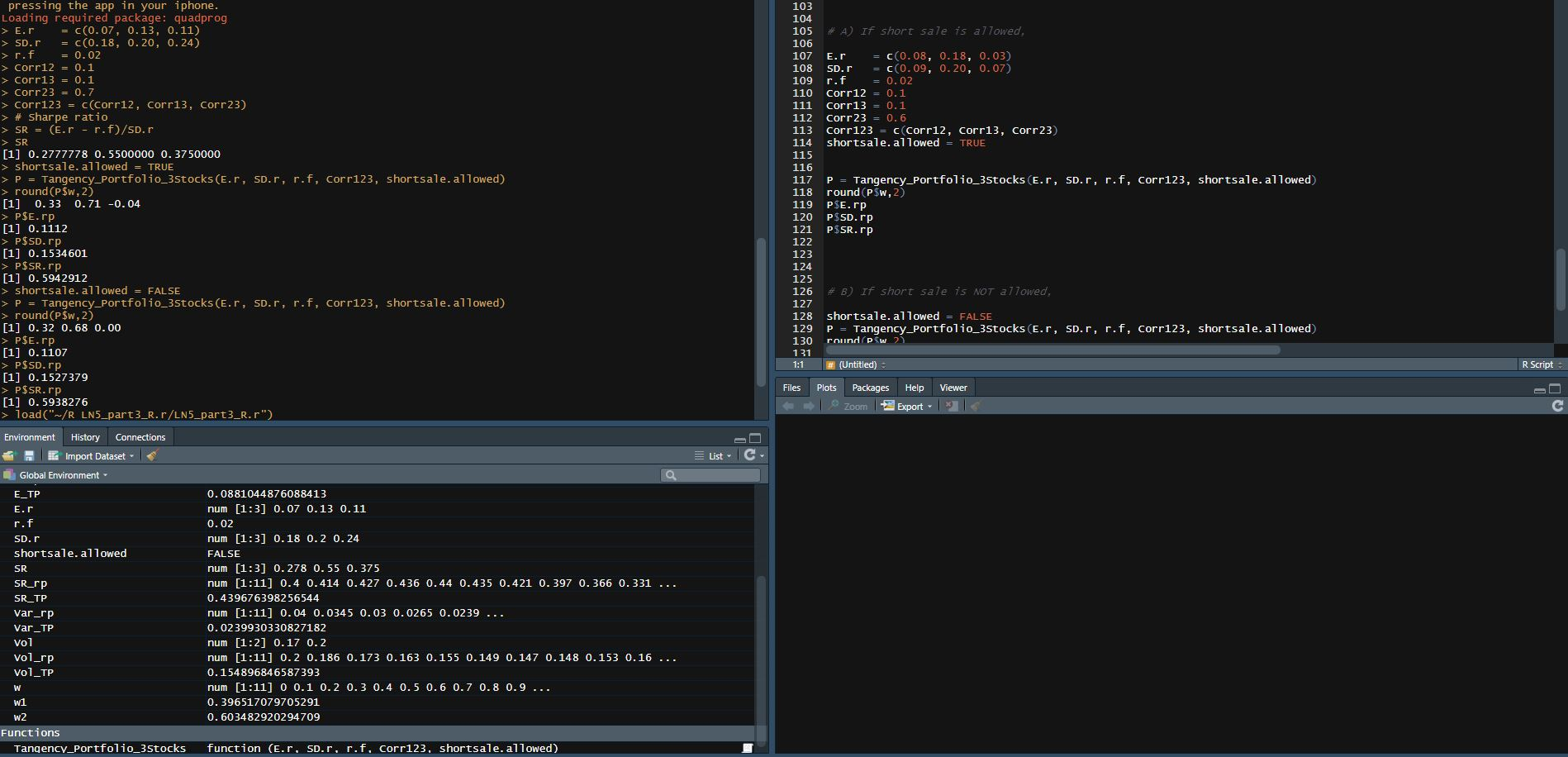

Compute the optimal weight on these three stocks a, b, and c so that your portfolio can have the highest possible Sharpe ratio. What is the weight on the stock c? Express your answer as a decimal (not percentage) and round it so that you have two digits below zero. ex) 0.78

Here, short sale is allowed. Hint: You need to modify the input part of 2) Tangency portfolio with multiple assets

See image for required information to answer the question. Any help would be greatly appreciated and will be rated as a thumbs up.

109 103 104 105 * A) If short sale is allowed, 106 107 E.r = c(0.08, 0.18, 0.03) 108 SD.r = c(0.09, 0.20, 0.07) r.f = 0.02 110 corr12 = 0.1 111 Corr13 = 0.1 112 corr23 = 0.6 113 Corr123 = c(Corr12, Corr13, corr23) 114 shortsale. allowed = TRUE 115 116 117 P = Tangency_Portfolio_3Stocks (E.r, s.r, r.f, corr123, shortsale. allowed) 118 round (PSW, 2) 119 PSE. 120 PSD.rp 121 PSSR. Op 122 123 124 125 126 # B If short sale is not allowed. 127 128 shortsale. allowed = FALSE P = Tangency_Portfolio_3Stocks (E.r, SD.r, r.f, corr123, shortsale. allowed) 130 round/PW2) 131 # (Untitled) 1:1 R Script pressing the app in your iphone. Loading required package: quadprog > E.r = c(0.07, 0.13, 0.11) > SD.r = c(0.18, 0.20, 0.24) > r.f = 0.02 > corr12 = 0.1 > Corr13 = 0.1 > Corr23 = 0.7 > Corr123 = c(corr12, corr13, corr23) > # sharpe ratio > SR = (E.r - r.f)/SD.r > SR [1] 0.2777778 0.5500000 0.37 50000 > shortsale. allowed = TRUE > P = Tangency_Portfolio_3stocks(E.r, so.r, r.f, Corr123, shortsale. allowed) > round (P$W,2) [1] 0.33 0.71 -0.04 > P$E.rp [1] 0.1112 > P$SD.rp [1] 0.1534601 > P$SR.rp [1] 0.5942912 > shortsale. allowed = FALSE > P = Tangency_Portfolio_3stocks (E.r, sb.r, rif, Corr123, shortsale. allowed) > round (P$w,2) [1] 0.32 0.68 0.00 > PSE.rp [1] 0.1107 > PSD.rp [1] 0.1527379 > P$SR.rp [1] 0.5938276 > load("~/R LN5_part3_R.r/LN5_part3_r.r") Environment History Connections - Import Dataset Global Environment E_TP 0.0881044876088413 Er num (1:3] 0.07 0.13 0.11 r.f 0.02 SD.r num [1:3] 0.18 0.2 0.24 shortsale. allowed FALSE SR num (1:3] 0.278 0.55 0.375 SR_rp num (1:11] 0.4 0.414 0.427 0.436 0.44 0.435 0.421 0.397 0.366 0.331 ... SR_TP 0.439676398256544 var_rp num (1:11] 0.04 0.0345 0.03 0.0265 0.0239 ... var_TP 0.0239930330827182 vol num [1:2] 0.17 0.2 vol_rp num (1:11] 0.2 0.186 0.173 0.163 0.155 0.149 0.147 0.148 0.153 0.16 ... vol_TP 0.154896846587393 num (1:11] 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 ... w1 0.396517079705291 0.603482920294709 Functions Tangency_Portfolio_3Stocks function (E.r. SD.r. r.f. Corr123, shortsale.allowed) Files Plots Viewer Packages Zoom Help Export List w2 Code View - in Bull Deling Profile - Gawe m atinal weight - Find the rangency portfelte - marine surper - Tangency fortfalletas (resor. com chid F r . . Corri23. shertsale, alle Fargen. Parallelseks The followings are for the rangery felfe. round PS2) che weight on the assets in the Cangency portfeito PS. expected return of the rangenty portrette Pssere standard deviations of the rangeny portfolio PS. Sharge partes or the tangenty portfolio > Carril - Carr, corris, Cerr23) 2 2000 nyfortfellesk .r, s.r. n., Cor.3, shortsale allowed) HAARAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA A feet the above are with orferene futs 2 2 2 A) If sale is allowed. 0.09, 0.30. > PTangencyPortfolte s .f. 10.F, F., Carr23, shortsale, allowed) crcorri2. corra), corr23) 2 2 Portfolio stocks(E.F. s.r... corr23, shortsale allowed) EEEEEEEEEEEEEEEEEEEEEEEEF [11] 0.6 0.13 G. sale f or allowed. r ate.at fold r , f. Corr123, shortsale.al 25 0.278 0.55 ) .0.414 . AT 2.4 2.44 0.435 4.4214. 4.14 F ) .4 8.0345 6.0 6.00 6.0223... C ) 0.2 0.16 0.17 0.16 0.15 0.149 4.147 .148 6.15 O G.1 0.2 0.3 0.4 .0.6 0.7 0.8 0.9 ... 6.16 ... C Tanpart s acks function ( Carri.hertale Code View Pos t Og Profile Took Help 7 SF, F., C Tangency fortfolio 12. Shortsale, allowed) compute the pre Cor de surpe parte y hr, ( find the Eary Arte dalanacks.. s.r.., corr123, shortsale allowed From the P rayer fall are for the raty A relle round CPI, 2) the weight or Breannes to the cayenty portfolio ered red of rolle PSS2 Sepertor of che rare trave 1101 132 cener che ave engle with different ve our cet Tangency Portfolio stocks. r p la function that finds the tangency portfolio 2 package. You need to b e just once w ed NENGE 2015 is required to und packages but is not currently tratalled. Please download and install the els before proceeding! Eps://cran.rstudio.com/bin/windows/Revols/ stalling package ince C:/Users/Andres Cabrera/Documents/R/wi-brawie I ying t he //cranstudio.combin/windows/contrib/6/quadprog.1.5-6.zip A) If sort sale is all checked Corral, ackage quadrag successfully cracked and he downloaded binary packages are in SUN Garettu r a care downloaded - TengencyPortfolio .F, s.rr.fCorri , sheriale allem @. 0 044576083413 11 0. . 0.0 f or sale in OT allowed tale, alle - FALSE - TANYA S., , . 1 0.18 0.2 0.24 G.278 0.95 . 175 42 0.4967292734544 .43 0.4 .4 6.4 6.1 0. ... 1) 6.2 6.18 6.13 6.16 0.159.186.147 6.14 6.11.16... 0.1 0.3 0.3 0.4 0..6 0.7 ........ fanetton CLASSE.. Carri. Stylos 109 103 104 105 * A) If short sale is allowed, 106 107 E.r = c(0.08, 0.18, 0.03) 108 SD.r = c(0.09, 0.20, 0.07) r.f = 0.02 110 corr12 = 0.1 111 Corr13 = 0.1 112 corr23 = 0.6 113 Corr123 = c(Corr12, Corr13, corr23) 114 shortsale. allowed = TRUE 115 116 117 P = Tangency_Portfolio_3Stocks (E.r, s.r, r.f, corr123, shortsale. allowed) 118 round (PSW, 2) 119 PSE. 120 PSD.rp 121 PSSR. Op 122 123 124 125 126 # B If short sale is not allowed. 127 128 shortsale. allowed = FALSE P = Tangency_Portfolio_3Stocks (E.r, SD.r, r.f, corr123, shortsale. allowed) 130 round/PW2) 131 # (Untitled) 1:1 R Script pressing the app in your iphone. Loading required package: quadprog > E.r = c(0.07, 0.13, 0.11) > SD.r = c(0.18, 0.20, 0.24) > r.f = 0.02 > corr12 = 0.1 > Corr13 = 0.1 > Corr23 = 0.7 > Corr123 = c(corr12, corr13, corr23) > # sharpe ratio > SR = (E.r - r.f)/SD.r > SR [1] 0.2777778 0.5500000 0.37 50000 > shortsale. allowed = TRUE > P = Tangency_Portfolio_3stocks(E.r, so.r, r.f, Corr123, shortsale. allowed) > round (P$W,2) [1] 0.33 0.71 -0.04 > P$E.rp [1] 0.1112 > P$SD.rp [1] 0.1534601 > P$SR.rp [1] 0.5942912 > shortsale. allowed = FALSE > P = Tangency_Portfolio_3stocks (E.r, sb.r, rif, Corr123, shortsale. allowed) > round (P$w,2) [1] 0.32 0.68 0.00 > PSE.rp [1] 0.1107 > PSD.rp [1] 0.1527379 > P$SR.rp [1] 0.5938276 > load("~/R LN5_part3_R.r/LN5_part3_r.r") Environment History Connections - Import Dataset Global Environment E_TP 0.0881044876088413 Er num (1:3] 0.07 0.13 0.11 r.f 0.02 SD.r num [1:3] 0.18 0.2 0.24 shortsale. allowed FALSE SR num (1:3] 0.278 0.55 0.375 SR_rp num (1:11] 0.4 0.414 0.427 0.436 0.44 0.435 0.421 0.397 0.366 0.331 ... SR_TP 0.439676398256544 var_rp num (1:11] 0.04 0.0345 0.03 0.0265 0.0239 ... var_TP 0.0239930330827182 vol num [1:2] 0.17 0.2 vol_rp num (1:11] 0.2 0.186 0.173 0.163 0.155 0.149 0.147 0.148 0.153 0.16 ... vol_TP 0.154896846587393 num (1:11] 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 ... w1 0.396517079705291 0.603482920294709 Functions Tangency_Portfolio_3Stocks function (E.r. SD.r. r.f. Corr123, shortsale.allowed) Files Plots Viewer Packages Zoom Help Export List w2 Code View - in Bull Deling Profile - Gawe m atinal weight - Find the rangency portfelte - marine surper - Tangency fortfalletas (resor. com chid F r . . Corri23. shertsale, alle Fargen. Parallelseks The followings are for the rangery felfe. round PS2) che weight on the assets in the Cangency portfeito PS. expected return of the rangenty portrette Pssere standard deviations of the rangeny portfolio PS. Sharge partes or the tangenty portfolio > Carril - Carr, corris, Cerr23) 2 2000 nyfortfellesk .r, s.r. n., Cor.3, shortsale allowed) HAARAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA A feet the above are with orferene futs 2 2 2 A) If sale is allowed. 0.09, 0.30. > PTangencyPortfolte s .f. 10.F, F., Carr23, shortsale, allowed) crcorri2. corra), corr23) 2 2 Portfolio stocks(E.F. s.r... corr23, shortsale allowed) EEEEEEEEEEEEEEEEEEEEEEEEF [11] 0.6 0.13 G. sale f or allowed. r ate.at fold r , f. Corr123, shortsale.al 25 0.278 0.55 ) .0.414 . AT 2.4 2.44 0.435 4.4214. 4.14 F ) .4 8.0345 6.0 6.00 6.0223... C ) 0.2 0.16 0.17 0.16 0.15 0.149 4.147 .148 6.15 O G.1 0.2 0.3 0.4 .0.6 0.7 0.8 0.9 ... 6.16 ... C Tanpart s acks function ( Carri.hertale Code View Pos t Og Profile Took Help 7 SF, F., C Tangency fortfolio 12. Shortsale, allowed) compute the pre Cor de surpe parte y hr, ( find the Eary Arte dalanacks.. s.r.., corr123, shortsale allowed From the P rayer fall are for the raty A relle round CPI, 2) the weight or Breannes to the cayenty portfolio ered red of rolle PSS2 Sepertor of che rare trave 1101 132 cener che ave engle with different ve our cet Tangency Portfolio stocks. r p la function that finds the tangency portfolio 2 package. You need to b e just once w ed NENGE 2015 is required to und packages but is not currently tratalled. Please download and install the els before proceeding! Eps://cran.rstudio.com/bin/windows/Revols/ stalling package ince C:/Users/Andres Cabrera/Documents/R/wi-brawie I ying t he //cranstudio.combin/windows/contrib/6/quadprog.1.5-6.zip A) If sort sale is all checked Corral, ackage quadrag successfully cracked and he downloaded binary packages are in SUN Garettu r a care downloaded - TengencyPortfolio .F, s.rr.fCorri , sheriale allem @. 0 044576083413 11 0. . 0.0 f or sale in OT allowed tale, alle - FALSE - TANYA S., , . 1 0.18 0.2 0.24 G.278 0.95 . 175 42 0.4967292734544 .43 0.4 .4 6.4 6.1 0. ... 1) 6.2 6.18 6.13 6.16 0.159.186.147 6.14 6.11.16... 0.1 0.3 0.3 0.4 0..6 0.7 ........ fanetton CLASSE.. Carri. Stylos