Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12 uan and Amy are discussing one of their audit client's cash and cash equivalents accounts while at lunch one day. Juan mentions to my

12

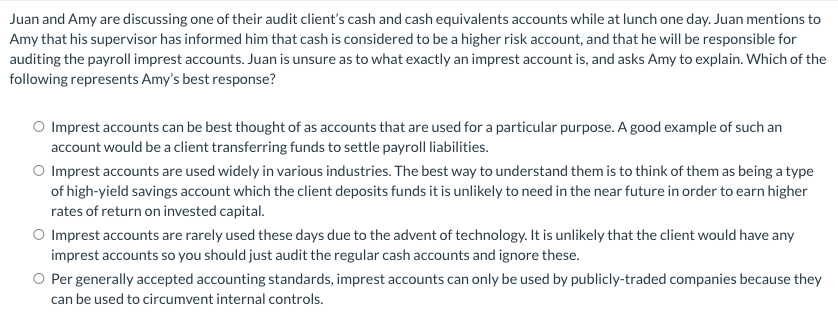

uan and Amy are discussing one of their audit client's cash and cash equivalents accounts while at lunch one day. Juan mentions to my that his supervisor has informed him that cash is considered to be a higher risk account, and that he will be responsible for uditing the payroll imprest accounts. Juan is unsure as to what exactly an imprest account is, and asks Amy to explain. Which of the blowing represents Amy's best response? Imprest accounts can be best thought of as accounts that are used for a particular purpose. A good example of such an account would be a client transferring funds to settle payroll liabilities. Imprest accounts are used widely in various industries. The best way to understand them is to think of them as being a type of high-yield savings account which the client deposits funds it is unlikely to need in the near future in order to earn higher rates of return on invested capital. Imprest accounts are rarely used these days due to the advent of technology. It is unlikely that the client would have any imprest accounts so you should just audit the regular cash accounts and ignore these. Per generally accepted accounting standards, imprest accounts can only be used by publicly-traded companies because they can be used to circumvent internal controlsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started