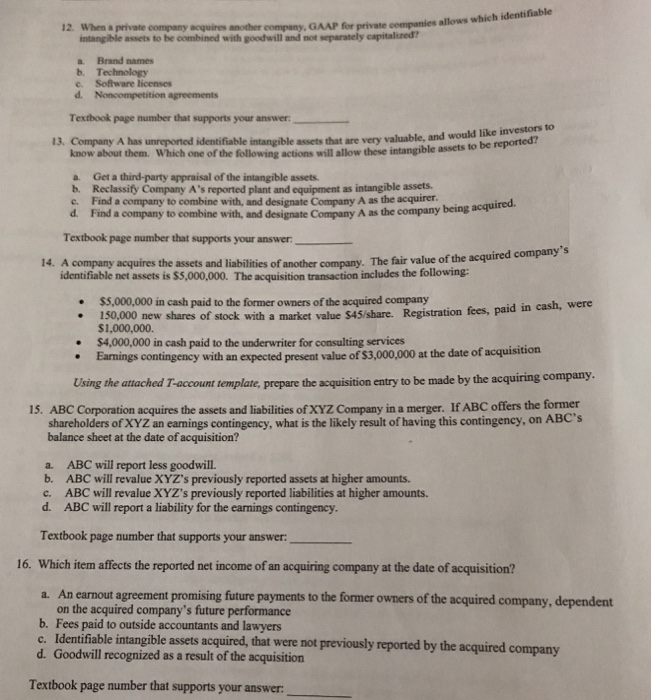

12. When a private company acquires another company, GMP for private companies allows which identifiable intangible assets to be combined with goodwill and not separately capitalized! Brand names b. Technology Software licenses d. Noncompetition agreements d. . Textbook page number that supports your answer: 13. Company A has unreported identifiable intangible assets that are very valuable, and would like investors to know about them. Which one of the following actions will allow these intangible assets to be reported? a. Get a third-party appraisal of the intangible assets. b. Reclassify Company A's reported plant and equipment as intangible assets. c. Find a company to combine with, and designate Company A as the acquirer. Find a company to combine with, and designate Company A as the company being acquired. Textbook page number that supports your answer. 14. A company acquires the assets and liabilities of another company. The fair value of the acquired company's identifiable net assets is $5,000,000. The acquisition transaction includes the following: $5,000,000 in cash paid to the former owners of the acquired company 150,000 new shares of stock with a market value 545/share. Registration fees, paid in cash, were $1,000,000 $4,000,000 in cash paid to the underwriter for consulting services Earnings contingency with an expected present value of $3,000,000 at the date of acquisition Using the attached T-account template, prepare the acquisition entry to be made by the acquiring company. 15. ABC Corporation acquires the assets and liabilities of XYZ Company in a merger. If ABC offers the former shareholders of XYZ an earnings contingency, what is the likely result of having this contingency, on ABC's balance sheet at the date of acquisition? ABC will report less goodwill. b. ABC will revalue XYZ's previously reported assets at higher amounts. c. ABC will revalue XYZ's previously reported liabilities at higher amounts. d. ABC will report a liability for the earnings contingency. Textbook page number that supports your answer: . 16. Which item affects the reported net income of an acquiring company at the date of acquisition? a. An earnout agreement promising future payments to the former owners of the acquired company, dependent on the acquired company's future performance b. Fees paid to outside accountants and lawyers c. Identifiable intangible assets acquired, that were not previously reported by the acquired company d. Goodwill recognized as a result of the acquisition Textbook page number that supports your