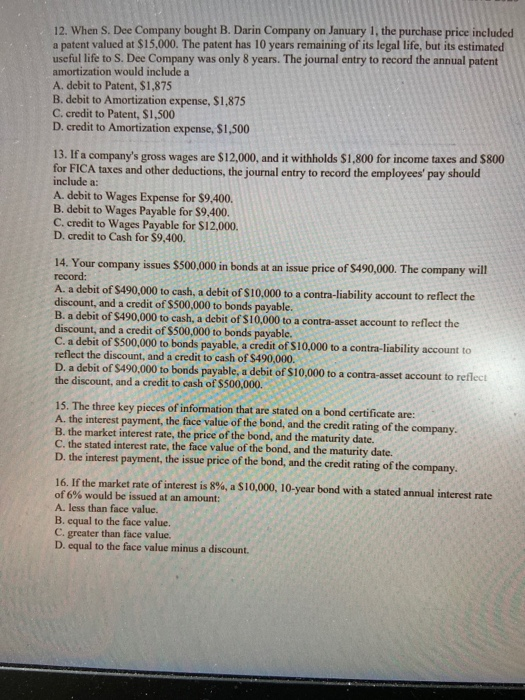

12. When S. Dee Company bought B. Darin Company on January 1, the purchase price included a patent valued at $15,000. The patent has 10 years remaining of its legal life, but its estimated useful life to S. Dee Company was only 8 years. The journal entry to record the annual patent amortization would include a A. debit to Patent, $1,875 B. debit to Amortization expense, $1.875 C. credit to Patent, $1,500 D. credit to Amortization expense, $1,500 13. If a company's gross wages are $12,000, and it withholds $1,800 for income taxes and $800 for FICA taxes and other deductions, the journal entry to record the employees' pay should include a: A. debit to Wages Expense for $9.400. B. debit to Wages Payable for $9,400. C. credit to Wages Payable for $12,000. D. credit to Cash for $9.400. 14. Your company issues $500,000 in bonds at an issue price of $490,000. The company will record: A. a debit of $490,000 to cash, a debit of S10,000 to a contra-liability account to reflect the discount, and a credit of $500,000 to bonds payable. B. a debit of $490,000 to cash, a debit of $10,000 to a contra-asset account to reflect the discount, and a credit of $500,000 to bonds payable. C. a debit of $500,000 to bonds payable, a credit of S10,000 to a contra-liability account to reflect the discount, and a credit to cash of $490,000. D. a debit of $490,000 to bonds payable, a debit of $10,000 to a contra-asset account to reflect the discount, and a credit to cash of $500,000. 15. The three key pieces of information that are stated on a bond certificate are: A. the interest payment, the face value of the bond, and the credit rating of the company B. the market interest rate, the price of the bond, and the maturity date. C. the stated interest rate, the face value of the bond, and the maturity date. D. the interest payment, the issue price of the bond, and the credit rating of the company 16. If the market rate of interest is 8%, a $10,000. 10-year bond with a stated annual interest rate of 6% would be issued at an amount: A. less than face value. B. equal to the face value. C. greater than face value. D. equal to the face value minus a discount