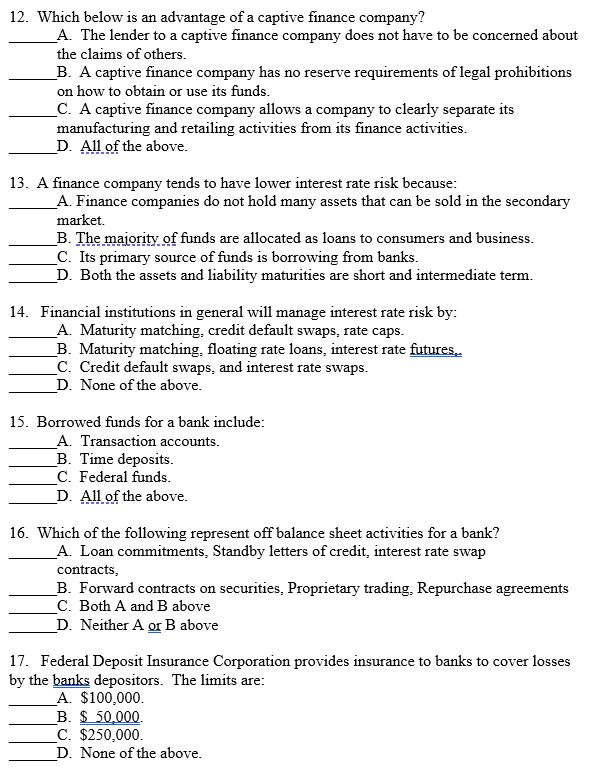

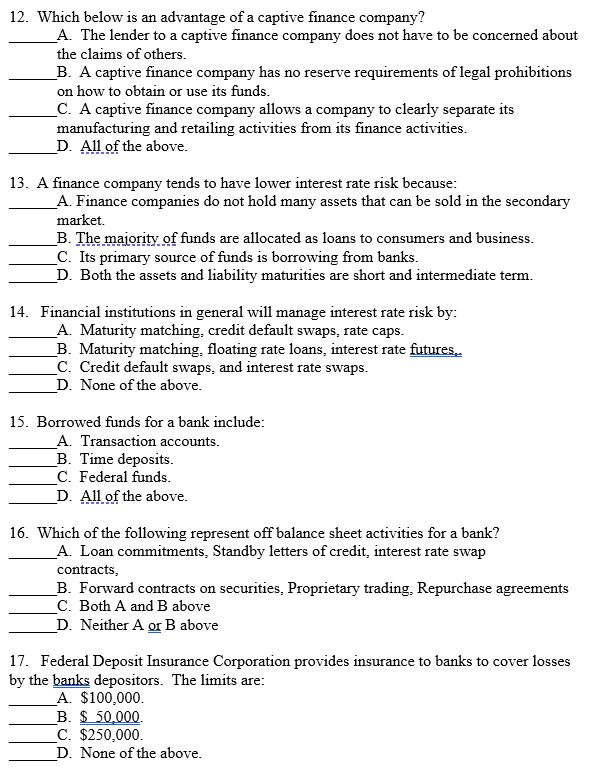

12. Which below is an advantage of a captive finance company? A. The lender to a captive finance company does not have to be concerned about the claims of others. B. A captive finance company has no reserve requirements of legal prohibitions on how to obtain or use its funds. C. A captive finance company allows a company to clearly separate its manufacturing and retailing activities from its finance activities. D. All of the above. 13. A finance company tends to have lower interest rate risk because: A. Finance companies do not hold many assets that can be sold in the secondary market. B. The majority of funds are allocated as loans to consumers and business. C. Its primary source of funds is borrowing from banks. D. Both the assets and liability maturities are short and intermediate term. 14. Financial institutions in general will manage interest rate risk by: A. Maturity matching, credit default swaps, rate caps. B. Maturity matching, floating rate loans, interest rate futures.. C. Credit default swaps, and interest rate swaps. D. None of the above. 15. Borrowed funds for a bank include: A. Transaction accounts. B. Time deposits. C. Federal funds. D. All of the above. 16. Which of the following represent off balance sheet activities for a bank? A. Loan commitments, Standby letters of credit, interest rate swap contracts, B. Forward contracts on securities. Proprietary trading, Repurchase agreements C. Both A and B above _D. Neither A or B above 17. Federal Deposit Insurance Corporation provides insurance to banks to cover losses by the banks depositors. The limits are: A. $100,000. B. $ 50.000 C. $250,000. D. None of the above. 12. Which below is an advantage of a captive finance company? A. The lender to a captive finance company does not have to be concerned about the claims of others. B. A captive finance company has no reserve requirements of legal prohibitions on how to obtain or use its funds. C. A captive finance company allows a company to clearly separate its manufacturing and retailing activities from its finance activities. D. All of the above. 13. A finance company tends to have lower interest rate risk because: A. Finance companies do not hold many assets that can be sold in the secondary market. B. The majority of funds are allocated as loans to consumers and business. C. Its primary source of funds is borrowing from banks. D. Both the assets and liability maturities are short and intermediate term. 14. Financial institutions in general will manage interest rate risk by: A. Maturity matching, credit default swaps, rate caps. B. Maturity matching, floating rate loans, interest rate futures.. C. Credit default swaps, and interest rate swaps. D. None of the above. 15. Borrowed funds for a bank include: A. Transaction accounts. B. Time deposits. C. Federal funds. D. All of the above. 16. Which of the following represent off balance sheet activities for a bank? A. Loan commitments, Standby letters of credit, interest rate swap contracts, B. Forward contracts on securities. Proprietary trading, Repurchase agreements C. Both A and B above _D. Neither A or B above 17. Federal Deposit Insurance Corporation provides insurance to banks to cover losses by the banks depositors. The limits are: A. $100,000. B. $ 50.000 C. $250,000. D. None of the above