Question

12) Winter Company maintains escrow accounts for various mortgage entities. The entity collects the receipts and pays real estate taxes on behalf of mortgage

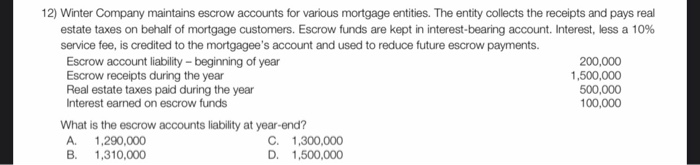

12) Winter Company maintains escrow accounts for various mortgage entities. The entity collects the receipts and pays real estate taxes on behalf of mortgage customers. Escrow funds are kept in interest-bearing account. Interest, less a 10% service fee, is credited to the mortgagee's account and used to reduce future escrow payments. Escrow account liability - beginning of year Escrow receipts during the year Real estate taxes paid during the year Interest earned on escrow funds 200,000 1,500,000 500,000 100,000 What is the escrow accounts liability at year-end? 1,290,000 1,310,000 C. 1,300,000 D. 1,500,000 A. B.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Beginning balance 200000 Add Escrow receipts during the year 1500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

10th Edition

1119491630, 978-1119491637, 978-0470534793

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App