Question

11) Gayle Company a division of Charis Realty Inc., maintains escrow account and pays real estate taxes for Charis mortgage customers. Escrow funds are

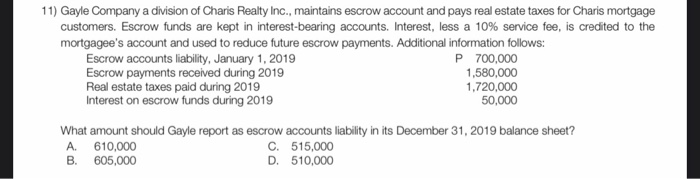

11) Gayle Company a division of Charis Realty Inc., maintains escrow account and pays real estate taxes for Charis mortgage customers. Escrow funds are kept in interest-bearing accounts. Interest, less a 10% service fee, is credited to the mortgagee's account and used to reduce future escrow payments. Additional information follows: Escrow accounts liability, January 1, 2019 Escrow payments received during 2019 Real estate taxes paid during 2019 Interest on escrow funds during 2019 P 700,000 1,580,000 1,720,000 50,000 What amount should Gayle report as escrow accounts liability in its December 31, 2019 balance sheet? C. 515,000 D. 510,000 A. 610,000 B. 605,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation of Gayle escH Ow accounts Gability in December 31 2019 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Business Decision Making And Analysis

Authors: Robert Stine, Dean Foster

2nd Edition

978-0321836519, 321836510, 978-0321890269

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App