The following rates are observed on the yield curve: 6-month 0.5%, 12-month 1.5%, 18-month 2%, 24-month 3%. You hold a portfolio with four semi-annual

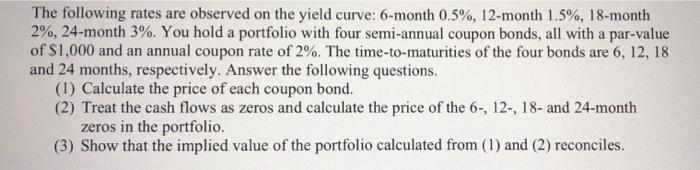

The following rates are observed on the yield curve: 6-month 0.5%, 12-month 1.5%, 18-month 2%, 24-month 3%. You hold a portfolio with four semi-annual coupon bonds, all with a par-value of $1,000 and an annual coupon rate of 2%. The time-to-maturities of the four bonds are 6, 12, 18 and 24 months, respectively. Answer the following questions. (1) Calculate the price of each coupon bond. (2) Treat the cash flows as zeros and calculate the price of the 6-, 12-, 18- and 24-month zeros in the portfolio. (3) Show that the implied value of the portfolio calculated from (1) and (2) reconciles.

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the price of each coupon bond we need to discount the cash flows using the appropriate spot rates from the yield curve The price of a bond is the present value of its future cash flows ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started