Shiloh Enterprises manufactures and sells gadgets. The business earned net income of $250,000 in 2016, when sales was 6,000 units and data for variable

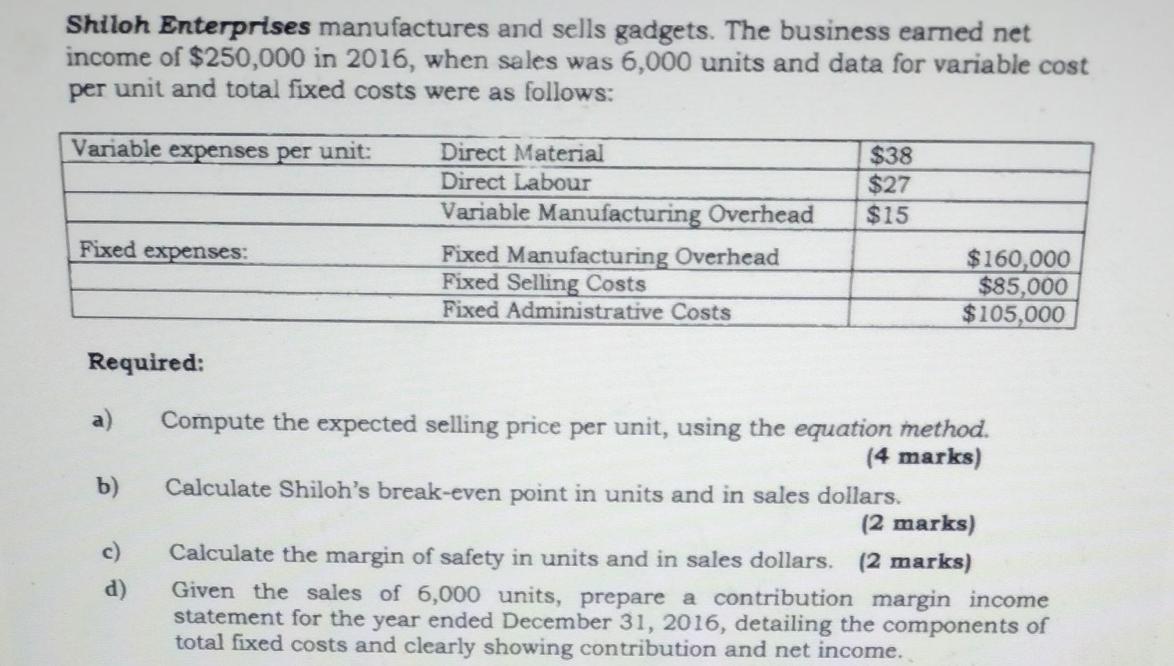

Shiloh Enterprises manufactures and sells gadgets. The business earned net income of $250,000 in 2016, when sales was 6,000 units and data for variable cost per unit and total fixed costs were as follows: Variable expenses per unit: Fixed expenses: Required: a) b) c) d) Direct Material Direct Labour Variable Manufacturing Overhead Fixed Manufacturing Overhead Fixed Selling Costs Fixed Administrative Costs $38 $27 $15 $160,000 $85,000 $105,000 Compute the expected selling price per unit, using the equation method. (4 marks) Calculate Shiloh's break-even point in units and in sales dollars. (2 marks) Calculate the margin of safety in units and in sales dollars. (2 marks) Given the sales of 6,000 units, prepare a contribution margin income statement for the year ended December 31, 2016, detailing the components of total fixed costs and clearly showing contribution and net income.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started