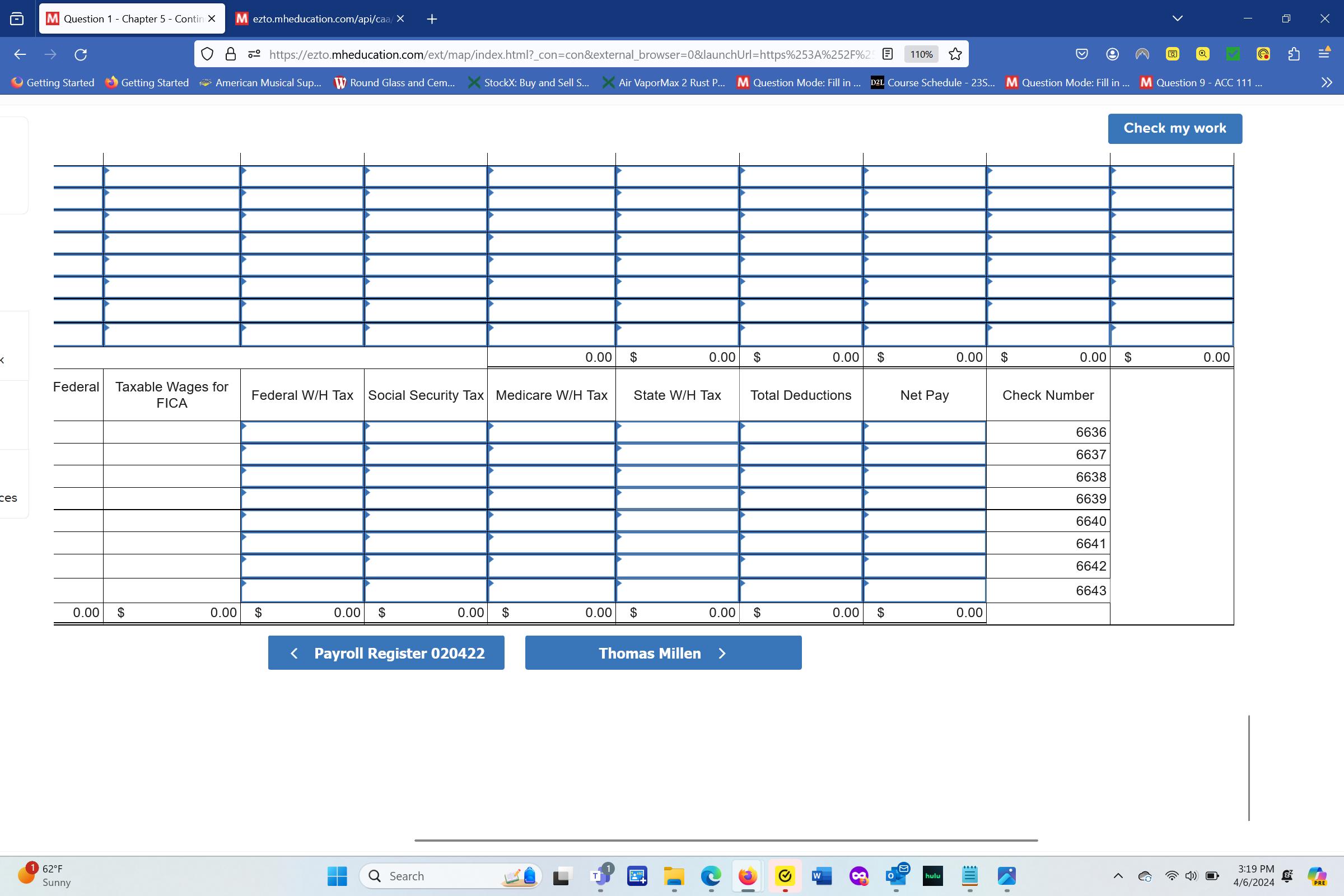

Question: Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. The Step-2 of

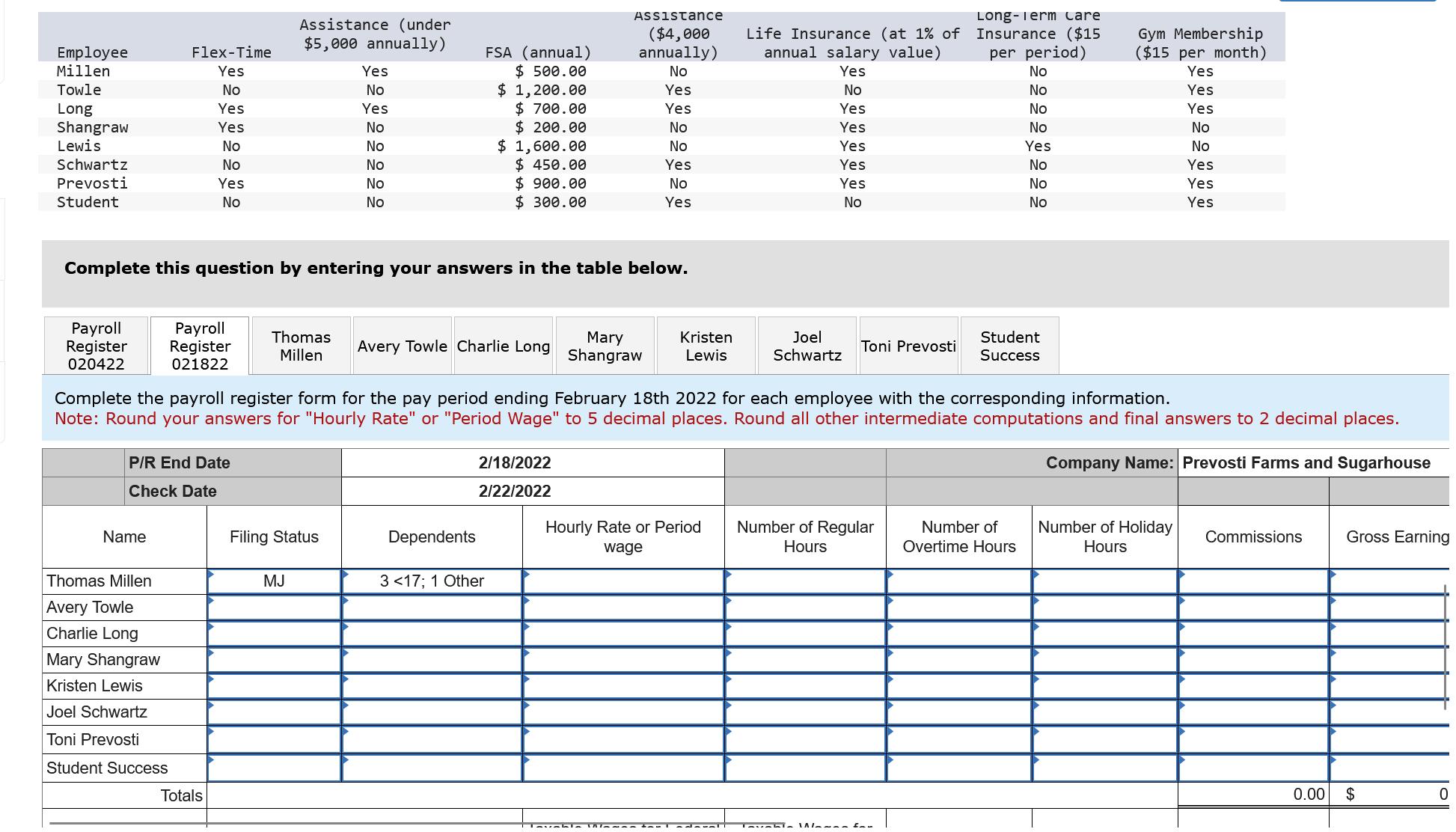

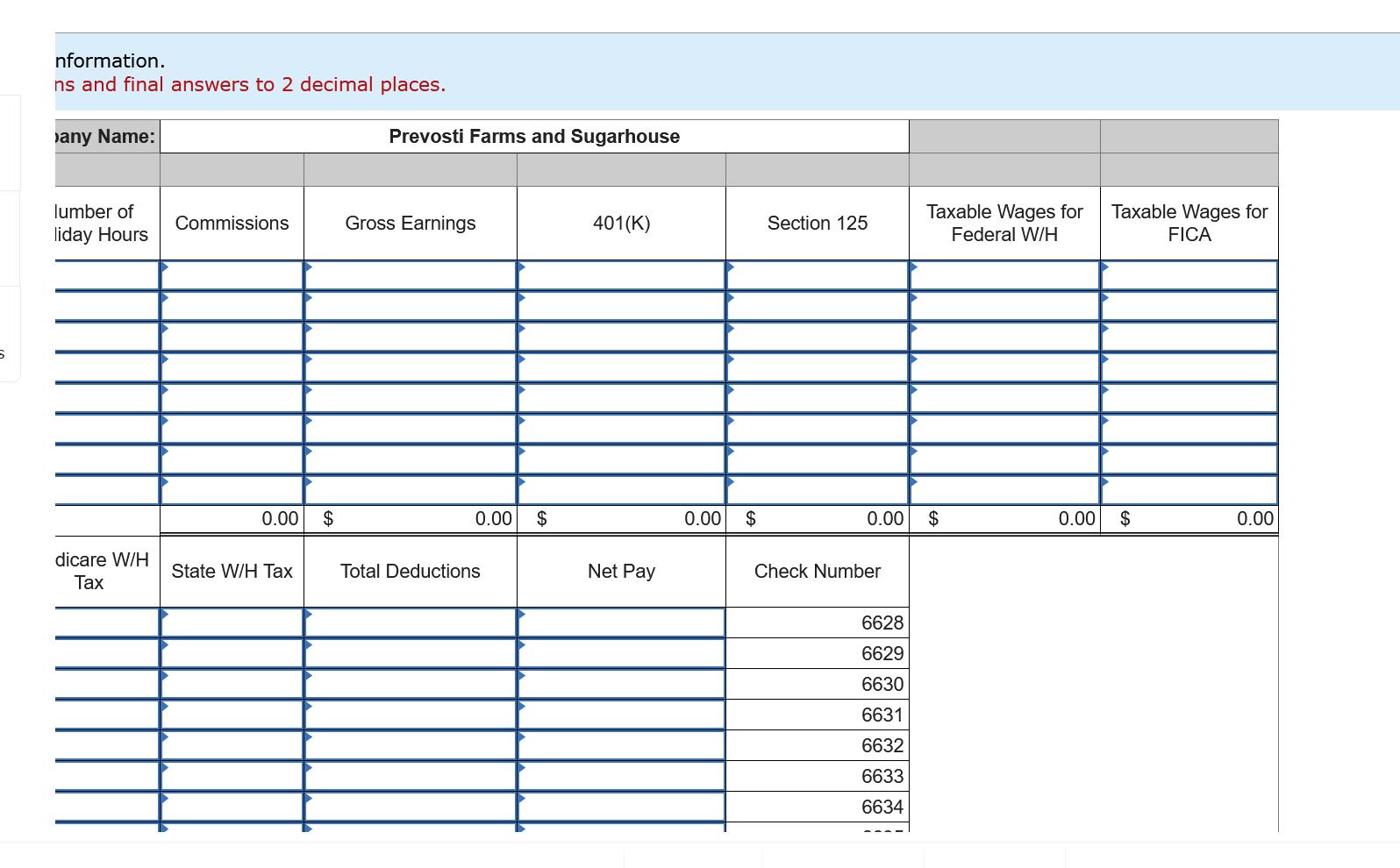

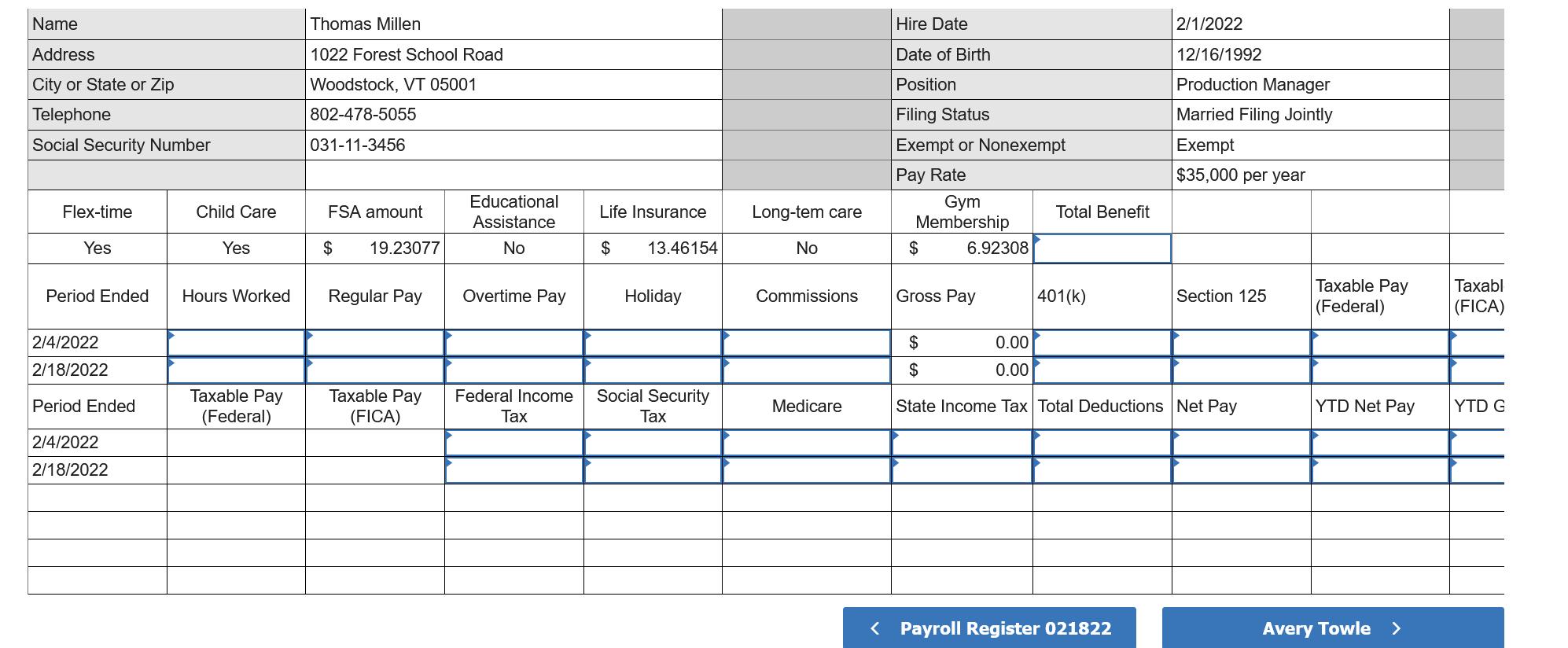

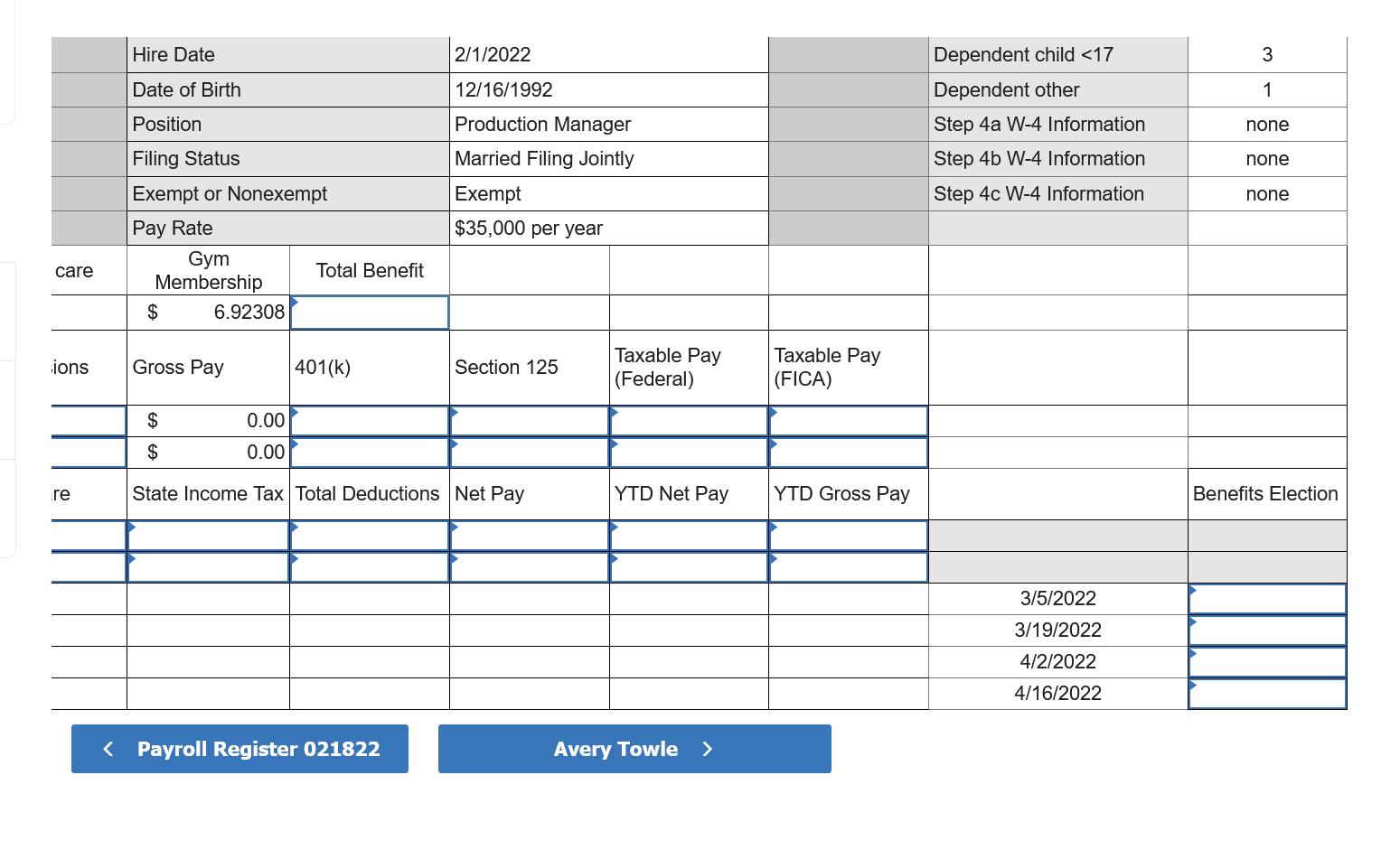

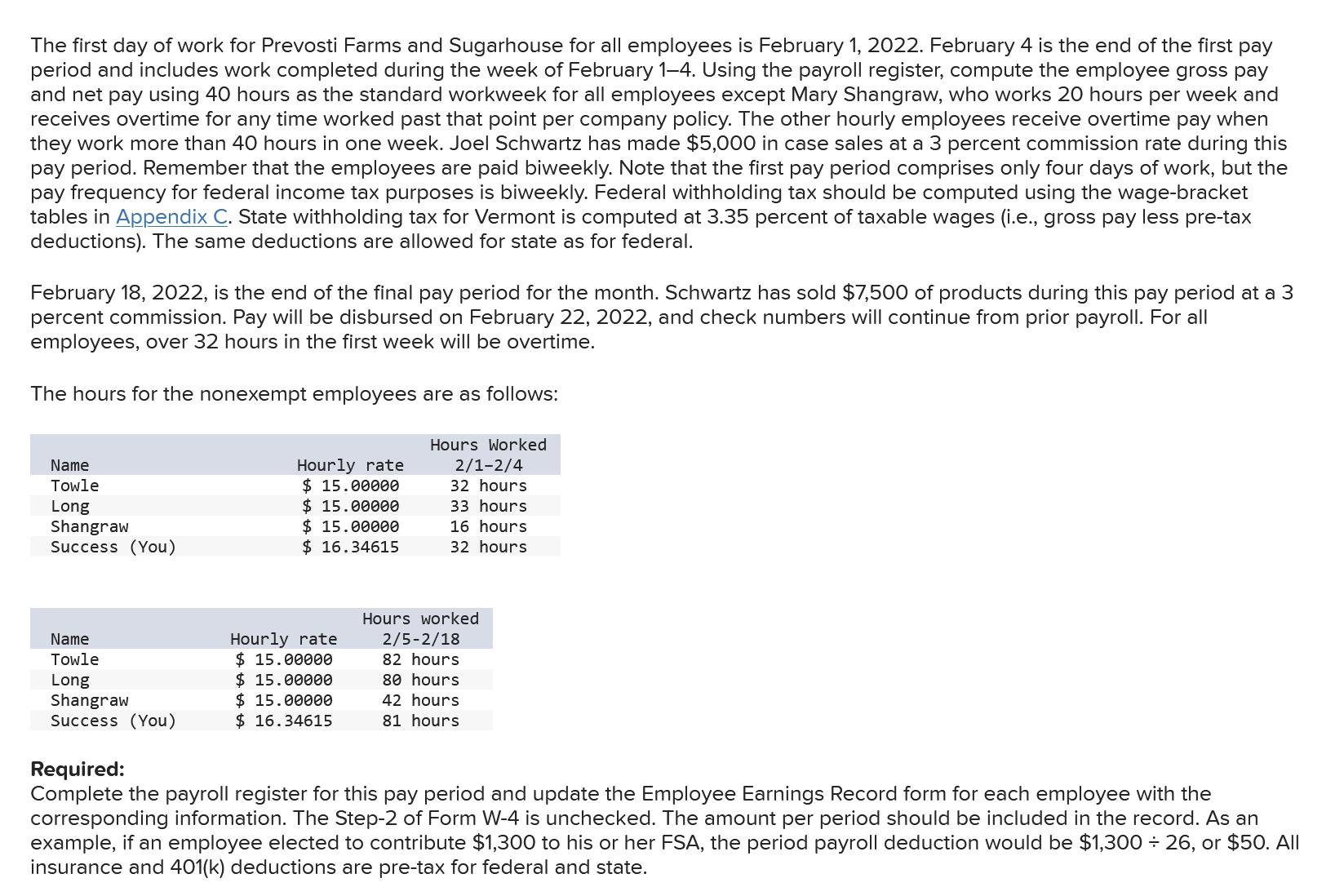

Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. The Step-2 of Form W-4 is unchecked. The amount per period should be included in the record. As an example, if an employee elected to contribute $1,300 to his or her FSA, the period payroll deduction would be $1,300 ÷ 26, or $50. All insurance and 401(k) deductions are pre-tax for federal and state.

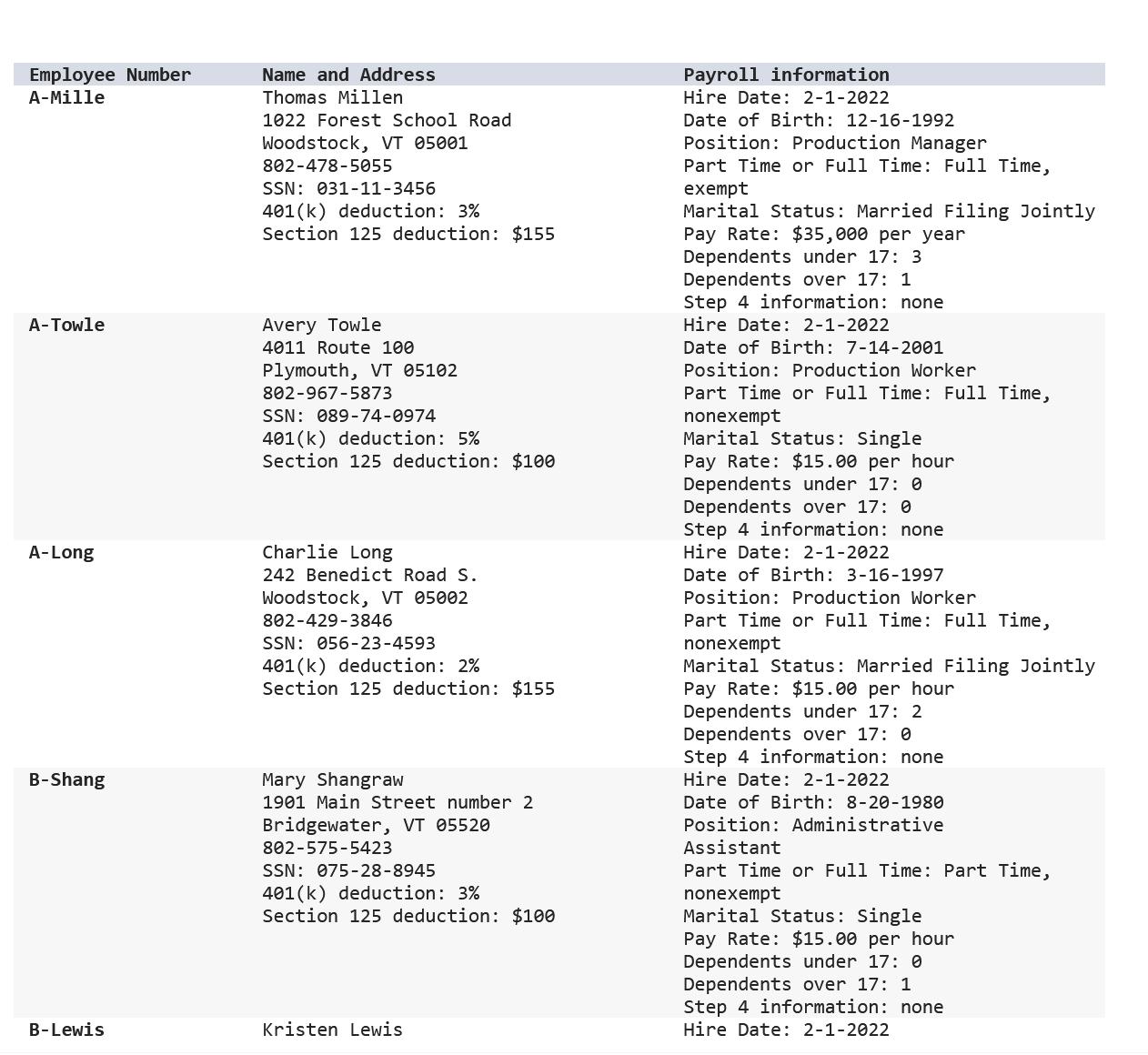

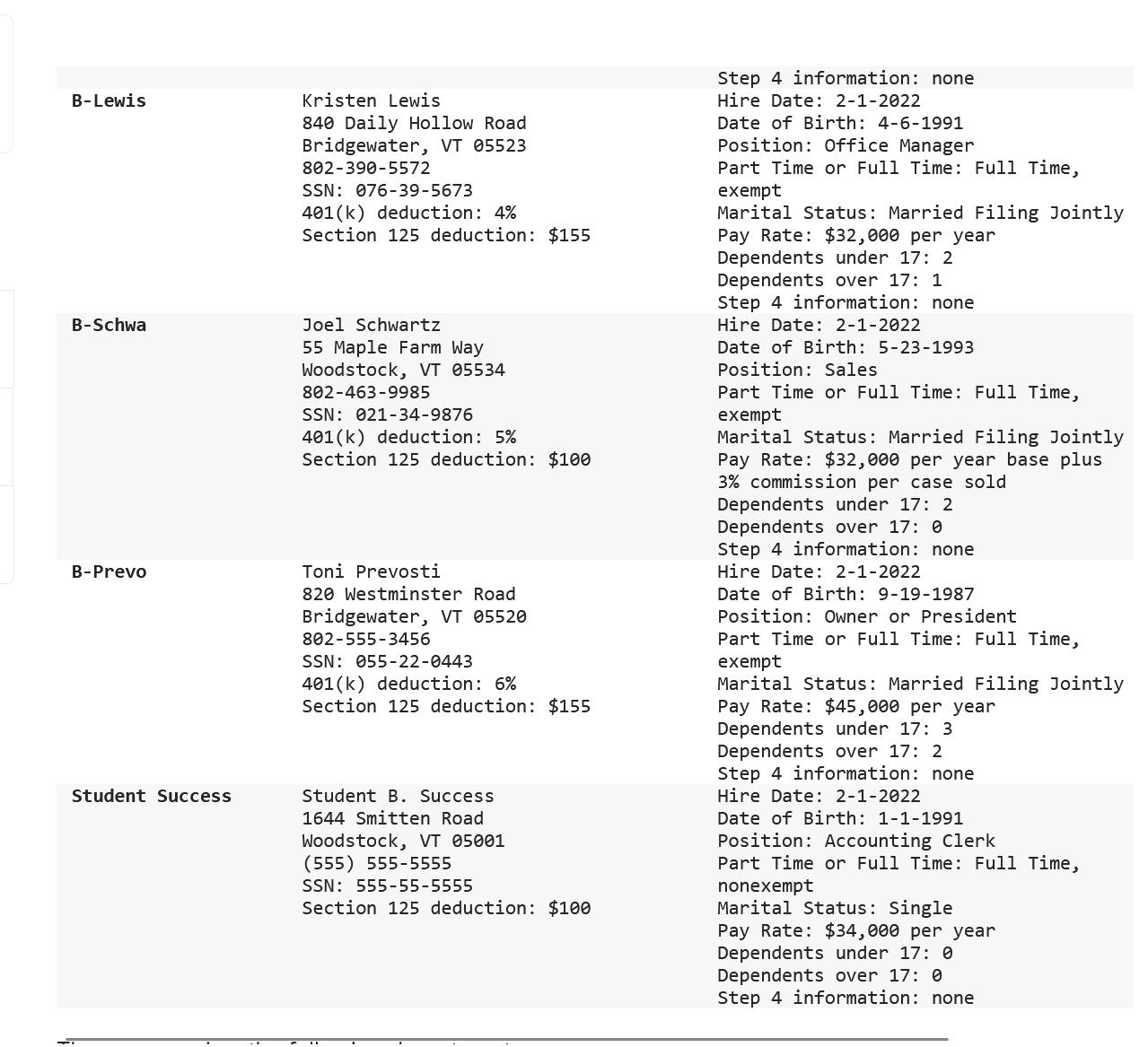

Employee Number A-Mille A-Towle A-Long B-Shang B-Lewis Name and Address Thomas Millen 1022 Forest School Road Woodstock, VT 05001 802-478-5055 SSN: 031-11-3456 401(k) deduction: 3% Section 125 deduction: $155 Avery Towle 4011 Route 100 Plymouth, VT 05102 802-967-5873 SSN: 089-74-0974 401(k) deduction: 5% Section 125 deduction: $100 Charlie Long 242 Benedict Road S.. Woodstock, VT 05002 802-429-3846 SSN: 056-23-4593 401(k) deduction: 2% Section 125 deduction: $155 Mary Shangraw 1901 Main Street number 2 Bridgewater, VT 05520 802-575-5423 SSN: 075-28-8945 401(k) deduction: 3% Section 125 deduction: $100 Kristen Lewis Payroll information Hire Date: 2-1-2022 Date of Birth: 12-16-1992 Position: Production Manager Part Time or Full Time: Full Time, exempt Marital Status: Married Filing Jointly Pay Rate: $35,000 per year Dependents under 17: 3 Dependents over 17: 1 Step 4 information: none Hire Date: 2-1-2022 Date of Birth: 7-14-2001 Position: Production Worker Part Time or Full Time: Full Time, nonexempt Marital Status: Single Pay Rate: $15.00 per hour Dependents under 17: 0 Dependents over 17: 0 Step 4 information: none Hire Date: 2-1-2022 Date of Birth: 3-16-1997 Position: Production Worker Part Time or Full Time: Full Time, nonexempt Marital Status: Married Filing Jointly Pay Rate: $15.00 per hour Dependents under 17: 2 Dependents over 17: 0 Step 4 information: none Hire Date: 2-1-2022 Date of Birth: 8-20-1980 Position: Administrative Assistant Part Time or Full Time: Part Time, nonexempt Marital Status: Single Pay Rate: $15.00 per hour Dependents under 17: 0 Dependents over 17: 1 Step 4 information: none Hire Date: 2-1-2022

Step by Step Solution

There are 3 Steps involved in it

I am unable to directly analyze the images you upl... View full answer

Get step-by-step solutions from verified subject matter experts