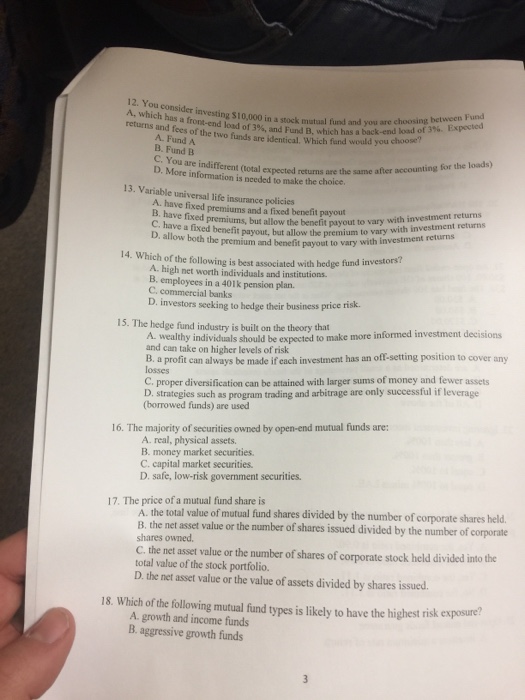

12. You consider investing $10 A, which has a front-cndlad of 3%, and FundB.which hasouldy u returns and f mutual fund and you are choosing between Fund Which fund would you choose? hdes of the two funds are identical. 013%, and Fund B, which has a back-end load of 3%. Expected A. Fund A B. Fund B C. You are indifferent (total D. More information is nceded to make the choice. information ied returns are the same after accounting for the loads) 13. Variable universal life insurance policies A. have fixed premiums and a fixed benefit payout Is. have fixed premiums, but allow the benefit payout to vary wwith investment returns C. have a fixed benefit payout, but allow the premium to va vestment returns vary wi with investm D. allow both the premium and benefit payout to vary 14. Which of the following is best associated with hedge fund invest A. high net worth individuals and institutions. B. employees in a 401k pension plan C. commercial banks D. investors seeking to hedge their business price risk. 15. The hedge fund industry is built on the theory that ormed investment decisions A. wealthy individuals should be expected to make more inf and can take on higher levels of risk B, a profit can always be made if each investment has an off-setting position to cover any losses D. strategies such as program trading and arbitrage are only successful if leverage (borrowed funds) are used C, proper diversification can be attained with larger sums of money and fewer assets 16. The majority of securities owned by open-end mutual funds are: A. real, physical assets. B. money market securities. C. capital market securities. D. safe, low-risk government securities. 17. The price of a mutual fund share is A. the total value of mutual fiund shares divided by the number of corporate shares held B. the net asset value or the number of shares issued divided by the number of corporate shares owmed. C. the net asset value or the number of shares of corporate stock held divided into the total value of the stock portfolio. D. the net asset value or the value of assets divided by shares issued. 18. Which of the following mutual fund types is likely to have the highest risk exposure? A. growth and income funds B. aggressive growth funds