Answered step by step

Verified Expert Solution

Question

1 Approved Answer

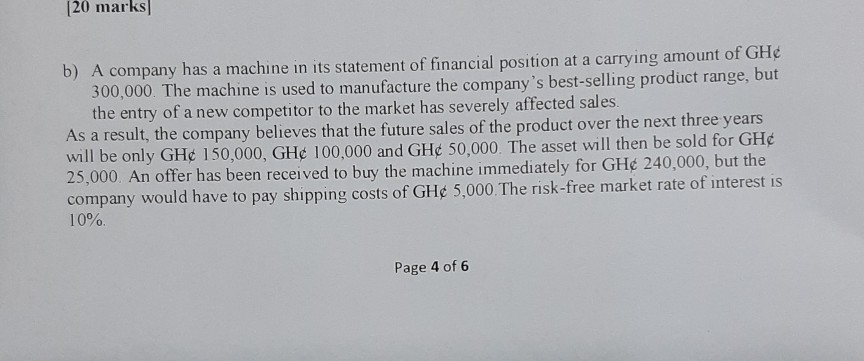

120 marks b) A company has a machine in its statement of financial position at a carrying amount of GH 300,000. The machine is used

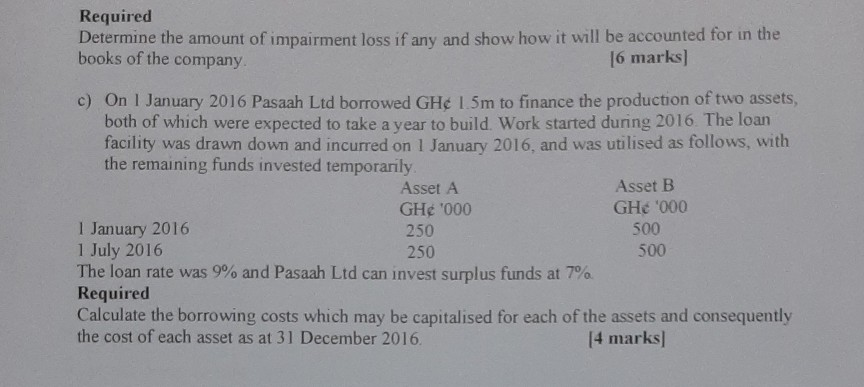

120 marks b) A company has a machine in its statement of financial position at a carrying amount of GH 300,000. The machine is used to manufacture the company's best-selling product range, but the entry of a new competitor to the market has severely affected sales. As a result, the company believes that the future sales of the product over the next three years will be only GH 150,000, GH 100,000 and GH 50,000. The asset will then be sold for GH 25,000. An offer has been received to buy the machine immediately for GH 240,000, but the company would have to pay shipping costs of GH 5,000. The risk-free market rate of interest is 10% Page 4 of 6 Required Determine the amount of impairment loss if any and show how it will be accounted for in the books of the company. 16 marks] c) On 1 January 2016 Pasaah Ltd borrowed GH 1.5m to finance the production of two assets, both of which were expected to take a year to build Work started during 2016. The loan facility was drawn down and incurred on 1 January 2016, and was utilised as follows, with the remaining funds invested temporarily Asset A Asset B GH '000 GH6 000 1 January 2016 250 500 1 July 2016 250 500 The loan rate was 9% and Pasaah Ltd can invest surplus funds at 7% Required Calculate the borrowing costs which may be capitalised for each of the assets and consequently the cost of each asset as at 31 December 2016. [4 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started