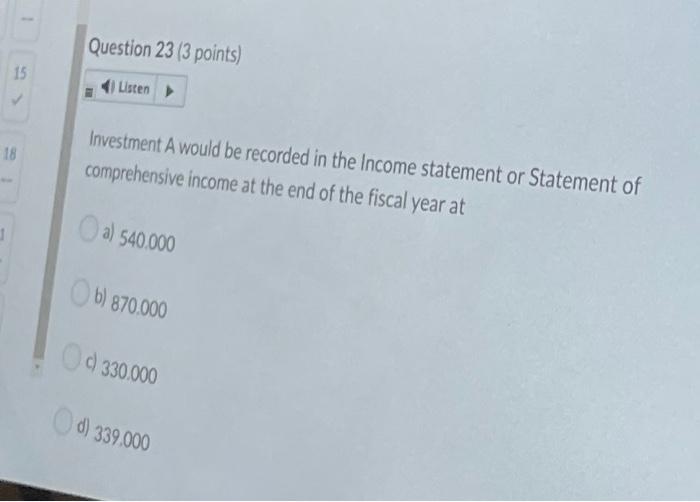

120000 Time Left 1:05:26 Alex Kavit Attempt 1 Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below. 0 11 12 15 Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months, Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the 17 18 fiscal year-end. 24 Investment B: The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment; rather, it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24 Investment C. At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee (Investment C), one of its smaller suppliers, for $6 million Z1000 me te Alex Ravic Attempt the past fiscal year ended December 31, the company made a number of investments, as described below 11 12 Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end 14 15 21 Investment B: The company purchased 12,000 units of a mutual fund which cost $28 each Management had no specific trading intentions for this investment; rather It was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24 Investment C. At the beginning of the year, Invest Up bought 25% of the common shares in Builder Bee (Investment C), one of its smaller suppliers, for $6 million These shares had a fair value of $6.6 million at the end of the year. During the year, Bulder Bee reported net income of $1,500,000 and paid total dividends of $10,000 Question 23 (3 points) 15 Listen 18 Investment A would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at 1 a) 540.000 b) 870.000 d 330.000 d) 339.000