Answered step by step

Verified Expert Solution

Question

1 Approved Answer

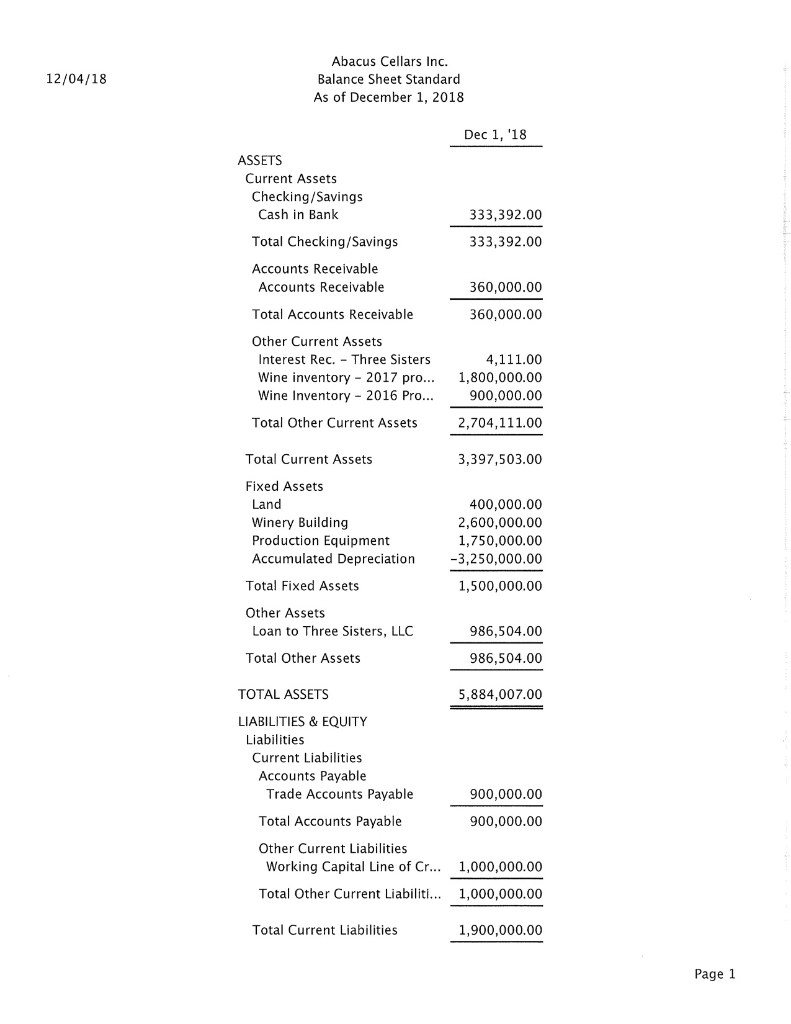

12/04/18 Abacus Cellars Inc. Balance Sheet Standard As of December 1, 2018 Dec 1, '18 ASSETS Current Assets Checking/Savings Cash in Bank 333,392.00 333,392.00 Total

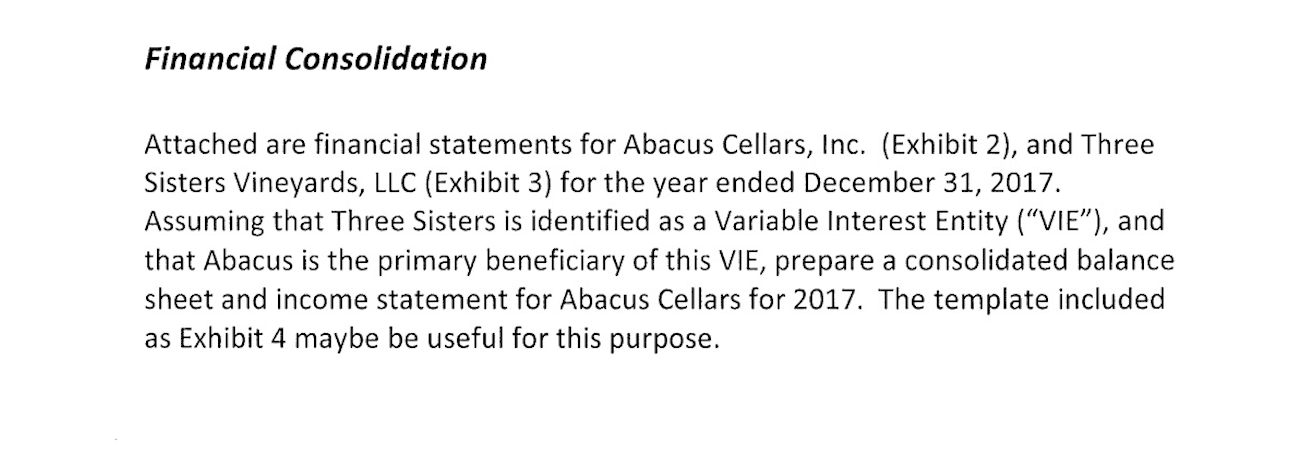

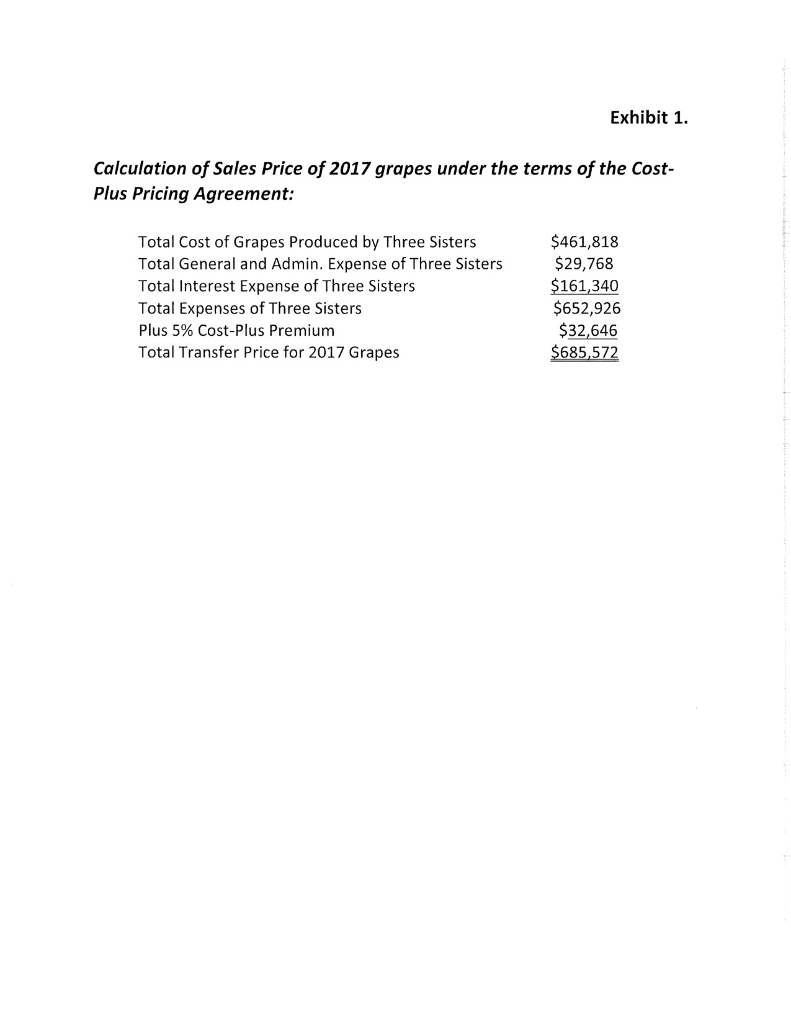

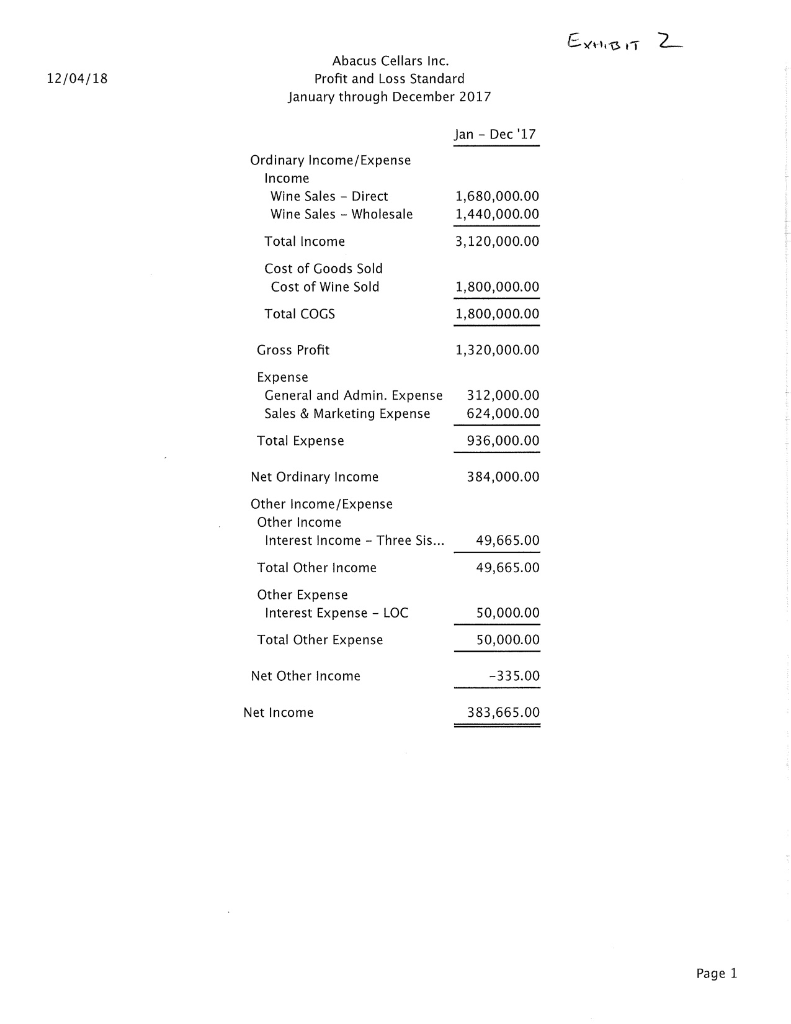

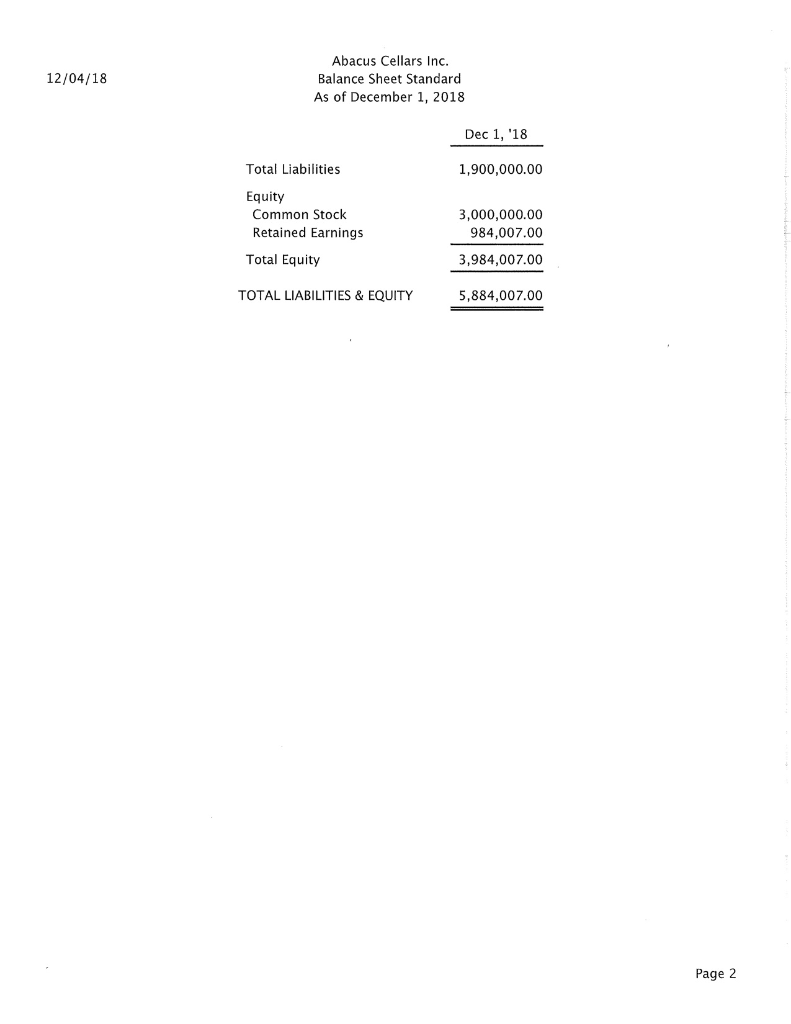

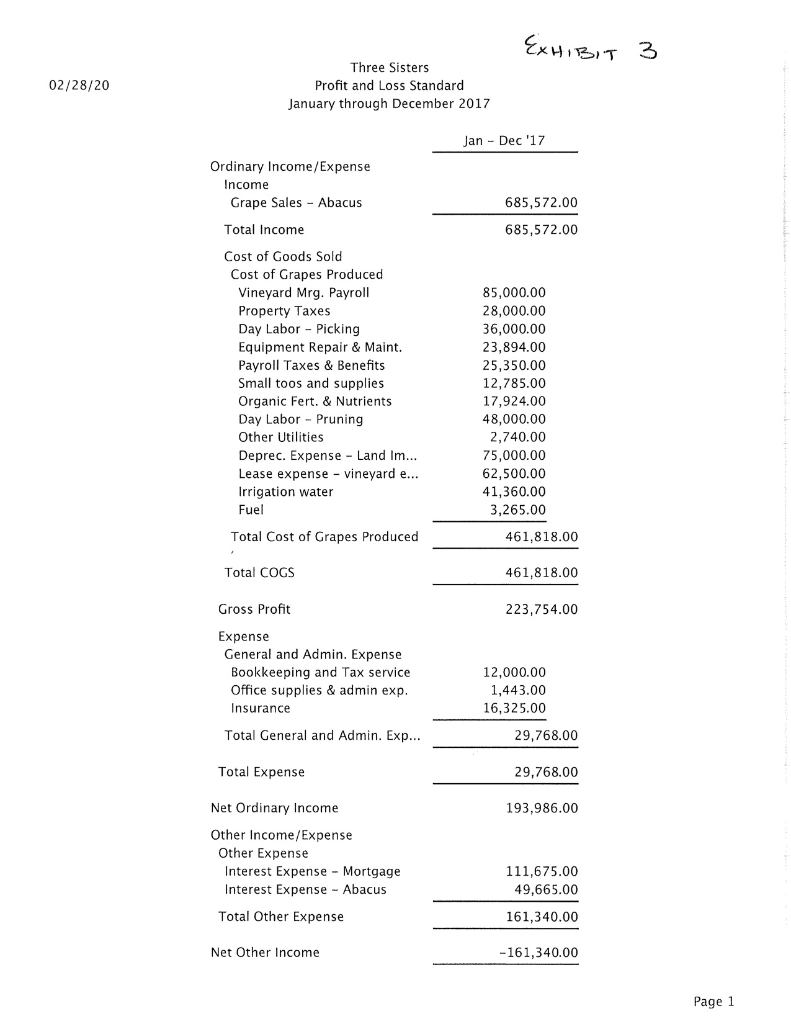

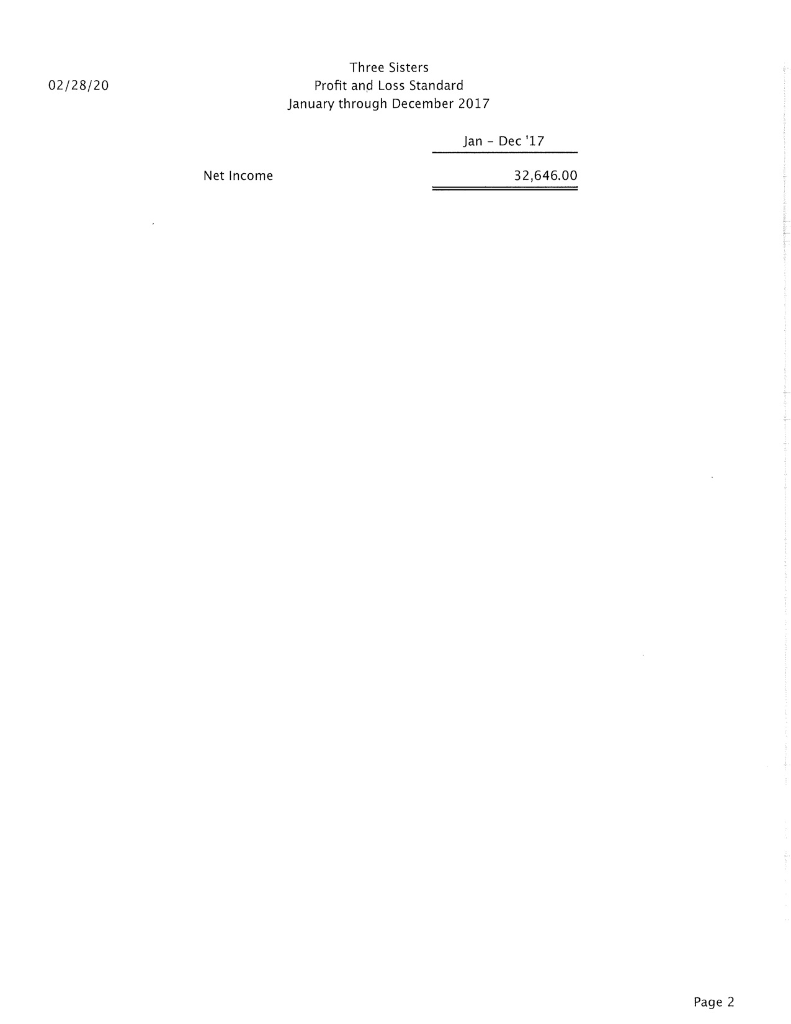

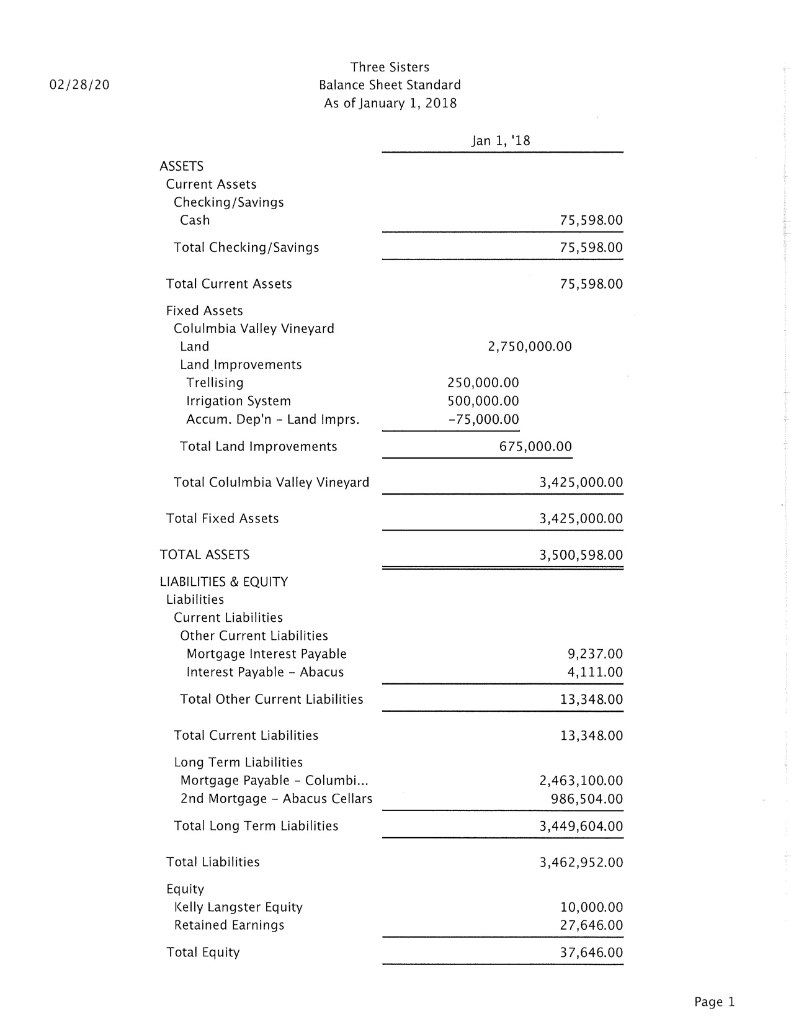

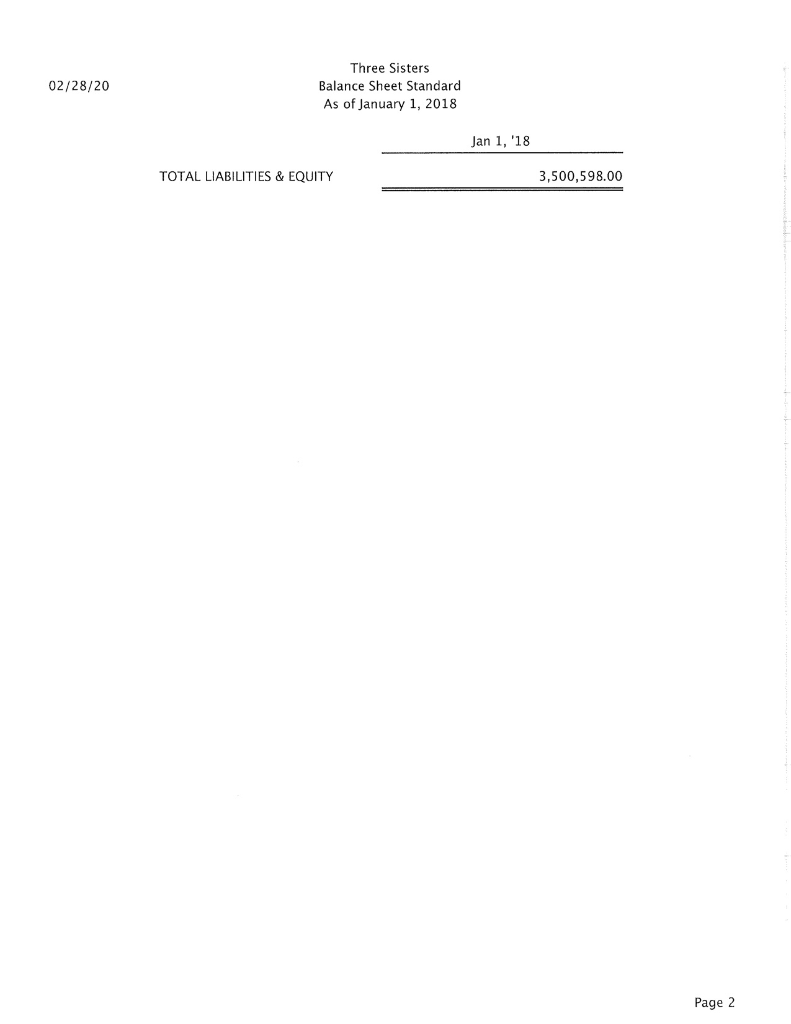

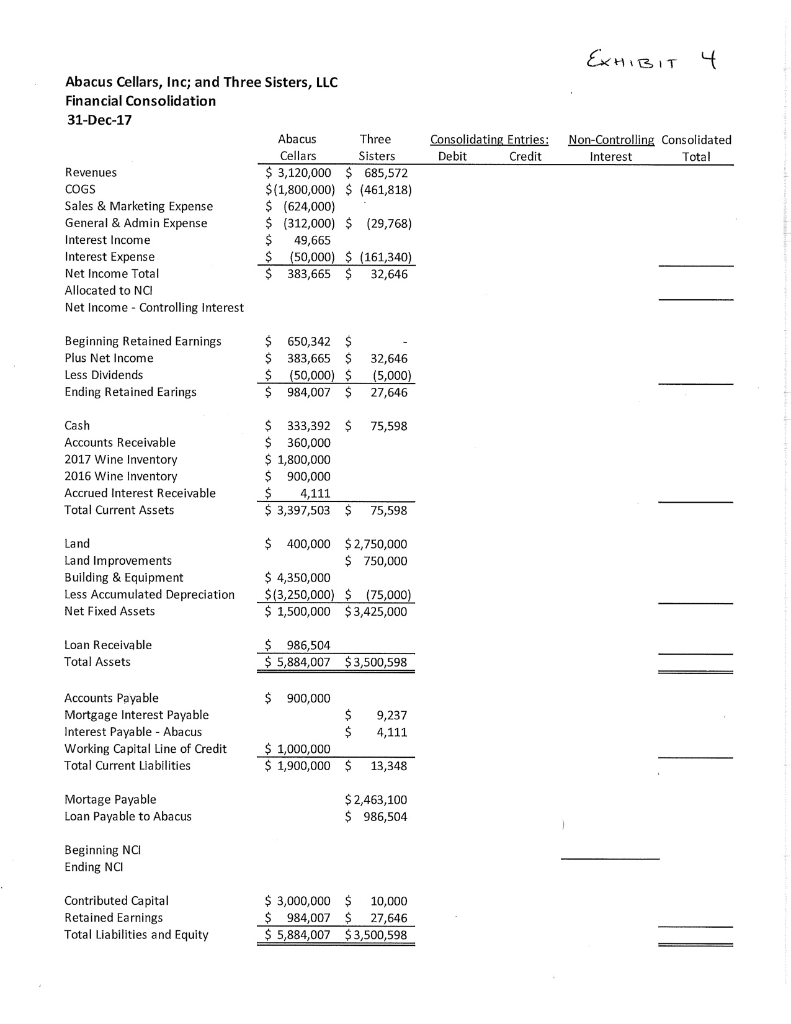

12/04/18 Abacus Cellars Inc. Balance Sheet Standard As of December 1, 2018 Dec 1, '18 ASSETS Current Assets Checking/Savings Cash in Bank 333,392.00 333,392.00 Total Checking/Savings Accounts Receivable Accounts Receivable 360,000.00 360,000.00 Total Accounts Receivable Other Current Assets Interest Rec. - Three Sisters Wine inventory - 2017 pro... Wine Inventory - 2016 Pro... Total Other Current Assets 4,111.00 1,800,000.00 900,000.00 2,704,111.00 Total Current Assets 3,397,503.00 Fixed Assets Land Winery Building Production Equipment Accumulated Depreciation Total Fixed Assets Other Assets Loan to Three Sisters, LLC 400,000.00 2,600,000.00 1,750,000.00 -3,250,000.00 1,500,000.00 986,504.00 Total Other Assets 986,504.00 TOTAL ASSETS 5,884,007.00 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable Trade Accounts Payable 900,000.00 900,000.00 Total Accounts Payable Other Current Liabilities Working Capital Line of Cr... Total Other Current Liabiliti... 1,000,000.00 1,000,000.00 Total Current Liabilities 1,900,000.00 Page 1 Financial Consolidation Attached are financial statements for Abacus Cellars, Inc. (Exhibit 2), and Three Sisters Vineyards, LLC (Exhibit 3) for the year ended December 31, 2017. Assuming that Three Sisters is identified as a Variable Interest Entity ("VIE"), and that Abacus is the primary beneficiary of this VIE, prepare a consolidated balance sheet and income statement for Abacus Cellars for 2017. The template included as Exhibit 4 maybe be useful for this purpose. Exhibit 1. Calculation of Sales Price of 2017 grapes under the terms of the Cost- Plus Pricing Agreement: Total Cost of Grapes Produced by Three Sisters Total General and Admin. Expense of Three Sisters Total Interest Expense of Three Sisters Total Expenses of Three Sisters Plus 5% Cost-Plus Premium Total Transfer Price for 2017 Grapes $461,818 $29,768 $161,340 $652,926 $32,646 $685,572 Exhibit 2 12/04/18 Abacus Cellars Inc. Profit and Loss Standard January through December 2017 Jan - Dec '17 1,680,000.00 1,440,000.00 Ordinary Income/Expense Income Wine Sales - Direct Wine Sales - Wholesale Total Income Cost of Goods Sold Cost of Wine Sold Total COGS 3,120,000.00 1,800,000.00 1,800,000.00 Gross Profit 1,320,000.00 Expense General and Admin. Expense Sales & Marketing Expense Total Expense 312,000.00 624,000.00 936,000.00 384,000.00 Net Ordinary Income Other Income/Expense Other Income Interest Income - Three Sis... Total Other Income Other Expense Interest Expense -LOC Total Other Expense 49,665.00 49,665.00 50,000.00 50,000.00 Net Other Income -335.00 Net Income 383,665.00 Page 1 12/04/18 Abacus Cellars Inc. Balance Sheet Standard As of December 1, 2018 Dec 1, '18 1,900,000.00 Total Liabilities Equity Common Stock Retained Earnings Total Equity 3,000,000.00 984,007.00 3,984,007.00 TOTAL LIABILITIES & EQUITY 5,884,007.00 Page 2 EXHIBIT 3 02/28/20 Three Sisters Profit and Loss Standard January through December 2017 Jan - Dec '17 685,572.00 685,572.00 Ordinary Income/Expense Income Grape Sales - Abacus Total Income Cost of Goods Sold Cost of Grapes Produced Vineyard Mrg. Payroll Property Taxes Day Labor - Picking Equipment Repair & Maint. Payroll Taxes & Benefits Small toos and supplies Organic Fert. & Nutrients Day Labor - Pruning Other Utilities Deprec. Expense - Land Im... Lease expense - vineyard e... Irrigation water Fuel 85,000.00 28,000.00 36,000.00 23,894.00 25,350.00 12,785.00 17,924.00 48,000.00 2,740.00 75,000.00 62,500.00 41,360.00 3,265.00 Total Cost of Grapes Produced 461,818.00 Total COGS 461,818.00 Gross Profit 223,754.00 Expense General and Admin. Expense Bookkeeping and Tax service Office supplies & admin exp. Insurance 12,000.00 1,443.00 16,325.00 Total General and Admin. Exp... 29,768.00 Total Expense 29,768.00 Net Ordinary Income 193,986.00 Other Income/Expense Other Expense Interest Expense - Mortgage Interest Expense - Abacus 111,675.00 49,665.00 Total Other Expense 161,340.00 Net Other Income -161,340.00 Page 1 02/28/20 Three Sisters Profit and Loss Standard January through December 2017 Jan - Dec '17 Net Income 32,646.00 Page 2 02/28/20 Three Sisters Balance Sheet Standard As of January 1, 2018 Jan 1, '18 ASSETS Current Assets Checking/Savings Cash Total Checking/Savings 75,598.00 75,598.00 Total Current Assets 75,598.00 2,750,000.00 Fixed Assets Colulmbia Valley Vineyard Land Land Improvements Trellising Irrigation System Accum. Dep'n - Land Imprs. Total Land Improvements 250,000.00 500,000.00 -75,000.00 675,000.00 Total Columbia Valley Vineyard 3,425,000.00 Total Fixed Assets 3,425,000.00 3,500,598.00 TOTAL ASSETS LIABILITIES & EQUITY Liabilities Current Liabilities Other Current Liabilities Mortgage Interest Payable Interest Payable - Abacus 9,237.00 4,111.00 Total Other Current Liabilities 13,348.00 13,348.00 Total Current Liabilities Long Term Liabilities Mortgage Payable - Columbi... 2nd Mortgage - Abacus Cellars Total Long Term Liabilities 2,463,100.00 986,504.00 3,449,604.00 Total Liabilities 3,462,952.00 Equity Kelly Langster Equity Retained Earnings 10,000.00 27,646.00 Total Equity 37,646.00 Page 1 02/28/20 Three Sisters Balance Sheet Standard As of January 1, 2018 Jan 1, '18 TOTAL LIABILITIES & EQUITY 3,500,598.00 Page 2 EXHIBIT 4 Consolidating Entries: Debit Credit Non-Controlling Consolidated Interest Total Abacus Cellars, Inc; and Three Sisters, LLC Financial Consolidation 31-Dec-17 Abacus Three Cellars Sisters Revenues $ 3,120,000 $ 685,572 COGS $(1,800,000) $ (461,818) Sales & Marketing Expense $ (624,000) General & Admin Expense $ (312,000) $ (29,768) Interest Income $ 49,665 Interest Expense $ (50,000) $ (161,340) Net Income Total $ 383,665 $ 32,646 Allocated to Na Net Income - Controlling Interest Beginning Retained Earnings Plus Net Income Less Dividends Ending Retained Earings $ $ $ $ 650,342 $ 383,665 $ (50,000) $ 984,007 $ 32,646 (5,000) 27,646 75,598 Cash Accounts Receivable 2017 Wine Inventory 2016 Wine Inventory Accrued Interest Receivable Total Current Assets $ 333,392 $ $ 360,000 $ 1,800,000 $ 900,000 $ 4,111 $ 3,397,503 $ 75,598 Land Land Improvements Building & Equipment Less Accumulated Depreciation Net Fixed Assets $ 400,000 $2,750,000 $ 750,000 $ 4,350,000 $ (3,250,000) $ (75,000) $ 1,500,000 $3,425,000 Loan Receivable Total Assets $ 986,504 $ 5,884,007 $3,500,598 $ 900,000 Accounts Payable Mortgage Interest Payable Interest Payable - Abacus Working Capital Line of Credit Total Current Liabilities $ $ 9,237 4,111 $ 1,000,000 $ 1,900,000 $ 13,348 Mortage Payable Loan Payable to Abacus $2,463,100 $ 986,504 Beginning NCI Ending NCI Contributed Capital Retained Earnings Total Liabilities and Equity $ 3,000,000 $ 10,000 $ 984,007 $ 27,646 $ 5,884,007 $3,500,598

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started