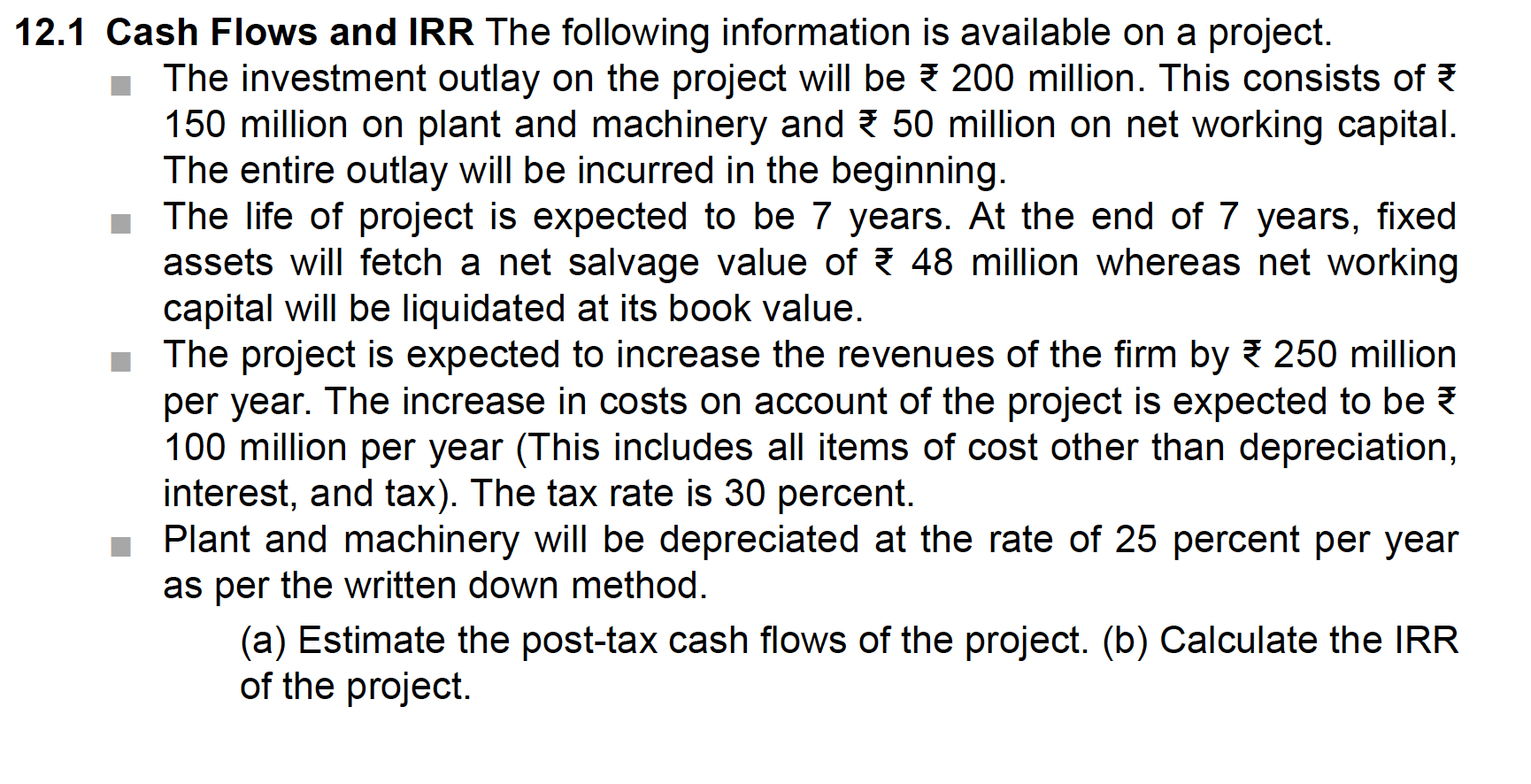

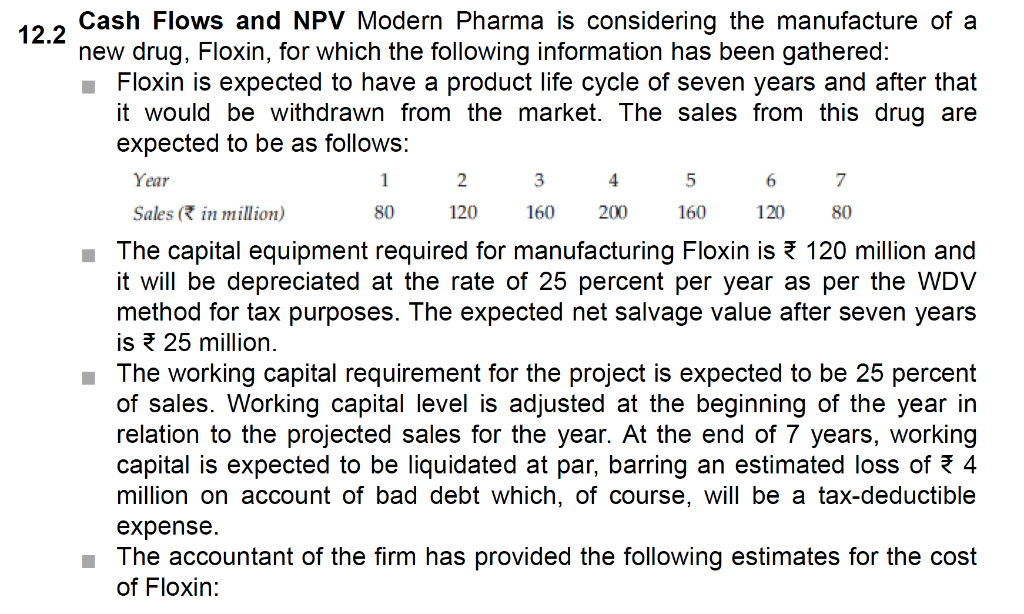

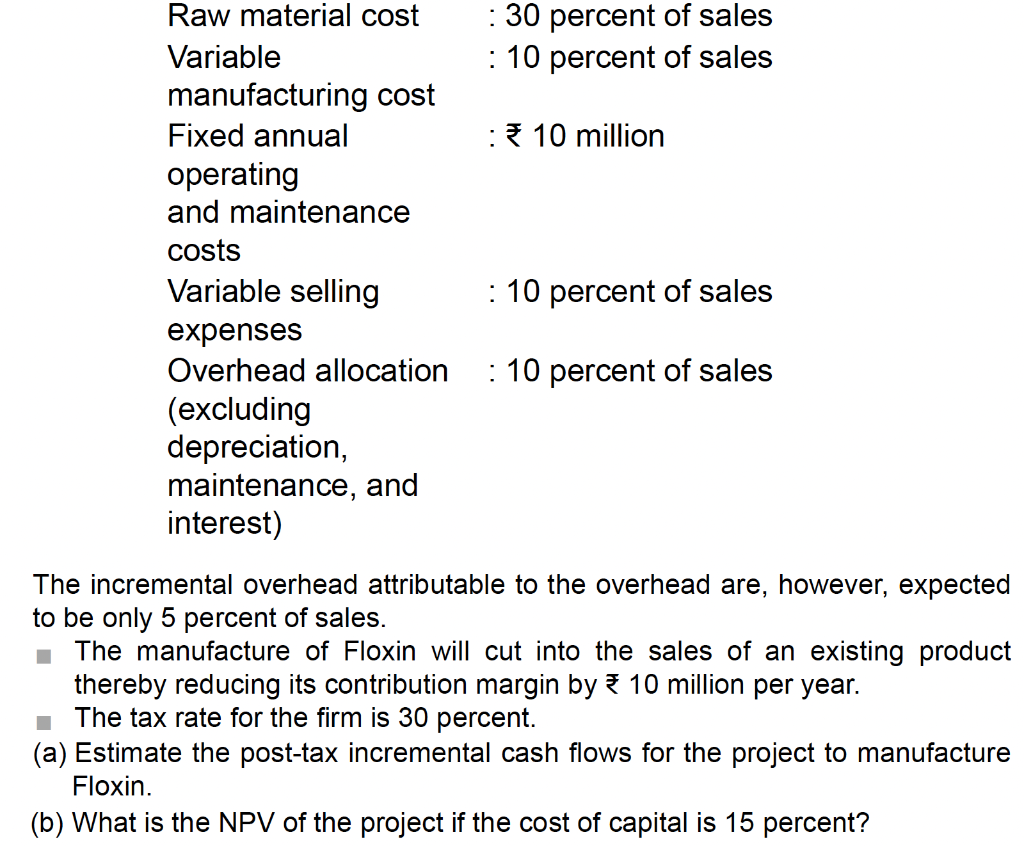

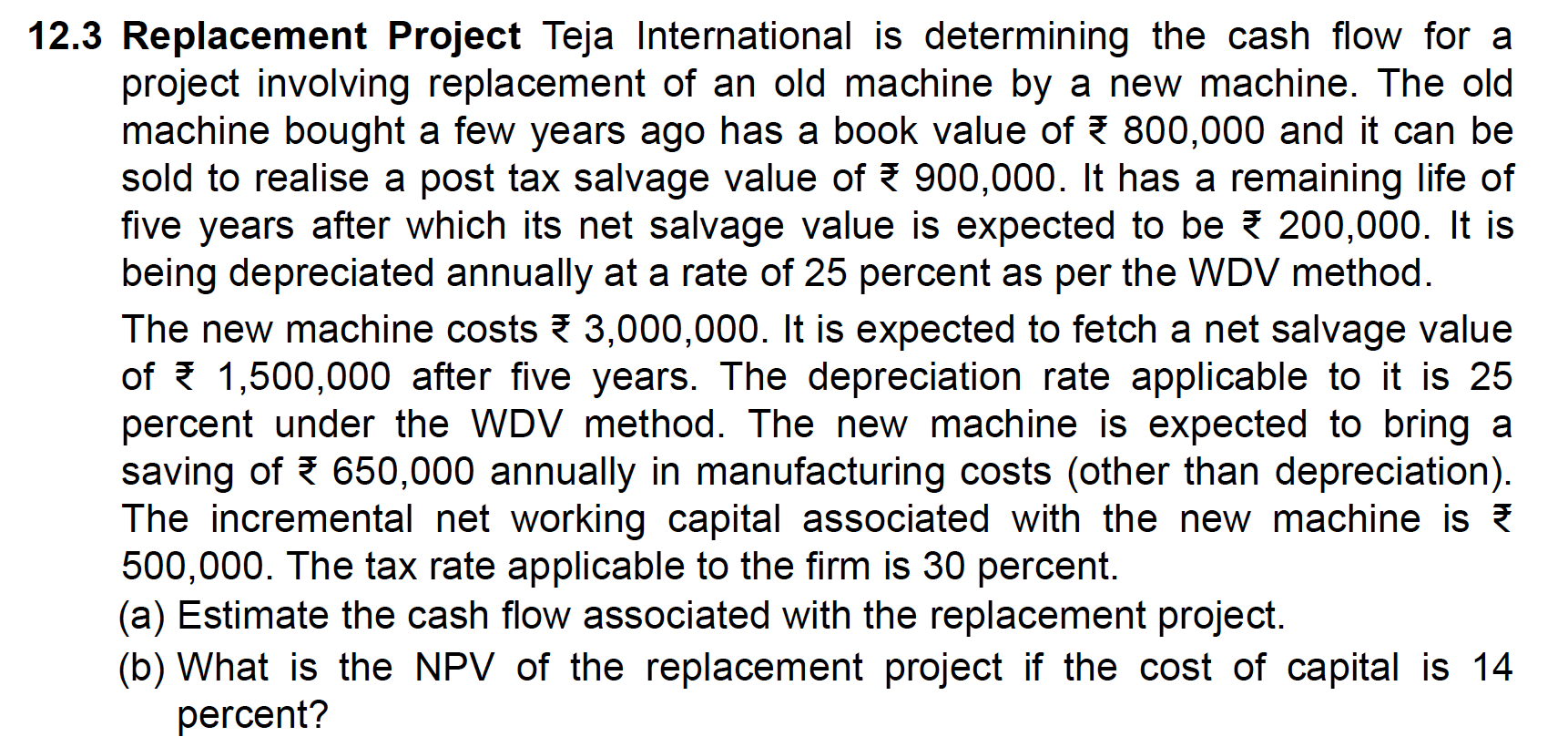

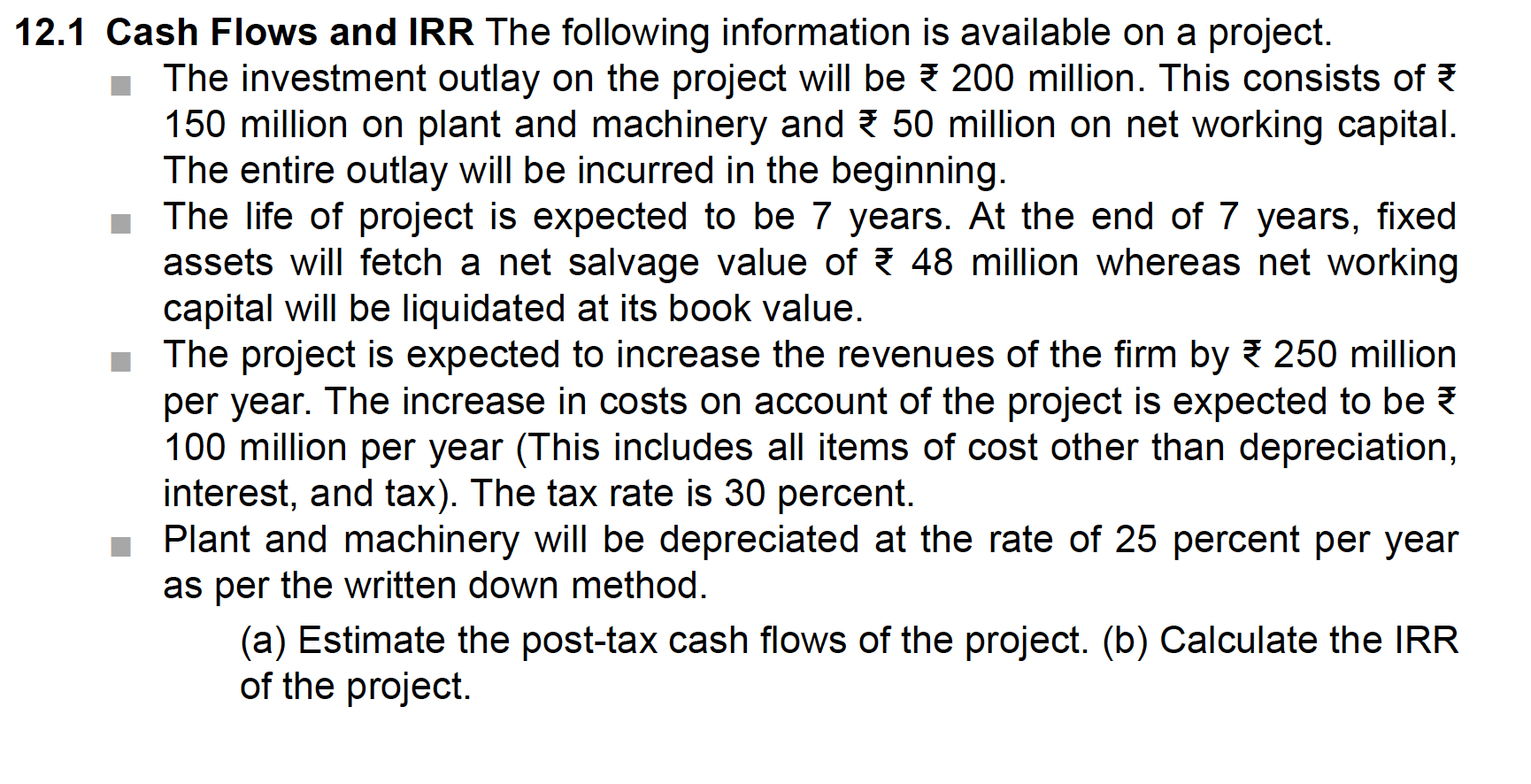

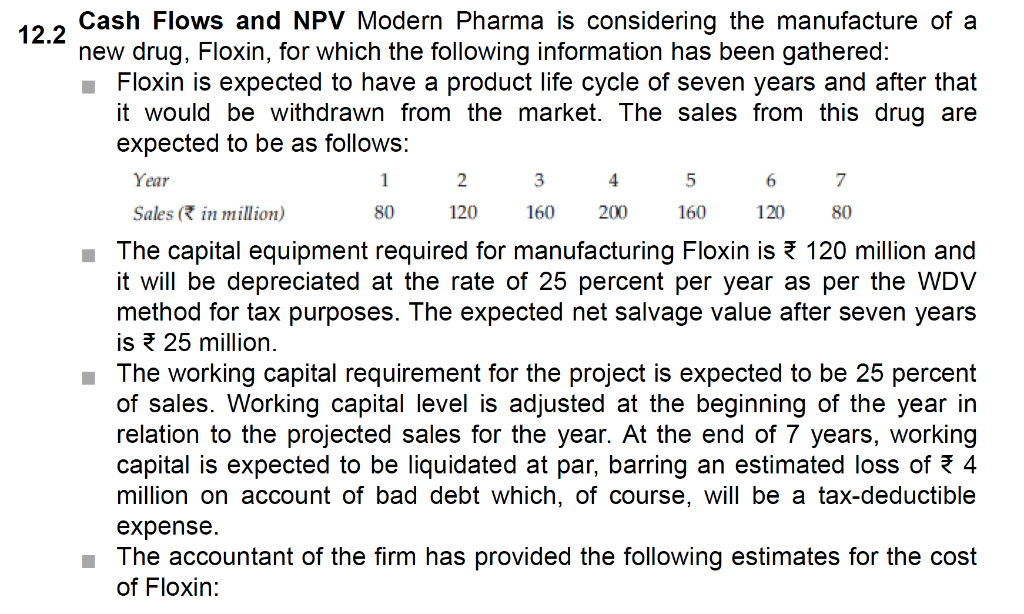

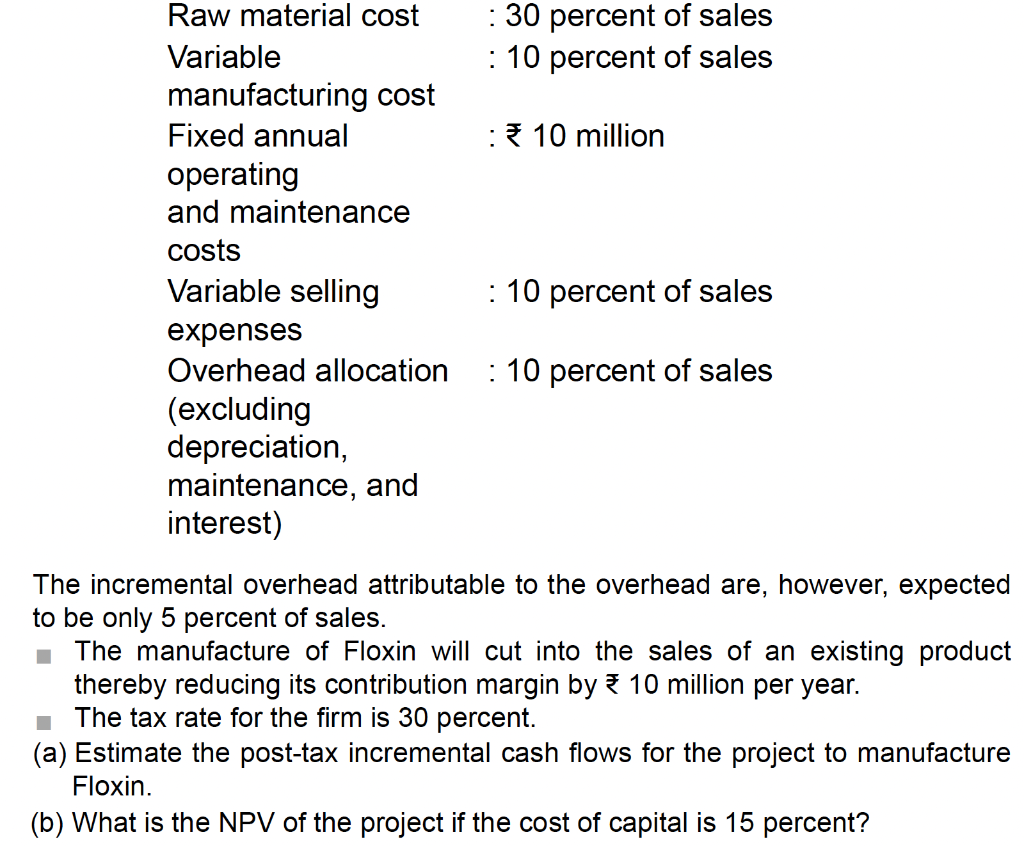

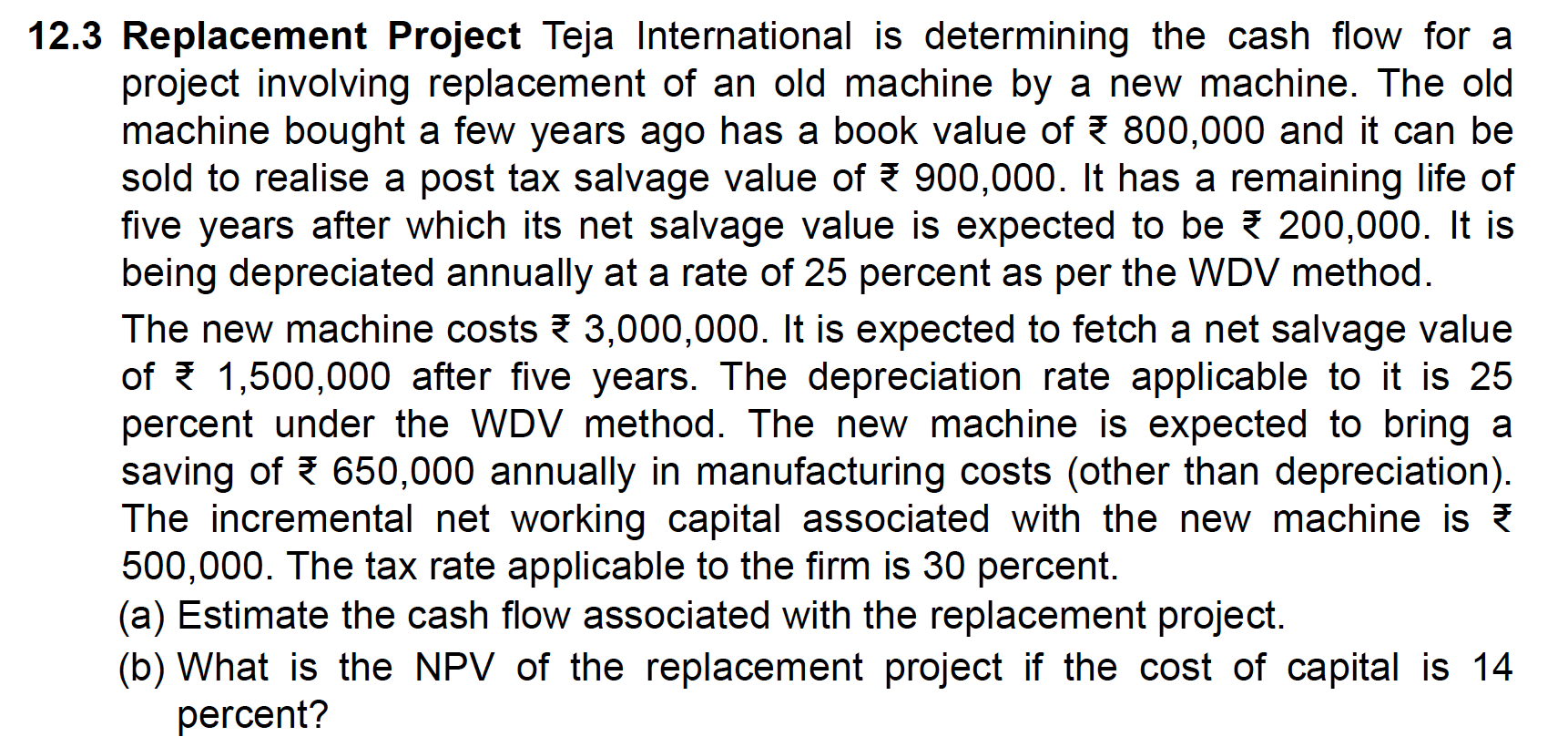

12.1 Cash Flows and IRR The following information is available on a project. The investment outlay on the project will be 200 million. This consists of 150 million on plant and machinery and 50 million on net working capital. The entire outlay will be incurred in the beginning. The life of project is expected to be 7 years. At the end of 7 years, fixed assets will fetch a net salvage value of 48 million whereas net working capital will be liquidated at its book value. The project is expected to increase the revenues of the firm by 250 million per year. The increase in costs on account of the project is expected to be 100 million per year (This includes all items of cost other than depreciation, interest, and tax). The tax rate is 30 percent. Plant and machinery will be depreciated at the rate of 25 percent per year as per the written down method. (a) Estimate the post-tax cash flows of the project. (b) Calculate the IRR of the project. 12.2 Year 1 3 4 5 6 7 80 120 160 200 160 80 Cash Flows and NPV Modern Pharma is considering the manufacture of a new drug, Floxin, for which the following information has been gathered: Floxin is expected to have a product life cycle of seven years and after that it would be withdrawn from the market. The sales from this drug are expected to be as follows: 2 Sales (in million) 120 The capital equipment required for manufacturing Floxin is 120 million and it will be depreciated at the rate of 25 percent per year as per the WDV method for tax purposes. The expected net salvage value after seven years is * 25 million. The working capital requirement for the project is expected to be 25 percent of sales. Working capital level is adjusted at the beginning of the year in relation to the projected sales for the year. At the end of 7 years, working capital is expected to be liquidated at par, barring an estimated loss of 3 4 million on account of bad debt which, of course, will be a tax-deductible expense. The accountant of the firm has provided the following estimates for the cost of Floxin: : 30 percent of sales : 10 percent of sales :* 10 million Raw material cost Variable manufacturing cost Fixed annual operating and maintenance costs Variable selling expenses Overhead allocation (excluding depreciation, maintenance, and interest) : 10 percent of sales : 10 percent of sales The incremental overhead attributable to the overhead are, however, expected to be only 5 percent of sales. 5 The manufacture of Floxin will cut into the sales of an existing product thereby reducing its contribution margin by 10 million per year. The tax rate for the firm is 30 percent. (a) Estimate the post-tax incremental cash flows for the project to manufacture Floxin. (b) What is the NPV of the project if the cost of capital is 15 percent? 12.3 Replacement Project Teja International is determining the cash flow for a project involving replacement of an old machine by a new machine. The old machine bought a few years ago has a book value of * 800,000 and it can be sold to realise a post tax salvage value of 900,000. It has a remaining life of five years after which its net salvage value is expected to be 200,000. It is being depreciated annually at a rate of 25 percent as per the WDV method. The new machine costs 3,000,000. It is expected to fetch a net salvage value of * 1,500,000 after five years. The depreciation rate applicable to it is 25 percent under the WDV method. The new machine is expected to bring a saving of 650,000 annually in manufacturing costs (other than depreciation). The incremental net working capital associated with the new machine is 500,000. The tax rate applicable to the firm is 30 percent. (a) Estimate the cash flow associated with the replacement project. (b) What is the NPV of the replacement project if the cost of capital is 14 percent