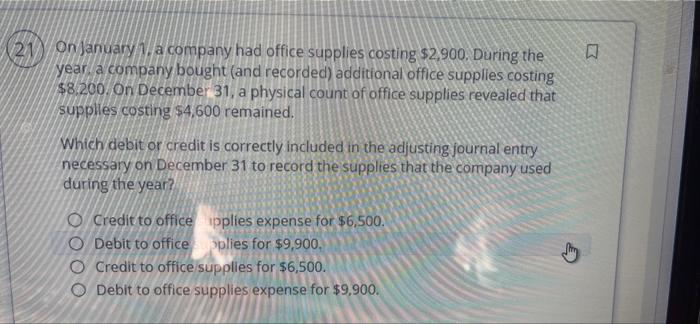

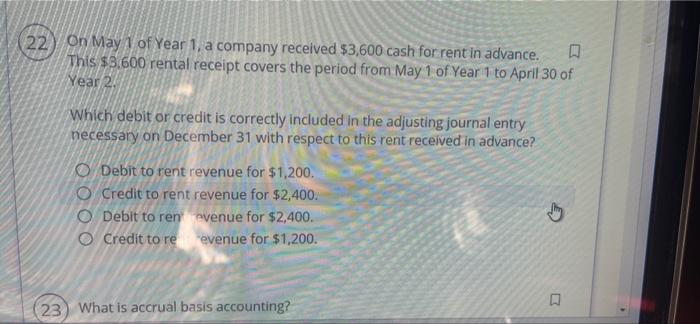

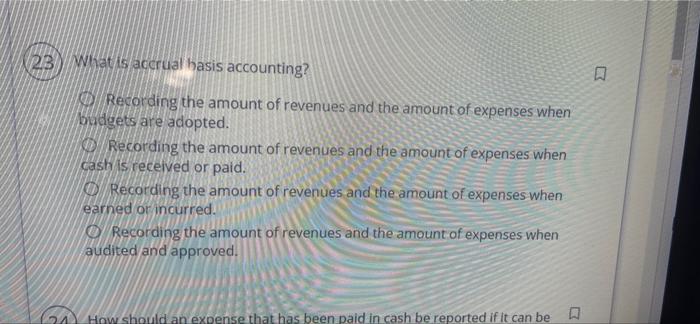

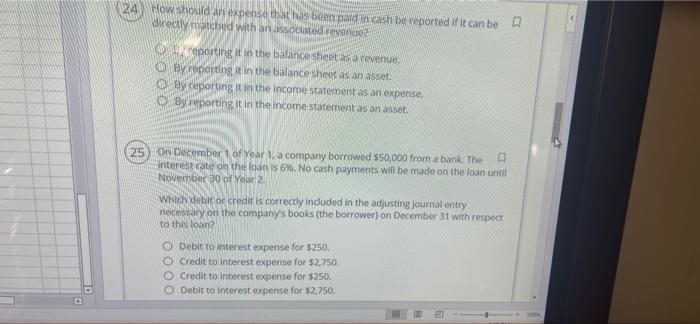

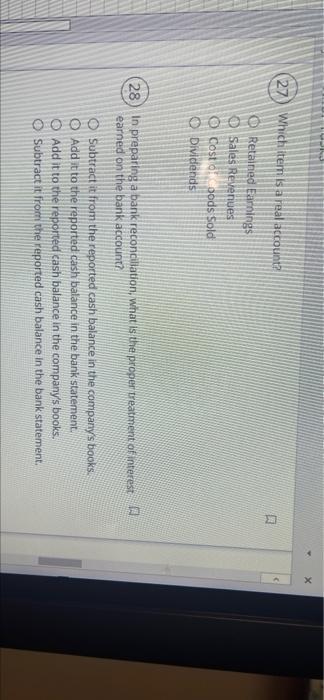

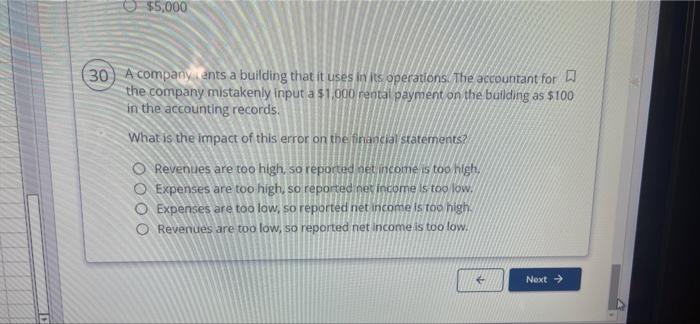

121 On January a company had office supplies costing $2,900. During the year a company bought and recorded) additional office supplies costing $8.200. On December 31, a physical count of office supplies revealed that supplles costing $4,600 remained. Which debit or credit is correctly included in the adjusting journal entry necessary on December 31 to record the supplies that the company used during the year? Credit to office pplies expense for $6,500. O Debit to office pplies for $9,900, O Credit to office supplies for $6,500. O Debit to office supplies expense for $9,900. (22) On May 1 of Year 1, a company received $3,600 cash for rent in advance. This $8.600 rental receipt covers the period from May 1 of Year 1 to April 30 of Year 2 Which debit or credit is correctly included in the adjusting journal entry necessary on December 31 with respect to this rent received in advance? O Debit to rent revenue for $1,200. O Credit to rent revenue for $2,400. O Debit to rent avenue for $2,400. Credit to revenue for $1,200. 23) What is accrual basis accounting? (23) What is accrual basis accounting? Recording the amount of revenues and the amount of expenses when budgets are adopted. Recording the amount of revenues and the amount of expenses when cash is received or paid. O Recording the amount of revenues and the amount of expenses when earned or incurred. O Recording the amount of revenues and the amount of expenses when audited and approved. 24 How should an expense that has been paid in cash be reported if it can be 24 How should an expense that has been paid in cash be reported if it can be a directly matched with an associated revenue? Ex reporting it in the balance sheet as a revenue. By reporting it in the balance sheet as an asset. By reporting it in the income statement as an expense. By reporting it in the income statement as an asset. 25 On December 1 of Year 1, a company borrowed $50,000 from a bank. The interest rate on the loan is 6%. No cash payments will be made on the loan until November 30 of Year 2 which debitor credit is correctly induded in the adjusting Journal entry necessity on the company's books (the borrower) on December 31 with respect to the loan O Debit to interest expense for $250. Credit to interest expense for $2.750. O Credit to interest expense for $250. Debit to interest expense for $2750 27 Which item is a real account? O Retained Earnings Sales Revenues O Cost ose gods sold O Dividends 28 In preparing a bank reconciliation, what is the proper treatment of interest earned on the bank account? O Subtract it from the reported cash balance in the company's books O Add it to the reported cash balance in the bank statement. Add it to the reported cash balance in the company's books. Subtract it from the reported cash balance in the bank statement. $5,000 30 A companyents a building that it uses in its operations. The accountant for a the company mistakenly input a $1.000 rental payment on the butlding as $100 in the accounting records. What is the impact of this error on the financial statements O Revenues are too high, so reported net income is too high, O Expenses are too high, so reported net income is too low. O Expenses are too low, so reported net income is too high, O Revenues are too low, so reported net income is too low. 1 Next