Answered step by step

Verified Expert Solution

Question

1 Approved Answer

{12.10} {12.11} Process Costing - Weighted Average General Information The I See The Light Company has a related company that produces the figurines. They use

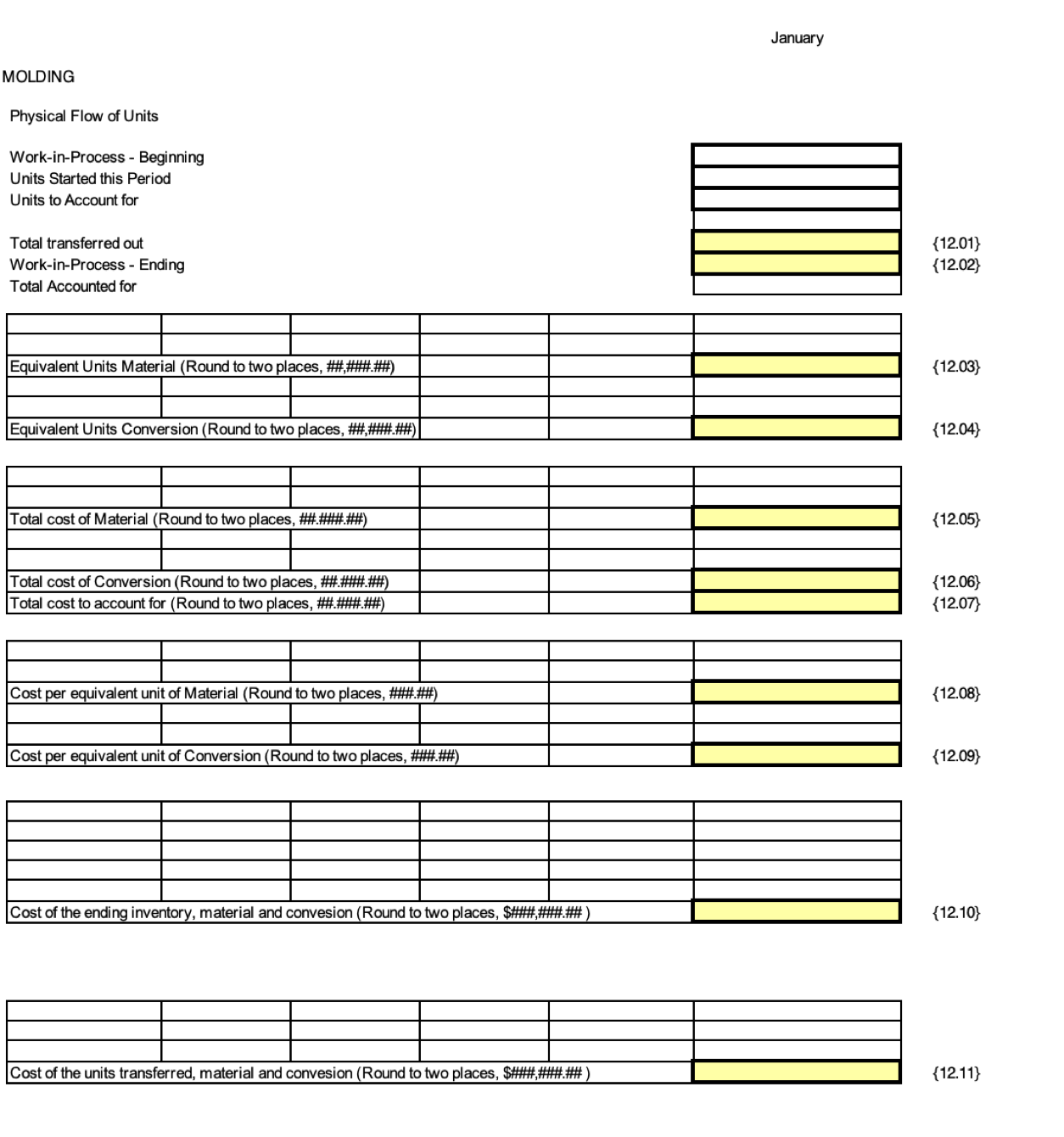

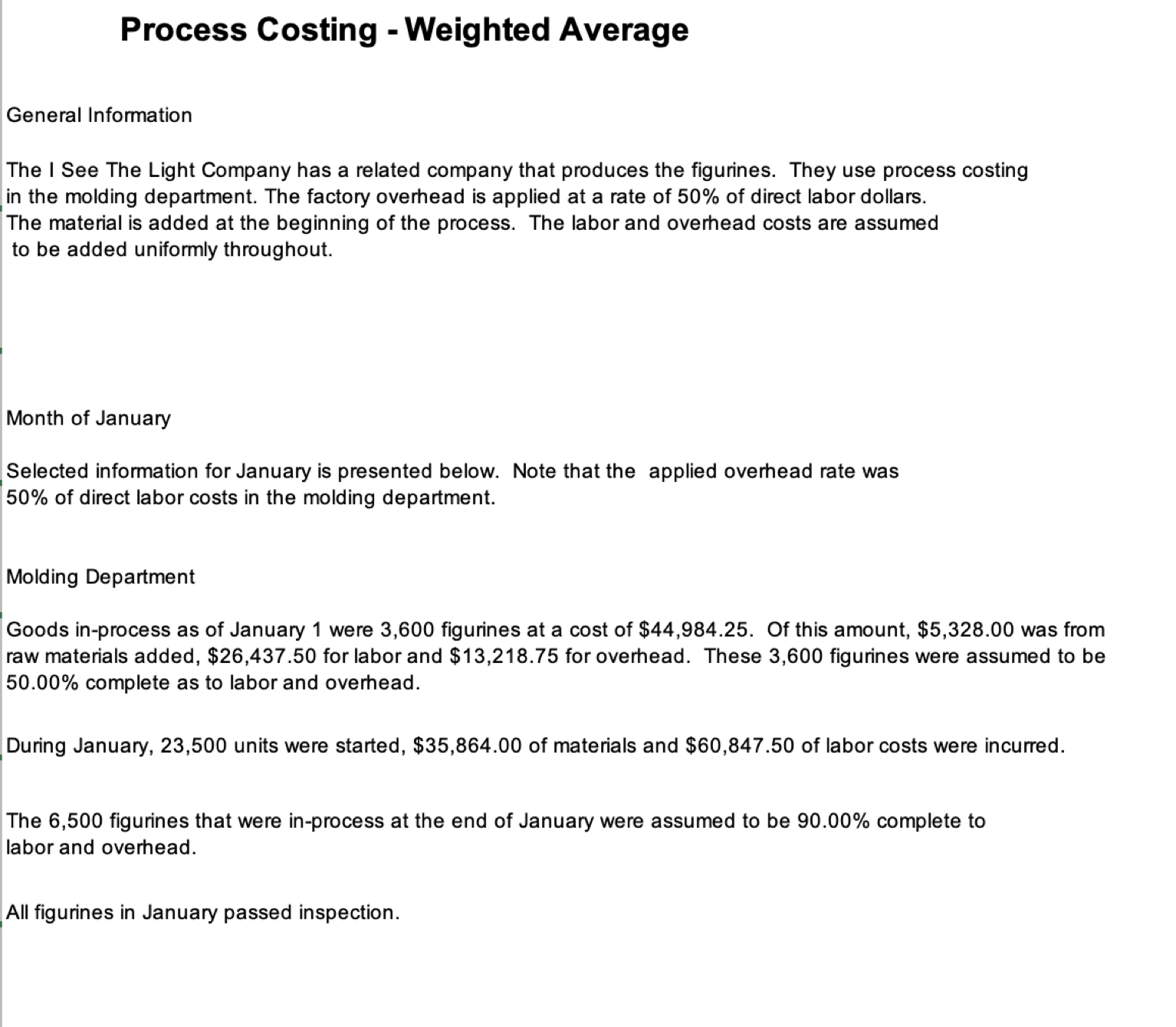

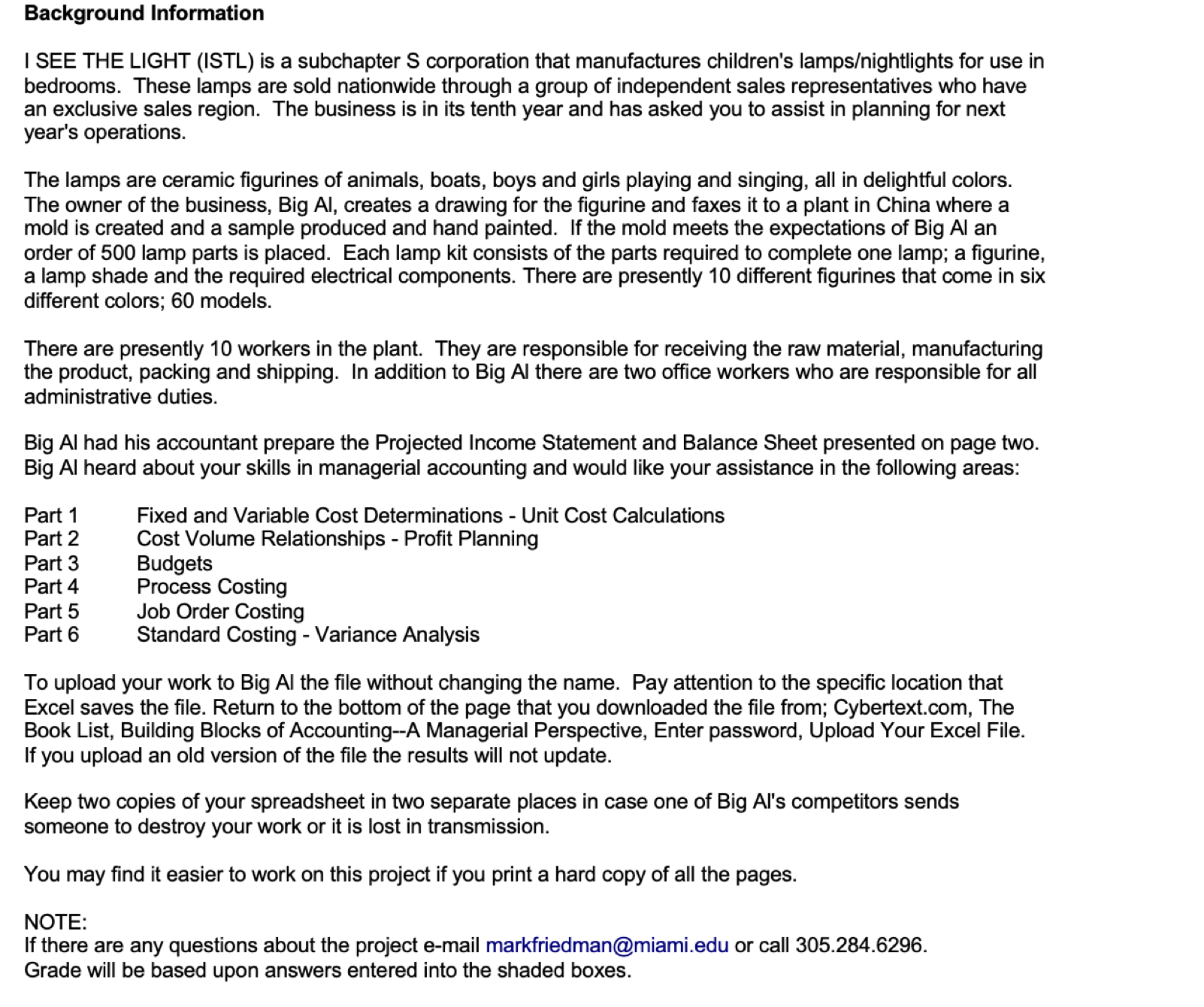

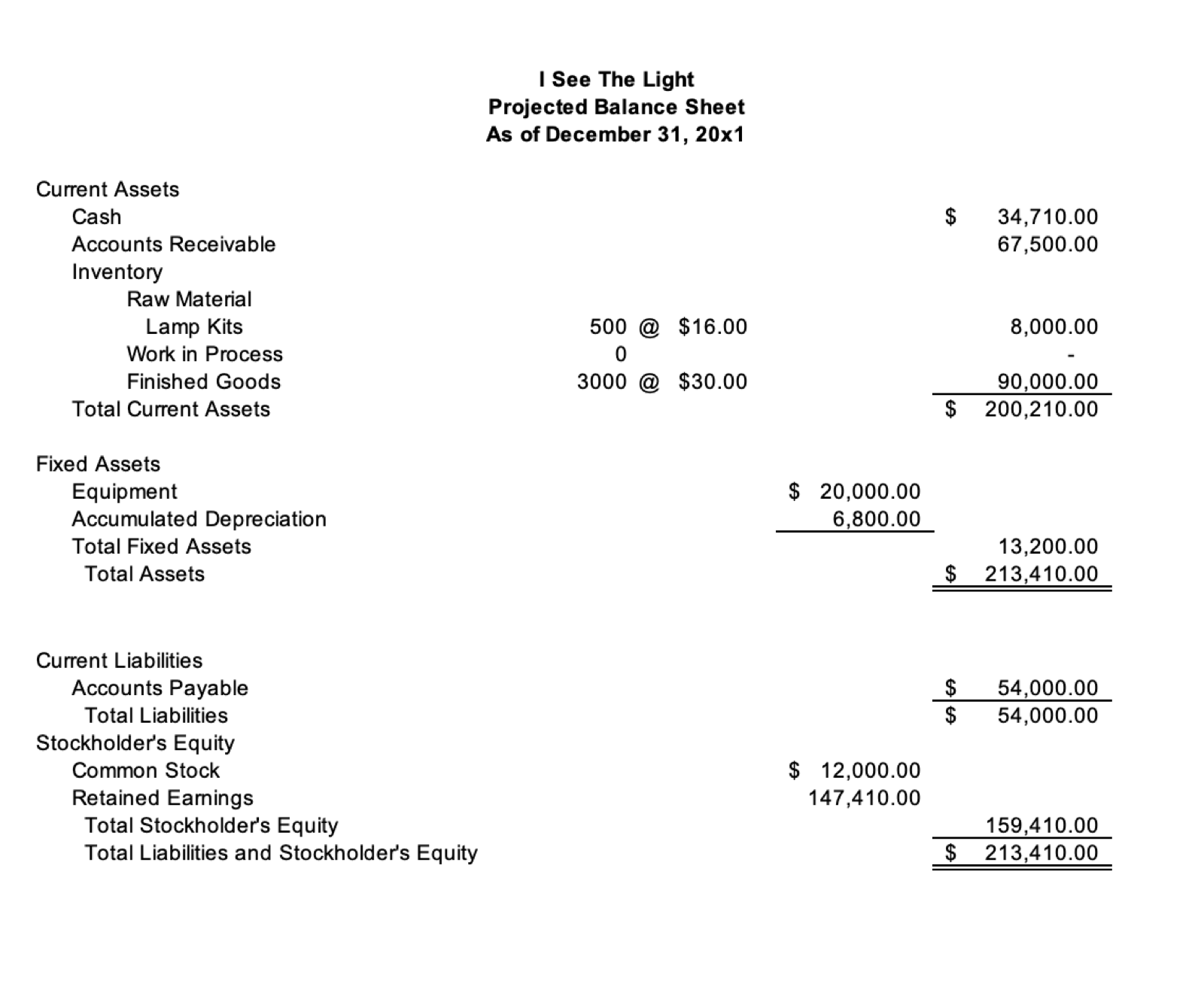

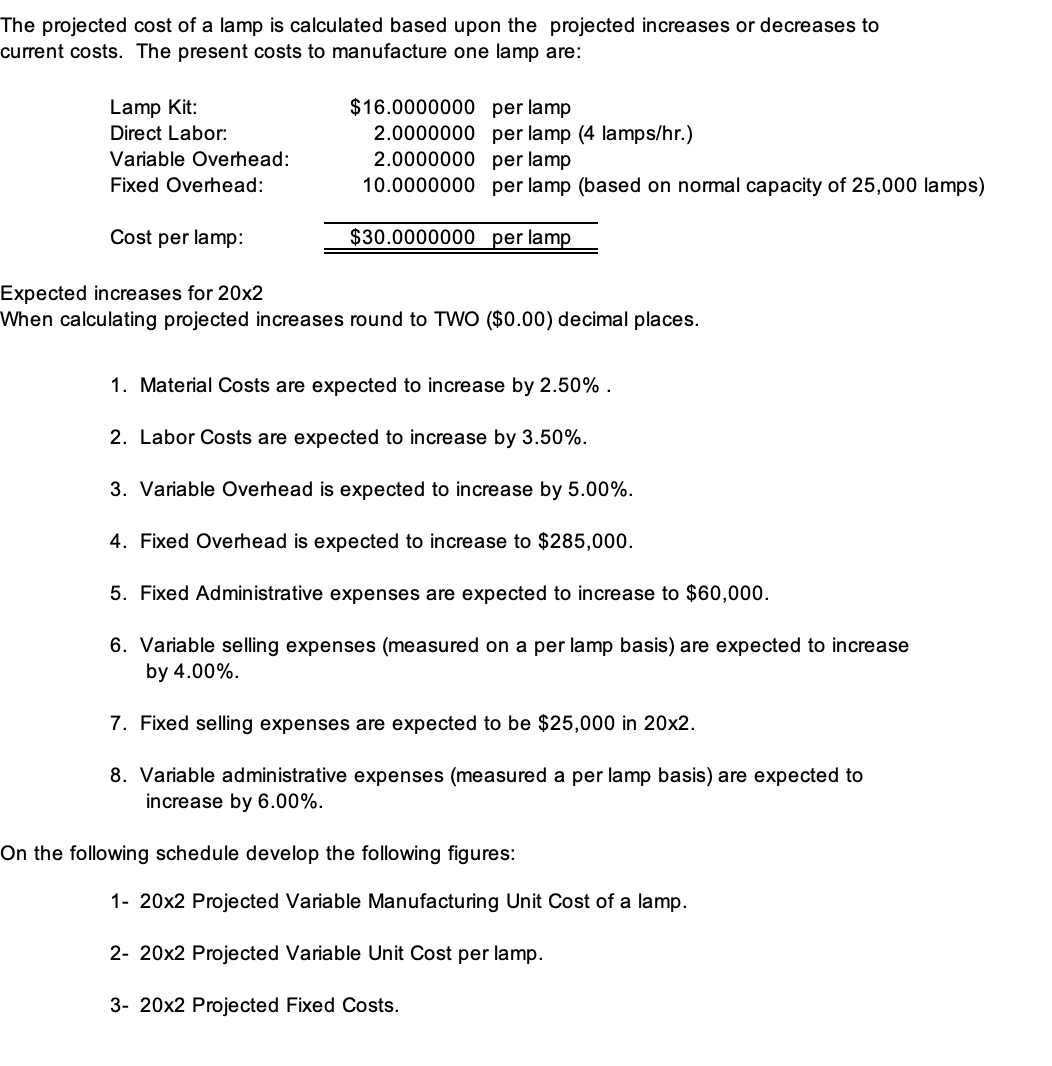

{12.10} {12.11} Process Costing - Weighted Average General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,600 figurines at a cost of $44,984.25. Of this amount, $5,328.00 was from raw materials added, $26,437.50 for labor and $13,218.75 for overhead. These 3,600 figurines were assumed to be 50.00% complete as to labor and overhead. During January, 23,500 units were started, $35,864.00 of materials and $60,847.50 of labor costs were incurred. The 6,500 figurines that were in-process at the end of January were assumed to be 90.00% complete to labor and overhead. All figurines in January passed inspection. I SEE THE LIGHT (ISTL) is a subchapter S corporation that manufactures children's lampsightlights for use in bedrooms. These lamps are sold nationwide through a group of independent sales representatives who have an exclusive sales region. The business is in its tenth year and has asked you to assist in planning for next year's operations. The lamps are ceramic figurines of animals, boats, boys and girls playing and singing, all in delightful colors. The owner of the business, Big Al, creates a drawing for the figurine and faxes it to a plant in China where a mold is created and a sample produced and hand painted. If the mold meets the expectations of Big Al an order of 500 lamp parts is placed. Each lamp kit consists of the parts required to complete one lamp; a figurine, a lamp shade and the required electrical components. There are presently 10 different figurines that come in six different colors; 60 models. There are presently 10 workers in the plant. They are responsible for receiving the raw material, manufacturing the product, packing and shipping. In addition to Big Al there are two office workers who are responsible for all administrative duties. Big Al had his accountant prepare the Projected Income Statement and Balance Sheet presented on page two. Big Al heard about your skills in managerial accounting and would like your assistance in the following areas: Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Fixed and Variable Cost Determinations - Unit Cost Calculations Cost Volume Relationships - Profit Planning Budgets Process Costing Job Order Costing Standard Costing - Variance Analysis To upload your work to Big Al the file without changing the name. Pay attention to the specific location that Excel saves the file. Return to the bottom of the page that you downloaded the file from; Cybertext.com, The Book List, Building Blocks of Accounting--A Managerial Perspective, Enter password, Upload Your Excel File. If you upload an old version of the file the results will not update. Keep two copies of your spreadsheet in two separate places in case one of Big Al's competitors sends someone to destroy your work or it is lost in transmission. You may find it easier to work on this project if you print a hard copy of all the pages. NOTE: If there are any questions about the project e-mail markfriedman@miami.edu or call 305.284.6296. Grade will be based upon answers entered into the shaded boxes. I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $34,710.00 67,500.00 500@$16.00 0 @ 3000@$30.00 $20,000.00 6,800.00 13,200.00$213,410.00 \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} \$ 12,000.00 147,410.00 \begin{tabular}{lr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} he projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: xpected increases for 202 Vhen calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 2.50%. 2. Labor Costs are expected to increase by 3.50%. 3. Variable Overhead is expected to increase by 5.00%. 4. Fixed Overhead is expected to increase to $285,000. 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $25,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. {12.10} {12.11} Process Costing - Weighted Average General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,600 figurines at a cost of $44,984.25. Of this amount, $5,328.00 was from raw materials added, $26,437.50 for labor and $13,218.75 for overhead. These 3,600 figurines were assumed to be 50.00% complete as to labor and overhead. During January, 23,500 units were started, $35,864.00 of materials and $60,847.50 of labor costs were incurred. The 6,500 figurines that were in-process at the end of January were assumed to be 90.00% complete to labor and overhead. All figurines in January passed inspection. I SEE THE LIGHT (ISTL) is a subchapter S corporation that manufactures children's lampsightlights for use in bedrooms. These lamps are sold nationwide through a group of independent sales representatives who have an exclusive sales region. The business is in its tenth year and has asked you to assist in planning for next year's operations. The lamps are ceramic figurines of animals, boats, boys and girls playing and singing, all in delightful colors. The owner of the business, Big Al, creates a drawing for the figurine and faxes it to a plant in China where a mold is created and a sample produced and hand painted. If the mold meets the expectations of Big Al an order of 500 lamp parts is placed. Each lamp kit consists of the parts required to complete one lamp; a figurine, a lamp shade and the required electrical components. There are presently 10 different figurines that come in six different colors; 60 models. There are presently 10 workers in the plant. They are responsible for receiving the raw material, manufacturing the product, packing and shipping. In addition to Big Al there are two office workers who are responsible for all administrative duties. Big Al had his accountant prepare the Projected Income Statement and Balance Sheet presented on page two. Big Al heard about your skills in managerial accounting and would like your assistance in the following areas: Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Fixed and Variable Cost Determinations - Unit Cost Calculations Cost Volume Relationships - Profit Planning Budgets Process Costing Job Order Costing Standard Costing - Variance Analysis To upload your work to Big Al the file without changing the name. Pay attention to the specific location that Excel saves the file. Return to the bottom of the page that you downloaded the file from; Cybertext.com, The Book List, Building Blocks of Accounting--A Managerial Perspective, Enter password, Upload Your Excel File. If you upload an old version of the file the results will not update. Keep two copies of your spreadsheet in two separate places in case one of Big Al's competitors sends someone to destroy your work or it is lost in transmission. You may find it easier to work on this project if you print a hard copy of all the pages. NOTE: If there are any questions about the project e-mail markfriedman@miami.edu or call 305.284.6296. Grade will be based upon answers entered into the shaded boxes. I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $34,710.00 67,500.00 500@$16.00 0 @ 3000@$30.00 $20,000.00 6,800.00 13,200.00$213,410.00 \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} \$ 12,000.00 147,410.00 \begin{tabular}{lr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} he projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: xpected increases for 202 Vhen calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 2.50%. 2. Labor Costs are expected to increase by 3.50%. 3. Variable Overhead is expected to increase by 5.00%. 4. Fixed Overhead is expected to increase to $285,000. 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $25,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs

{12.10} {12.11} Process Costing - Weighted Average General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,600 figurines at a cost of $44,984.25. Of this amount, $5,328.00 was from raw materials added, $26,437.50 for labor and $13,218.75 for overhead. These 3,600 figurines were assumed to be 50.00% complete as to labor and overhead. During January, 23,500 units were started, $35,864.00 of materials and $60,847.50 of labor costs were incurred. The 6,500 figurines that were in-process at the end of January were assumed to be 90.00% complete to labor and overhead. All figurines in January passed inspection. I SEE THE LIGHT (ISTL) is a subchapter S corporation that manufactures children's lampsightlights for use in bedrooms. These lamps are sold nationwide through a group of independent sales representatives who have an exclusive sales region. The business is in its tenth year and has asked you to assist in planning for next year's operations. The lamps are ceramic figurines of animals, boats, boys and girls playing and singing, all in delightful colors. The owner of the business, Big Al, creates a drawing for the figurine and faxes it to a plant in China where a mold is created and a sample produced and hand painted. If the mold meets the expectations of Big Al an order of 500 lamp parts is placed. Each lamp kit consists of the parts required to complete one lamp; a figurine, a lamp shade and the required electrical components. There are presently 10 different figurines that come in six different colors; 60 models. There are presently 10 workers in the plant. They are responsible for receiving the raw material, manufacturing the product, packing and shipping. In addition to Big Al there are two office workers who are responsible for all administrative duties. Big Al had his accountant prepare the Projected Income Statement and Balance Sheet presented on page two. Big Al heard about your skills in managerial accounting and would like your assistance in the following areas: Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Fixed and Variable Cost Determinations - Unit Cost Calculations Cost Volume Relationships - Profit Planning Budgets Process Costing Job Order Costing Standard Costing - Variance Analysis To upload your work to Big Al the file without changing the name. Pay attention to the specific location that Excel saves the file. Return to the bottom of the page that you downloaded the file from; Cybertext.com, The Book List, Building Blocks of Accounting--A Managerial Perspective, Enter password, Upload Your Excel File. If you upload an old version of the file the results will not update. Keep two copies of your spreadsheet in two separate places in case one of Big Al's competitors sends someone to destroy your work or it is lost in transmission. You may find it easier to work on this project if you print a hard copy of all the pages. NOTE: If there are any questions about the project e-mail markfriedman@miami.edu or call 305.284.6296. Grade will be based upon answers entered into the shaded boxes. I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $34,710.00 67,500.00 500@$16.00 0 @ 3000@$30.00 $20,000.00 6,800.00 13,200.00$213,410.00 \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} \$ 12,000.00 147,410.00 \begin{tabular}{lr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} he projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: xpected increases for 202 Vhen calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 2.50%. 2. Labor Costs are expected to increase by 3.50%. 3. Variable Overhead is expected to increase by 5.00%. 4. Fixed Overhead is expected to increase to $285,000. 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $25,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs. {12.10} {12.11} Process Costing - Weighted Average General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,600 figurines at a cost of $44,984.25. Of this amount, $5,328.00 was from raw materials added, $26,437.50 for labor and $13,218.75 for overhead. These 3,600 figurines were assumed to be 50.00% complete as to labor and overhead. During January, 23,500 units were started, $35,864.00 of materials and $60,847.50 of labor costs were incurred. The 6,500 figurines that were in-process at the end of January were assumed to be 90.00% complete to labor and overhead. All figurines in January passed inspection. I SEE THE LIGHT (ISTL) is a subchapter S corporation that manufactures children's lampsightlights for use in bedrooms. These lamps are sold nationwide through a group of independent sales representatives who have an exclusive sales region. The business is in its tenth year and has asked you to assist in planning for next year's operations. The lamps are ceramic figurines of animals, boats, boys and girls playing and singing, all in delightful colors. The owner of the business, Big Al, creates a drawing for the figurine and faxes it to a plant in China where a mold is created and a sample produced and hand painted. If the mold meets the expectations of Big Al an order of 500 lamp parts is placed. Each lamp kit consists of the parts required to complete one lamp; a figurine, a lamp shade and the required electrical components. There are presently 10 different figurines that come in six different colors; 60 models. There are presently 10 workers in the plant. They are responsible for receiving the raw material, manufacturing the product, packing and shipping. In addition to Big Al there are two office workers who are responsible for all administrative duties. Big Al had his accountant prepare the Projected Income Statement and Balance Sheet presented on page two. Big Al heard about your skills in managerial accounting and would like your assistance in the following areas: Part 1 Part 2 Part 3 Part 4 Part 5 Part 6 Fixed and Variable Cost Determinations - Unit Cost Calculations Cost Volume Relationships - Profit Planning Budgets Process Costing Job Order Costing Standard Costing - Variance Analysis To upload your work to Big Al the file without changing the name. Pay attention to the specific location that Excel saves the file. Return to the bottom of the page that you downloaded the file from; Cybertext.com, The Book List, Building Blocks of Accounting--A Managerial Perspective, Enter password, Upload Your Excel File. If you upload an old version of the file the results will not update. Keep two copies of your spreadsheet in two separate places in case one of Big Al's competitors sends someone to destroy your work or it is lost in transmission. You may find it easier to work on this project if you print a hard copy of all the pages. NOTE: If there are any questions about the project e-mail markfriedman@miami.edu or call 305.284.6296. Grade will be based upon answers entered into the shaded boxes. I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $34,710.00 67,500.00 500@$16.00 0 @ 3000@$30.00 $20,000.00 6,800.00 13,200.00$213,410.00 \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} \$ 12,000.00 147,410.00 \begin{tabular}{lr} 159,410.00 \\ \hline$213,410.00 \\ \hline \hline \end{tabular} he projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: xpected increases for 202 Vhen calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 2.50%. 2. Labor Costs are expected to increase by 3.50%. 3. Variable Overhead is expected to increase by 5.00%. 4. Fixed Overhead is expected to increase to $285,000. 5. Fixed Administrative expenses are expected to increase to $60,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 4.00%. 7. Fixed selling expenses are expected to be $25,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 202 Projected Fixed Costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started