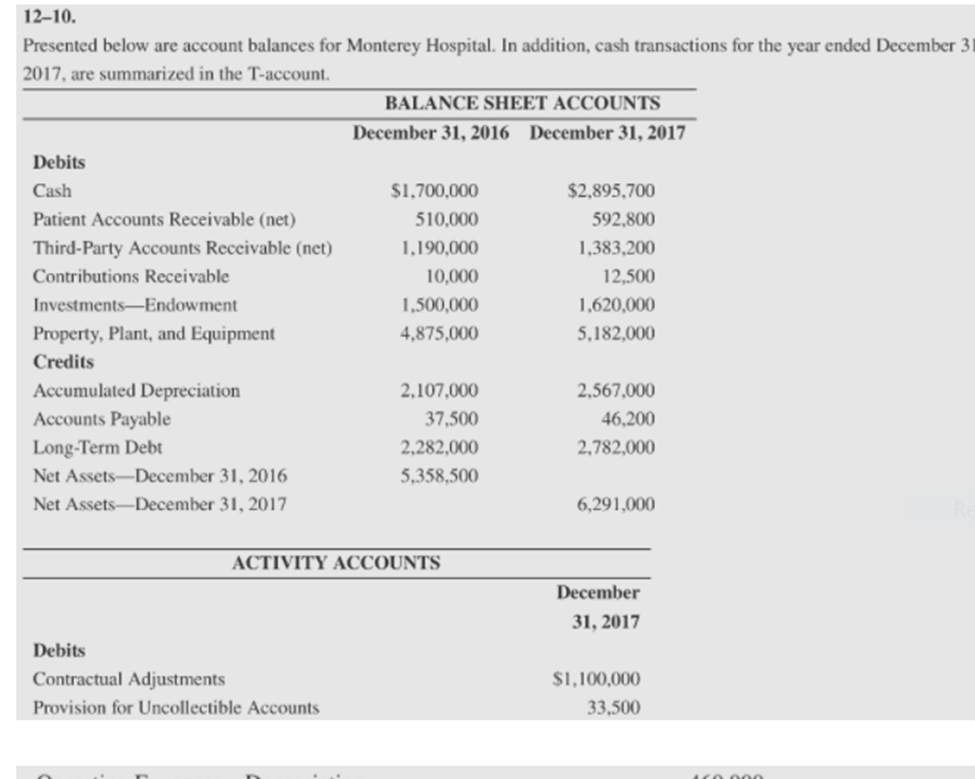

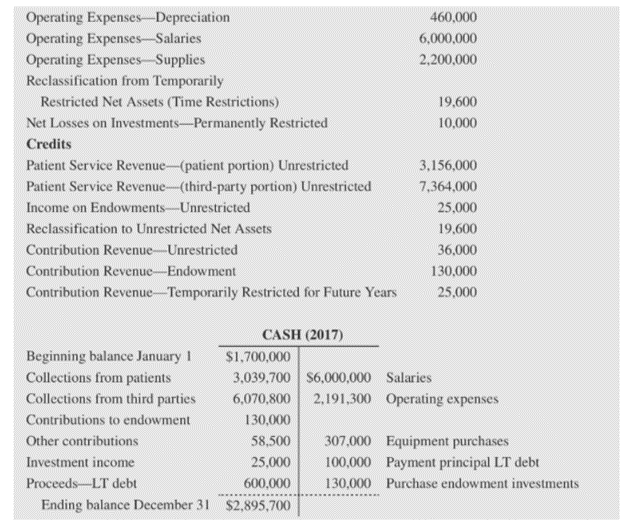

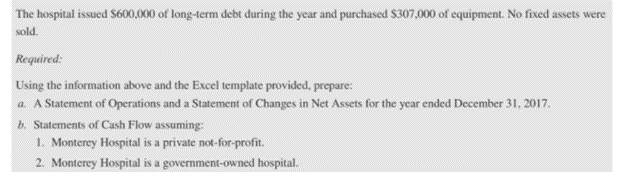

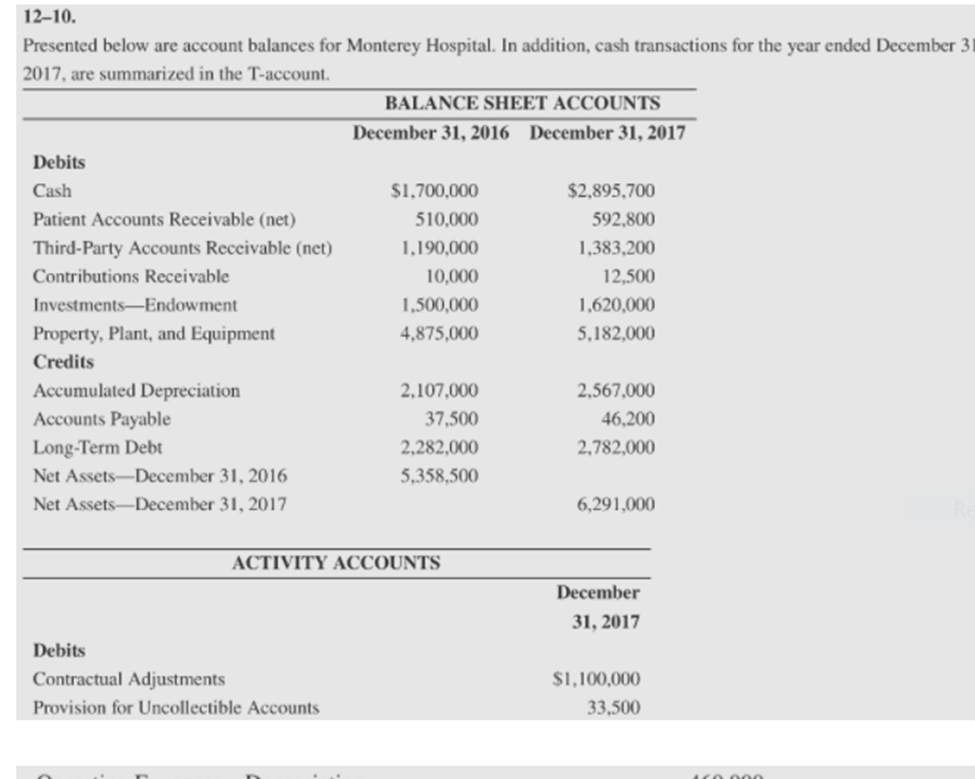

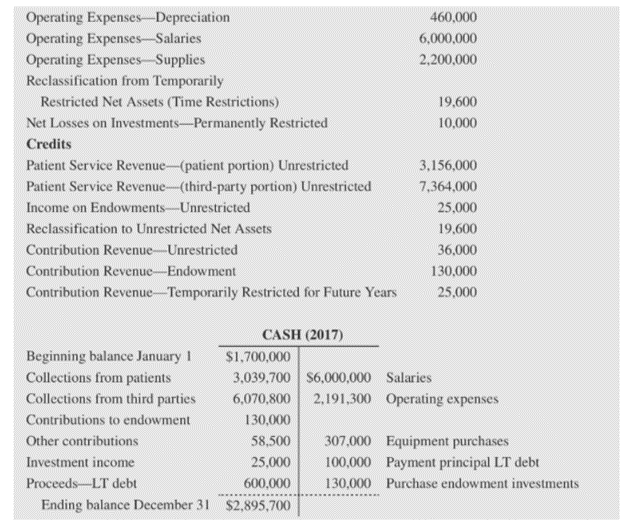

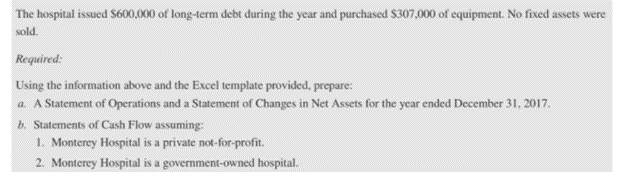

12-10. Presented below are account balances for Monterey Hospital. In addition, cash transactions for the year ended December 31 2017, are summarized in the T-account. BALANCE SHEET ACCOUNTS December 31, 2016 December 31, 2017 Debits Cash $1.700.000 $2.895,700 Patient Accounts Receivable (net) 510,000 592.800 Third-Party Accounts Receivable (net) 1,190,000 1,383,200 Contributions Receivable 10,000 12,500 Investments-Endowment 1,500,000 1,620,000 Property, Plant, and Equipment 4,875,000 5,182.000 Credits Accumulated Depreciation 2,107,000 2,567,000 Accounts Payable 37,500 46,200 Long-Term Debt 2.282.000 2,782,000 Net Assets December 31, 2016 5.358,500 Net Assets-December 31, 2017 6,291,000 ACTIVITY ACCOUNTS December 31, 2017 Debits Contractual Adjustments Provision for Uncollectible Accounts $1,100,000 33,500 ICO 460,000 6,000,000 2,200,000 19,600 10,000 Operating Expenses-Depreciation Operating Expenses-Salaries Operating Expenses Supplies Reclassification from Temporarily Restricted Net Assets (Time Restrictions) Net Losses on Investments--Permanently Restricted Credits Patient Service Revenue-patient portion) Unrestricted Patient Service Revenue-(third-party portion) Unrestricted Income on Endowments-Unrestricted Reclassification to Unrestricted Net Assets Contribution Revenue-Unrestricted Contribution Revenue-Endowment Contribution Revenue-Temporarily Restricted for Future Years 3,156,000 7,364,000 25,000 19,600 36,000 130,000 25,000 CASH (2017) Beginning balance January 1 $1,700,000 Collections from patients 3.039.700 56,000,000 Salaries Collections from third parties 6,070,800 2,191,300 Operating expenses Contributions to endowment 130,000 Other contributions 58,500 307,000 Equipment purchases Investment income 25,000 100,000 Payment principal LT debt Proceeds LT debt 600,000 130,000 Purchase endowment investments Ending balance December 31 $2,895,700 The hospital issued $600,000 of long-term debt during the year and purchased $307,000 of equipment. No fixed assets were sold. Required: Using the information above and the Excel template provided, prepare: a A Statement of Operations and a Statement of Changes in Net Assets for the year ended December 31, 2017. b. Statements of Cash Flow assuming: 1. Monterey Hospital is a private not-for-profit. 2. Monterey Hospital is a government-owned hospital. 12-10. Presented below are account balances for Monterey Hospital. In addition, cash transactions for the year ended December 31 2017, are summarized in the T-account. BALANCE SHEET ACCOUNTS December 31, 2016 December 31, 2017 Debits Cash $1.700.000 $2.895,700 Patient Accounts Receivable (net) 510,000 592.800 Third-Party Accounts Receivable (net) 1,190,000 1,383,200 Contributions Receivable 10,000 12,500 Investments-Endowment 1,500,000 1,620,000 Property, Plant, and Equipment 4,875,000 5,182.000 Credits Accumulated Depreciation 2,107,000 2,567,000 Accounts Payable 37,500 46,200 Long-Term Debt 2.282.000 2,782,000 Net Assets December 31, 2016 5.358,500 Net Assets-December 31, 2017 6,291,000 ACTIVITY ACCOUNTS December 31, 2017 Debits Contractual Adjustments Provision for Uncollectible Accounts $1,100,000 33,500 ICO 460,000 6,000,000 2,200,000 19,600 10,000 Operating Expenses-Depreciation Operating Expenses-Salaries Operating Expenses Supplies Reclassification from Temporarily Restricted Net Assets (Time Restrictions) Net Losses on Investments--Permanently Restricted Credits Patient Service Revenue-patient portion) Unrestricted Patient Service Revenue-(third-party portion) Unrestricted Income on Endowments-Unrestricted Reclassification to Unrestricted Net Assets Contribution Revenue-Unrestricted Contribution Revenue-Endowment Contribution Revenue-Temporarily Restricted for Future Years 3,156,000 7,364,000 25,000 19,600 36,000 130,000 25,000 CASH (2017) Beginning balance January 1 $1,700,000 Collections from patients 3.039.700 56,000,000 Salaries Collections from third parties 6,070,800 2,191,300 Operating expenses Contributions to endowment 130,000 Other contributions 58,500 307,000 Equipment purchases Investment income 25,000 100,000 Payment principal LT debt Proceeds LT debt 600,000 130,000 Purchase endowment investments Ending balance December 31 $2,895,700 The hospital issued $600,000 of long-term debt during the year and purchased $307,000 of equipment. No fixed assets were sold. Required: Using the information above and the Excel template provided, prepare: a A Statement of Operations and a Statement of Changes in Net Assets for the year ended December 31, 2017. b. Statements of Cash Flow assuming: 1. Monterey Hospital is a private not-for-profit. 2. Monterey Hospital is a government-owned hospital