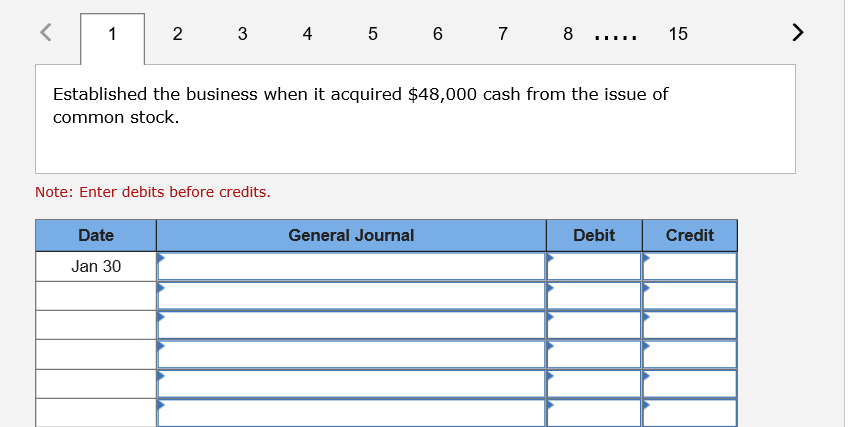

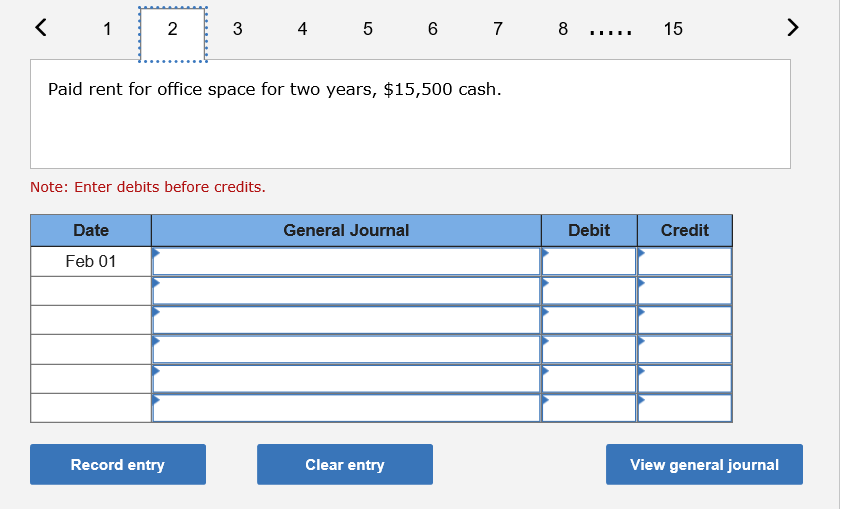

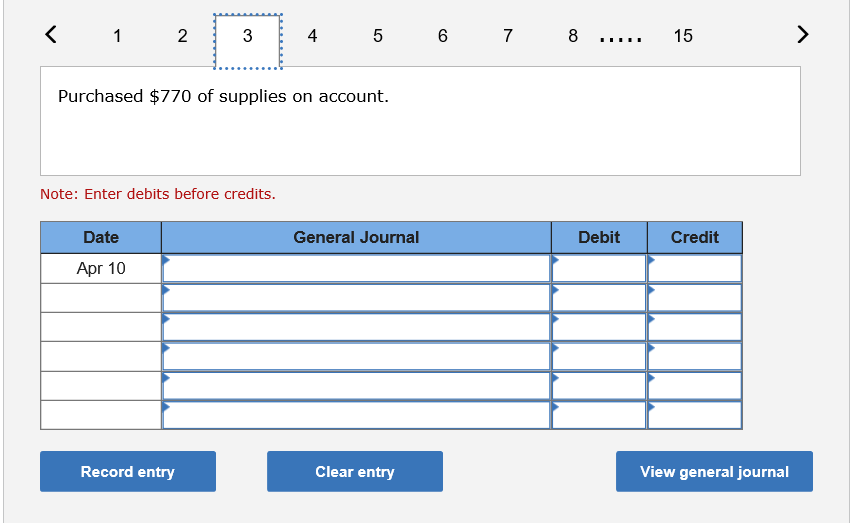

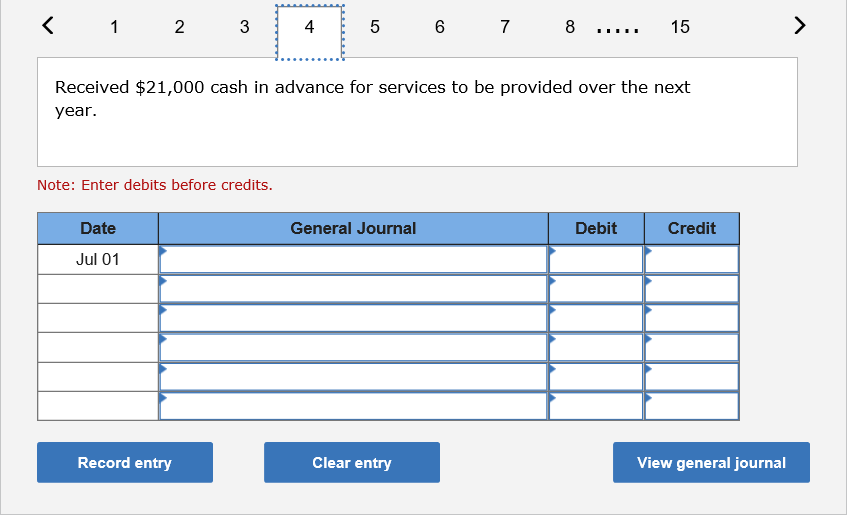

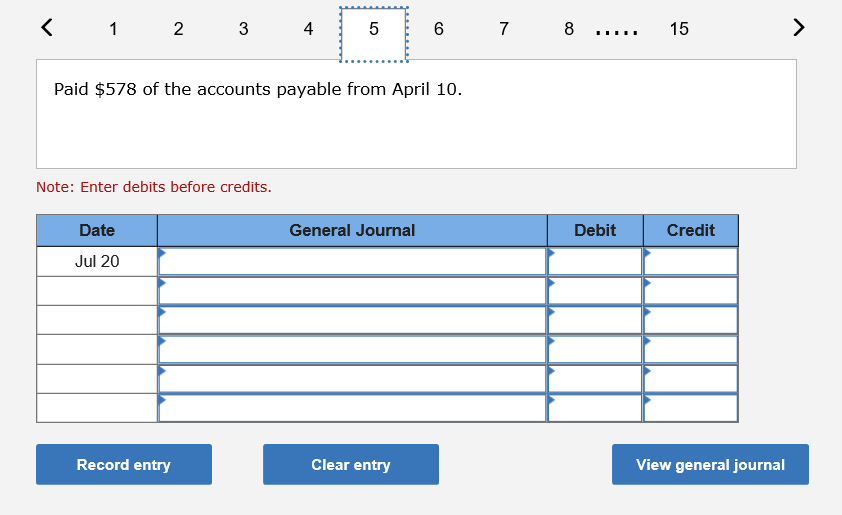

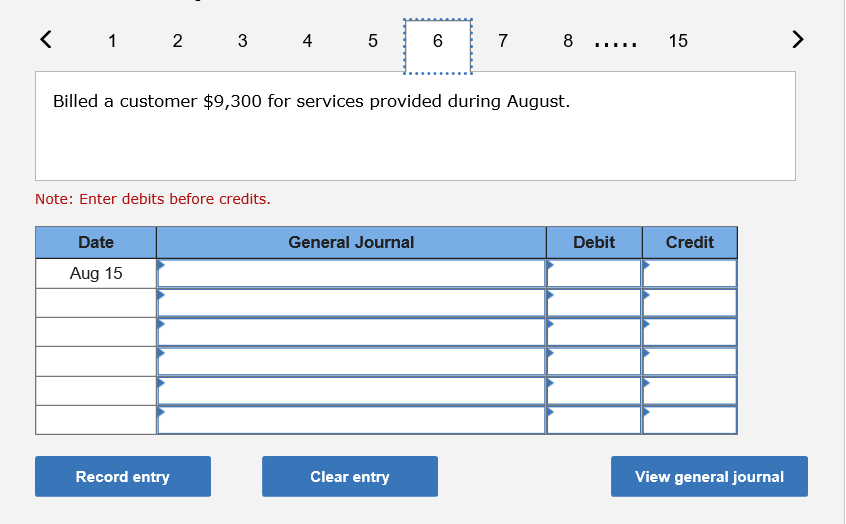

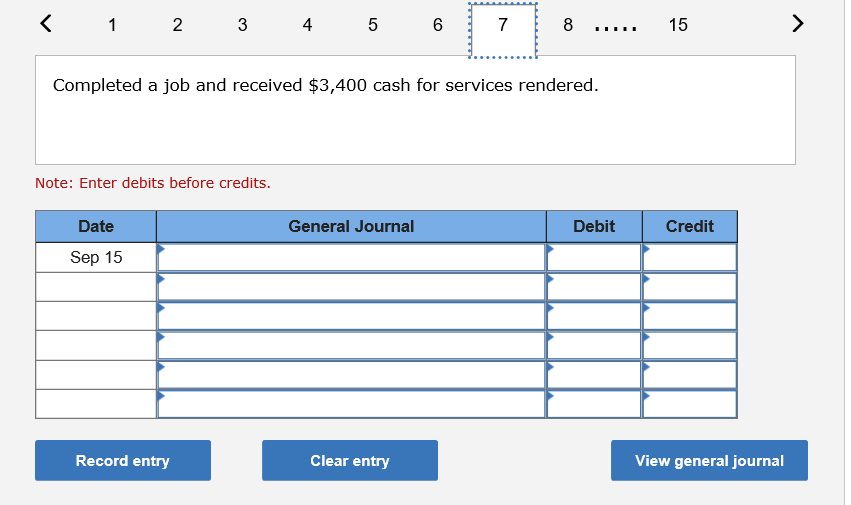

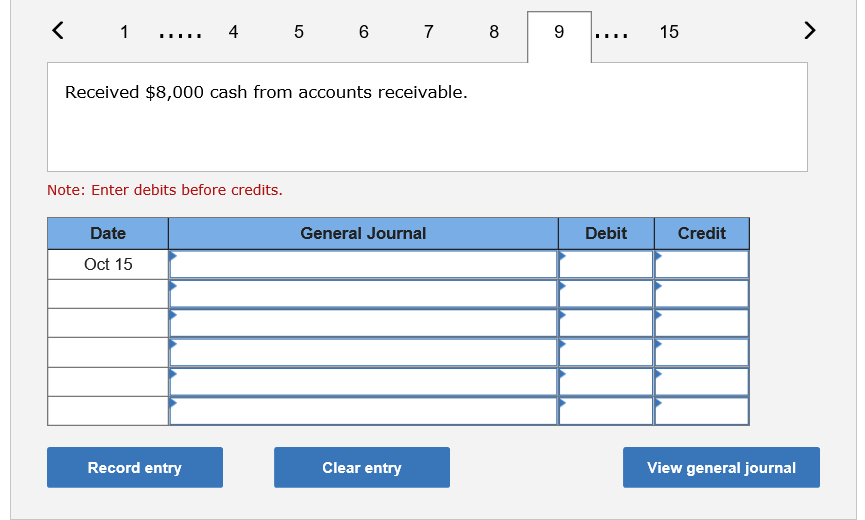

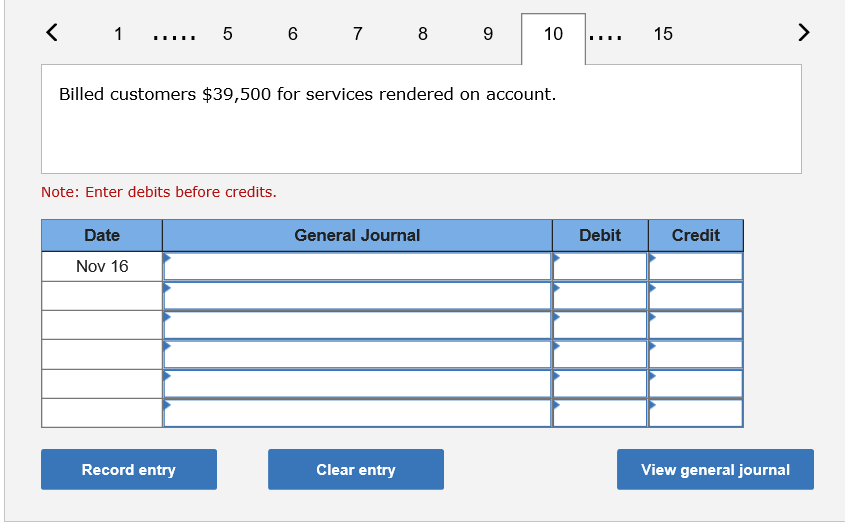

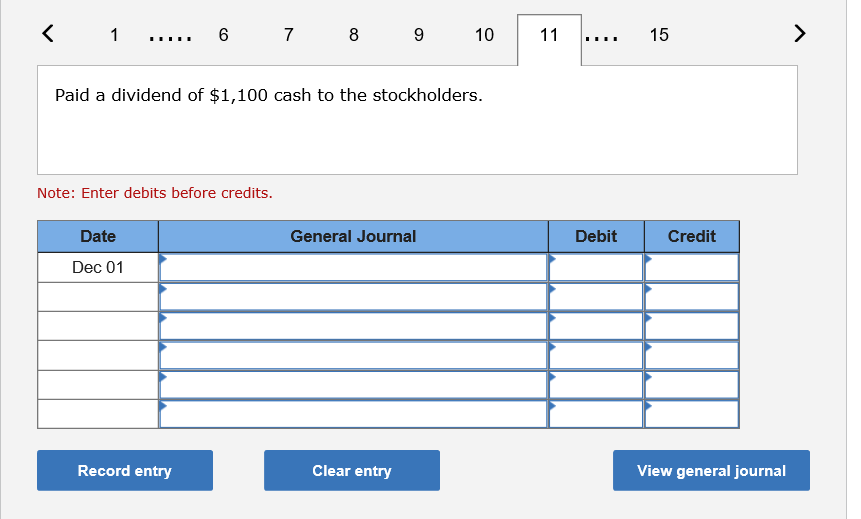

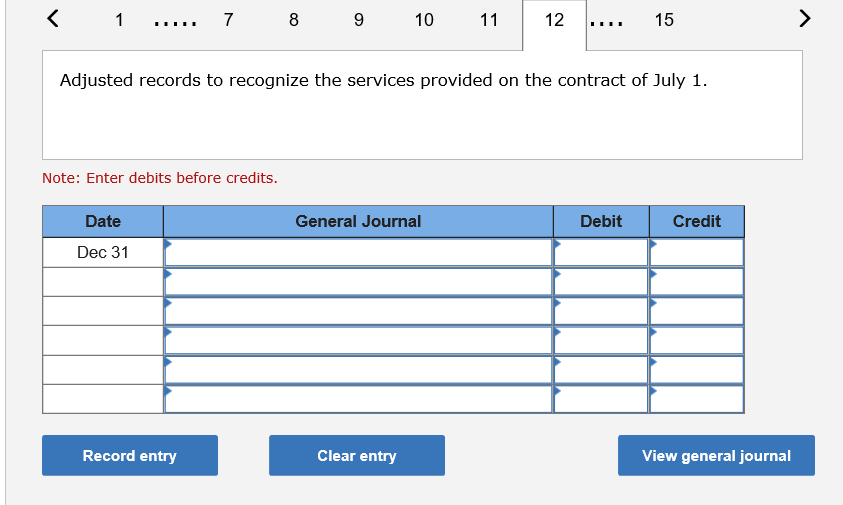

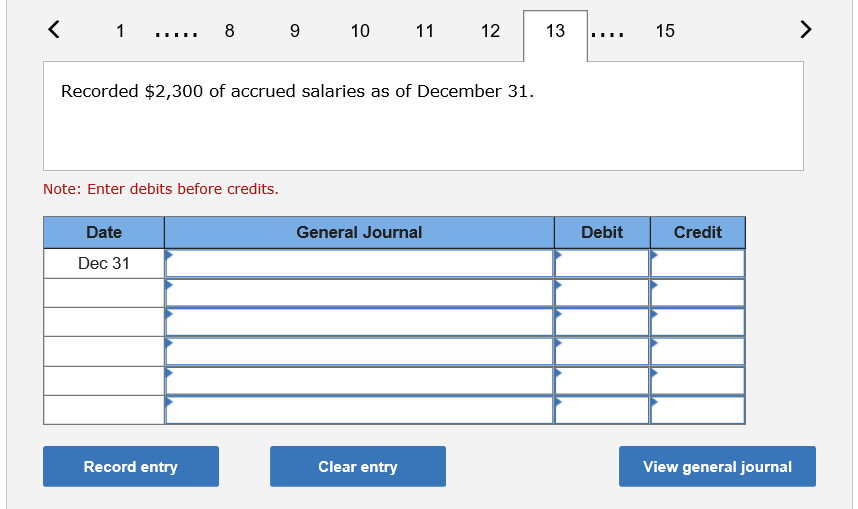

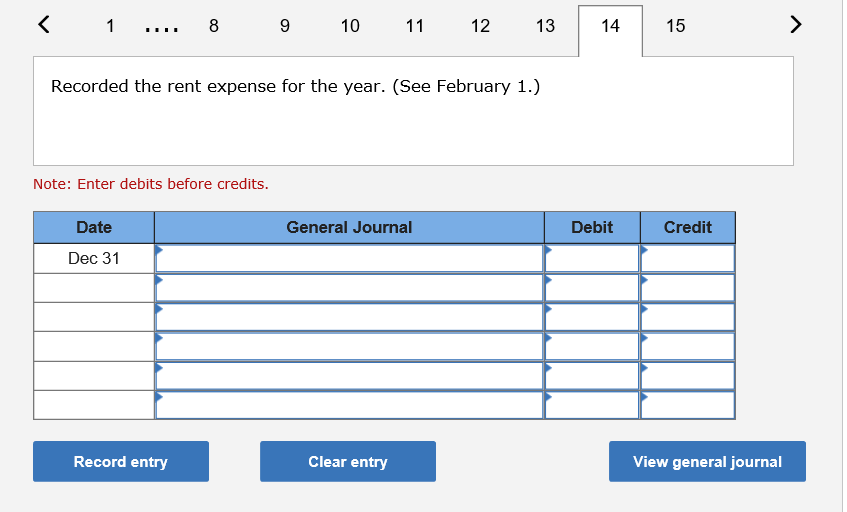

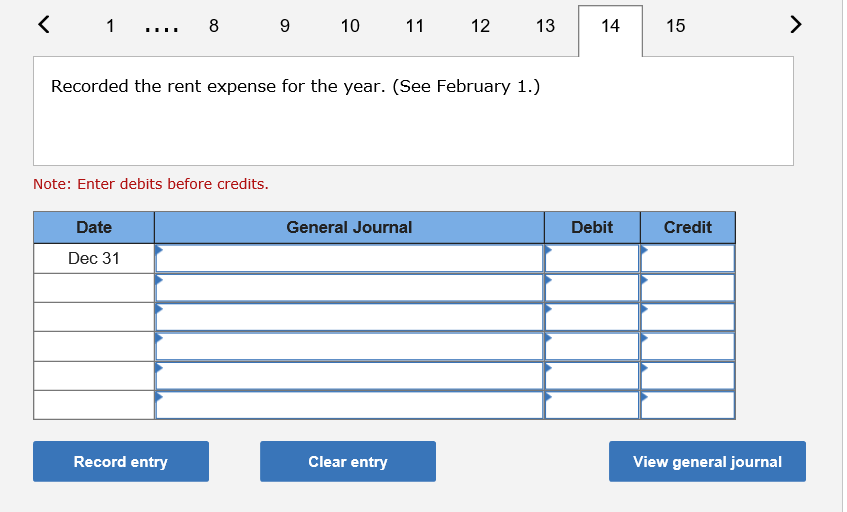

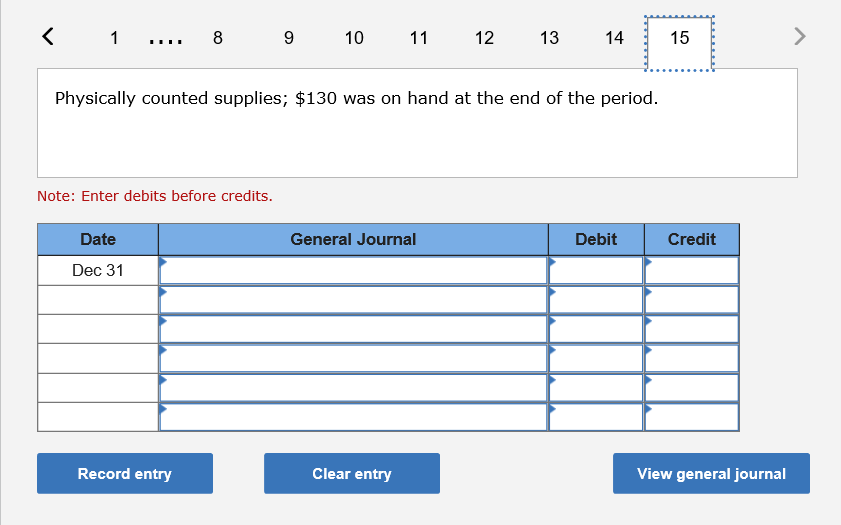

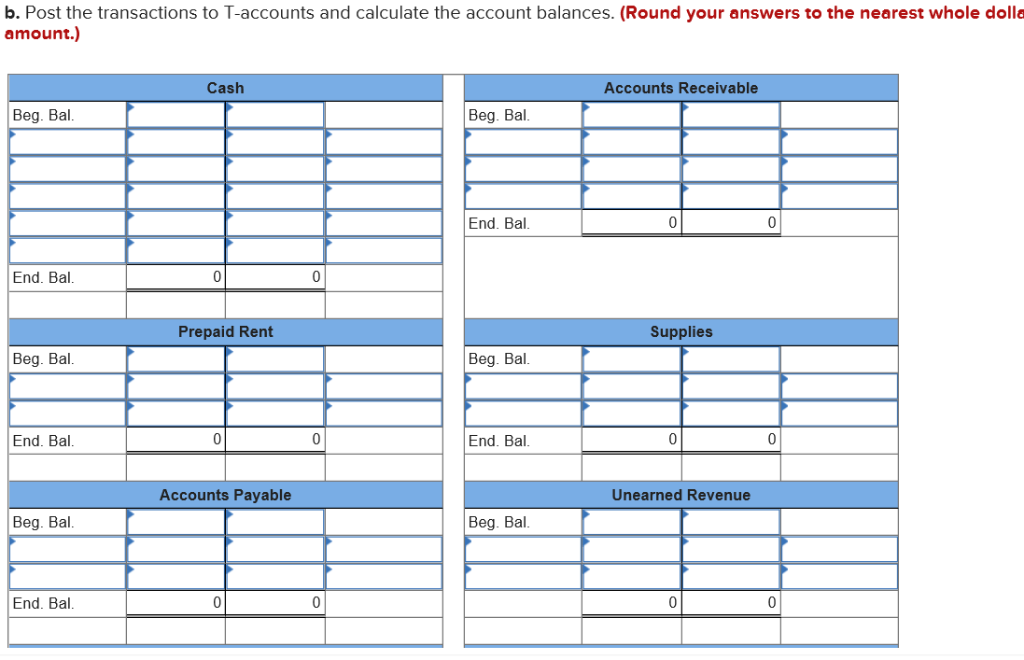

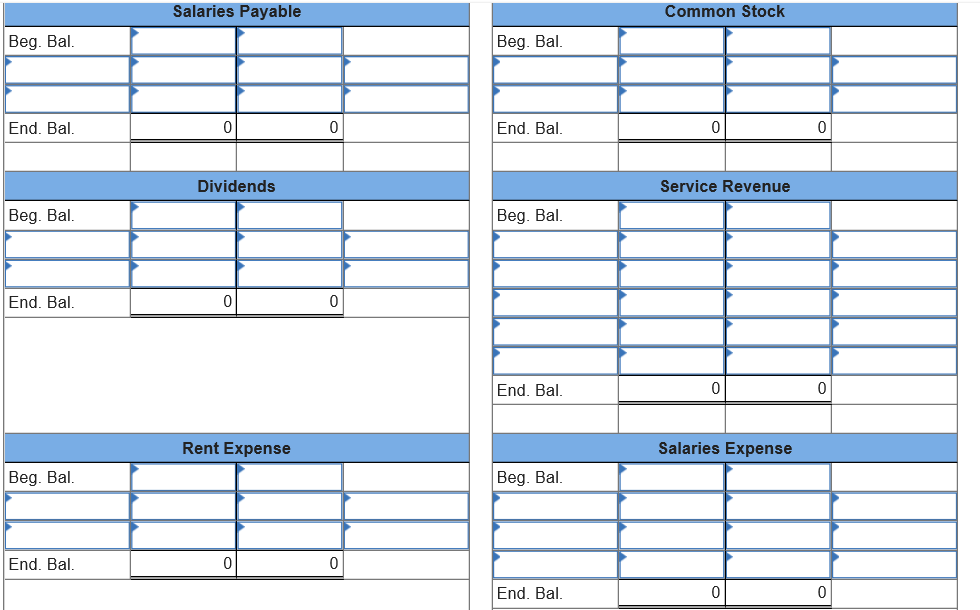

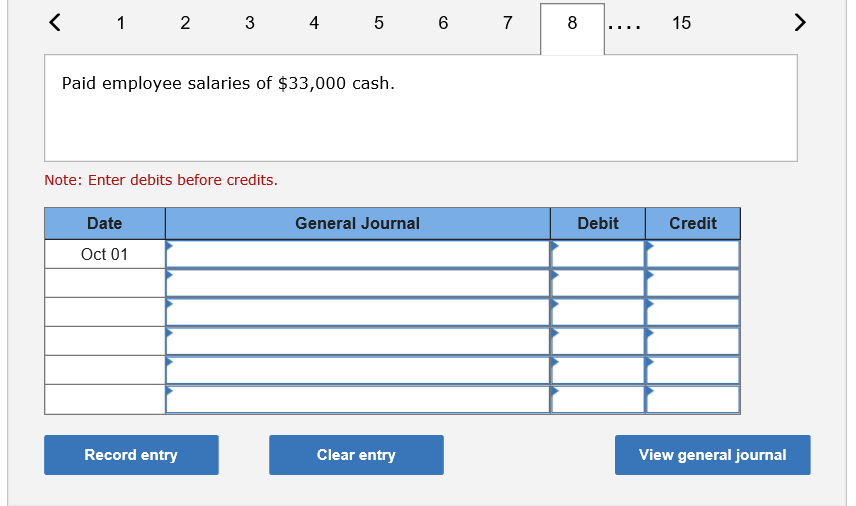

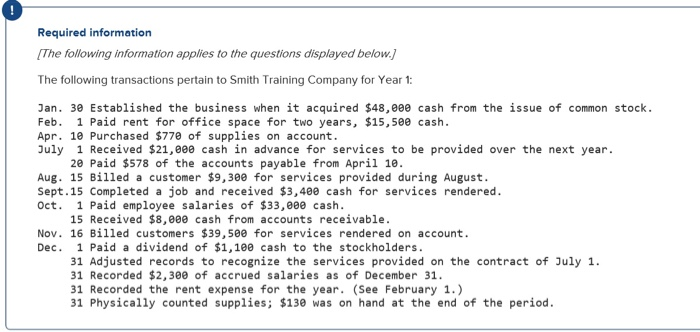

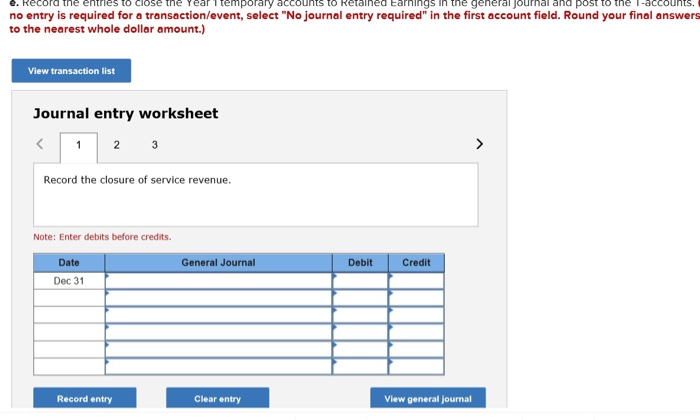

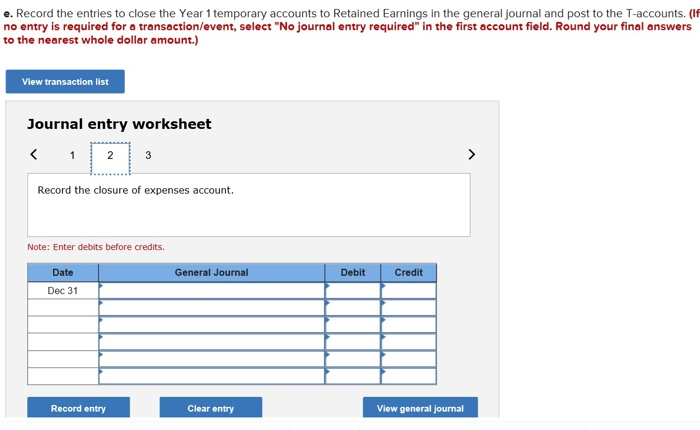

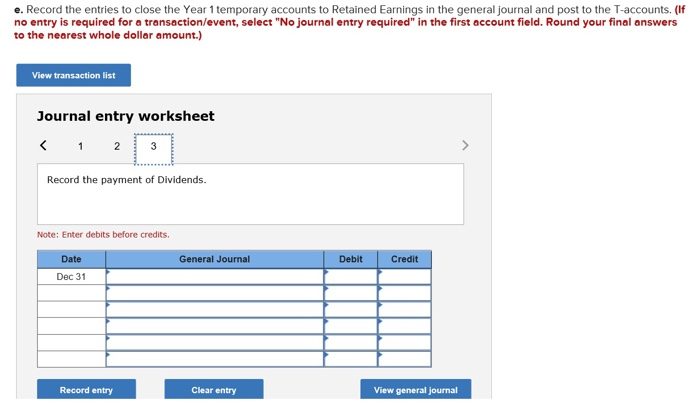

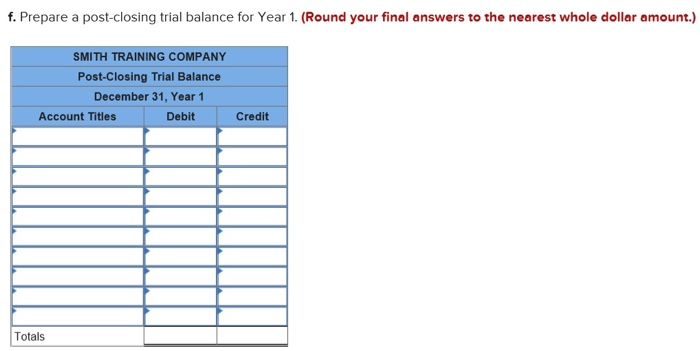

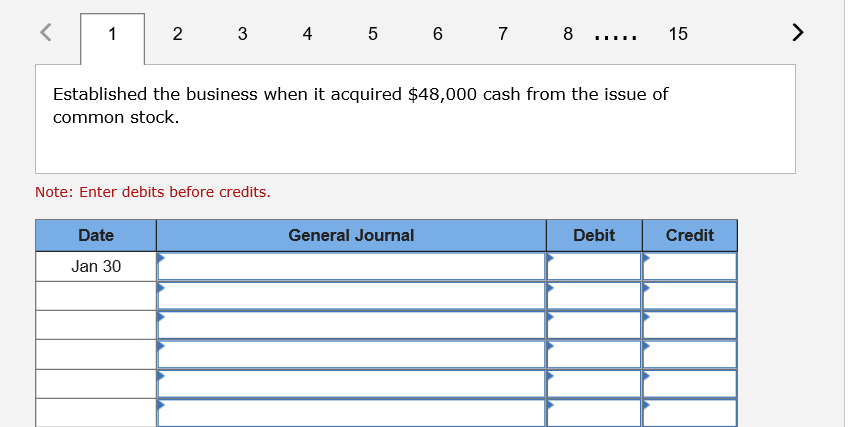

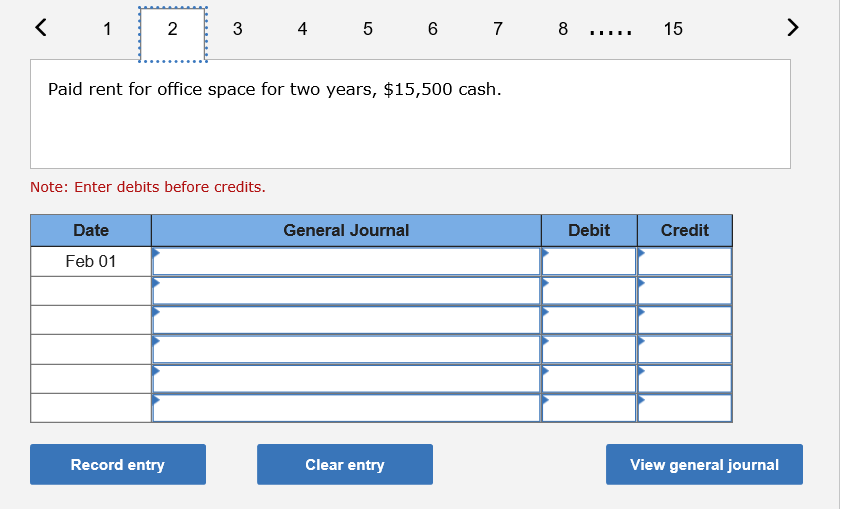

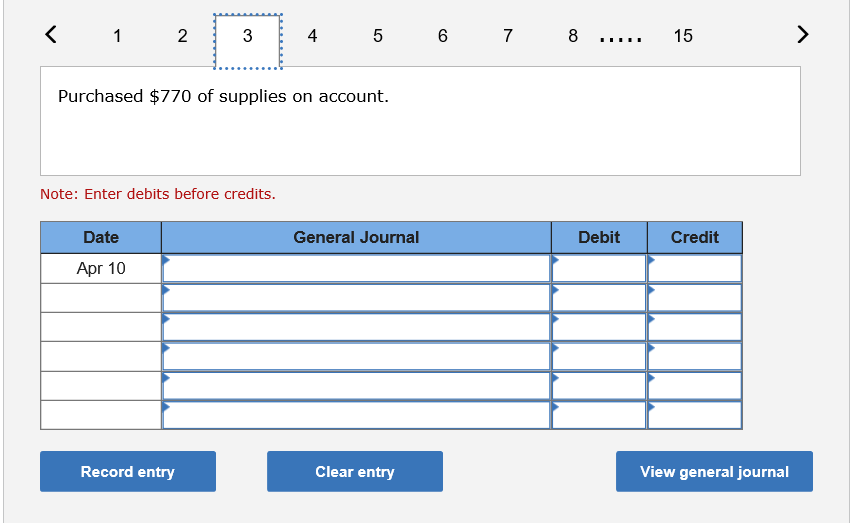

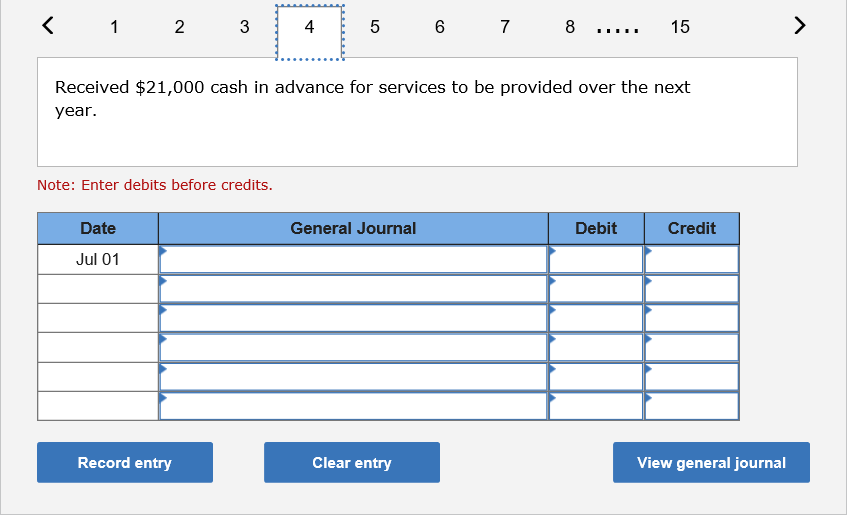

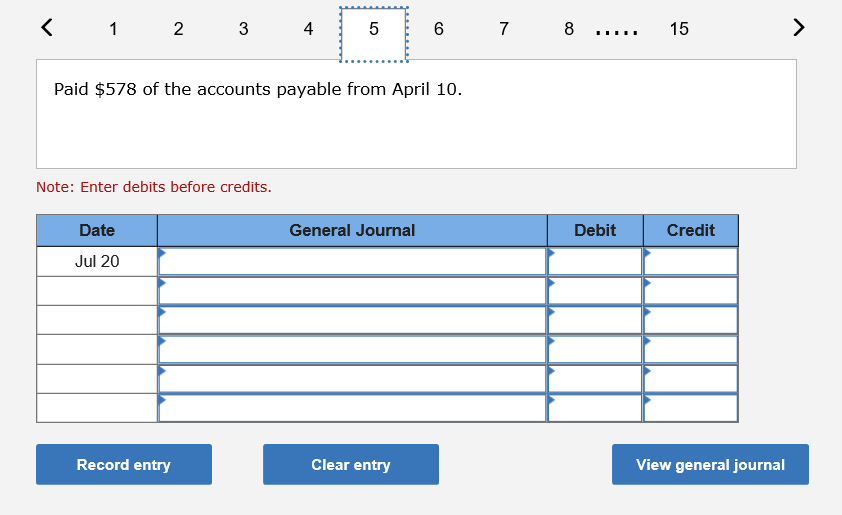

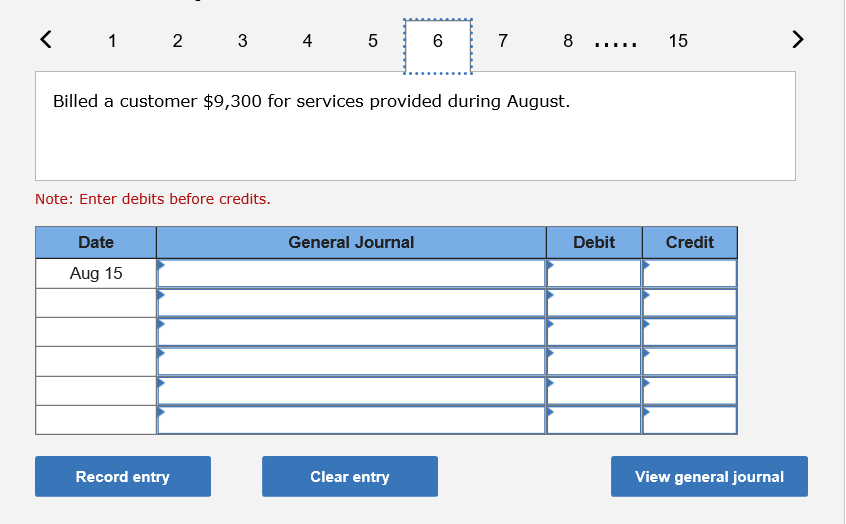

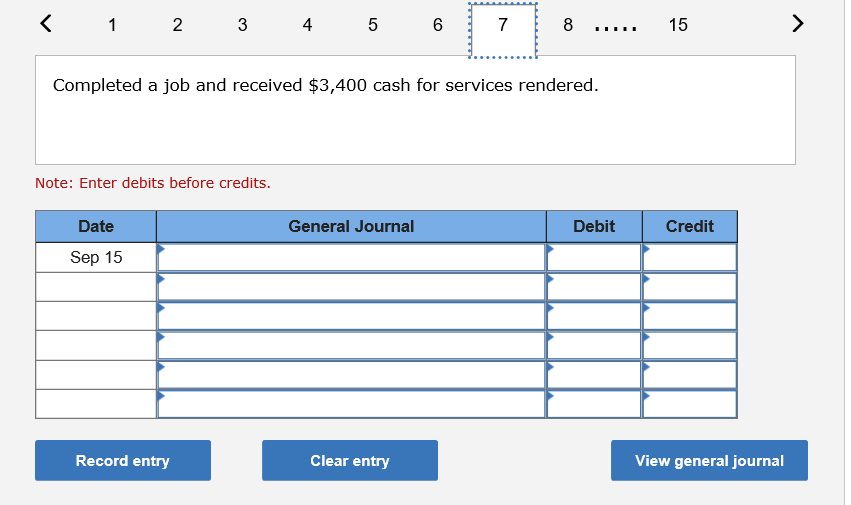

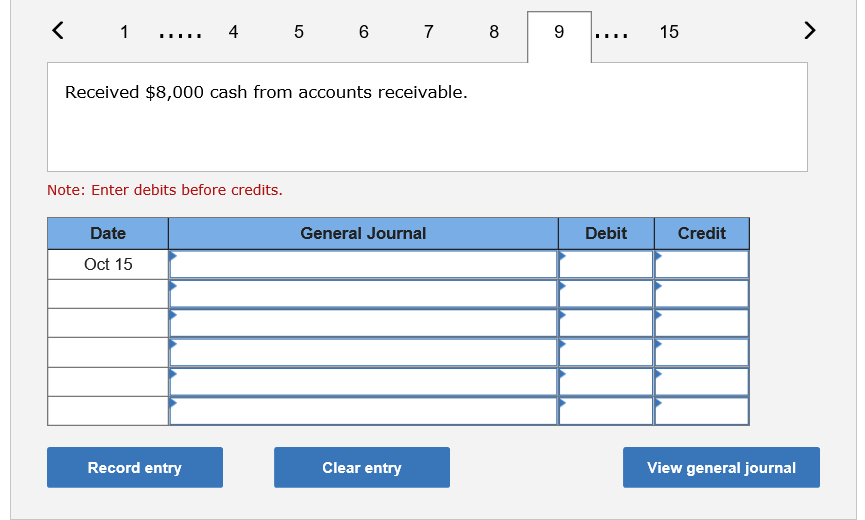

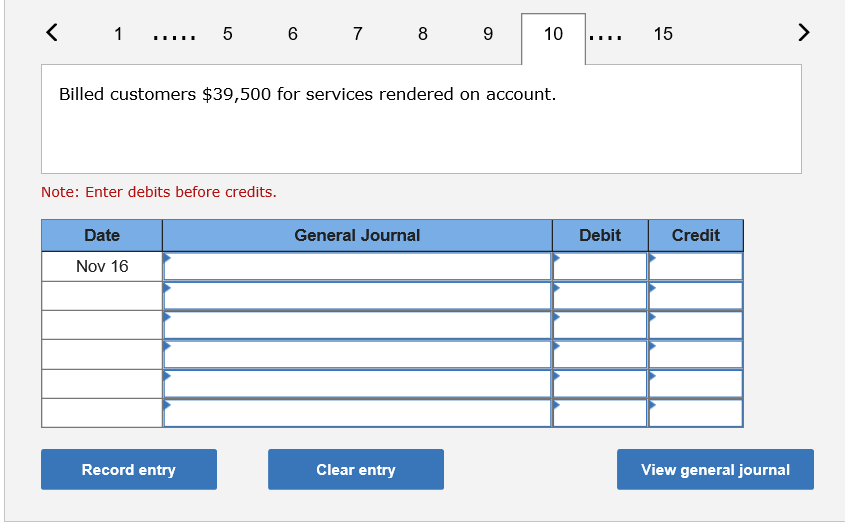

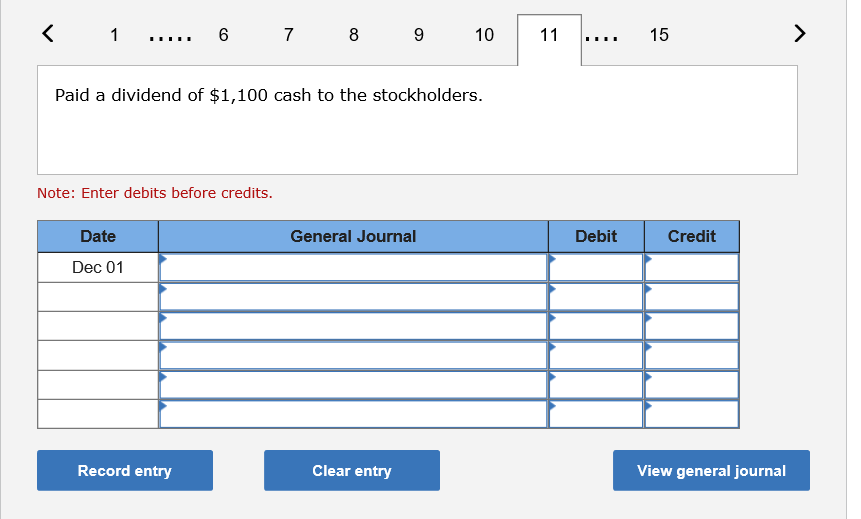

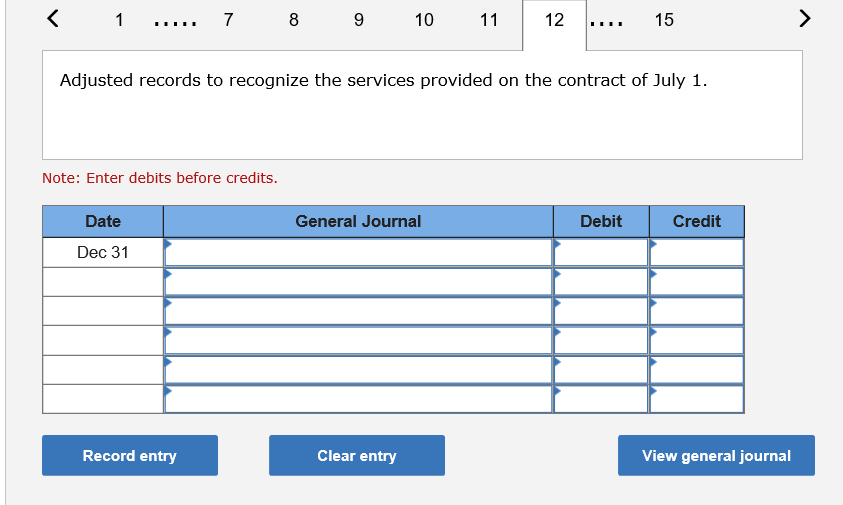

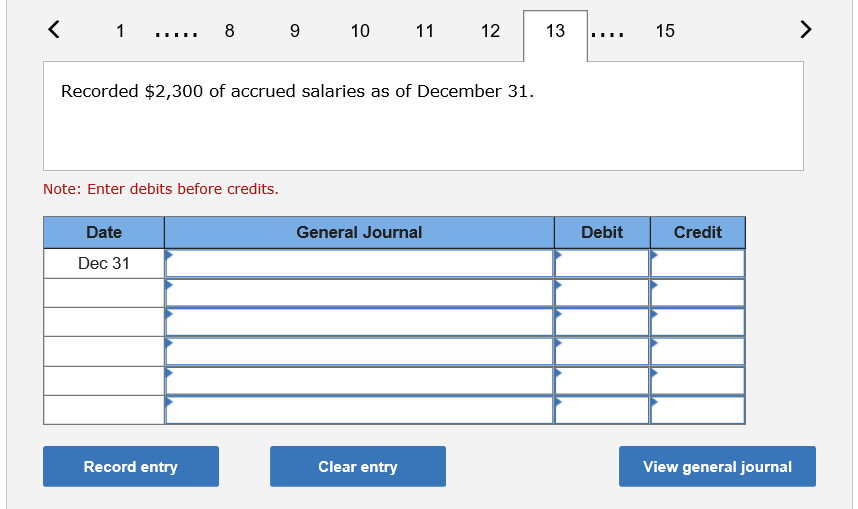

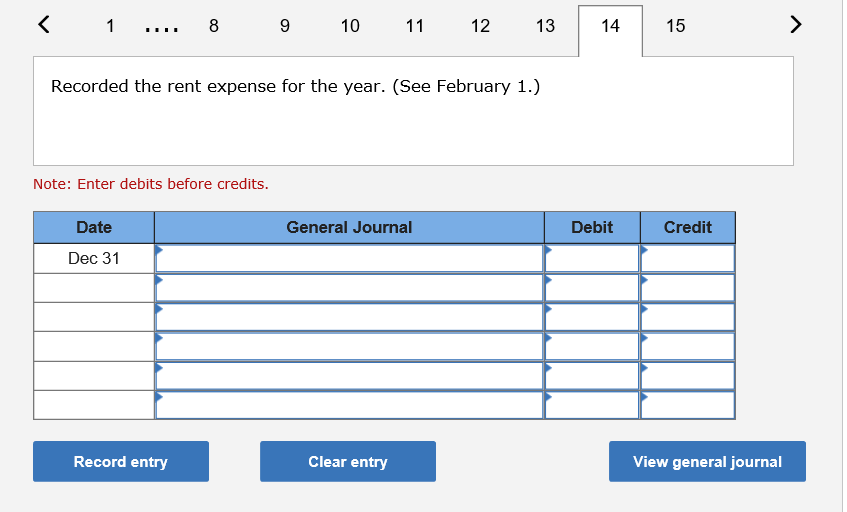

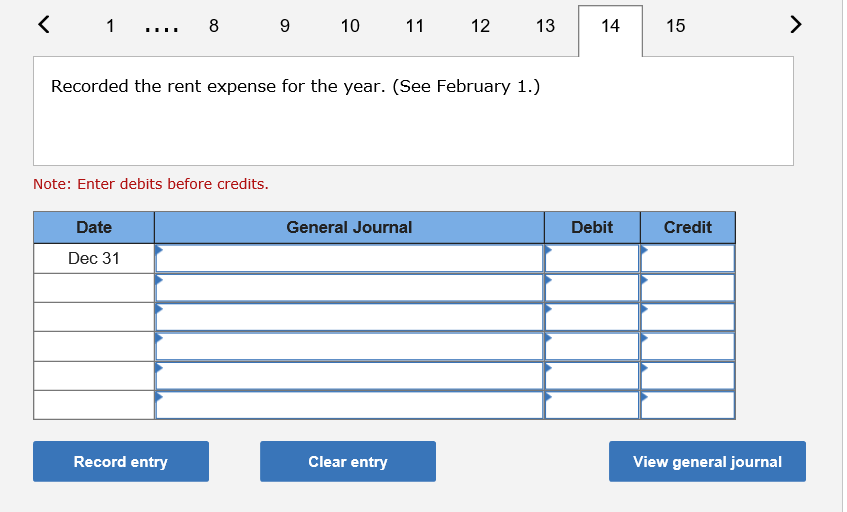

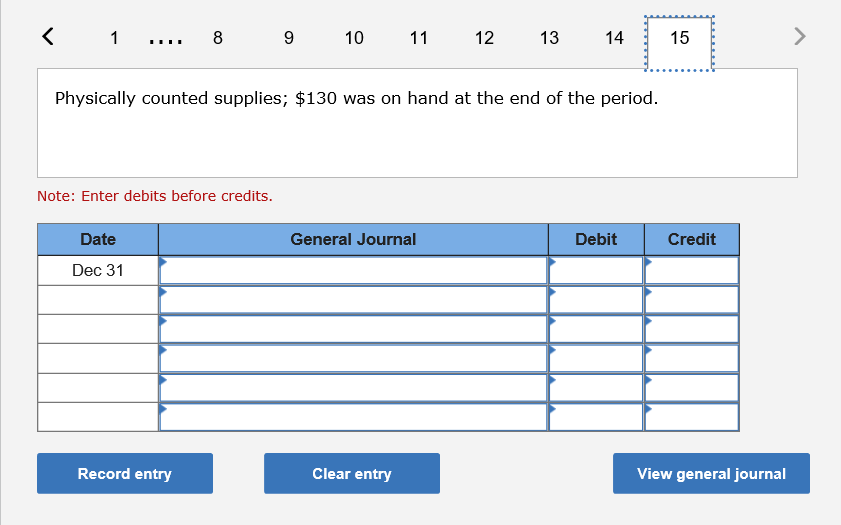

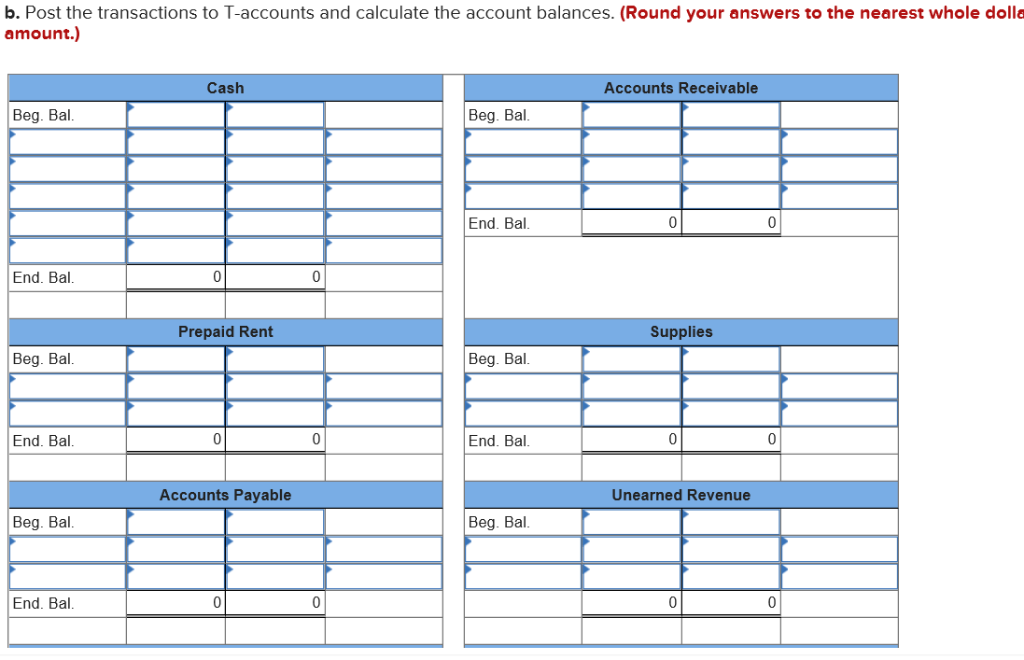

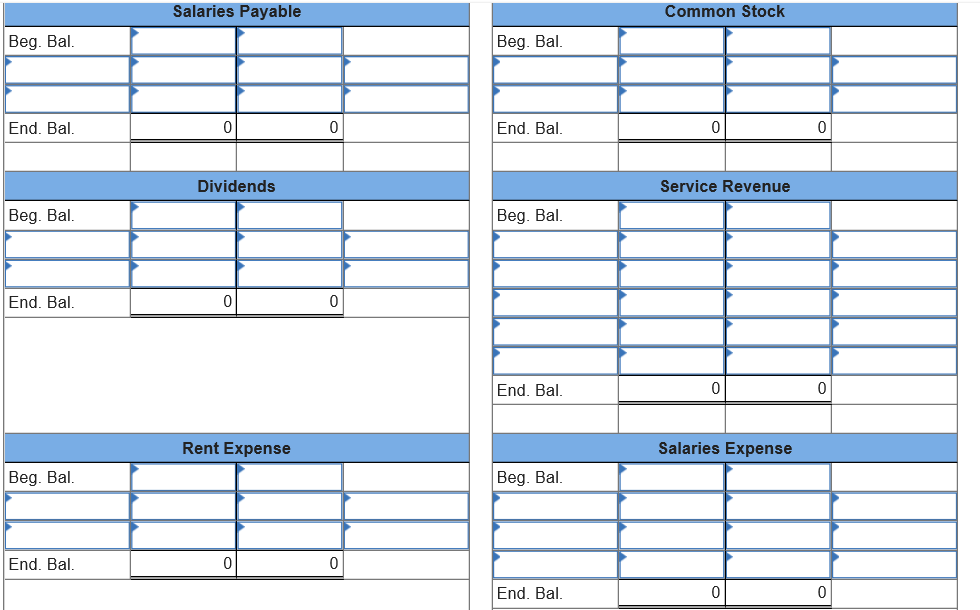

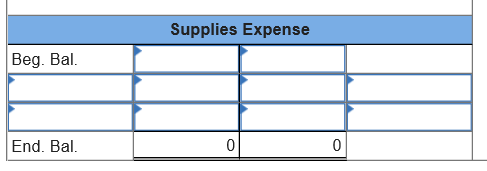

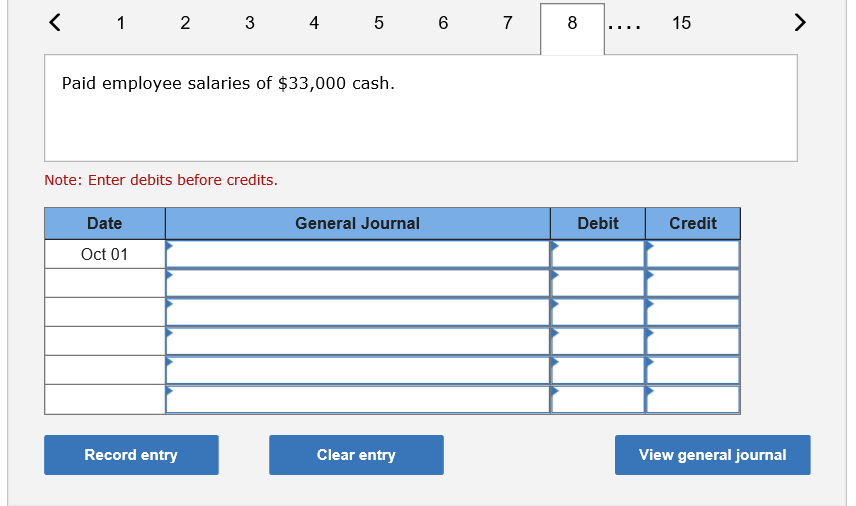

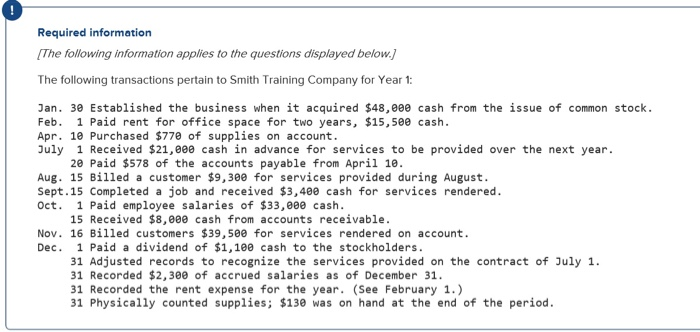

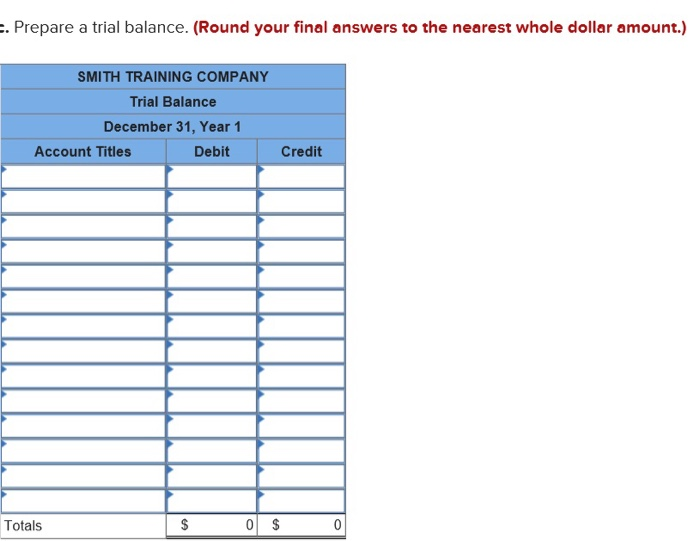

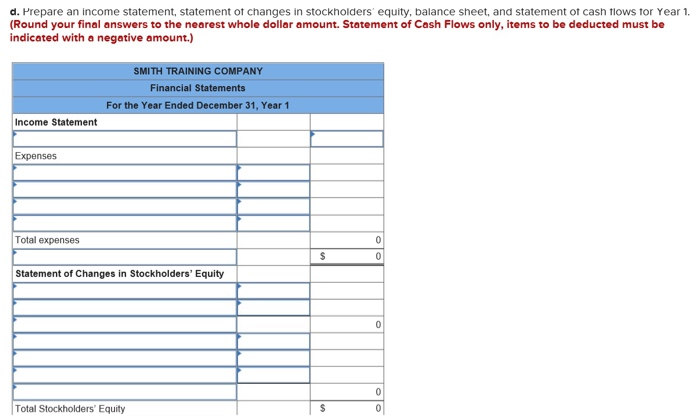

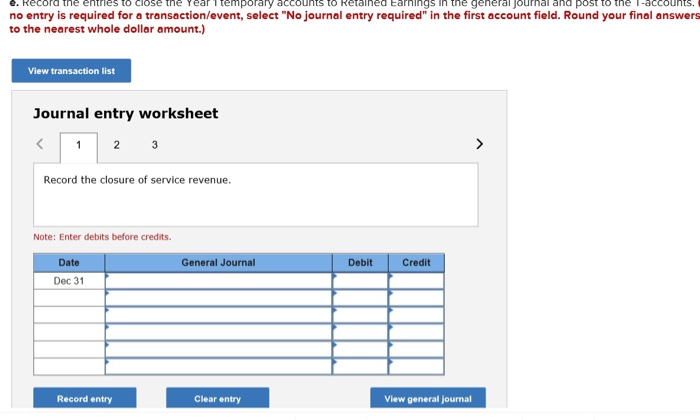

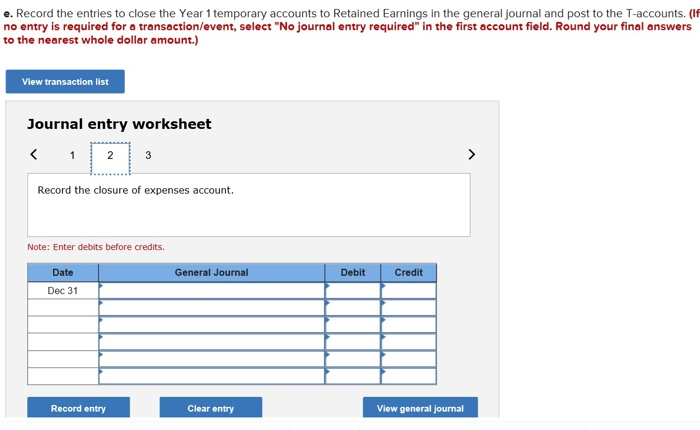

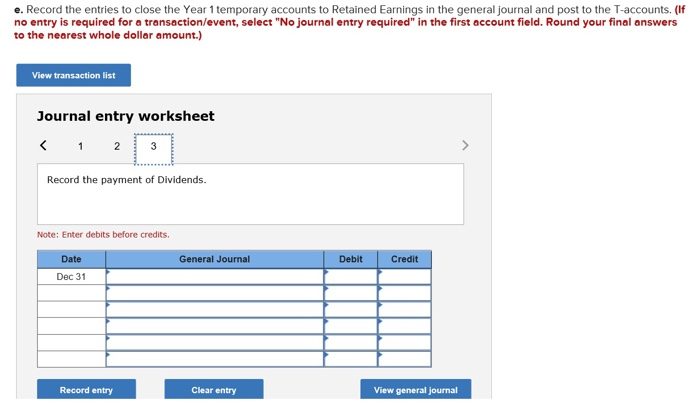

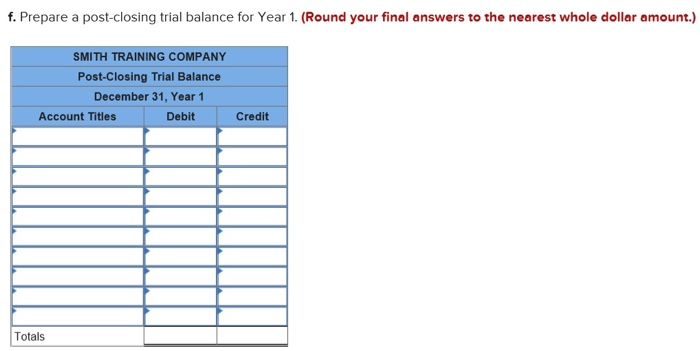

123 4 5 678 15 Established the business when it acquired $48,000 cash from the issue of common stock. Note: Enter debits before credits. Date General Journal Debit Credit Jan 30 2 4 5 6 7 Paid rent for office space for two years, $15,500 cash. Note: Enter debits before credits Date General Journal Debit Credit Feb 01 Record entry Clear entry View general journal 2 4 5 6 7 Purchased $770 of supplies on account. Note: Enter debits before credits. Date General Journal Debit Credit Apr 10 Record entry Clear entry View general journal 2 3 4 5 6 7 Received $21,000 cash in advance for services to be provided over the next year. Note: Enter debits before credits. Date General Journal Debit Credit Jul 01 Record entry Clear entry View general journal 2 4 5 6 7 Paid $578 of the accounts payable from April 10. Note: Enter debits before credits. Date General Journal Debit Credit Jul 20 Record entry Clear entry View general journal 2 3 4 5 6 7 Billed a customer $9,300 for services provided during August. Note: Enter debits before credits. Date General Journal Debit Credit Aug 15 Record entry Clear entry View general journal 2 4 5 6 Completed a job and received $3,400 cash for services rendered. Note: Enter debits before credits. Date General Journal Debit Credit Sep 15 Record entry Clear entry View general journal 4 5 6 8 Received $8,000 cash from accounts receivable Note: Enter debits before credits. Date General Journal Debit Credit Oct 15 Record entry Clear entry View general journal K 56 78910.... 15 Billed customers $39,500 for services rendered on account. Note: Enter debits before credits. Date General Journal Debit Credit Nov 16 Record entry Clear entry View general journal K1 .. .. 67 89 10 1 15 Paid a dividend of $1,100 cash to the stockholders. Note: Enter debits before credits. Date General Journal Debit Credit Dec 01 Record entry Clear entry View general journal 7 8 10 12...15 Adjusted records to recognize the services provided on the contract of July 1 Note: Enter debits before credits. Date General Journl Debit Credit Dec 31 Record entry Clear entry View general journal 8 Recorded $2,300 of accrued salaries as of December 31. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal K1.... 8 9 1012 13 14 15 Recorded the rent expense for the year. (See February 1.) Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal K1.... 8 9 1012 13 14 15 Recorded the rent expense for the year. (See February 1.) Note: Enter debits before credits. Date General Journal Debit Credit Dec 31 Record entry Clear entry View general journal