Answered step by step

Verified Expert Solution

Question

1 Approved Answer

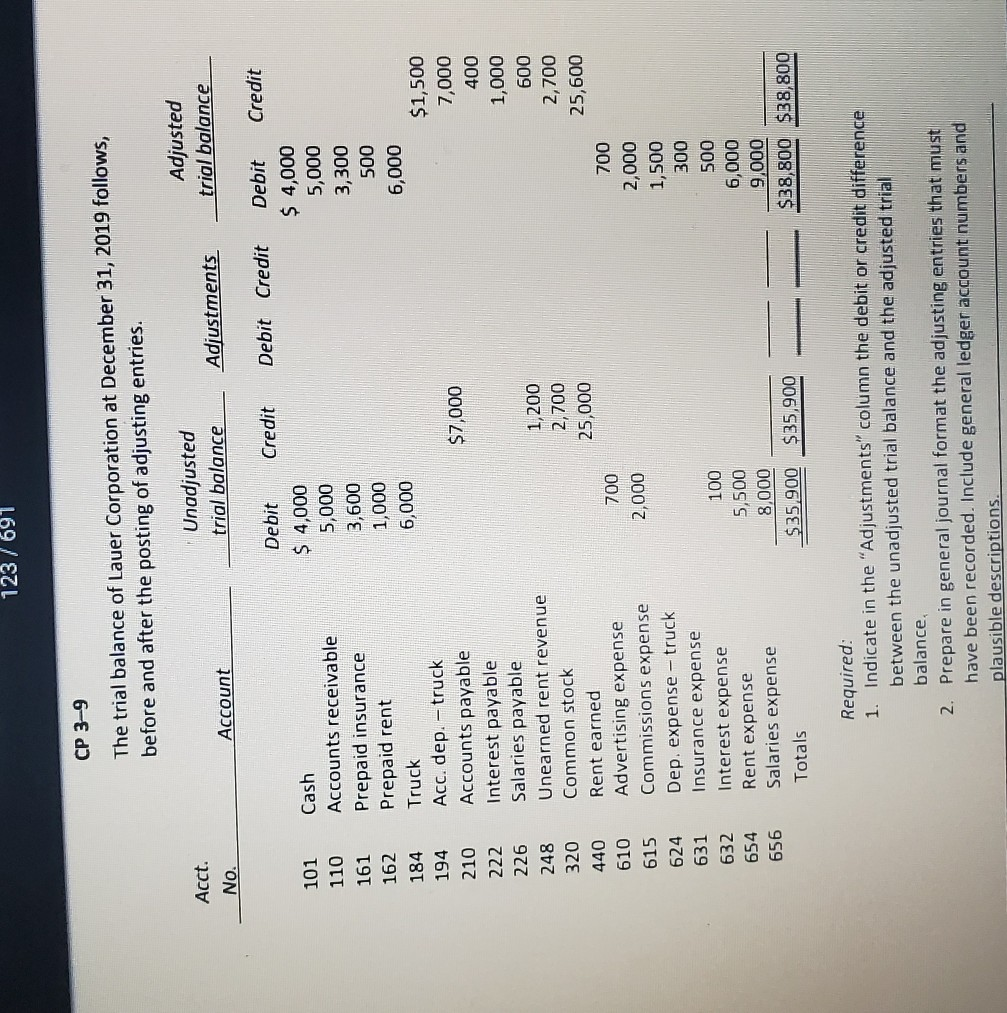

123 / 691 CP 3-9 The trial balance of Lauer Corporation at December 31, 2019 follows, before and after the posting of adjusting entries. Unadjusted

123 / 691 CP 3-9 The trial balance of Lauer Corporation at December 31, 2019 follows, before and after the posting of adjusting entries. Unadjusted trial balance Adjusted trial balance Acct. No. Adjustments Account Credit Debit Credit 101 Debit $ 4,000 5,000 3,600 1,000 6,000 $7,000 110 161 162 184 194 210 222 226 248 320 440 610 615 624 631 632 654 656 Cash Accounts receivable Prepaid insurance Prepaid rent Truck Acc. dep. - truck Accounts payable Interest payable Salaries payable Unearned rent revenue Common stock Rent earned Advertising expense Commissions expense Dep. expense - truck Insurance expense Interest expense Rent expense Salaries expense Totals Debit Credit $ 4,000 5,000 3,300 500 6,000 $1,500 7,000 400 1,000 600 2,700 25,600 700 2,000 1,500 300 500 6,000 9,000 $38,800 $38,800 1,200 2,700 25,000 700 2,000 100 5,500 8,000 $35,900 $35,900 Required: 1. Indicate in the "Adjustments" column the debit or credit difference between the unadjusted trial balance and the adjusted trial balance, 2. Prepare in general journal format the adjusting entries that must have been recorded. Include general ledger account numbers and plausible descriptions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started