Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1,2,3 Q 1 of 3 + View as Text Download Capital Budgeting Class Practice 1. Rambus Inc. would like to purchase a production machine for

1,2,3

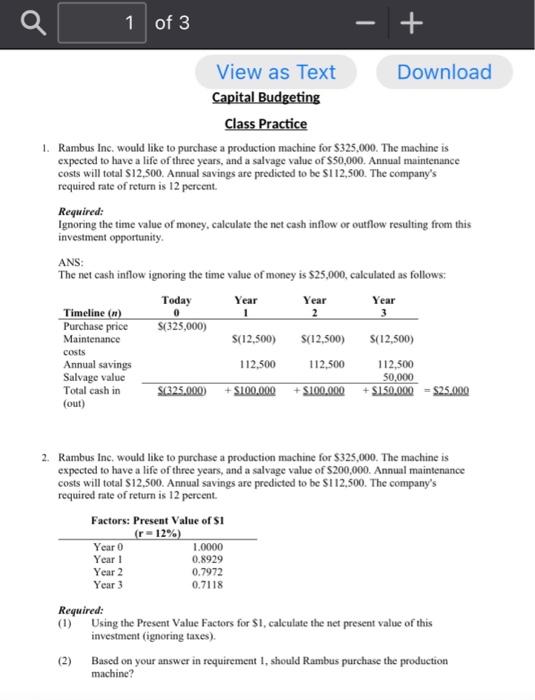

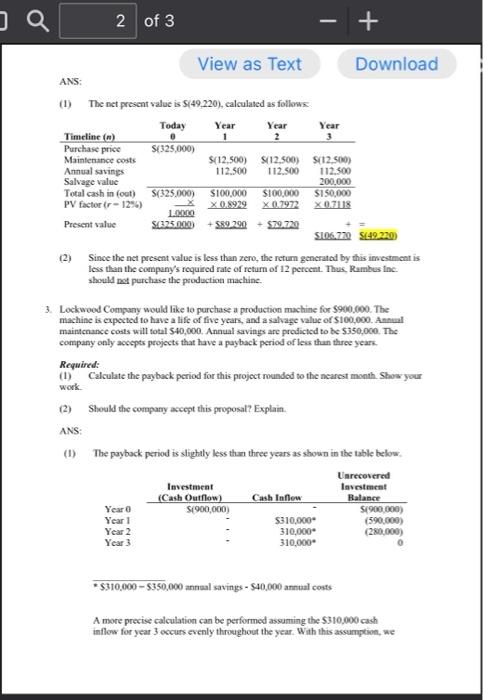

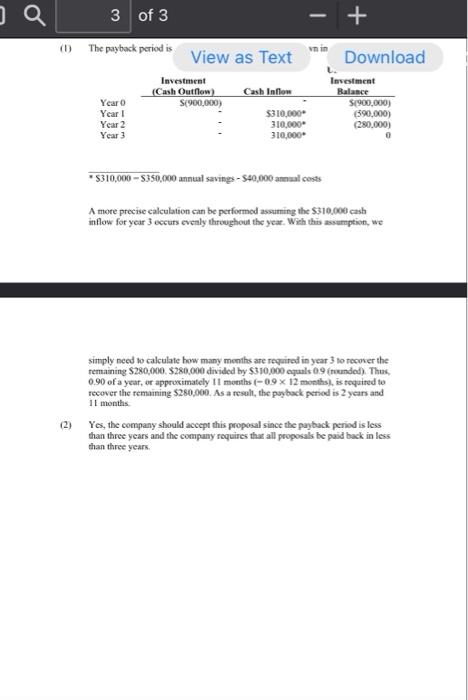

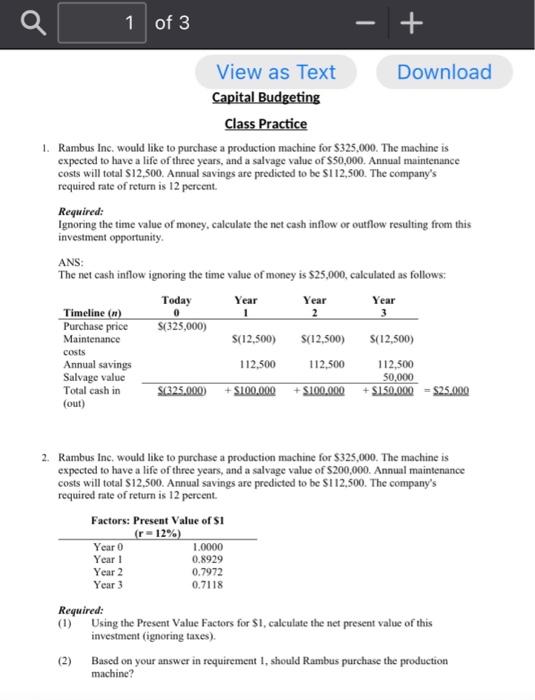

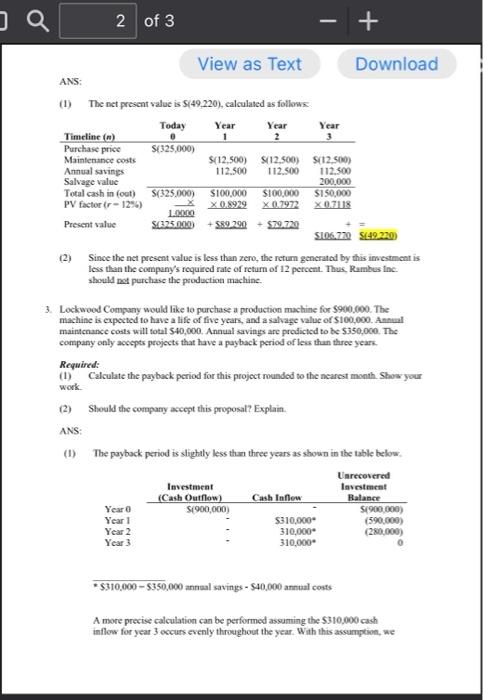

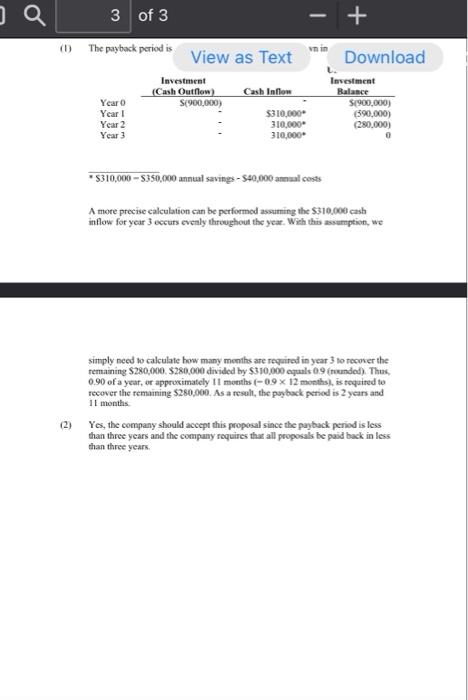

Q 1 of 3 + View as Text Download Capital Budgeting Class Practice 1. Rambus Inc. would like to purchase a production machine for $325.000. The machine is expected to have a life of three years, and a salvage value of $50,000. Annual maintenance costs will total 12,500. Annual savings are predicted to be S112,500. The company's required rate of return is 12 percent. Required: Ignoring the time value of money, calculate the net cash inflow or outflow resulting from this investment opportunity ANS The net cash inflow ignoring the time value of money is $25,000, calculated as follows: Today Year Year Year Timeline (1) 2 Purchase price S(325,000) Maintenance S(12,500) S(12,500) S(12,500) Annual savings 112,500 112,500 112,500 Salvage value 50,000 Total cash in $1325.000 $100.000 +$100.000 S150.000 - $25.000 (out) 1 3 costs 2. Rambus Inc. would like to purchase a production machine for $325,000. The machine is expected to have a life of three years, and a salvage value of $200,000. Annual maintenance costs will total 12.500. Annual savings are predicted to be S112,500. The company's required rate of return is 12 percent. Factors: Present Value of SI (r=12%) Year 0 1.0000 Year 1 0.8929 Year 2 0.7972 Year 3 0.7118 Required: (1) Using the Present Value Factors for SI, calculate the net present value of this investment (ignoring taxes). (2) Based on your answer in requirement 1, should Rambus purchase the production machine? 2 of 3 + View as Text Download ANS: (1) The net present value is $(49.220), calculated as follows Today Year Year Year Timeline 1 2 3 Purchase price S(325,000) Maintenance costs $(12.500) S(12,500) (12.500) Annual savings 112.500 112.500 112.500 Salvage value 200.000 Total cash in (out) S(325.000) $100,000 S100,000 S150,000 PV factor ir-12%) X 0.8929 X 0.7972 X0.718 LAMBO Present value $(325.000 +589.290 + $79.720 S106.720 5:49.220 (2) Since the net present value is less than zero, the retum generated by this investment is less than the company's required rate of return of 12 percent. Thus, Rumbus inc. should not purchase the production machine. 3. Lockwood Company would like to purchase a production machine for $900,000. The machine is expected to have a life of five years, and a salvage value of $100.000. Annual maintenance costs will total $40,000. Annual savings are predicted to be $350,000. The company only accepts projects that have a payback period of less than three years Required: Calculate the payback period for this project rounded to the nearest month. Show your work (2) Should the company accept this proposal? Explain. ANS (1) The payback period is slightly less than three years as shown in the table below Unrecovered Investment Investment (Cash Outflow) Cash Inflow Balance Year o 8(900,000) $1900,000) Year 1 $310,000 (590,000) Year 2 310,000 (280,000) Year 3 310.000 *$310,000 - $350,000 annual savings - S40.000 annual costs A more precise calculation can be performed assuming the S310,000 cash inflow for year 3 occuts evenly throughout the year. With this assumption, we Q + 3 of 3 (0) The payback period is View as Text Download Investment (Cash Outflow S(900,000) Cash Inflow Year Year! Year 2 Year 3 Investment Balance $1900,000) (390,000) 280.000) $310.000 310.000 310,000 *$310,000 - $350,000 annual savings - $40,000 annual costs A more precise calculation can be performed assuming the $310,000 cash inflow for year 3 occurs evenly throughout the year. With this assumption, we simply need to calculate how many months are required in year 3 to recover the remaining $280,000 $280.000 divided by S310,000 equal 09 (rounded) Thus, 0.90 of a year, or approximately 11 months (-09 x 12 months, is required to recover the remaining $280,000. As a result, the payback period is 2 years and 11 months Yes, the company should accept this proposal since the payback period is less than three years and the company requires that all proposals be paid back in less than three years (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started