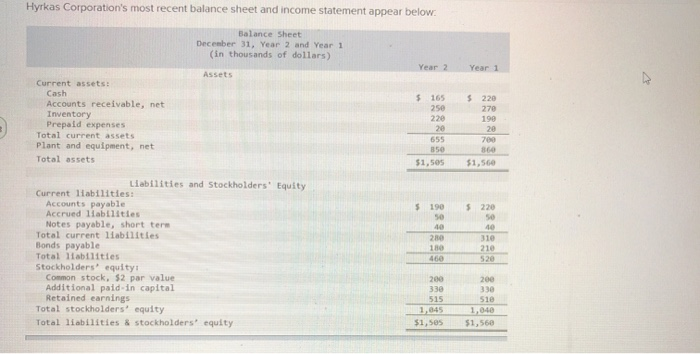

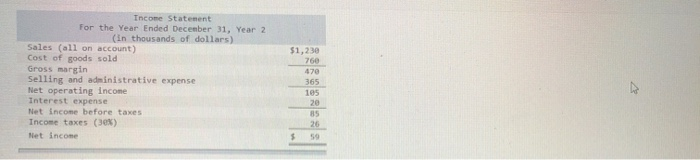

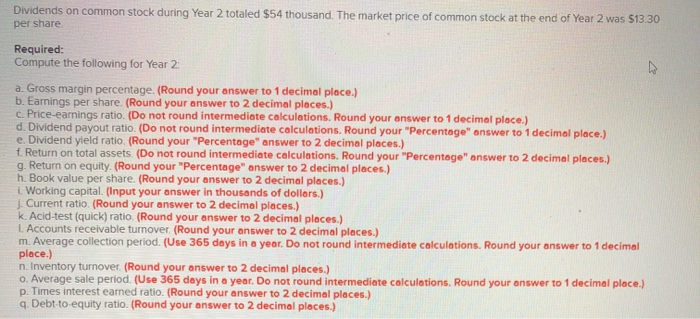

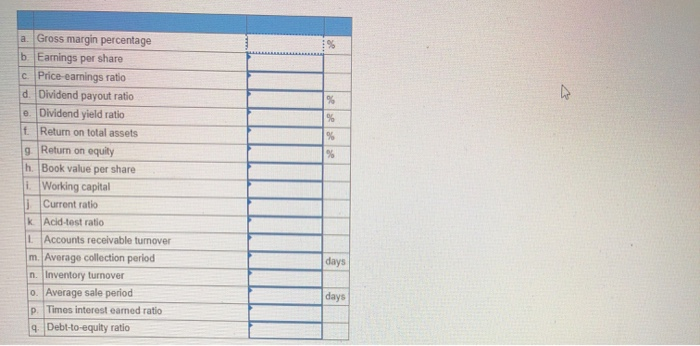

$1,230 Income Statement For the Year Ended December 31, Year 2 (in thousands of dollars) Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating Income Interest expense Net Income before taxes Income taxes (30%) Net income Dividends on common stock during Year 2 totaled $54 thousand. The market price of common stock at the end of Year 2 was $13.30 per share Required: Compute the following for Year 2 a. Gross margin percentage. (Round your answer to 1 decimal place.) b. Earnings per share. (Round your answer to 2 decimal places.) c. Price-earnings ratio. (Do not round intermediate calculations. Round your answer to 1 decimal place.) d. Dividend payout ratio. (Do not round intermediate calculations. Round your "Percentage" answer to 1 decimal place.) e. Dividend yield ratio. (Round your "Percentage" answer to 2 decimal places.) f. Return on total assets (Do not round intermediate calculations. Round your "Percentage" answer to 2 decimal places.) g. Return on equity. (Round your "Percentage" answer to 2 decimal places.) h. Book value per share. (Round your answer to 2 decimal places.) Working capital. (Input your answer in thousands of dollars.) 1. Current ratio. (Round your answer to 2 decimal places.) k. Acid-test (quick) ratio. (Round your answer to 2 decimal places.) Accounts receivable turnover (Round your answer to 2 decimal places.) m. Average collection period. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 1 decimal place.) n. Inventory turnover (Round your answer to 2 decimal places.) o. Average sale period. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 1 decimal place.) p. Times interest earned ratio. (Round your answer to 2 decimal places.) q Debt-to-equity ratio. (Round your answer to 2 decimal places.) a. Gross margin percentage b. Earnings per share c. Price earnings ratio d. Dividend payout ratio e Dividend yield ratio f Return on total assets 9 Return on equity h. Book value per share Working capital Current ratio Acid-test ratio Accounts receivable turnover m. Average collection period n. Inventory turnover 0. Average sale period P. Times interest earned ratio 9. Debt-to-equity ratio days days