Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12-30 please At December 31, KC Co reported accounts recelvable of $75,000 and an allowance for uncollectible accounts of $400 (credit). An analysis of accounts

12-30 please

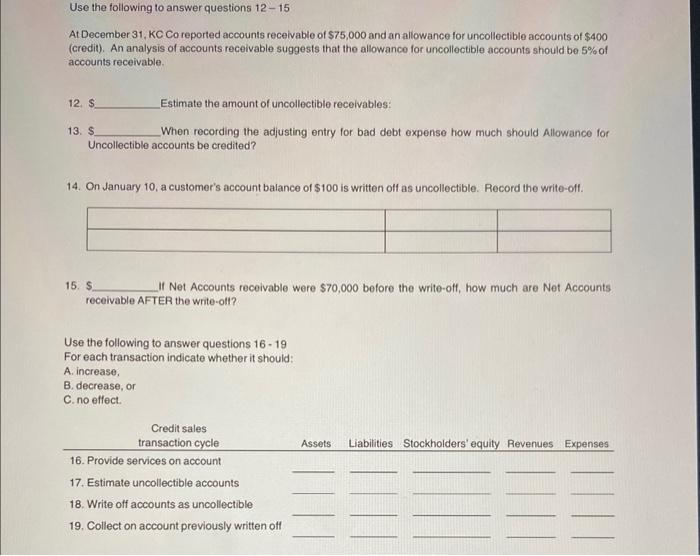

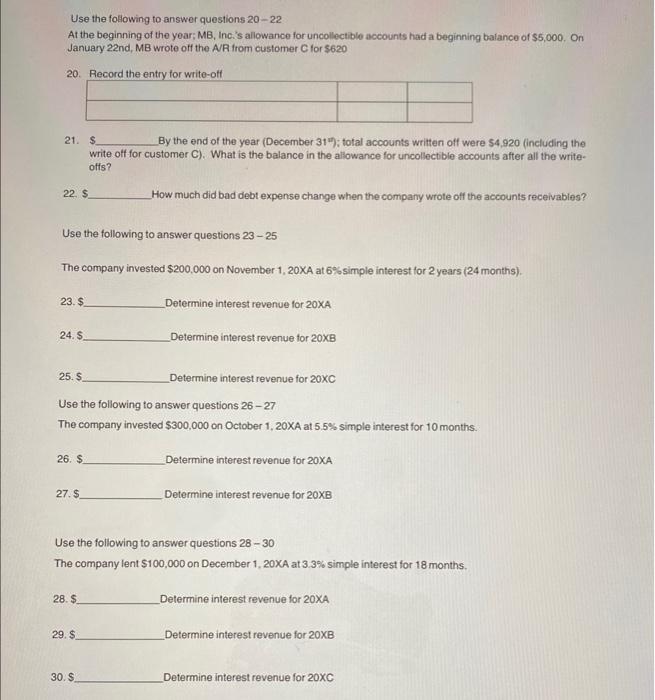

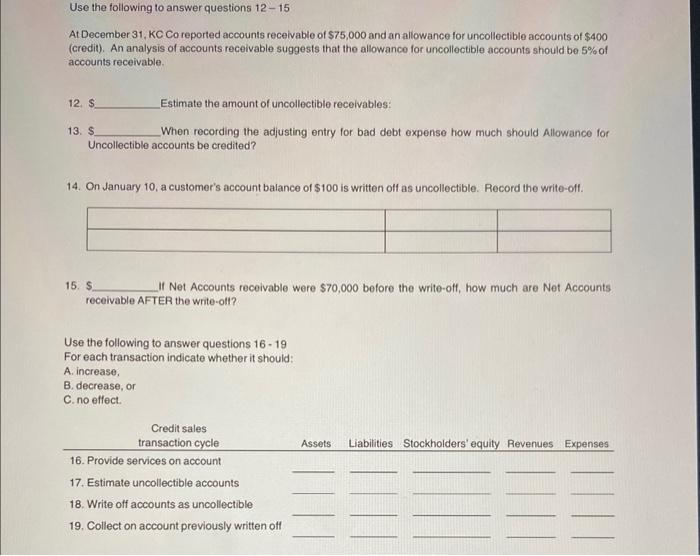

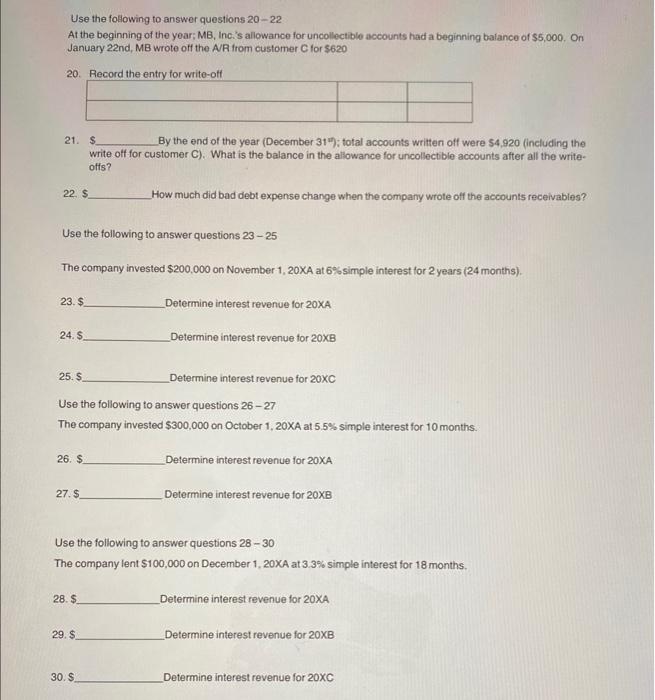

At December 31, KC Co reported accounts recelvable of $75,000 and an allowance for uncollectible accounts of $400 (credit). An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 5% of accounts receivable. 12. $ Estimate the amount of uncollectible receivables: 13. $ When recording the adjusting entry for bad debt expense how much should Allowance for Uncollectible accounts be credited? 14. On January 10, a customer's account balance of $100 is written off as uncollectible. Record the write-off. 15. \$ If Net Accounts receivable were $70,000 before the write-off, how much are Net Accounts receivable AFTER the write-oll? Use the following to answer questions 1619 For each transaction indicate whether it should: A. increase, B. decrease, or C. no effect. Use the following to answer questions 2022 At the beginning of the year; MB, Inc.'s allowance for uncollectible accounts had a beginning balance of $5,000. On January 22nd, MB wrote off the ARA from customer C for $620 20 21. $ By the end of the year (December 31th ): total accounts written off were 54,920 (including the write off for customer C). What is the balance in the allowance for uncollectible accounts after all the writeofts? 22. $ How much did bad debt expense change when the company wrote off the accounts receivables? Use the following to answer questions 23-25 The company invested $200,000 on November 1,20 XA at 6% simple interest for 2 years (24 months). 23. $ Determine interest revenue for 20A 24.5 Determine interest revenue for 208 25. $ Determine interest revenue for 20C Use the following to answer questions 26 - 27 The company invested $300,000 on October 1,20X at 5.5% simple interest for 10 months. 26. $ Determine interest revenue for 20A 27. \$ Determine interest revenue for 208 Use the following to answer questions 2830 The company lent $100,000 on December 1,20A at 3.3% simple interest for 18 months. 28. $ Determine interest revenue for 20XA 29.$ Determine interest revenue for 20B 30.$ Determine interest revenue for 20C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started