Question

1231 Problem McGrath Corporation, a C Corporation, began a business 10 years ago. 3 years ago, McGrath sold land used in their business (basis

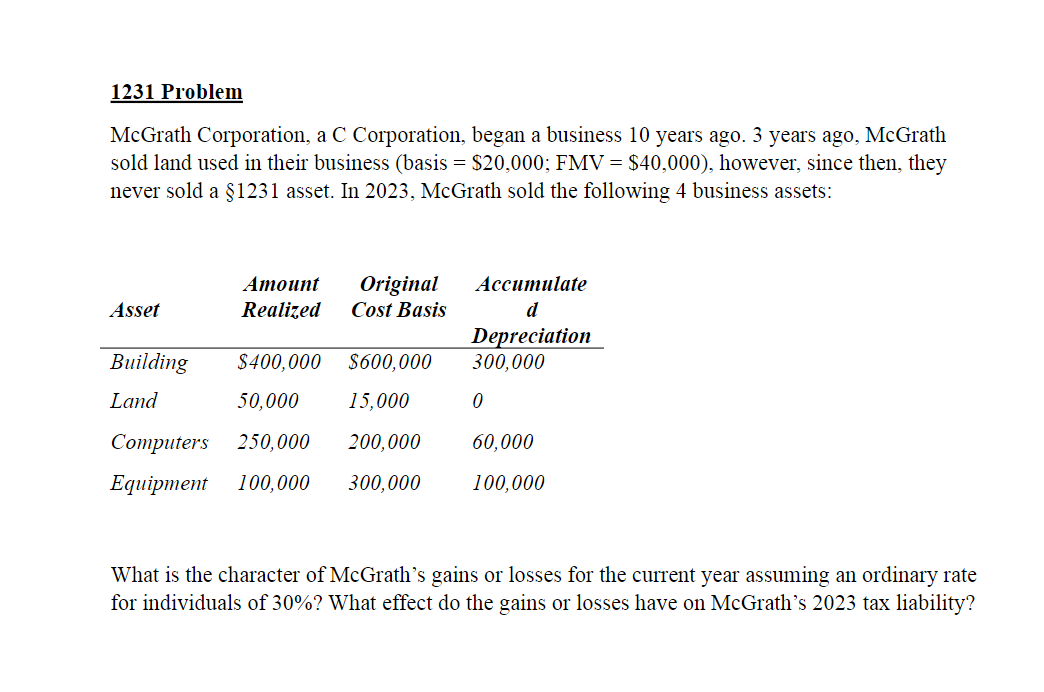

1231 Problem McGrath Corporation, a C Corporation, began a business 10 years ago. 3 years ago, McGrath sold land used in their business (basis = $20,000; FMV = $40,000), however, since then, they never sold a 1231 asset. In 2023, McGrath sold the following 4 business assets: Asset Amount Original Realized Cost Basis Accumulate d Depreciation Building $400,000 $600,000 300,000 Land 50,000 15,000 0 Computers 250,000 200,000 60,000 Equipment 100,000 300,000 100,000 What is the character of McGrath's gains or losses for the current year assuming an ordinary rate for individuals of 30%? What effect do the gains or losses have on McGrath's 2023 tax liability?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Marketing And Export Management

Authors: Gerald Albaum , Alexander Josiassen , Edwin Duerr

8th Edition

1292016922, 978-1292016924

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App