12/31 Record depreciation expense for the year. Depreciation is calculated on a straight-line basis over 7-years with no salvage value. It is recorded in

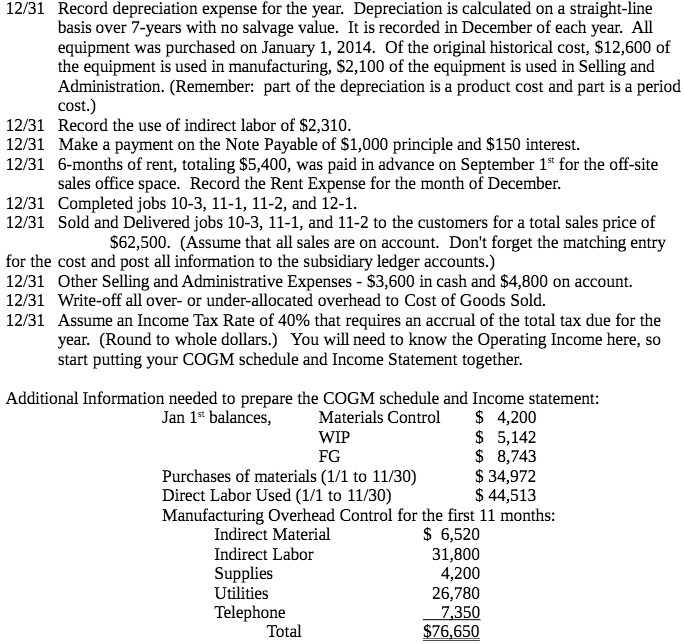

12/31 Record depreciation expense for the year. Depreciation is calculated on a straight-line basis over 7-years with no salvage value. It is recorded in December of each year. All equipment was purchased on January 1, 2014. Of the original historical cost, $12,600 of the equipment is used in manufacturing, $2,100 of the equipment is used in Selling and Administration. (Remember: part of the depreciation is a product cost and part is a period cost.) 12/31 Record the use of indirect labor of $2,310. 12/31 Make a payment on the Note Payable of $1,000 principle and $150 interest. 12/31 6-months of rent, totaling $5,400, was paid in advance on September 1st for the off-site sales office space. Record the Rent Expense for the month of December. 12/31 Completed jobs 10-3, 11-1, 11-2, and 12-1. 12/31 Sold and Delivered jobs 10-3, 11-1, and 11-2 to the customers for a total sales price of $62,500. (Assume that all sales are on account. Don't forget the matching entry for the cost and post all information to the subsidiary ledger accounts.) 12/31 Other Selling and Administrative Expenses - $3,600 in cash and $4,800 on account. 12/31 Write-off all over- or under-allocated overhead to Cost of Goods Sold. 12/31 Assume an Income Tax Rate of 40% that requires an accrual of the total tax due for the year. (Round to whole dollars.) You will need to know the Operating Income here, so start putting your COGM schedule and Income Statement together. Additional Information needed to prepare the COGM schedule and Income statement: Jan 1st balances, Materials Control WIP FG Purchases of materials (1/1 to 11/30) Direct Labor Used (1/1 to 11/30) $ 4,200 $ 5,142 $ 8,743 $ 34,972 $ 44,513 Manufacturing Overhead Control for the first 11 months: Indirect Material $ 6,520 Indirect Labor 31,800 Supplies 4,200 Utilities 26,780 Telephone 7,350 Total $76,650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started