Question

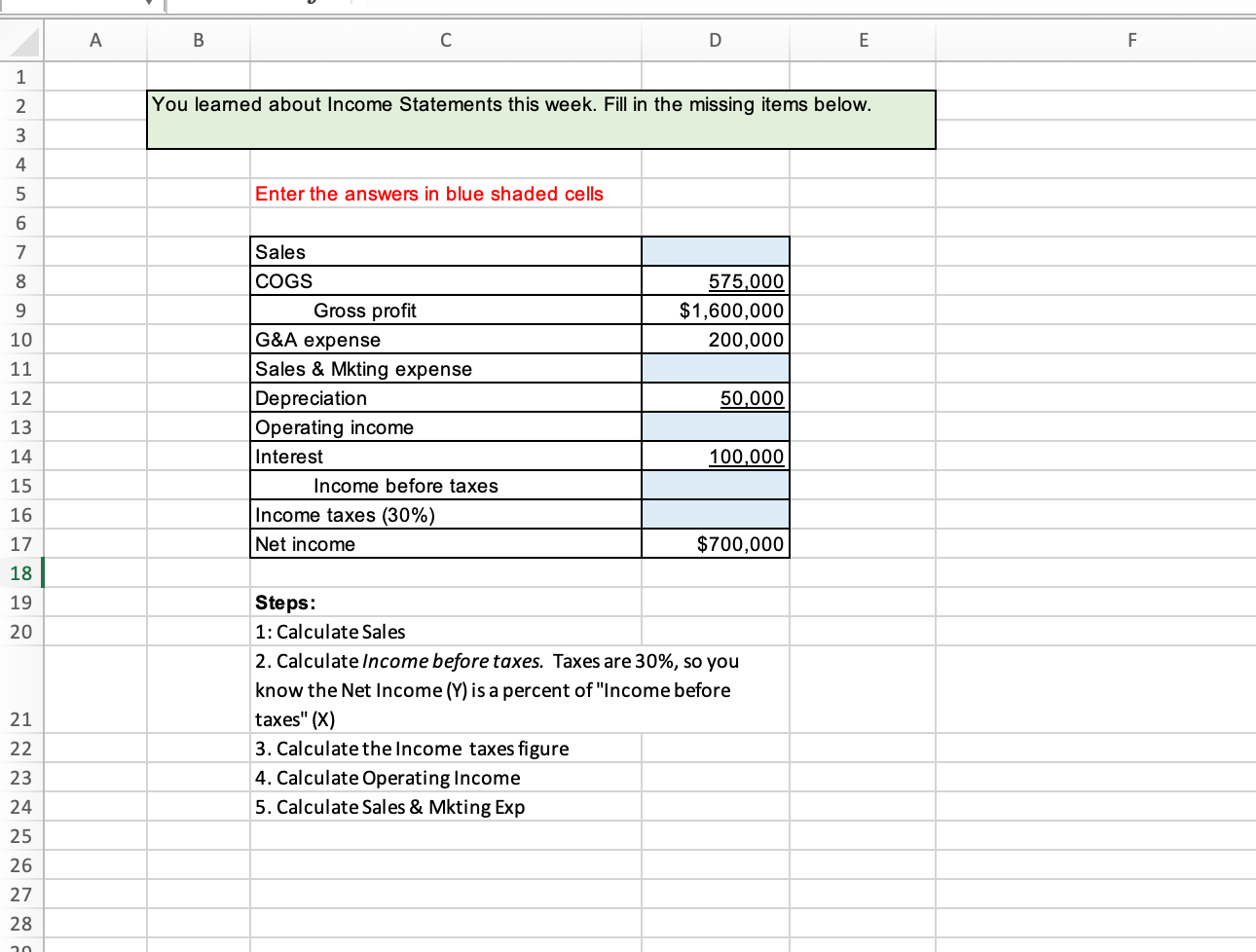

A B C D E F 9 10 1234567822222222222 19 20 11 You learned about Income Statements this week. Fill in the missing items

A B C D E F 9 10 1234567822222222222 19 20 11 You learned about Income Statements this week. Fill in the missing items below. Enter the answers in blue shaded cells Sales COGS Gross profit G&A expense Sales & Mkting expense Depreciation Operating income 575,000 $1,600,000 200,000 50,000 Interest 100,000 Income before taxes Income taxes (30%) Net income $700,000 21 Steps: 1: Calculate Sales 2. Calculate Income before taxes. Taxes are 30%, so you know the Net Income (Y) is a percent of "Income before taxes" (X) 3. Calculate the Income taxes figure 23 4. Calculate Operating Income 24 5. Calculate Sales & Mkting Exp 25 26 27 28 20 22222222

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Sales Gross Profit Sales Cost of Goods Sold COGS 1600000 Sales 575000 Sales 1600000 575000 Sales 2175000 2 Calculation of Income Befo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microsoft Excel Data Analysis And Business Modeling

Authors: Wayne Winston

7th Edition

0137613660, 9780137613663

Students also viewed these Human Resource Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App