12-34 Strategic analysis of operating income Scott Company manufactures a DVD player called Orlicon. The company sells the player to discount stores throughout the

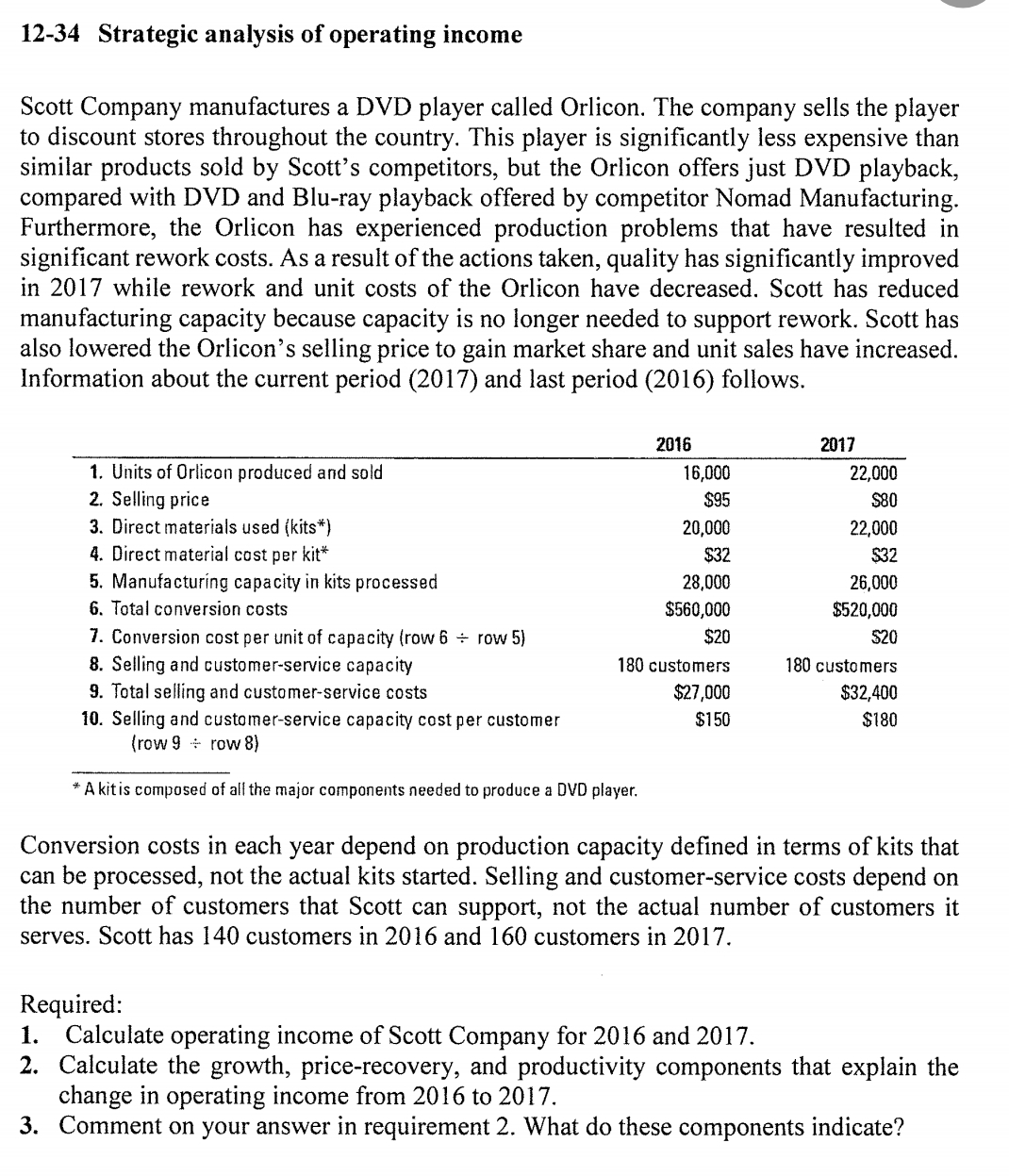

12-34 Strategic analysis of operating income Scott Company manufactures a DVD player called Orlicon. The company sells the player to discount stores throughout the country. This player is significantly less expensive than similar products sold by Scott's competitors, but the Orlicon offers just DVD playback, compared with DVD and Blu-ray playback offered by competitor Nomad Manufacturing. Furthermore, the Orlicon has experienced production problems that have resulted in significant rework costs. As a result of the actions taken, quality has significantly improved in 2017 while rework and unit costs of the Orlicon have decreased. Scott has reduced manufacturing capacity because capacity is no longer needed to support rework. Scott has also lowered the Orlicon's selling price to gain market share and unit sales have increased. Information about the current period (2017) and last period (2016) follows. 1. Units of Orlicon produced and sold 2. Selling price 3. Direct materials used (kits*) 4. Direct material cost per kit* 5. Manufacturing capacity in kits processed 6. Total conversion costs 7. Conversion cost per unit of capacity (row 6 row 5) 8. Selling and customer-service capacity 9. Total selling and customer-service costs 10. Selling and customer-service capacity cost per customer (row 9 row 8) 2016 2017 16,000 22,000 $95 $80 20,000 22,000 $32 $32 28,000 $560,000 26,000 $520,000 $20 $20 180 customers 180 customers $27,000 $150 $32,400 * A kit is composed of all the major components needed to produce a DVD player. $180 Conversion costs in each year depend on production capacity defined in terms of kits that can be processed, not the actual kits started. Selling and customer-service costs depend on the number of customers that Scott can support, not the actual number of customers it serves. Scott has 140 customers in 2016 and 160 customers in 2017. Required: 1. Calculate operating income of Scott Company for 2016 and 2017. 2. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2016 to 2017. 3. Comment on your answer in requirement 2. What do these components indicate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started