Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following independent situations. Situation 1: Ducharme Corporation purchased electrical equipment at a cost of $62,000 on June 2, 2017. From 2017 through

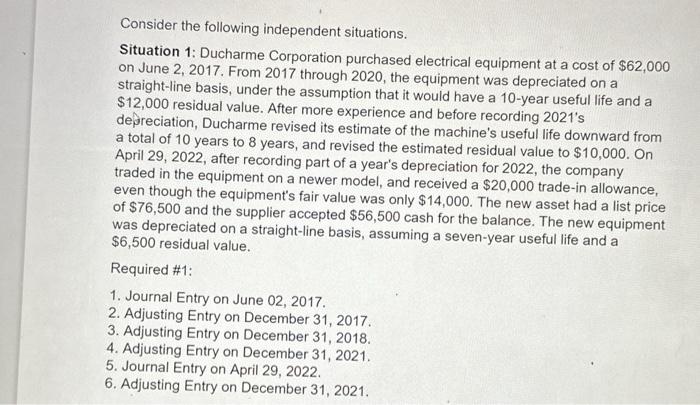

Consider the following independent situations. Situation 1: Ducharme Corporation purchased electrical equipment at a cost of $62,000 on June 2, 2017. From 2017 through 2020, the equipment was depreciated on a straight-line basis, under the assumption that it would have a 10-year useful life and a $12,000 residual value. After more experience and before recording 2021's depreciation, Ducharme revised its estimate of the machine's useful life downward from a total of 10 years to 8 years, and revised the estimated residual value to $10,000. On April 29, 2022, after recording part of a year's depreciation for 2022, the company traded in the equipment on a newer model, and received a $20,000 trade-in allowance, even though the equipment's fair value was only $14,000. The new asset had a list price of $76,500 and the supplier accepted $56,500 cash for the balance. The new equipment was depreciated on a straight-line basis, assuming a seven-year useful life and a $6,500 residual value. Required #1: 1. Journal Entry on June 02, 2017. 2. Adjusting Entry on December 31, 2017. 3. Adjusting Entry on December 31, 2018. 4. Adjusting Entry on December 31, 2021. 5. Journal Entry on April 29, 2022. 6. Adjusting Entry on December 31, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Journal Entry on June 02 2017 Electrical Equipment 62000 Cash or Accounts Payable 62000 To record ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started