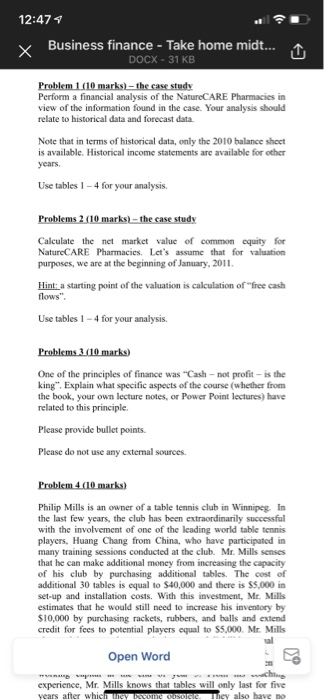

12:47 y Business finance - Take home midt... DOCX - 31 KB 1 Problem 1 (10 marks) - the case study Perform a financial analysis of the NatureCARE Pharmacies in view of the information found in the case. Your analysis should relate to historical data and forecast data Note that in terms of historical data, only the 2010 balance sheet is available. Historical income statements are available for other years. Use tables 1 - 4 for your analysis. Problems 2 (10 marks)-the case study Calculate the net market value of common equity for NatureCARE Pharmacies. Let's assume that for valuation purposes, we are at the beginning of January, 2011. Hint: a starting point of the valuation is calculation of free cash flows" Use tables 1 - 4 for your analysis. Problems 3. (10 marks) One of the principles of finance was "Cash -not profit is the king". Explain what specific aspects of the course (whether from the book, your own lecture notes, or Power Point lectures) have related to this principle. Please provide bullet points. Please do not use any external sources Problem 4. (10 marks) Philip Mills is an owner of a table tennis club in Winnipeg. In the last few years, the club has been extraordinarily successful with the involvement of one of the leading world table tennis players, Huang Chang from China, who have participated in many training sessions conducted at the club. Mr. Mills senses that he can make additional money from increasing the capacity of his club by purchasing additional tables. The cost of additional 30 tables is equal to $40,000 and there is $5.000 in set-up and installation costs. With this investment, Mr. Mills estimates that he would still need to increase his inventory by $10,000 by purchasing rackets, rubbers, and balls and extend credit for fees to potential players equal to $5,000. Mr. Mills Open Word experience, Mr. Mills knows that tables will only last for five years after which they become one. They also have no 12:47 y Business finance - Take home midt... DOCX - 31 KB 1 Problem 1 (10 marks) - the case study Perform a financial analysis of the NatureCARE Pharmacies in view of the information found in the case. Your analysis should relate to historical data and forecast data Note that in terms of historical data, only the 2010 balance sheet is available. Historical income statements are available for other years. Use tables 1 - 4 for your analysis. Problems 2 (10 marks)-the case study Calculate the net market value of common equity for NatureCARE Pharmacies. Let's assume that for valuation purposes, we are at the beginning of January, 2011. Hint: a starting point of the valuation is calculation of free cash flows" Use tables 1 - 4 for your analysis. Problems 3. (10 marks) One of the principles of finance was "Cash -not profit is the king". Explain what specific aspects of the course (whether from the book, your own lecture notes, or Power Point lectures) have related to this principle. Please provide bullet points. Please do not use any external sources Problem 4. (10 marks) Philip Mills is an owner of a table tennis club in Winnipeg. In the last few years, the club has been extraordinarily successful with the involvement of one of the leading world table tennis players, Huang Chang from China, who have participated in many training sessions conducted at the club. Mr. Mills senses that he can make additional money from increasing the capacity of his club by purchasing additional tables. The cost of additional 30 tables is equal to $40,000 and there is $5.000 in set-up and installation costs. With this investment, Mr. Mills estimates that he would still need to increase his inventory by $10,000 by purchasing rackets, rubbers, and balls and extend credit for fees to potential players equal to $5,000. Mr. Mills Open Word experience, Mr. Mills knows that tables will only last for five years after which they become one. They also have no