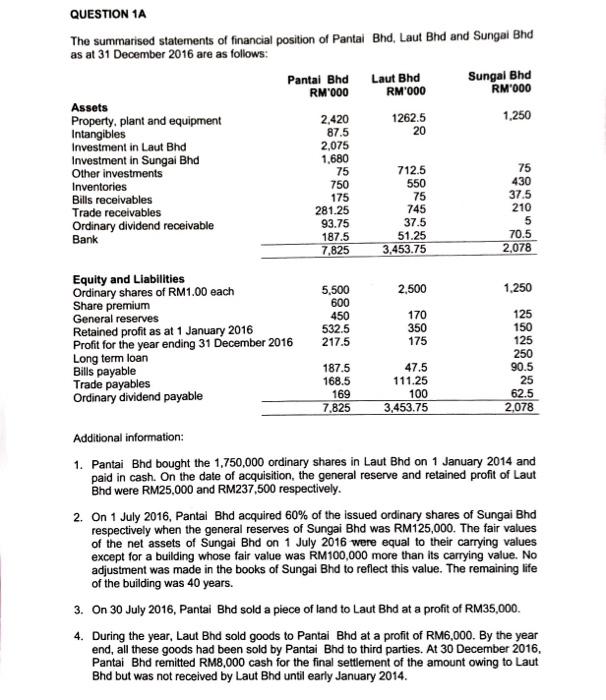

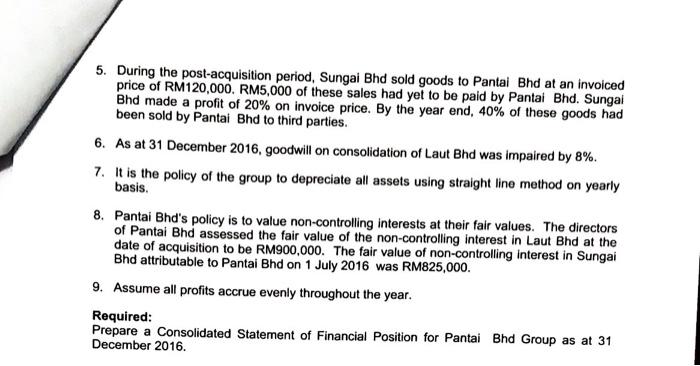

125 QUESTION 1A The summarised statements of financial position of Pantal Bhd, Laut Bhd and Sungai Bhd as at 31 December 2016 are as follows: Pantai Bhd Laut Bhd Sungal Bhd RM'000 RM'000 RM'000 Assets Property, plant and equipment 2,420 1262.5 1.250 Intangibles 87.5 20 Investment in Laut Bhd 2,075 Investment in Sungai Bhd 1,680 Other investments 75 712.5 75 Inventories 750 550 430 Bills receivables 175 75 37.5 Trade receivables 281.25 745 210 Ordinary dividend receivable 93.75 37.5 5 Bank 187.5 51.25 70.5 7,825 3,453.75 2,078 Equity and Liabilities Ordinary shares of RM1.00 each 5,500 2,500 1.250 Share premium 600 General reserves 450 170 Retained profit as at 1 January 2016 532.5 350 150 Profit for the year ending 31 December 2016 217.5 175 125 Long term loan 250 Bills payable 187.5 47.5 90.5 Trade payables 168.5 111.25 25 Ordinary dividend payable 169 100 7,825 3,453.75 2,078 Additional information: 1. Pantai Bhd bought the 1,750,000 ordinary shares in Laut Bhd on 1 January 2014 and paid in cash. On the date of acquisition, the general reserve and retained profit of Laut Bhd were RM25,000 and RM237,500 respectively. 2. On 1 July 2016, Pantai Bhd acquired 60% of the issued ordinary shares of Sungai Bhd respectively when the general reserves of Sungai Bhd was RM125,000. The fair values of the net assets of Sungai Bhd on 1 July 2016 were equal to their carrying values except for a building whose fair value was RM100,000 more than its carrying value. No adjustment was made in the books of Sungai Bhd to reflect this value. The remaining life of the building was 40 years. 3. On 30 July 2016, Pantai Bhd sold a piece of land to Laut Bhd at a profit of RM35,000 4. During the year, Laut Bhd sold goods to Pantai Bhd at a profit of RM6,000. By the year end, all these goods had been sold by Pantai Bhd to third parties. At 30 December 2016, Pantai Bhd remitted RM8,000 cash for the final settlement of the amount owing to Laut Bhd but was not received by Laut Bhd until early January 2014. 62.5 5. During the post-acquisition period, Sungai Bhd sold goods to Pantai Bhd at an invoiced price of RM120,000. RM5,000 of these sales had yet to be paid by Pantai Bhd. Sungai Bhd made a profit of 20% on invoice price. By the year end, 40% of these goods had been sold by Pantai Bhd to third parties. 6. As at 31 December 2016, goodwill on consolidation of Laut Bhd was impaired by 8%. 7. It is the policy of the group to depreciate all assets using straight line method on yearly basis. 8. Pantai Bhd's policy is to value non-controlling interests at their fair values. The directors of Pantai Bhd assessed the fair value of the non-controlling interest in Laut Bhd at the date of acquisition to be RM900,000. The fair value of non-controlling Interest in Sungai Bhd attributable to Pantal Bhd on 1 July 2016 was RM825,000. 9. Assume all profits accrue evenly throughout the year. Required: Prepare a Consolidated Statement of Financial Position for Pantai Bhd Group as at 31 December 2016 125 QUESTION 1A The summarised statements of financial position of Pantal Bhd, Laut Bhd and Sungai Bhd as at 31 December 2016 are as follows: Pantai Bhd Laut Bhd Sungal Bhd RM'000 RM'000 RM'000 Assets Property, plant and equipment 2,420 1262.5 1.250 Intangibles 87.5 20 Investment in Laut Bhd 2,075 Investment in Sungai Bhd 1,680 Other investments 75 712.5 75 Inventories 750 550 430 Bills receivables 175 75 37.5 Trade receivables 281.25 745 210 Ordinary dividend receivable 93.75 37.5 5 Bank 187.5 51.25 70.5 7,825 3,453.75 2,078 Equity and Liabilities Ordinary shares of RM1.00 each 5,500 2,500 1.250 Share premium 600 General reserves 450 170 Retained profit as at 1 January 2016 532.5 350 150 Profit for the year ending 31 December 2016 217.5 175 125 Long term loan 250 Bills payable 187.5 47.5 90.5 Trade payables 168.5 111.25 25 Ordinary dividend payable 169 100 7,825 3,453.75 2,078 Additional information: 1. Pantai Bhd bought the 1,750,000 ordinary shares in Laut Bhd on 1 January 2014 and paid in cash. On the date of acquisition, the general reserve and retained profit of Laut Bhd were RM25,000 and RM237,500 respectively. 2. On 1 July 2016, Pantai Bhd acquired 60% of the issued ordinary shares of Sungai Bhd respectively when the general reserves of Sungai Bhd was RM125,000. The fair values of the net assets of Sungai Bhd on 1 July 2016 were equal to their carrying values except for a building whose fair value was RM100,000 more than its carrying value. No adjustment was made in the books of Sungai Bhd to reflect this value. The remaining life of the building was 40 years. 3. On 30 July 2016, Pantai Bhd sold a piece of land to Laut Bhd at a profit of RM35,000 4. During the year, Laut Bhd sold goods to Pantai Bhd at a profit of RM6,000. By the year end, all these goods had been sold by Pantai Bhd to third parties. At 30 December 2016, Pantai Bhd remitted RM8,000 cash for the final settlement of the amount owing to Laut Bhd but was not received by Laut Bhd until early January 2014. 62.5 5. During the post-acquisition period, Sungai Bhd sold goods to Pantai Bhd at an invoiced price of RM120,000. RM5,000 of these sales had yet to be paid by Pantai Bhd. Sungai Bhd made a profit of 20% on invoice price. By the year end, 40% of these goods had been sold by Pantai Bhd to third parties. 6. As at 31 December 2016, goodwill on consolidation of Laut Bhd was impaired by 8%. 7. It is the policy of the group to depreciate all assets using straight line method on yearly basis. 8. Pantai Bhd's policy is to value non-controlling interests at their fair values. The directors of Pantai Bhd assessed the fair value of the non-controlling interest in Laut Bhd at the date of acquisition to be RM900,000. The fair value of non-controlling Interest in Sungai Bhd attributable to Pantal Bhd on 1 July 2016 was RM825,000. 9. Assume all profits accrue evenly throughout the year. Required: Prepare a Consolidated Statement of Financial Position for Pantai Bhd Group as at 31 December 2016