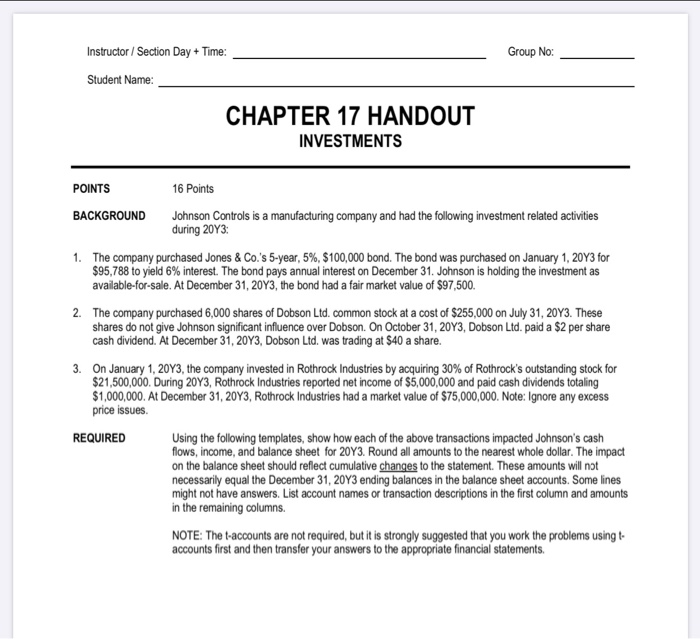

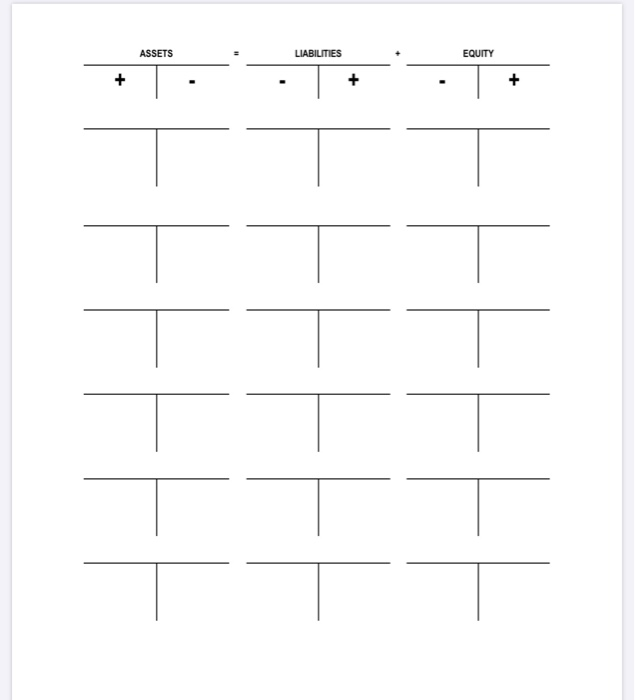

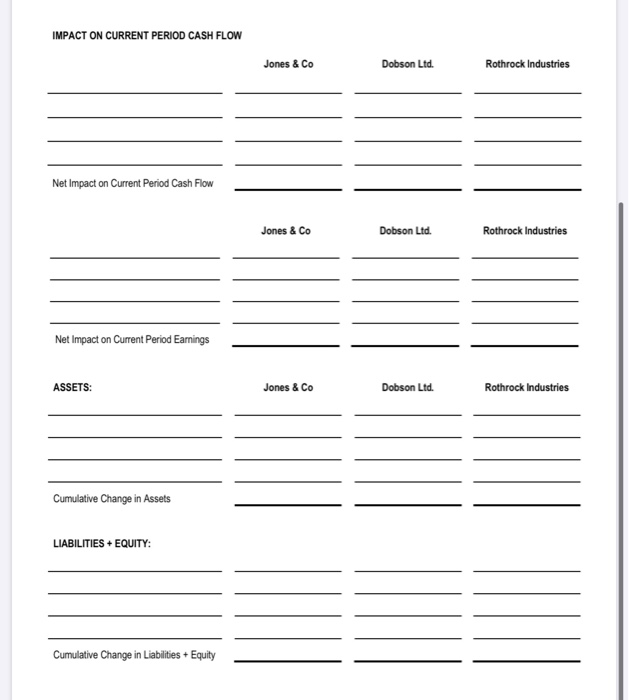

1:25 X Chapter 17 Handout - Investments... CHAPTER 17 HANDOUT INVESTMENTS POINTS BACKGROUND am The company purchased receye. 10.00 Sond. The bonds 2 The company purchased hard botonat commodo 6.000 are not give changer lever Detsen Oneste 3.200, Donal ah didend December 2009 Dobrading 21. During 1000 A 203 REQUIRED on the balance she would refled under the Margul the December 31.20 ending might not have an amesema - + T. 1:26 X Chapter 17 Handout - Investments... 2 of 3 CUPTOME ET IMPACT ON CURRENT PERIOD CASH ROW Doba Netine on One Periodas Pow Jones & Co Dobro 1:26 X Chapter 17 Handout - Investments... 3 of 3 IMPACT ON CURRENT PERIOO CASH FLOW Nation Current Periodo Jones & Co Nematonu Pro ASSETS Joce DM Cung LIABILITES EQUITE Cumulative argen CW COUPE Group No: Instructor / Section Day + Time: Student Name: CHAPTER 17 HANDOUT INVESTMENTS POINTS 16 Points BACKGROUND Johnson Controls is a manufacturing company and had the following investment related activities during 2093 1. The company purchased Jones & Co.'s 5-year, 5%, $100,000 bond. The bond was purchased on January 1, 20Y3 for $95,788 to yield 6% interest. The bond pays annual interest on December 31. Johnson is holding the investment as available-for-sale. At December 31, 20Y3, the bond had a fair market value of $97,500. 2. The company purchased 6,000 shares of Dobson Ltd. common stock at a cost of $255,000 on July 31, 20Y3. These shares do not give Johnson significant influence over Dobson. On October 31, 20Y3, Dobson Ltd. paid a $2 per share cash dividend. At December 31, 20Y3, Dobson Ltd. was trading at $40 a share. 3. On January 1, 20Y3, the company invested in Rothrock Industries by acquiring 30% of Rothrock's outstanding stock for $21,500,000. During 2043, Rothrock Industries reported net income of $5,000,000 and paid cash dividends totaling $1,000,000. At December 31, 20Y3, Rothrock Industries had a market value of $75,000,000. Note: Ignore any excess price issues. REQUIRED Using the following templates, show how each of the above transactions impacted Johnson's cash flows, income, and balance sheet for 20Y3. Round all amounts to the nearest whole dollar. The impact on the balance sheet should reflect cumulative changes to the statement. These amounts will not necessarily equal the December 31, 2043 ending balances in the balance sheet accounts. Some lines might not have answers. List account names or transaction descriptions in the first column and amounts in the remaining columns NOTE: The t-accounts are not required, but it is strongly suggested that you work the problems using t- accounts first and then transfer your answers to the appropriate financial statements. ASSETS LIABILITIES EQUITY + + IMPACT ON CURRENT PERIOD CASH FLOW Jones & Co Dobson Ltd. Rothrock Industries Net Impact on Current Period Cash Flow Jones & Co Dobson Ltd. Rothrock Industries Net Impact on Current Period Earnings ASSETS: Jones & Co Dobson Ltd. Rothrock Industries Cumulative Change in Assets LIABILITIES + EQUITY: Cumulative Change in Liabilities + Equity 1:25 X Chapter 17 Handout - Investments... CHAPTER 17 HANDOUT INVESTMENTS POINTS BACKGROUND am The company purchased receye. 10.00 Sond. The bonds 2 The company purchased hard botonat commodo 6.000 are not give changer lever Detsen Oneste 3.200, Donal ah didend December 2009 Dobrading 21. During 1000 A 203 REQUIRED on the balance she would refled under the Margul the December 31.20 ending might not have an amesema - + T. 1:26 X Chapter 17 Handout - Investments... 2 of 3 CUPTOME ET IMPACT ON CURRENT PERIOD CASH ROW Doba Netine on One Periodas Pow Jones & Co Dobro 1:26 X Chapter 17 Handout - Investments... 3 of 3 IMPACT ON CURRENT PERIOO CASH FLOW Nation Current Periodo Jones & Co Nematonu Pro ASSETS Joce DM Cung LIABILITES EQUITE Cumulative argen CW COUPE Group No: Instructor / Section Day + Time: Student Name: CHAPTER 17 HANDOUT INVESTMENTS POINTS 16 Points BACKGROUND Johnson Controls is a manufacturing company and had the following investment related activities during 2093 1. The company purchased Jones & Co.'s 5-year, 5%, $100,000 bond. The bond was purchased on January 1, 20Y3 for $95,788 to yield 6% interest. The bond pays annual interest on December 31. Johnson is holding the investment as available-for-sale. At December 31, 20Y3, the bond had a fair market value of $97,500. 2. The company purchased 6,000 shares of Dobson Ltd. common stock at a cost of $255,000 on July 31, 20Y3. These shares do not give Johnson significant influence over Dobson. On October 31, 20Y3, Dobson Ltd. paid a $2 per share cash dividend. At December 31, 20Y3, Dobson Ltd. was trading at $40 a share. 3. On January 1, 20Y3, the company invested in Rothrock Industries by acquiring 30% of Rothrock's outstanding stock for $21,500,000. During 2043, Rothrock Industries reported net income of $5,000,000 and paid cash dividends totaling $1,000,000. At December 31, 20Y3, Rothrock Industries had a market value of $75,000,000. Note: Ignore any excess price issues. REQUIRED Using the following templates, show how each of the above transactions impacted Johnson's cash flows, income, and balance sheet for 20Y3. Round all amounts to the nearest whole dollar. The impact on the balance sheet should reflect cumulative changes to the statement. These amounts will not necessarily equal the December 31, 2043 ending balances in the balance sheet accounts. Some lines might not have answers. List account names or transaction descriptions in the first column and amounts in the remaining columns NOTE: The t-accounts are not required, but it is strongly suggested that you work the problems using t- accounts first and then transfer your answers to the appropriate financial statements. ASSETS LIABILITIES EQUITY + + IMPACT ON CURRENT PERIOD CASH FLOW Jones & Co Dobson Ltd. Rothrock Industries Net Impact on Current Period Cash Flow Jones & Co Dobson Ltd. Rothrock Industries Net Impact on Current Period Earnings ASSETS: Jones & Co Dobson Ltd. Rothrock Industries Cumulative Change in Assets LIABILITIES + EQUITY: Cumulative Change in Liabilities + Equity