Answered step by step

Verified Expert Solution

Question

1 Approved Answer

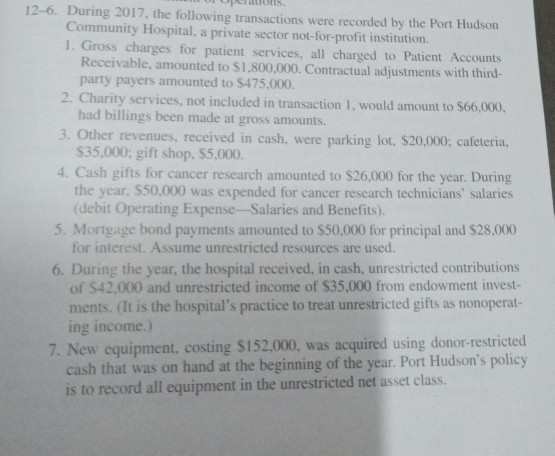

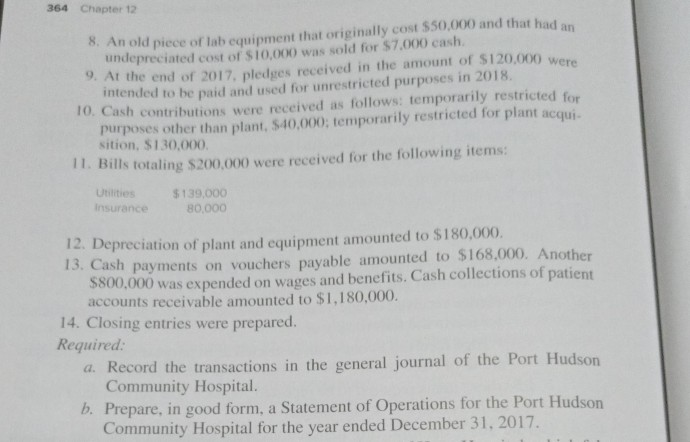

12-6. During 2017, the following transactions were recorded by the Port Hudson Community Hospital, a private sector not-for-profit institution. 1. Gross charges for patient services,

12-6. During 2017, the following transactions were recorded by the Port Hudson Community Hospital, a private sector not-for-profit institution. 1. Gross charges for patient services, all charged to Patient Accounts Receivable, amounted to $1,800,000. Contractual adjustments with third- party payers amounted to $475,000. 2. Charity services, not included in transaction 1, would amount to $66,000, had billings been made at gross amounts. 3. Other revenues, received in cash, were $35,000; gift shop, $5,000. 4. Cash gifts for cancer research amounted to $26,000 for the year. During the year, $50,000 was expended for cancer research technicians' salaries (debit Operating Expense-Salaries and Benefits). 5. Mortgage bond payments amounted to $50,000 for principal and $28,000 parking lot, $20,000; cafeteria, for interest. Assume unrestricted resources are used. 6. During the year, the hospital received, in cash, unrestricted contributions of $42,000 and unrestricted income of $35,000 from endowment invest- ments. (It is the hospital's practice to treat unrestricted gifts ing income.) 7. New equipment, costing $152,000, was acquired using donor-restricted cash that was on hand at the beginning of the year. Port Hudson's policy is to record all equipment in the unrestricted net asset class. as nonoperat- V 364 Chapter 12 8. An old piece of lab equipment that originally cost $50,000 and that had an undepreciated cost of $10,000 was sold for $7.000 cash. 9. At the end of 2017, pledges received in the amount of $120,000 were intended to be paid and used for unrestricted purposes in 2018 10. Cash contributions were received as follows: temporarily restricted for purposes other than plant, $40,000; temporarily restricted for plant acqui sition, $130,000. 11. Bills totaling $200,000 were received for the following items: $139,000 80,000 Utilities Insurance 12. Depreciation of plant and equipment amounted to $180,000. 13. Cash payments on vouchers payable amounted to $168,000. Another $800,000 was expended on wages and benefits. Cash collections of patient accounts receivable amounted to $1,180,000. 14. Closing entries were prepared. Required a. Record the transactions in the general journal of the Port Hudson Community Hospital. b. Prepare, in good form, a Statement of Operations for the Port Hudson Community Hospital for the year ended December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started