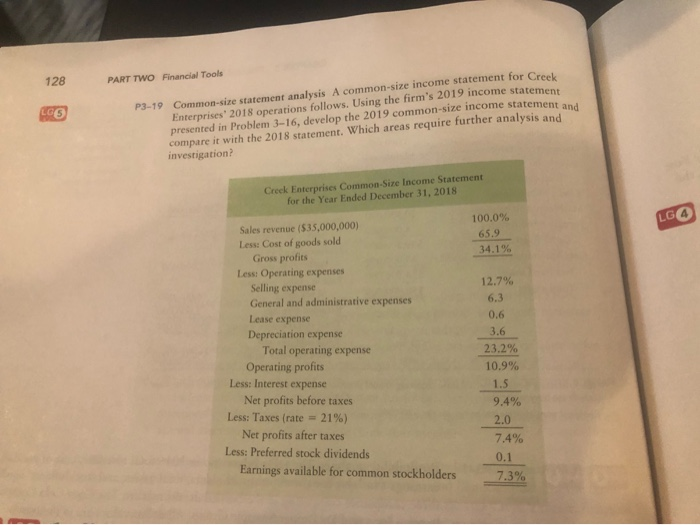

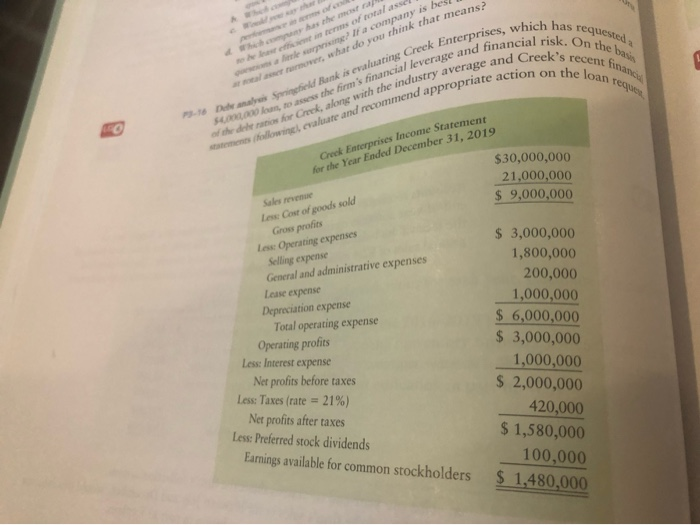

128 PART TWO Financial Tools LGS P3-19 Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows. Using the firm's 2019 income statement presented in Problem 3-16, develop the 2019 common-size income statement and compare it with the 2018 statement. Which areas require further analysis and investigation? Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2018 LG 100.0% 65.9 34.1% Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 12.7% 6.3 0.6 3.6 23.2% 10.9% 1.5 9.4% 2.0 7.4% 0.1 7.3% 128 PART TWO Financial Tools LOG P3-19 Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows. Using the firm's 2019 income statement compare it with the 2018 statement. Which areas require further analysis and presented in Problem 3-16, develop the 2019 common-size income statement and investigation? Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2018 100.0% 65.9 34.1% Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholm 12.7% 6.3 0.6 3.6 23.2% 10.9% 1.5 9.4% 2.0 7.4% 0.1 7.3% P3-20 The relationship betwee Dahil Bank is evaluating Creek Enterprises, which has requested FULL, to assess the firms financial leverage and financial risk. On the basis of the date os for Creek, along with the industry average and Creek's recent fra statements following evaluare and recommend appropriate action has the mostra obrers of rotalasse alime rame If a company is b ale rumover, what do you think that means? on the loan teger Creek Enterprises Income Statement for the Year Ended December 31, 2019 $30,000,000 21,000,000 $ 9,000,000 Sales Le Cost of goods sold Gross profits Les Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders $ 3,000,000 1,800,000 200,000 1,000,000 $ 6,000,000 $ 3,000,000 1,000,000 $ 2,000,000 420,000 $ 1,580,000 100,000 $ 1,480,000