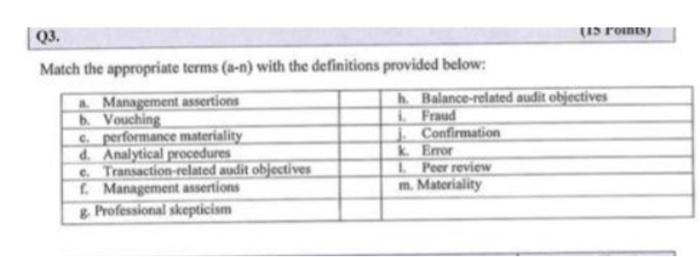

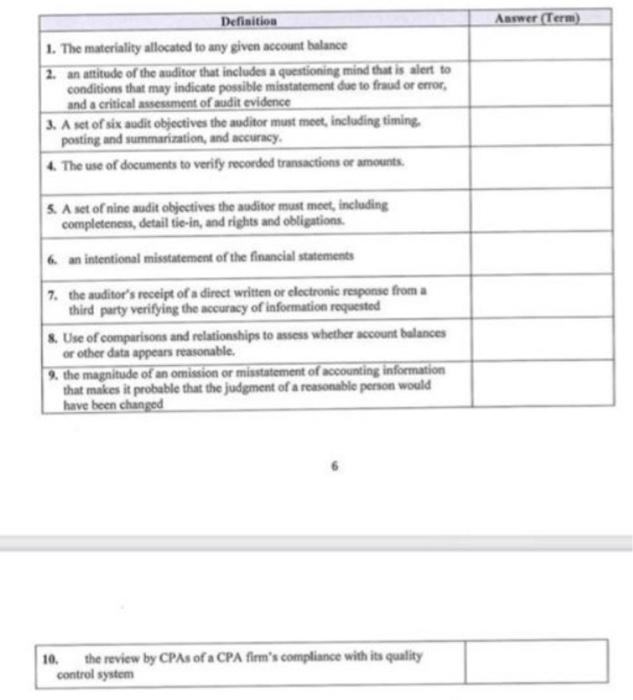

1:29 Expert Q&A Done 44 Q3. 13 roints) Match the appropriate terms (a-n) with the definitions provided below: Management assertions h. Balance-related audit objectives b. Vouching Fraud c. performance materiality Confirmation d. Analytical procedures KError e Transaction-related audit objectives Peer review Management assertions m. Materiality & Professional skepticism Answer Term) Definition 1. The materiality allocated to any given account balance 2. an attitude of the auditor that includes a questioning mind that is alert to conditions that may indicate possible misstatement due to fraud or error, and a critical assessment of audit evidence 3. A set of six audit objectives the auditor must meet, including timing posting and summarization, and accuracy 4. The use of documents to verify recorded transactions or amounts. S. A set of nine audit objectives the auditor must meet, including completeness, detail tie-in, and rights and obligations 6 an intentional misstatement of the financial statements 7. the auditor's receipt of a direct written or electronic response from a third party verifying the accuracy of information requested & Use of comparisons and relationships to assess whether account balances or other data appears reasonable. 9. the magnitude of an omission or misstatement of accounting information that makes it probable that the judgment of a reasonable person would have been changed 10. the review by CPAs of a CPA firm's compliance with its quality control system 1:29 Expert Q&A Done 44 Q3. 13 roints) Match the appropriate terms (a-n) with the definitions provided below: Management assertions h. Balance-related audit objectives b. Vouching Fraud c. performance materiality Confirmation d. Analytical procedures KError e Transaction-related audit objectives Peer review Management assertions m. Materiality & Professional skepticism Answer Term) Definition 1. The materiality allocated to any given account balance 2. an attitude of the auditor that includes a questioning mind that is alert to conditions that may indicate possible misstatement due to fraud or error, and a critical assessment of audit evidence 3. A set of six audit objectives the auditor must meet, including timing posting and summarization, and accuracy 4. The use of documents to verify recorded transactions or amounts. S. A set of nine audit objectives the auditor must meet, including completeness, detail tie-in, and rights and obligations 6 an intentional misstatement of the financial statements 7. the auditor's receipt of a direct written or electronic response from a third party verifying the accuracy of information requested & Use of comparisons and relationships to assess whether account balances or other data appears reasonable. 9. the magnitude of an omission or misstatement of accounting information that makes it probable that the judgment of a reasonable person would have been changed 10. the review by CPAs of a CPA firm's compliance with its quality control system