Answered step by step

Verified Expert Solution

Question

1 Approved Answer

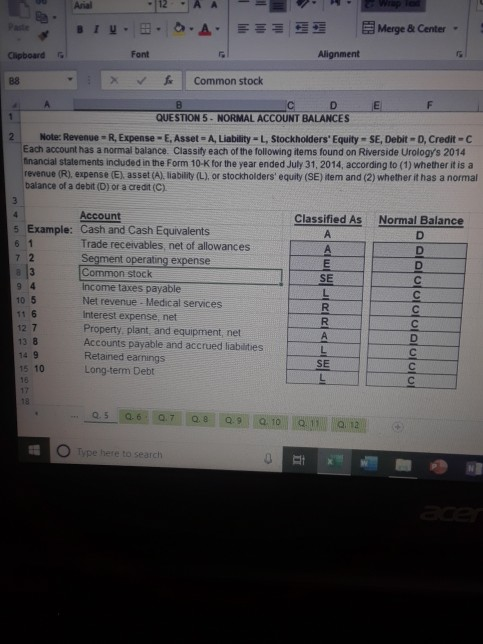

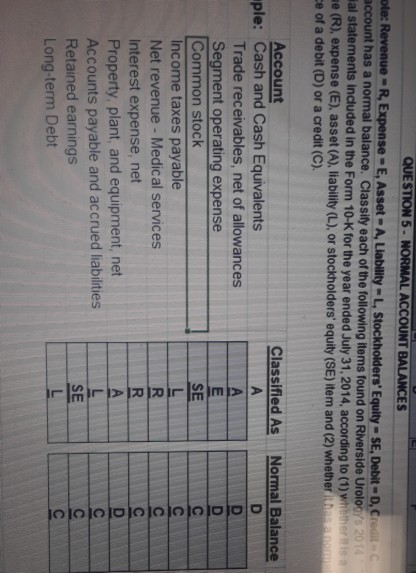

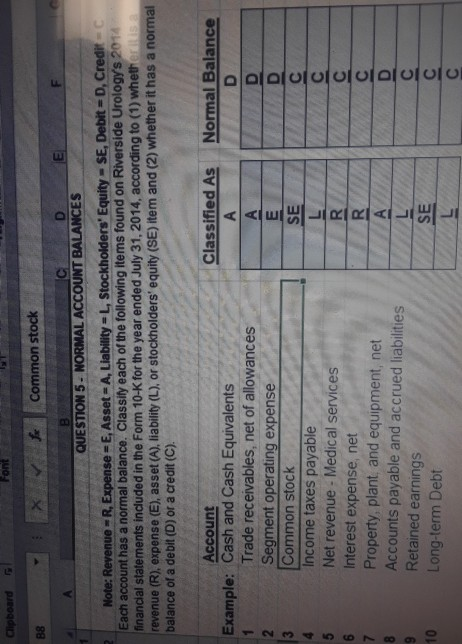

12AA Anal = - W BIU...A === Merge & Center Clipboard Font Alignment - for Common stock B C D E QUESTION 5 - NORMAL

12AA Anal = - W BIU...A === Merge & Center Clipboard Font Alignment - for Common stock B C D E QUESTION 5 - NORMAL ACCOUNT BALANCES 2 Note: Revenue - R. Expense - E.Asset - A LiabilityLStockholders' Equity-SE, Debit D. Credit C Each account has a normal balance. Classify each of the following items found on Riverside Urology's 2014 financial statements included in the Form 10-K for the year ended July 31, 2014, according to (1) whether it is a revenue (R), expense (E) asset (A), liability (L) or stockholders' equity (SE) item and (2) whether it has a normal balance of a debit (D) or a credit (C) Classified As Normal Balance D Account 5 Example: Cash and Cash Equivalents Trade receivables, net of allowances Segment operating expense Common stock Income taxes payable Net revenue - Medical services Interest expense, net Property plant, and equipment, net Accounts payable and accrued liabilities Retained earnings Long-term Debt > UTLU - 0.5 0.6 0.7 0.8 0.9 0.10 Q . 12 O Type here to search 0 QUESTION 5 - NORMAL ACCOUNT BALANCES ole: Revenue - R. Expense-E, Asset - A, Liability - Stockholders' Equity - SE, Debit-D, Cro account has a normal balance. Classify each of the following items found on Riverside Urology 2011 a statements included in the Form 10-K for the year ended July 31, 2014, according to (1) where (R) expense (E), asset (A), liability (L), or stockholders' equity (SE) item and (2) whether than ce of a debit (D) or a credit (C). Classified As Normal Balance Account ple: Cash and Cash Equivalents Trade receivables, net of allowances Segment operating expense Common stock Income taxes payable Net revenue - Medical services Interest expense, net Property, plant, and equipment, net Accounts payable and accrued liabilities Retained earnings Long-term Debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started