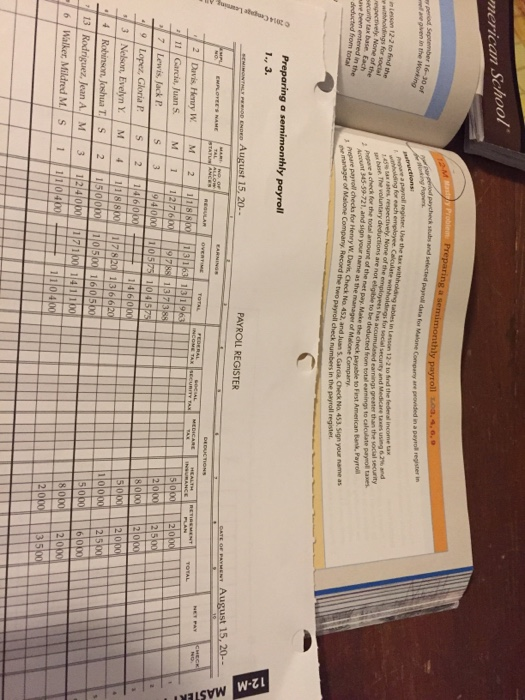

12-M MASTER Tusmay abehu3t merican School r2M Masty Problem Preparing a semimonthly payroll Loa, 4,6,9 Oregd paycheck subs end selected payroll data for Malgne Compeny are provided in a peyrol register in arod September 16-30 of e ane gven in the ionki dng Poner hepare a payroll register he the tax withholding tebles in Lesson 122 to Snd the federal income tax whholding for each employee Calculate wihholdings for sorial 145% ax ates respectively, None of the employees has aco ty and Medicare taes using d2% and erbuse. The voluntary deductions are not eligible to be deducted from total earnings to calculate pryrol taxes 2 Pepeea check for the tosal amount of the net pay, Make the check perable to First American Bank, Payrol 4snt 345-59-721 and sign your name as the manager of Malona Cormpeny etrctions eleson 12-2 to find the athholdings for social espectively None of he ecurity tax base Each e been entered in the deducted from total cial security earnings greater than t 1 hre payroll checka for Henry WDevis, Check No 452, and Juan 5. Garga, Check No 453 Sign your name as hemanager of Malone Company Record the two payroll check numbers in the payroll registe Preparing a semimonthly payroll 1., 3. PAYROLL REGISTER sEMIMONTHLY PDD ENDED August 15, 20- GATE OF PAYMENT August 15, 20-- EARNING EMPLOYEES NAME DEDUC TIONS sTATN4NG C REGULAR OYERTIM NET PAY TOTAL EdERAS socIAL TAX SECUuRITY TAN MEDICARE HEALTH Ibva BAHCE BET ENT TOTAL 2 Davis, Henry W M 118 8/00 13163 13 19k3 5000 2oo0 11 Garcia, Juan S M 112/71600 917/88 13/7 38s 20l00 2500 7 Lewis, Jack P S 3 9/4/olb |1101575 1104|575 8 ol0 2 000 Lopez, Gloria P 2 1/4 6/000 1/4 6 ol0n 5oloo 2 000 3 Nelson, Evely Y 4 1/18 800 1 /7 8/20 1 3 6 6/20 1lolopo 21500 Robinson, Joshua T S 2 15 0lobo 1110150 116|150 5obo 6 oD0 13 Rodriguez, Jean A. 3 11214/000 1 7100 14 1100) 8 OD0 2000 6 Walker, Mildred M S 1101400 11lol4 00 2 000 3 500 12-M MASTER Tusmay abehu3t merican School r2M Masty Problem Preparing a semimonthly payroll Loa, 4,6,9 Oregd paycheck subs end selected payroll data for Malgne Compeny are provided in a peyrol register in arod September 16-30 of e ane gven in the ionki dng Poner hepare a payroll register he the tax withholding tebles in Lesson 122 to Snd the federal income tax whholding for each employee Calculate wihholdings for sorial 145% ax ates respectively, None of the employees has aco ty and Medicare taes using d2% and erbuse. The voluntary deductions are not eligible to be deducted from total earnings to calculate pryrol taxes 2 Pepeea check for the tosal amount of the net pay, Make the check perable to First American Bank, Payrol 4snt 345-59-721 and sign your name as the manager of Malona Cormpeny etrctions eleson 12-2 to find the athholdings for social espectively None of he ecurity tax base Each e been entered in the deducted from total cial security earnings greater than t 1 hre payroll checka for Henry WDevis, Check No 452, and Juan 5. Garga, Check No 453 Sign your name as hemanager of Malone Company Record the two payroll check numbers in the payroll registe Preparing a semimonthly payroll 1., 3. PAYROLL REGISTER sEMIMONTHLY PDD ENDED August 15, 20- GATE OF PAYMENT August 15, 20-- EARNING EMPLOYEES NAME DEDUC TIONS sTATN4NG C REGULAR OYERTIM NET PAY TOTAL EdERAS socIAL TAX SECUuRITY TAN MEDICARE HEALTH Ibva BAHCE BET ENT TOTAL 2 Davis, Henry W M 118 8/00 13163 13 19k3 5000 2oo0 11 Garcia, Juan S M 112/71600 917/88 13/7 38s 20l00 2500 7 Lewis, Jack P S 3 9/4/olb |1101575 1104|575 8 ol0 2 000 Lopez, Gloria P 2 1/4 6/000 1/4 6 ol0n 5oloo 2 000 3 Nelson, Evely Y 4 1/18 800 1 /7 8/20 1 3 6 6/20 1lolopo 21500 Robinson, Joshua T S 2 15 0lobo 1110150 116|150 5obo 6 oD0 13 Rodriguez, Jean A. 3 11214/000 1 7100 14 1100) 8 OD0 2000 6 Walker, Mildred M S 1101400 11lol4 00 2 000 3 500