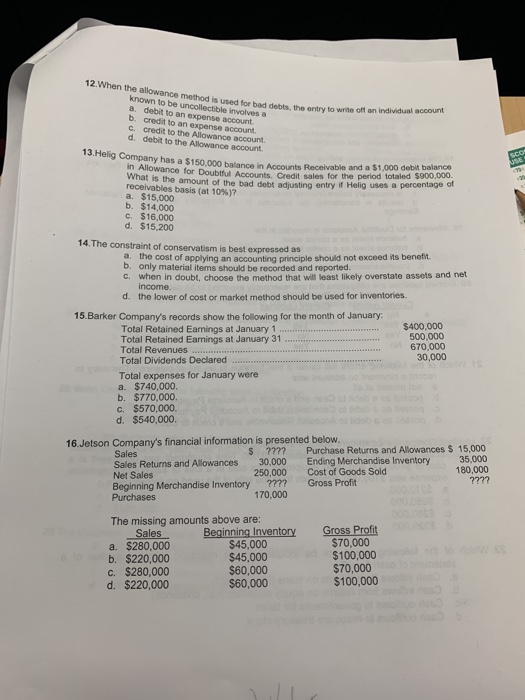

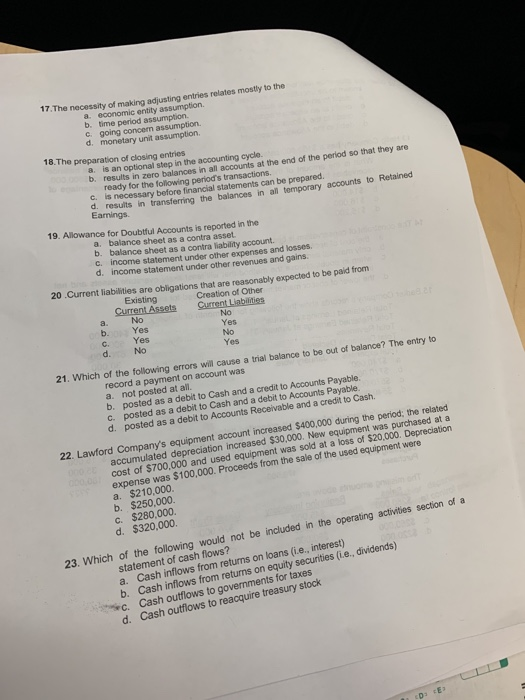

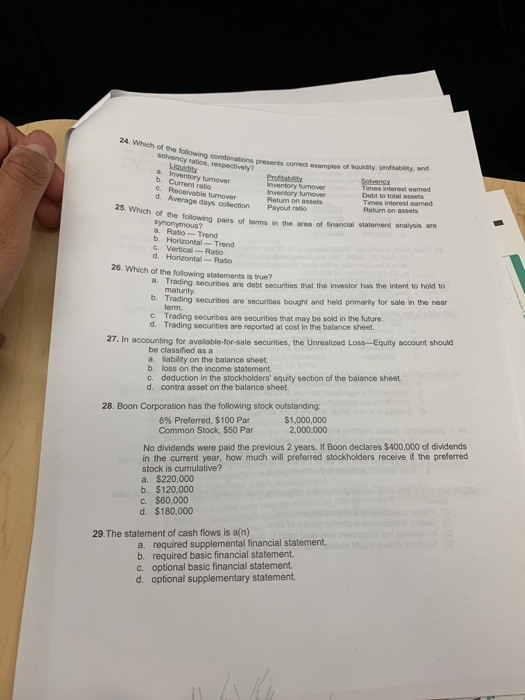

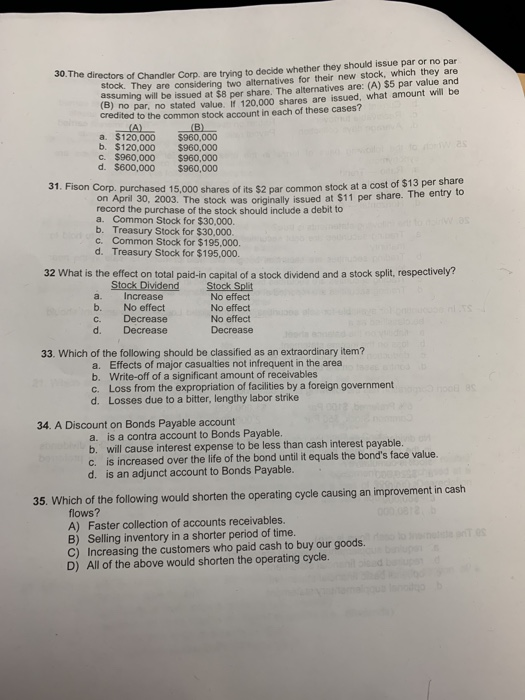

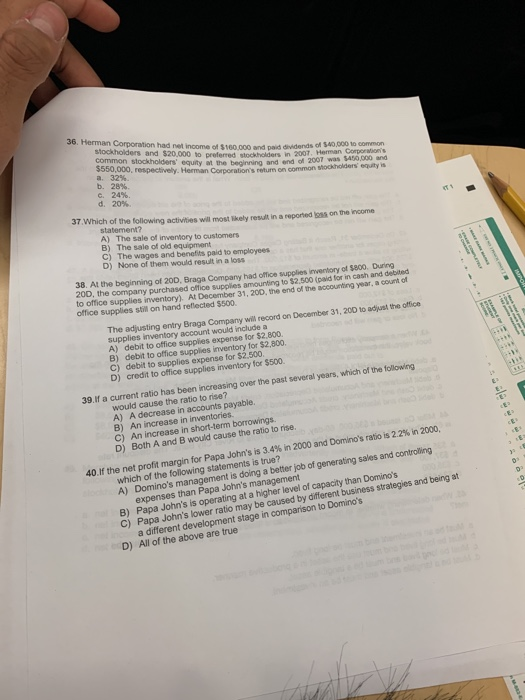

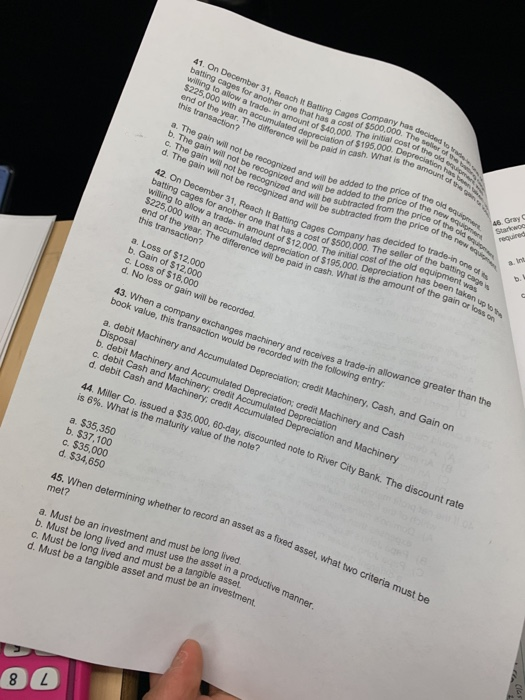

12.When the allowance method is used for bad debts, the on ce method is used for bad debts the entry to write of an individual con known to be uncollectible involves a a debit to an expense account b. credit to an expense account C. credit to the Allowance account d. debit to the Allowance account 13. Helig Company has a $150,000 balance in Acco mpany has a $150.000 balance in Accounts Receivable and a $1,000 debit balance in Allowance for Doubt Accounts Credit sales for the period totaled $900.000 What is the amount of the bad debt adiusting entry of Helig uses a percentage of receivables basis (at 1095? a $15.000 b. $14,000 c. $16,000 d. $15 200 14. The constraint of conservatism is best expressed as a. the cost of applying an accounting principle should not exceed its benefit b. only material items should be recorded and reported. c. when in doubt, choose the method that will least likely overstate assets and net income. d. the lower of cost or market method should be used for inventories $400,000 500,000 670,000 30,000 15.Barker Company's records show the following for the month of January Total Retained Earnings at January 1 .... Total Retained Earnings at January 31 ..... Total Revenues ... Total Dividends Declared Total expenses for January were a. $740,000 b. $770,000. c. $570,000 d. $540,000 16.Jetson Company's financial information is presented below. Sales S ???? Purchase Returns and Allowances $ 15,000 Sales Returns and Allowances 30,000 Ending Merchandise Inventory 35,000 Net Sales 250,000 Cost of Goods Sold 180,000 Beginning Merchandise Inventory ???? Gross Profit ???? Purchases 170,000 The missing amounts above are: Sales Beginning Inventory a. $280,000 $45,000 b. $220,000 $45,000 c. $280,000 $60,000 d. $220,000 $60,000 Gross Profit $70,000 $100,000 $70,000 $100,000 17. The necessity of making adjusting entries relatos mostly to the a economic entity assumption. b. time period assumption. going concern assumption. d. monetary unit assumption. 18.The preparation of closing entries a is an optional step in the accounting cycle. b results in zero balances in all accounts at the end of the period so that they are ready for the following period's transactions c is necessary before financial statements can be prepared. d results in transferring the balances in all temporary accounts to Retained Earnings 19. Allowance for Doubtful Accounts is reported in the a. balance sheet as a contra asset. b. balance sheet as a contra liability account. c. income statement under other expenses and losses. d. income statement under other revenues and gains. 20.Current liabilities are obligations that are reasonably expected to be paid from Existing Creation of Other Current Assets Current Liabilities No b. Yes No Yes No Yes Yes No 21. Which of the following errors will cause a trial balance to be out of balance? The entry to record a payment on account was a. not posted at all. b. posted as a debit to Cash and a credit to Accounts Payable. C. posted as a debit to Cash and a debit to Accounts Payable. d. posted as a debit to Accounts Receivable and a credit to Cash 22. Lawford Company's equipment account increased $400,000 during the period: the related accumulated depreciation increased $30,000. New equipment was purchased at a cost of $700,000 and used equipment was sold at a loss of $20,000. Depreciation expense was $100,000. Proceeds from the sale of the used equipment were a. $210,000. b. $250,000 c. $280,000 d. $320,000 23. Which of the following would not be included in the operating activities section of a statement of cash flows? a. Cash inflows from returns on loans (ie, interest) b. Cash inflows from returns on equity securities (i.e., dividends) c. Cash outflows to governments for taxes d. Cash outflows to reacquire treasury stock 24. Which of the following combinations prove a inventory turnover b. Current ratio Receivable turnover 25. Which of the following po synonymous? solve combinations presents core s of typrow n Liquidity respectively Prof tabel Inventory burnover Times interest samed Inventory tumover Debt to totales Average days collection Return on assets Time interest earned Payout ratio the following pairs of in the area of Sancial statement analysis are Ratio - Trend b. Horont-Trend Vertical-Ratio d. Horizontal Ratio 26. Which of the following statements is true? a Trading securities are debt securities that the investor has the intent to hold to maturity b. Trading securities are securities bought and held primarily for sale in the near C Trading securities are securities that may be sold in the future. d Trading securities are reported at cost in the balance sheet 27. In accounting for available for sale securities, the Unrealized Loss-Equity account should be classified as a a liability on the balance sheet. b. loss on the income statement. C. deduction in the stockholders' equity section of the balance sheet. d. contra asset on the balance sheet. 28. Boon Corporation has the following stock outstanding: 6% Preferred, $100 Par $1,000,000 Common Stock. $50 Par 2,000,000 No dividends were paid the previous 2 years. If Boon declares $400,000 of dividends in the current year, how much will preferred stockholders receive if the preferred stock is cumulative? a $220.000 b. $120,000 c. $60,000 d. $180,000 29. The statement of cash flows is an) a required supplemental financial statement. b. required basic financial statement C. optional basic financial statement. d. optional supplementary statement w the directors of Chandler Corp. are trying to decide whether they should issue par or no par STOCK. They are considering two alternatives for their new stock, which they are assuming will be issued at $8 per share. The alternatives are: (A) $5 par value and () no par, no stated value. i 120.000 shares are issued, what amount will be credited to the common stock account in each of these cases? (A) (B) a. $120,000 $960,000 b. $120,000 $960,000 c. $960,000 $960,000 d. $600,000 $960,000 31. Fison Corp. purchased 15.000 shares of te a r common stock at a cost of $13 per share on April 30, 2003. The stock was originally issued at $11 per share. The entry to record the purchase of the stock should include a debit to a. Common Stock for $30,000. b. Treasury Stock for $30,000. C. Common Stock for $195,000 d. Treasury Stock for $195,000 32 What is the effect on total paid-in capital of a stock dividend and a stock split, respectively? Stock Dividend Stock Split a. Increase No effect b. No effect No effect c. Decrease No effect d. Decrease Decrease 33. Which of the following should be classified as an extraordinary item? a. Effects of major casualties not infrequent in the area b. Write-off of a significant amount of receivables c. Loss from the expropriation of facilities by a foreign government reign government d. Losses due to a bitter, lengthy labor strike 34. A Discount on Bonds Payable account a. is a contra account to Bonds Payable. b. will cause interest expense to be less than cash interest payable. c. is increased over the life of the bond until it equals the bond's face value. d. is an adjunct account to Bonds Payable. 35. Which of the following would shorten the operating cycle causing an improvement in cash flows? A) Faster collection of accounts receivables. B) Selling inventory in a shorter period of time. C) Increasing the customers who paid cash to buy our oods D) All of the above would shorten the operating cycle. 36. Herman Corporation had net income of $160 000 and paid dividen stockholders and $20.000 to preferred stockholders in 200 $160.000 and paid dividends of $40,000 to common 2007 Herman Corps S common stockholders' equity at the beginning and end of 2 450 000 and $550,000, respectively, Herman Corporation's return on common stockholder a 32% 28% C. 24% on the come 37 Which of the following activities will most key result in a reported statement? A) The sale of inventory to customers B) The sale of old equipment C) The wages and benefits paid to employees D) None of them would result in a loss 38. At the beginning of 20D, Braga Company had office supplies invertory of $600 Dung 200, the company purchased office supplies amounting to $2.500 (paid for in cash and debied to office supplies inventory). At December 31, 200, the end of the accounting year, a count of office supplies still on hand reflected $500 The adjusting entry Braga Company will record on December 31, 200 to adjust the office supplies inventory account would include a A) debit to office supplies expense for $2.800 B) debit to office supplies inventory for $2,800 C) debit to supplies expense for $2.500. D) credit to office supplies inventory for $500. 39. If a current ratio has been increasing over the past several years, which of the following would cause the ratio to rise? A) A decrease in accounts payable. B) An increase in inventories c) An increase in short-term borrowings D) Both A and B would cause the ratio to rise. 40. If the net profit margin for Papa John's is 3.4% in 2000 and Domino's ratio is 2.2% in 2000, which of the following statements is true? A) Domino's management is doing a better job of generating sales and controling expenses than Papa John's management B) Papa John's is operating at a higher level of capacity than Domino's C) Papa John's lower ratio may be caused by different business strategies and being at a different development stage in comparison to Domino's D) All of the above are true 41. On December 31. Reach Batting Cago batting cages for another one that has willing to allow a trade in amount of $40,000 S200,000 with an accumulated depreciation end of the year. The difference will be paid in this transaction? Company has decis other one that has a cost of $500,000. The 00 The initial cost of the $500,000. The seller 495 000. Depreciation cash. What is the amount a. The gain will not be recognized and w b. The gain will not be recognized and we c. The gain will not be recognized and w d. The gain will not be recognized and w 42. On December 31, Reach It Batting a ng cages for another one that has a cost of $500 Wong to allow a trade-in amount of $12.000. The int $225,000 with an accumulated depreciation of $190 end of the year. The difference will be paid this transaction? recognized and will be added to the price of the cognized and will be added to the price of the recognized and will be subtracted from the price of the cognized and will be subtracted from the price of the each It Batting Cras Company has decided to trade in 000. The seller of the battino OP 46. Gray SO ied depreciation of $195.000. Depreciation has been take auterence will be paid in cash. What is the amount of the gain or in 085 on a. Loss of $12.000 b. Gain of $12,000 c. Loss of $18,000 d. No loss or gain will be recorded. of the old equipment was e rneciation has been taken up 3. When a company exchanges machinery and receives a trade-in allowance greater than the book value, this transaction would be recorded with the following entry a. debit Machinery and Accumulated Depreciation, credit Machinery, Cash, and Gain on Disposal b. debit Machinery and Accumulated Depreciation credit Machinery and Cash C. debit Cash and Machinery, credit Accumulated Depreciation d. debit Cash and Machinery, credit Accumulated Depreciation and Machinery 44. Miller Co. issued a $35,000, 60-day, discounted note to River City Bank. The discount rate is 6%. What is the maturity value of the note? a. $35,350 b. $37.100 c. $35.000 d. $34,650 45. When determining whether to record an asset as a fixed met? ed an asset as a foxed asset, what two criteria must be a. Must be an investment and must be long lived. b. Must be long lived and must use the asset in a produse c. Must be long lived and must be a tangible asset. d. Must be a tangible asset and must be an investment in a productive manner. 80 12.When the allowance method is used for bad debts, the on ce method is used for bad debts the entry to write of an individual con known to be uncollectible involves a a debit to an expense account b. credit to an expense account C. credit to the Allowance account d. debit to the Allowance account 13. Helig Company has a $150,000 balance in Acco mpany has a $150.000 balance in Accounts Receivable and a $1,000 debit balance in Allowance for Doubt Accounts Credit sales for the period totaled $900.000 What is the amount of the bad debt adiusting entry of Helig uses a percentage of receivables basis (at 1095? a $15.000 b. $14,000 c. $16,000 d. $15 200 14. The constraint of conservatism is best expressed as a. the cost of applying an accounting principle should not exceed its benefit b. only material items should be recorded and reported. c. when in doubt, choose the method that will least likely overstate assets and net income. d. the lower of cost or market method should be used for inventories $400,000 500,000 670,000 30,000 15.Barker Company's records show the following for the month of January Total Retained Earnings at January 1 .... Total Retained Earnings at January 31 ..... Total Revenues ... Total Dividends Declared Total expenses for January were a. $740,000 b. $770,000. c. $570,000 d. $540,000 16.Jetson Company's financial information is presented below. Sales S ???? Purchase Returns and Allowances $ 15,000 Sales Returns and Allowances 30,000 Ending Merchandise Inventory 35,000 Net Sales 250,000 Cost of Goods Sold 180,000 Beginning Merchandise Inventory ???? Gross Profit ???? Purchases 170,000 The missing amounts above are: Sales Beginning Inventory a. $280,000 $45,000 b. $220,000 $45,000 c. $280,000 $60,000 d. $220,000 $60,000 Gross Profit $70,000 $100,000 $70,000 $100,000 17. The necessity of making adjusting entries relatos mostly to the a economic entity assumption. b. time period assumption. going concern assumption. d. monetary unit assumption. 18.The preparation of closing entries a is an optional step in the accounting cycle. b results in zero balances in all accounts at the end of the period so that they are ready for the following period's transactions c is necessary before financial statements can be prepared. d results in transferring the balances in all temporary accounts to Retained Earnings 19. Allowance for Doubtful Accounts is reported in the a. balance sheet as a contra asset. b. balance sheet as a contra liability account. c. income statement under other expenses and losses. d. income statement under other revenues and gains. 20.Current liabilities are obligations that are reasonably expected to be paid from Existing Creation of Other Current Assets Current Liabilities No b. Yes No Yes No Yes Yes No 21. Which of the following errors will cause a trial balance to be out of balance? The entry to record a payment on account was a. not posted at all. b. posted as a debit to Cash and a credit to Accounts Payable. C. posted as a debit to Cash and a debit to Accounts Payable. d. posted as a debit to Accounts Receivable and a credit to Cash 22. Lawford Company's equipment account increased $400,000 during the period: the related accumulated depreciation increased $30,000. New equipment was purchased at a cost of $700,000 and used equipment was sold at a loss of $20,000. Depreciation expense was $100,000. Proceeds from the sale of the used equipment were a. $210,000. b. $250,000 c. $280,000 d. $320,000 23. Which of the following would not be included in the operating activities section of a statement of cash flows? a. Cash inflows from returns on loans (ie, interest) b. Cash inflows from returns on equity securities (i.e., dividends) c. Cash outflows to governments for taxes d. Cash outflows to reacquire treasury stock 24. Which of the following combinations prove a inventory turnover b. Current ratio Receivable turnover 25. Which of the following po synonymous? solve combinations presents core s of typrow n Liquidity respectively Prof tabel Inventory burnover Times interest samed Inventory tumover Debt to totales Average days collection Return on assets Time interest earned Payout ratio the following pairs of in the area of Sancial statement analysis are Ratio - Trend b. Horont-Trend Vertical-Ratio d. Horizontal Ratio 26. Which of the following statements is true? a Trading securities are debt securities that the investor has the intent to hold to maturity b. Trading securities are securities bought and held primarily for sale in the near C Trading securities are securities that may be sold in the future. d Trading securities are reported at cost in the balance sheet 27. In accounting for available for sale securities, the Unrealized Loss-Equity account should be classified as a a liability on the balance sheet. b. loss on the income statement. C. deduction in the stockholders' equity section of the balance sheet. d. contra asset on the balance sheet. 28. Boon Corporation has the following stock outstanding: 6% Preferred, $100 Par $1,000,000 Common Stock. $50 Par 2,000,000 No dividends were paid the previous 2 years. If Boon declares $400,000 of dividends in the current year, how much will preferred stockholders receive if the preferred stock is cumulative? a $220.000 b. $120,000 c. $60,000 d. $180,000 29. The statement of cash flows is an) a required supplemental financial statement. b. required basic financial statement C. optional basic financial statement. d. optional supplementary statement w the directors of Chandler Corp. are trying to decide whether they should issue par or no par STOCK. They are considering two alternatives for their new stock, which they are assuming will be issued at $8 per share. The alternatives are: (A) $5 par value and () no par, no stated value. i 120.000 shares are issued, what amount will be credited to the common stock account in each of these cases? (A) (B) a. $120,000 $960,000 b. $120,000 $960,000 c. $960,000 $960,000 d. $600,000 $960,000 31. Fison Corp. purchased 15.000 shares of te a r common stock at a cost of $13 per share on April 30, 2003. The stock was originally issued at $11 per share. The entry to record the purchase of the stock should include a debit to a. Common Stock for $30,000. b. Treasury Stock for $30,000. C. Common Stock for $195,000 d. Treasury Stock for $195,000 32 What is the effect on total paid-in capital of a stock dividend and a stock split, respectively? Stock Dividend Stock Split a. Increase No effect b. No effect No effect c. Decrease No effect d. Decrease Decrease 33. Which of the following should be classified as an extraordinary item? a. Effects of major casualties not infrequent in the area b. Write-off of a significant amount of receivables c. Loss from the expropriation of facilities by a foreign government reign government d. Losses due to a bitter, lengthy labor strike 34. A Discount on Bonds Payable account a. is a contra account to Bonds Payable. b. will cause interest expense to be less than cash interest payable. c. is increased over the life of the bond until it equals the bond's face value. d. is an adjunct account to Bonds Payable. 35. Which of the following would shorten the operating cycle causing an improvement in cash flows? A) Faster collection of accounts receivables. B) Selling inventory in a shorter period of time. C) Increasing the customers who paid cash to buy our oods D) All of the above would shorten the operating cycle. 36. Herman Corporation had net income of $160 000 and paid dividen stockholders and $20.000 to preferred stockholders in 200 $160.000 and paid dividends of $40,000 to common 2007 Herman Corps S common stockholders' equity at the beginning and end of 2 450 000 and $550,000, respectively, Herman Corporation's return on common stockholder a 32% 28% C. 24% on the come 37 Which of the following activities will most key result in a reported statement? A) The sale of inventory to customers B) The sale of old equipment C) The wages and benefits paid to employees D) None of them would result in a loss 38. At the beginning of 20D, Braga Company had office supplies invertory of $600 Dung 200, the company purchased office supplies amounting to $2.500 (paid for in cash and debied to office supplies inventory). At December 31, 200, the end of the accounting year, a count of office supplies still on hand reflected $500 The adjusting entry Braga Company will record on December 31, 200 to adjust the office supplies inventory account would include a A) debit to office supplies expense for $2.800 B) debit to office supplies inventory for $2,800 C) debit to supplies expense for $2.500. D) credit to office supplies inventory for $500. 39. If a current ratio has been increasing over the past several years, which of the following would cause the ratio to rise? A) A decrease in accounts payable. B) An increase in inventories c) An increase in short-term borrowings D) Both A and B would cause the ratio to rise. 40. If the net profit margin for Papa John's is 3.4% in 2000 and Domino's ratio is 2.2% in 2000, which of the following statements is true? A) Domino's management is doing a better job of generating sales and controling expenses than Papa John's management B) Papa John's is operating at a higher level of capacity than Domino's C) Papa John's lower ratio may be caused by different business strategies and being at a different development stage in comparison to Domino's D) All of the above are true 41. On December 31. Reach Batting Cago batting cages for another one that has willing to allow a trade in amount of $40,000 S200,000 with an accumulated depreciation end of the year. The difference will be paid in this transaction? Company has decis other one that has a cost of $500,000. The 00 The initial cost of the $500,000. The seller 495 000. Depreciation cash. What is the amount a. The gain will not be recognized and w b. The gain will not be recognized and we c. The gain will not be recognized and w d. The gain will not be recognized and w 42. On December 31, Reach It Batting a ng cages for another one that has a cost of $500 Wong to allow a trade-in amount of $12.000. The int $225,000 with an accumulated depreciation of $190 end of the year. The difference will be paid this transaction? recognized and will be added to the price of the cognized and will be added to the price of the recognized and will be subtracted from the price of the cognized and will be subtracted from the price of the each It Batting Cras Company has decided to trade in 000. The seller of the battino OP 46. Gray SO ied depreciation of $195.000. Depreciation has been take auterence will be paid in cash. What is the amount of the gain or in 085 on a. Loss of $12.000 b. Gain of $12,000 c. Loss of $18,000 d. No loss or gain will be recorded. of the old equipment was e rneciation has been taken up 3. When a company exchanges machinery and receives a trade-in allowance greater than the book value, this transaction would be recorded with the following entry a. debit Machinery and Accumulated Depreciation, credit Machinery, Cash, and Gain on Disposal b. debit Machinery and Accumulated Depreciation credit Machinery and Cash C. debit Cash and Machinery, credit Accumulated Depreciation d. debit Cash and Machinery, credit Accumulated Depreciation and Machinery 44. Miller Co. issued a $35,000, 60-day, discounted note to River City Bank. The discount rate is 6%. What is the maturity value of the note? a. $35,350 b. $37.100 c. $35.000 d. $34,650 45. When determining whether to record an asset as a fixed met? ed an asset as a foxed asset, what two criteria must be a. Must be an investment and must be long lived. b. Must be long lived and must use the asset in a produse c. Must be long lived and must be a tangible asset. d. Must be a tangible asset and must be an investment in a productive manner. 80