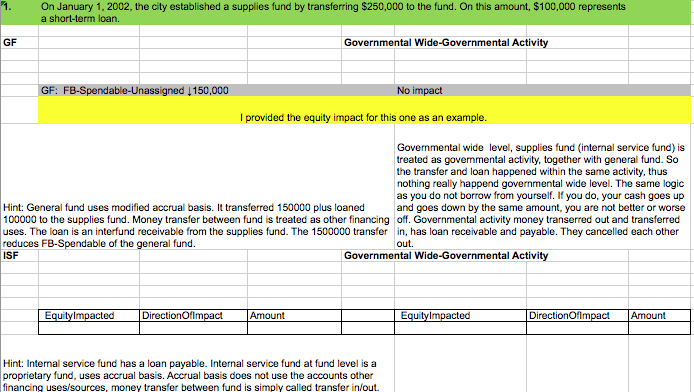

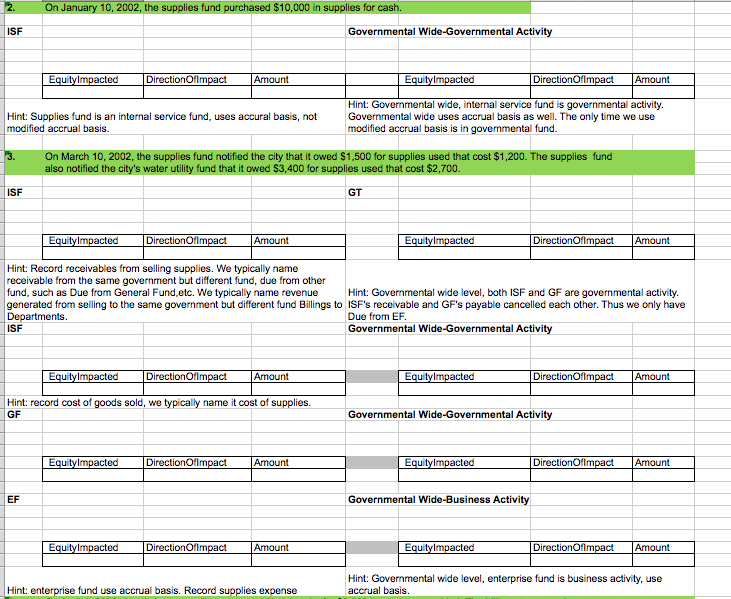

1-3

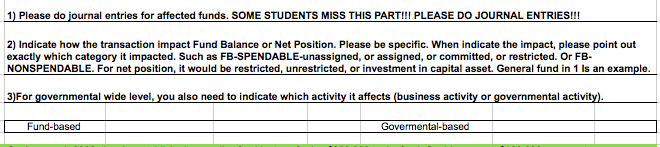

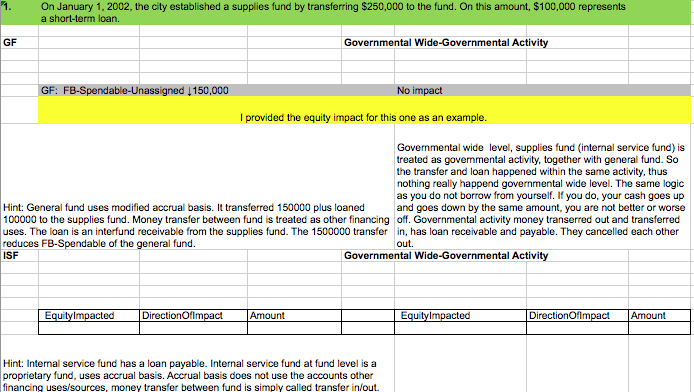

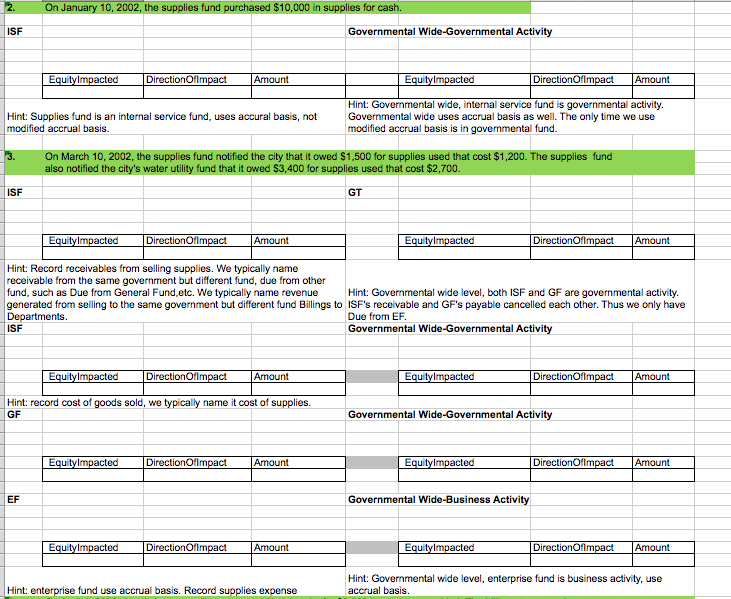

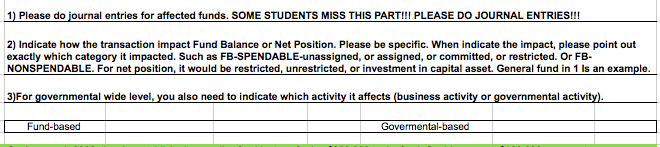

1) Please do journal entries for affected funds. SOME STUDENTS MISS THIS PART!!I PLEASE DO JOURNAL ENTRIES!!! 2) Indicate how the transaction impact Fund Balance or Net Position. Please be specific. When .ndicate the limpact pease point out exactly which category it impacted. Such as FB-SPENDABLE-unassigned, or assigned, or committed, or restricted. Or FB- NONSPENDABLE. For net position, it would be restricted, unrestricted, or investment in capital asset. General fund in 1 Is an example. 3 For governmental wide level, you also need to indicate which activity it affects (business activity or governmental activity) Fund-based Govermental-based On January 1, 2002, the city established a supplies fund by transferring $250,000 to the fund. On this amount, $100,000 represents GF Governmental Wide-Governmental Activity FB-Spendable-Unassigned 1150,000 No impact l provided the equity impact for this one as an example Governmental wide level, supplies fund (internal service fund) is treated as govenmental activity, together with general fund. So the transfer and loan happened within the same activity, thus nothing really happend governmental wide level. The same logic as you do not borrow from yourself. If you do, your cash goes up and goes down by the same amount, you are not better or worse Hint: General fund uses modified accrual basis. It transferred 150000 plus loaned 100000 to the supplies fund. Money transfer between fund is treated as other financing off. Governmental activity money transerred out and transferred uses. The loan is an interfund receivable from the supplies fund. The 1500000 transfer in, has loan receivable and payable. They cancelled each other ISF reduces FB-Spendable of the general fund. out Governmental Wide-Governmental Activity acted DirectionOflmpact Amount acted DirectionOflmpact Amount Hint: Intemal service fund has a loan payable. Internal service fund at fund level is a proprietary fund, uses accrual basis. Accrual basis does not use the accounts other financing uses/sources, money transfer between fund is simply called transfer in/out 1) Please do journal entries for affected funds. SOME STUDENTS MISS THIS PART!!I PLEASE DO JOURNAL ENTRIES!!! 2) Indicate how the transaction impact Fund Balance or Net Position. Please be specific. When .ndicate the limpact pease point out exactly which category it impacted. Such as FB-SPENDABLE-unassigned, or assigned, or committed, or restricted. Or FB- NONSPENDABLE. For net position, it would be restricted, unrestricted, or investment in capital asset. General fund in 1 Is an example. 3 For governmental wide level, you also need to indicate which activity it affects (business activity or governmental activity) Fund-based Govermental-based On January 1, 2002, the city established a supplies fund by transferring $250,000 to the fund. On this amount, $100,000 represents GF Governmental Wide-Governmental Activity FB-Spendable-Unassigned 1150,000 No impact l provided the equity impact for this one as an example Governmental wide level, supplies fund (internal service fund) is treated as govenmental activity, together with general fund. So the transfer and loan happened within the same activity, thus nothing really happend governmental wide level. The same logic as you do not borrow from yourself. If you do, your cash goes up and goes down by the same amount, you are not better or worse Hint: General fund uses modified accrual basis. It transferred 150000 plus loaned 100000 to the supplies fund. Money transfer between fund is treated as other financing off. Governmental activity money transerred out and transferred uses. The loan is an interfund receivable from the supplies fund. The 1500000 transfer in, has loan receivable and payable. They cancelled each other ISF reduces FB-Spendable of the general fund. out Governmental Wide-Governmental Activity acted DirectionOflmpact Amount acted DirectionOflmpact Amount Hint: Intemal service fund has a loan payable. Internal service fund at fund level is a proprietary fund, uses accrual basis. Accrual basis does not use the accounts other financing uses/sources, money transfer between fund is simply called transfer in/out