Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13 (40 points): A stock follows our lognormal model. You are given: - The initial stock price is 10. - The volatility of the stock

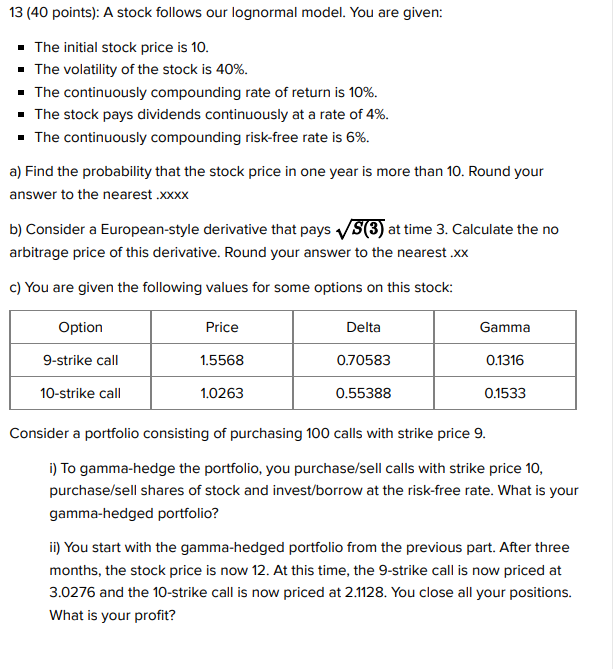

13 (40 points): A stock follows our lognormal model. You are given: - The initial stock price is 10. - The volatility of the stock is 40%. - The continuously compounding rate of return is 10%. - The stock pays dividends continuously at a rate of 4%. - The continuously compounding risk-free rate is 6%. a) Find the probability that the stock price in one year is more than 10 . Round your answer to the nearest .xxxx b) Consider a European-style derivative that pays S(3) at time 3. Calculate the no arbitrage price of this derivative. Round your answer to the nearest.xx c) You are given the following values for some options on this stock: Consider a portfolio consisting of purchasing 100 calls with strike price 9. i) To gamma-hedge the portfolio, you purchase/sell calls with strike price 10, purchase/sell shares of stock and invest/borrow at the risk-free rate. What is your gamma-hedged portfolio? ii) You start with the gamma-hedged portfolio from the previous part. After three months, the stock price is now 12. At this time, the 9-strike call is now priced at 3.0276 and the 10 -strike call is now priced at 2.1128 . You close all your positions. What is your profit

13 (40 points): A stock follows our lognormal model. You are given: - The initial stock price is 10. - The volatility of the stock is 40%. - The continuously compounding rate of return is 10%. - The stock pays dividends continuously at a rate of 4%. - The continuously compounding risk-free rate is 6%. a) Find the probability that the stock price in one year is more than 10 . Round your answer to the nearest .xxxx b) Consider a European-style derivative that pays S(3) at time 3. Calculate the no arbitrage price of this derivative. Round your answer to the nearest.xx c) You are given the following values for some options on this stock: Consider a portfolio consisting of purchasing 100 calls with strike price 9. i) To gamma-hedge the portfolio, you purchase/sell calls with strike price 10, purchase/sell shares of stock and invest/borrow at the risk-free rate. What is your gamma-hedged portfolio? ii) You start with the gamma-hedged portfolio from the previous part. After three months, the stock price is now 12. At this time, the 9-strike call is now priced at 3.0276 and the 10 -strike call is now priced at 2.1128 . You close all your positions. What is your profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started