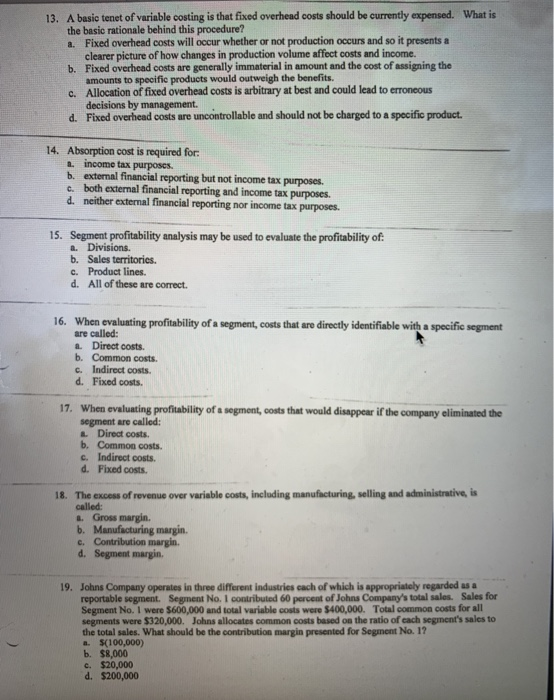

13. A basic tenet of variable costing is that fixed overhead costs should be currently expensed. What is the basic rationale behind this procedure? 2. Fixed overhead costs will occur whether or not production occurs and so it presents a clearer picture of how changes in production volume affect costs and income. b. Fixed overhead costs are generally immaterial in amount and the cost of assigning the amounts to specific products would outweigh the benefits. c. Allocation of fixed overhead costs is arbitrary at best and could lead to erroneous decisions by management. . d. Fixed overhead costs are uncontrollable and should not be charged to a specific product. 14. Absorption cost is required for: income tax purposes. b. external financial reporting but not income tax purposes. c. both external financial reporting and income tax purposes. d. neither external financial reporting nor income tax purposes. 15. Segment profitability analysis may be used to evaluate the profitability of: 2. Divisions. b. Sales territories. c. Product lines. d. All of these are correct. 16. When evaluating profitability of a segment, costs that are directly identifiable with a specific segment are called: a. Direct costs. b. Common costs. c. Indirect costs. d. Fixed costs. 17. When evaluating profitability of a segment, costs that would disappear if the company eliminated the segment are called: Direct costs. b. Common costs. c. Indirect costs. d. Fixed costs. 8. The excess of revenue over variable costs, including manufacturing, selling and administrative, is called: .. Gross margin. b. Manufacturing margin. c. Contribution margin. d. Segment margin. 19. Johns Company operates in three different industries cach of which is appropriately regarded as a reportable segment. Segment No. I contributed 60 percent of Johns Company's total sales. Sales for Segment No. I were 5600,000 and total variable costs were $400,000. Total common costs for all segments were $320,000. Johns allocates common costs based on the ratio of each segment's sales to the total sales. What should be the contribution margin presented for Segment No. 17 a. 5(100,000) b. $8,000 c. $20,000 d. $200,000